by Calculated Risk on 1/10/2020 08:44:00 AM

Friday, January 10, 2020

December Employment Report: 145,000 Jobs Added, 3.5% Unemployment Rate

From the BLS:

Total nonfarm payroll employment rose by 145,000 in December, and the unemployment rate was unchanged at 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in retail trade and health care, while mining lost jobs.

...

The change in total nonfarm payroll employment for October was revised down by 4,000 from +156,000 to +152,000, and the change for November was revised down by 10,000 from +266,000 to +256,000. With these revisions, employment gains in October and November combined were 14,000 lower than previously reported.

...

In December, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $28.32. Over the last 12 months, average hourly earnings have increased by 2.9 percent.

emphasis added

Click on graph for larger image.

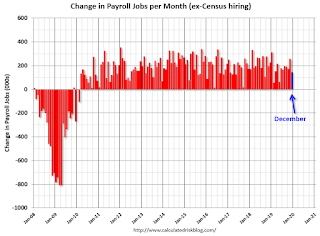

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 145 thousand in December (private payrolls increased 139 thousand).

Payrolls for October and November were revised down 14 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In November, the year-over-year change was 2.108 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in December at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate was unchanged in December at 63.2%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in December at 3.5%.

This was below consensus expectations of 160,000 jobs added, and October and November were revised down by 14,000 combined.

I'll have much more later ...

Thursday, January 09, 2020

Friday: Employment Report

by Calculated Risk on 1/09/2020 08:14:00 PM

My December Employment Preview.

Goldman's December Payrolls preview.

Friday:

• At 8:30 AM ET, Employment Report for December. The consensus is for 160,000 jobs added, and for the unemployment rate to be unchanged at 3.5%.

Goldman: December Payrolls Preview

by Calculated Risk on 1/09/2020 04:56:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased 185k in December … We estimate an unchanged unemployment rate at 3.5% … we estimate average hourly earnings increased 0.2% month-over-month, lowering the year-over-year rate to 3.0%

emphasis added

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 1/09/2020 02:35:00 PM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

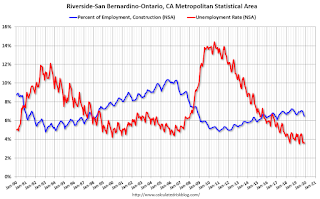

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 3.6% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still well below the bubble years.

So the unemployment rate has fallen to a record low, and the economy isn't as heavily depending on construction. Overall the Inland Empire economy is in much better shape today.

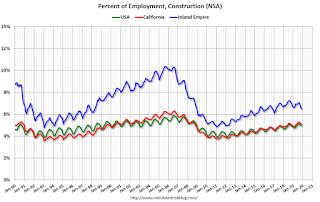

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction has picked up as a percent of total employment, but the economy in California and the U.S. is not as dependent on construction as during the bubble years.

December Employment Preview

by Calculated Risk on 1/09/2020 10:03:00 AM

Special Note: The 2020 Decennial Census will start increasing hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend.

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 160,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.5%.

Last month, the BLS reported 266,000 jobs added in November (including the end of the GM strike).

Here is a summary of recent data:

• The ADP employment report showed an increase of 202,000 private sector payroll jobs in December. This was well above consensus expectations of 156,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 45.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 45,000 in December. The ADP report indicated manufacturing jobs decreased 7,000 in December.

The ISM non-manufacturing employment index decreased in December to 55.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 215,000 in December.

Combined, the ISM surveys suggest employment gains at 170,000 suggesting gains close to consensus expectations.

• Initial weekly unemployment claims averaged 224,000 in December, up from 219,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 235,000, up from 228,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in December than in November.

• The final December University of Michigan consumer sentiment index increased to 99.3 from the October reading of 96.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker declined sharply in December to 54K, down from 195K in November, suggesting fewer jobs added in December.

• Conclusion: There have been some large misses by the consensus in the month of December (high and low), Since November was surprisingly strong (even with the end of the GM strike), my guess is December will be at or below the consensus forecast.

