by Calculated Risk on 2/12/2020 07:00:00 AM

Wednesday, February 12, 2020

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 7, 2020.

... The Refinance Index increased 5 percent from the previous week and was 207 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 0.3 percent compared with the previous week and was 16 percent higher than the same week one year ago.

...

“The mortgage market continues to be active in early 2020, as applications increased for the third straight week. Rates also rose, but still remained close to their lowest levels since October 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The refinance index climbed to its highest level since June 2013, and refinance loan sizes also increased as a result of an active jumbo lending market.”

Added Kan, “Last month was the strongest January for purchase applications since 2009, which is perhaps a sign that mild weather brought out prospective buyers earlier than normal. Despite a decline last week, purchase activity was still up almost 16 percent from a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.72 percent from 3.71 percent, with points remaining unchanged at 0.28 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

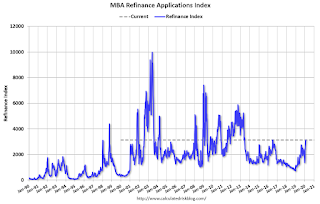

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a 2012 size refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 16% year-over-year.