by Calculated Risk on 12/03/2019 09:11:00 AM

Tuesday, December 03, 2019

CoreLogic: House Prices up 3.5% Year-over-year in October

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports October Home Prices Increased by 3.5% Year Over Year

Home prices nationwide, including distressed sales, increased year over year by 3.5% in October 2019 compared with October 2018 and increased month over month by 0.5% in October 2019 compared with September 2019 (revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results).CR Note: The YoY change in the CoreLogic index decreased over the last year, but is now moving sideways at around 3.5%.

“Local home-price growth can deviate widely from the change in our U.S. index. While we saw prices up 3.5% nationally last year, home prices also declined in 22 metropolitan areas. Price softness occurred in some high-cost urban areas and in metros with weak employment growth during the past year.” Dr. Frank Nothaft, Chief Economist for CoreLogic

The CoreLogic HPI Forecast indicates that home prices will increase by 5.4% on a year-over-year basis from October 2019 to October 2020. On a month-over-month basis, home prices are expected to increase by 0.2% from October 2019 to November 2019. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables.

emphasis added

Monday, December 02, 2019

30 Year Mortgage Rates at 3.75% Top Tier Scenarios

by Calculated Risk on 12/02/2019 09:06:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Up To 2-Week Highs

Mortgage rates increased moderately to begin the new week/month and had been increasing in general during the previous week. The net effect is some lenders are quoting rates that are an eighth of a point higher compared to those seen at the beginning of last week, and an average rate quote that's as high as it's been in just over 2 weeks.Tuesday:

In the bigger picture, this amount of movement is fairly tame. [Most Prevalent Rates For Top Tier Scenarios 30YR FIXED 3.75%]

emphasis added

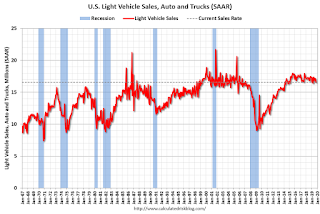

• All day: Light vehicle sales for November. The consensus is for 16.8 million SAAR in November, up from the BEA estimate of 16.6 million SAAR in October 2019 (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Corelogic House Price index for October.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 12/02/2019 02:55:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now mostly unchanged year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Nov 15, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 10% from a year ago, and CME futures are up 4% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Construction Spending Decreased in October

by Calculated Risk on 12/02/2019 10:20:00 AM

From the Census Bureau reported that overall construction spending decreased in October:

Construction spending during October 2019 was estimated at a seasonally adjusted annual rate of $1,291.1 billion, 0.8 percent below the revised September estimate of $1,301.8 billion. The October figure is 1.1 percent above the October 2018 estimate of $1,277.4 billion. During the first ten months of this year, construction spending amounted to $1,086.5 billion, 1.7 percent below the $1,105.2 billion for the same period in 2018.Both private and public spending decreased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $956.3 billion, 1.0 percent below the revised September estimate of $966.1 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $334.8 billion, 0.2 percent below the revised September estimate of $335.6 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - but turned down in the 2nd half of 2018 - and is now 25% below the bubble peak.

Non-residential spending is 8% above the previous peak in January 2008 (nominal dollars).

Public construction spending is 3% above the previous peak in March 2009, and 28% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up slightly. Non-residential spending is down 4% year-over-year. Public spending is up 10% year-over-year.

This was below consensus expectations, however construction spending for August and September were revised up.

ISM Manufacturing index Decreased to 48.1 in November

by Calculated Risk on 12/02/2019 10:05:00 AM

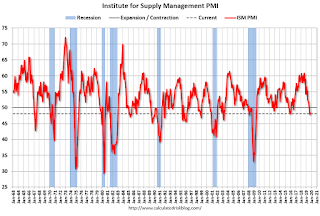

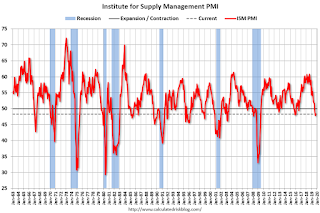

The ISM manufacturing index indicated contraction in November. The PMI was at 48.1% in November, down from 48.3% in October. The employment index was at 46.6%, down from 47.7% last month, and the new orders index was at 47.2%, down from 49.1%.

From the Institute for Supply Management: November 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November, and the overall economy grew for the 127th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The November PMI® registered 48.1 percent, a decrease of 0.2 percentage point from the October reading of 48.3 percent. The New Orders Index registered 47.2 percent, a decrease of 1.9 percentage points from the October reading of 49.1 percent. The Production Index registered 49.1 percent, up 2.9 percentage points compared to the October reading of 46.2 percent. The Backlog of Orders Index registered 43 percent, down 1.1 percentage points compared to the October reading of 44.1 percent. The Employment Index registered 46.6 percent, a 1.1-percentage point decrease from the October reading of 47.7 percent. The Supplier Deliveries Index registered 52 percent, a 2.5-percentage point increase from the October reading of 49.5 percent. The Inventories Index registered 45.5 percent, a decrease of 3.4 percentage points from the October reading of 48.9 percent. The Prices Index registered 46.7 percent, a 1.2-percentage point increase from the October reading of 45.5 percent. The New Export Orders Index registered 47.9 percent, a 2.5-percentage point decrease from the October reading of 50.4 percent. The Imports Index registered 48.3 percent, a 3-percentage point increase from the October reading of 45.3 percent.