Weekly Initial Unemployment Claims Decrease to 214,000

by Calculated Risk on 1/09/2020 08:35:00 AM

The DOL reported:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 224,000, a decrease of 9,500 from the previous week's revised average. The previous week's average was revised up by 250 from 233,250 to 233,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,000.

This was lower than the consensus forecast.

Wednesday, January 08, 2020

Four Bank Failures in 2019

by Calculated Risk on 1/08/2020 04:08:00 PM

There were four bank failures in 2019. This was up from zero in 2018. The median number of failures since the FDIC was established in 1933 was 7 - so 4 failures in 2019 was well below the median.

The great recession / housing bust / financial crisis related failures have been behind us for a few years.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. Also, a large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s than during the recent crisis, the recent financial crisis was much worse (larger banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Houston Real Estate in December: Sales up 14.7% YoY, Inventory Up 3.6%, Record Sales Year

by Calculated Risk on 1/08/2020 12:06:00 PM

From the HAR: The Houston Housing Market Charges Across the Finish Line for a Record 2019

Low mortgage interest rates, healthy employment growth and a stable supply of homes created fertile ground for the Houston real estate market, which blossomed to record levels in 2019. Single-family home sales for the full year surpassed 2018’s record volume by nearly five percent. December delivered the year’s strongest percentage increase in single-family home sales. However, as 2020 gets underway, housing inventory has shrunk slightly, which could narrow options for consumers that may be hoping to buy a home in the new year.Sales set a record in 2019 and were strong in December.

According to the Houston Association of Realtors’ (HAR) latest annual report, 2019 single-family home sales rose 4.8 percent to 86,205. Sales of all property types totaled 102,593, which represents a 4.3-percent increase over 2018’s record volume and marks the first time that total property sales have ever broken the 100,000 level. Total dollar volume for 2019 climbed 6.7 percent to a record-breaking $30 billion.

...

December single-family home sales jumped 14.3 percent year-over-year with 7,505 units sold. That marks the greatest one-month percentage increase of the year; Total December property sales increased 14.7 percent to 8,879 units;

…

Total active listings, or the total number of available properties, rose 3.6 percent from December 2018 to 38,504. Single-family homes inventory narrowed slightly from a 3.5-months supply to 3.4 months.

emphasis added

Seattle Real Estate in December: Sales up 18.7% YoY, Inventory down 24.6% YoY

by Calculated Risk on 1/08/2020 10:50:00 AM

The Northwest Multiple Listing Service reported Eager home buyers were plentiful in December but their choices were meager

"The buyers are out there and are showing up at open houses and making multiple offers on new listings," was how one industry leader summarized December's housing activity involving members of the Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 12.0% year-over-year, and active inventory was down 38.8% year-over-year.

...

Newly-released figures from Northwest MLS show inventory at the end of December was down 31% from the same month a year ago, with only 8,469 active listings compared to the year-ago total of 12,275. The figures include single family homes and condominiums across the 23 counties in the MLS service area.

…

Northwest MLS member-brokers recorded 7,093 completed transactions during December, a gain of more than 11% from the 6,374 closed sales of the same month a year ago. Prices on last month's closed sales of single family homes and condos rose 8.75% from a year ago. For the MLS market overall the price was $435,000 versus the year-ago figure of $400,000.

emphasis added

In Seattle, sales were up 18.7% year-over-year, and inventory was down 24.6% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (1.1 months). In many areas it appears the inventory build that started last year is over.

ADP: Private Employment increased 202,000 in December

by Calculated Risk on 1/08/2020 08:22:00 AM

Private sector employment increased by 202,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 156,000 private sector jobs added in the ADP report.

...

“As 2019 came to a close, we saw expanded payrolls in December,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The service providers posted the largest gain since April, driven mainly by professional and business services. Job creation was strong across companies of all sizes, led predominantly by midsized companies.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Looking through the monthly vagaries of the data, job gains continue to moderate. Manufacturers, energy producers and small companies have been shedding jobs. Unemployment is low, but will begin to rise if job growth slows much further.”

The BLS report will be released Friday, and the consensus is for 160,000 non-farm payroll jobs added in December.