by Calculated Risk on 1/09/2020 10:03:00 AM

Thursday, January 09, 2020

December Employment Preview

Special Note: The 2020 Decennial Census will start increasing hiring in early 2020. In reporting the employment report, the headline number should be reduced (or increased) by the change in Census temporary employment to show the underlying trend.

On Friday at 8:30 AM ET, the BLS will release the employment report for December. The consensus is for an increase of 160,000 non-farm payroll jobs, and for the unemployment rate to be unchanged at 3.5%.

Last month, the BLS reported 266,000 jobs added in November (including the end of the GM strike).

Here is a summary of recent data:

• The ADP employment report showed an increase of 202,000 private sector payroll jobs in December. This was well above consensus expectations of 156,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in December to 45.1%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased around 45,000 in December. The ADP report indicated manufacturing jobs decreased 7,000 in December.

The ISM non-manufacturing employment index decreased in December to 55.2%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll increased 215,000 in December.

Combined, the ISM surveys suggest employment gains at 170,000 suggesting gains close to consensus expectations.

• Initial weekly unemployment claims averaged 224,000 in December, up from 219,000 in November. For the BLS reference week (includes the 12th of the month), initial claims were at 235,000, up from 228,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in December than in November.

• The final December University of Michigan consumer sentiment index increased to 99.3 from the October reading of 96.8. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker declined sharply in December to 54K, down from 195K in November, suggesting fewer jobs added in December.

• Conclusion: There have been some large misses by the consensus in the month of December (high and low), Since November was surprisingly strong (even with the end of the GM strike), my guess is December will be at or below the consensus forecast.

Weekly Initial Unemployment Claims Decrease to 214,000

by Calculated Risk on 1/09/2020 08:35:00 AM

The DOL reported:

In the week ending January 4, the advance figure for seasonally adjusted initial claims was 214,000, a decrease of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 224,000, a decrease of 9,500 from the previous week's revised average. The previous week's average was revised up by 250 from 233,250 to 233,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,000.

This was lower than the consensus forecast.

Wednesday, January 08, 2020

Four Bank Failures in 2019

by Calculated Risk on 1/08/2020 04:08:00 PM

There were four bank failures in 2019. This was up from zero in 2018. The median number of failures since the FDIC was established in 1933 was 7 - so 4 failures in 2019 was well below the median.

The great recession / housing bust / financial crisis related failures have been behind us for a few years.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. Also, a large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s than during the recent crisis, the recent financial crisis was much worse (larger banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Houston Real Estate in December: Sales up 14.7% YoY, Inventory Up 3.6%, Record Sales Year

by Calculated Risk on 1/08/2020 12:06:00 PM

From the HAR: The Houston Housing Market Charges Across the Finish Line for a Record 2019

Low mortgage interest rates, healthy employment growth and a stable supply of homes created fertile ground for the Houston real estate market, which blossomed to record levels in 2019. Single-family home sales for the full year surpassed 2018’s record volume by nearly five percent. December delivered the year’s strongest percentage increase in single-family home sales. However, as 2020 gets underway, housing inventory has shrunk slightly, which could narrow options for consumers that may be hoping to buy a home in the new year.Sales set a record in 2019 and were strong in December.

According to the Houston Association of Realtors’ (HAR) latest annual report, 2019 single-family home sales rose 4.8 percent to 86,205. Sales of all property types totaled 102,593, which represents a 4.3-percent increase over 2018’s record volume and marks the first time that total property sales have ever broken the 100,000 level. Total dollar volume for 2019 climbed 6.7 percent to a record-breaking $30 billion.

...

December single-family home sales jumped 14.3 percent year-over-year with 7,505 units sold. That marks the greatest one-month percentage increase of the year; Total December property sales increased 14.7 percent to 8,879 units;

…

Total active listings, or the total number of available properties, rose 3.6 percent from December 2018 to 38,504. Single-family homes inventory narrowed slightly from a 3.5-months supply to 3.4 months.

emphasis added

Seattle Real Estate in December: Sales up 18.7% YoY, Inventory down 24.6% YoY

by Calculated Risk on 1/08/2020 10:50:00 AM

The Northwest Multiple Listing Service reported Eager home buyers were plentiful in December but their choices were meager

"The buyers are out there and are showing up at open houses and making multiple offers on new listings," was how one industry leader summarized December's housing activity involving members of the Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 12.0% year-over-year, and active inventory was down 38.8% year-over-year.

...

Newly-released figures from Northwest MLS show inventory at the end of December was down 31% from the same month a year ago, with only 8,469 active listings compared to the year-ago total of 12,275. The figures include single family homes and condominiums across the 23 counties in the MLS service area.

…

Northwest MLS member-brokers recorded 7,093 completed transactions during December, a gain of more than 11% from the 6,374 closed sales of the same month a year ago. Prices on last month's closed sales of single family homes and condos rose 8.75% from a year ago. For the MLS market overall the price was $435,000 versus the year-ago figure of $400,000.

emphasis added

In Seattle, sales were up 18.7% year-over-year, and inventory was down 24.6% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (1.1 months). In many areas it appears the inventory build that started last year is over.