“Comments from the panel were consistent with the previous month, with sentiment improving compared to October. November was the fourth consecutive month of PMI® contraction, at a faster rate compared to the prior month. Demand contracted, with the New Orders Index contracting faster, the Customers’ Inventories Index remaining at ‘too low’ levels and the Backlog of Orders Index contracting for the seventh straight month (and at a faster rate). The New Export Orders Index returned to contraction territory, likely contributing to the faster contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined 1.8-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in November, due primarily to contraction in inventories that was partially offset by supplier deliveries returning to ‘slowing.’ This resulted in a combined 0.9-percentage point decrease in the Supplier Deliveries and Inventories indexes. Imports contraction softened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are less confident that materials received will be consumed in a reasonable time period. Prices decreased for the sixth consecutive month, at a slower rate.”

“Global trade remains the most significant cross-industry issue."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 49.2%, and suggests manufacturing contracted further in November.

Sunday, December 01, 2019

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 12/01/2019 06:28:00 PM

Weekend:

• Schedule for Week of December 1, 2019

Monday:

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%. The PMI was at 48.3% in October, the employment index was at 47.7%, and the new orders index was at 49.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for 0.4% increase in spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 6, and DOW futures are down 64 (fair value).

Oil prices were down over the last week with WTI futures at $55.76 per barrel and Brent at $61.05 barrel. A year ago, WTI was at $51, and Brent was at $60 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.59 per gallon. A year ago prices were at $2.59 per gallon, so gasoline prices are unchanged year-over-year.

Hotels: Occupancy Rate Increased Sharply Year-over-year due to Timing of Thanksgiving

by Calculated Risk on 12/01/2019 12:57:00 PM

Note: Due to the timing of Thanksgiving, the occupancy rate was up sharply YoY last week, and will be down sharply YoY in the report next week.

From HotelNewsNow.com: STR: US hotel results for week ending 23 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 17-23 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 18-24 November 2018, the industry recorded the following:

• Occupancy: +17.7% to 61.2%

• Average daily rate (ADR): +10.8% to US$124.71

• Revenue per available room (RevPAR): +30.4% to US$76.32

STR analysts note the positive performance is due to the year-over-year comparison with the week of Thanksgiving in 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, November 30, 2019

Schedule for Week of December 1, 2019

by Calculated Risk on 11/30/2019 11:27:00 AM

The key report this week is the November employment report on Friday.

Other key indicators include the November ISM manufacturing and non-manufacturing indexes, November auto sales, and the October trade deficit.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%.

10:00 AM: ISM Manufacturing Index for November. The consensus is for 49.2%, up from 48.3%.Here is a long term graph of the ISM manufacturing index.

The PMI was at 48.3% in October, the employment index was at 47.7%, and the new orders index was at 49.1%.

10:00 AM: Construction Spending for October. The consensus is for 0.4% increase in spending.

All day: Light vehicle sales for November.

All day: Light vehicle sales for November.The consensus is for 16.8 million SAAR in November, up from the BEA estimate of 16.6 million SAAR in October 2019 (Seasonally Adjusted Annual Rate).

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the current sales rate.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 140,000 jobs added, up from 125,000 in October.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 54.5 from 54.7.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 213,000 last week.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $49.0 billion. The U.S. trade deficit was at $52.5 billion in September.

8:30 AM: Employment Report for November. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

8:30 AM: Employment Report for November. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.There were 148,000 jobs added in October. ex-Census (128,000 including Census jobs), and the unemployment rate was at 3.6%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.093 million jobs.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for December).

3:00 PM: Consumer Credit from the Federal Reserve.

Friday, November 29, 2019

November 2019: Unofficial Problem Bank list Decreased to 65 Institutions

by Calculated Risk on 11/29/2019 05:00:00 PM

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

DISCLAIMER: This is an unofficial list, the information is from public sources and while deemed to be reliable is not guaranteed. No warranty or representation, expressed or implied, is made as to the accuracy of the information contained herein and same is subject to errors and omissions. This is not intended as investment advice. Please contact CR with any errors.

Here is the unofficial problem bank list for November 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for November 2019. During the month, the list declined by six to 65 banks after seven removals and one addition. Aggregate assets dropped by $4.3 billion from the month to $51.0 billion. Part of the $4.3 billion decline came from a $2.1 billion decrease in reported assets with the release of third quarter financials earlier this week. A year ago, the list held 75 institutions with assets of $53.9 billion.The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew quickly and peaked at 1,003 institutions in July, 2011 - and then steadily declined to below 100 institutions.

Removals this month occurred through merger, action termination, or failure. Banks finding a merger partner include MidSouth Bank, National Association, Lafayette, LA ($1.7 billion Ticker: MSL); Markesan State Bank, Markesan, WI ($118 million); Fort Gibson State Bank, Fort Gibson, OK ($61 million); and The First National Bank of Paducah, Paducah, TX ($44 million). Actions were terminated against The Peoples Bank, Eatonton, GA ($130 million) and The Bank of Houston, Houston, MO ($32 million). Exiting through failure was City National Bank of New Jersey, Newark, NJ ($143 million). Added this month was Beauregard FSB, Deridder, LA ($66 million).

Q4 GDP Forecasts: 0.8% to 2.0%

by Calculated Risk on 11/29/2019 11:28:00 AM

From Goldman Sachs:

[W]e lowered our Q4 GDP tracking estimate by one tenth to +2.0% (qoq ar). (qoq ar). [Nov 27 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.8% for 2019:Q4. [Nov 29 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.7 percent on November 27, up from 0.4 percent on November 19. [Nov 27 estimate]CR Note: These early estimates suggest real GDP growth will be between 0.8% and 2.0% annualized in Q4.