ADP: Private Employment increased 202,000 in December

by Calculated Risk on 1/08/2020 08:22:00 AM

Private sector employment increased by 202,000 jobs from November to December according to the December ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 156,000 private sector jobs added in the ADP report.

...

“As 2019 came to a close, we saw expanded payrolls in December,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The service providers posted the largest gain since April, driven mainly by professional and business services. Job creation was strong across companies of all sizes, led predominantly by midsized companies.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Looking through the monthly vagaries of the data, job gains continue to moderate. Manufacturers, energy producers and small companies have been shedding jobs. Unemployment is low, but will begin to rise if job growth slows much further.”

The BLS report will be released Friday, and the consensus is for 160,000 non-farm payroll jobs added in December.

MBA: Mortgage Applications Decreased Over Last Two Weeks in Latest Weekly Survey

by Calculated Risk on 1/08/2020 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

Mortgage applications decreased 1.5 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 3, 2020. The results include adjustments to account for the holidays.

... The Refinance Index decreased 8 percent from two weeks ago and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from two weeks ago. The unadjusted Purchase Index decreased 14 percent compared with two weeks ago and was 2 percent higher than the same week one year ago.

...

“Mortgage rates dropped last week, as investors sought safety in U.S. Treasury securities as a result of the events in the Middle East, with the 30-year fixed mortgage rate declining to its lowest level (3.91 percent) since early October,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Despite lower rates, refinance volume decreased these last two weeks, and we expect that it will slowly trail off in the first half of 2020 as long as mortgage rates remain in this same narrow range. Homeowners would need to see a sharp drop in rates to reinvigorate the refinance wave seen in 2019.”

Added Fratantoni, “The end of the year is the slowest time for home sales, so it is not at all surprising that activity was light. However, after a seasonal adjustment, purchase application volume was up relative to the pre-holiday period and started off 2020 ahead of last year’s pace. We expect that the strong job market will continue to support purchase activity this year, and the uptick in housing construction towards the end of last year should provide more inventory for prospective buyers.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.91 percent from 3.95 percent, with points increasing to 0.34 from 0.31 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

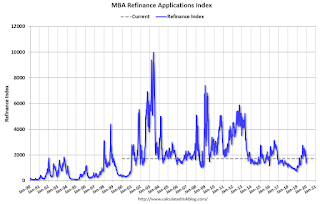

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 2% year-over-year.

Tuesday, January 07, 2020

Wednesday: ADP Employment

by Calculated Risk on 1/07/2020 08:02:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for December. This report is for private payrolls only (no government). The consensus is for 156,000 payroll jobs added in December, up from 67,000 added in November.

Las Vegas Real Estate in December: Sales up 21% YoY, Inventory down 13% YoY

by Calculated Risk on 1/07/2020 02:27:00 PM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports year ended with higher home prices, dip in annual home sales; GLVAR housing statistics for December 2019

According to GLVAR, the total number of existing local homes, condos, townhomes and other residential properties sold in Southern Nevada during 2019 was 41,269. That’s down from 42,876 total sales in 2018 and from 45,388 in 2017.1) Overall sales were up 20.9% year-over-year to 3,214 in December 2019 from 2,658 in December 2018.

The total number of existing local homes, condos and townhomes sold during December was 3,214. Compared to one year ago, December sales were up 21.8% for homes and up 17.2% for condos and townhomes.

...

By the end of December, GLVAR reported 5,538 single-family homes listed for sale without any sort of offer. That’s down 16.3% from one year ago. For condos and townhomes, the 1,555 properties listed without offers in December represented a 1.8% increase from one year ago.

…

At the same time, the number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for 1.8% of all existing local property sales in December. That compares to 2.9% of all sales one year ago, 3.6% two years ago and 11% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 8,143 in December 2018 to 7,093 in December 2019. Note: Total inventory was down 12.9% year-over-year. This is the second consecutive month with a year-over-year decrease in inventory, and that follows 16 consecutive months with a YoY increase in inventory. And months of inventory is still low.

3) Low level of distressed sales.

CoreLogic: House Prices up 3.7% Year-over-year in November

by Calculated Risk on 1/07/2020 12:30:00 PM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: oreLogic Reports November Home Prices Increased by 3.7% Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for November 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% from November 2018. On a month-over-month basis, prices increased by 0.5% in November 2019. (October 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The YoY change in the CoreLogic index decreased over the last year, but lately the YoY change has been increasing.

...

“The latest U.S. index shows that the slowdown in home prices we saw in early 2019 ended by late summer,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Growth in the U.S. index quickened in November and posted the largest 12-month gain since February. The decline in mortgage rates, down more than one percentage point for fixed-rate loans from November 2018, has supported a rise in sales activity and home prices.”

emphasis added