by Calculated Risk on 11/01/2019 10:05:00 AM

Friday, November 01, 2019

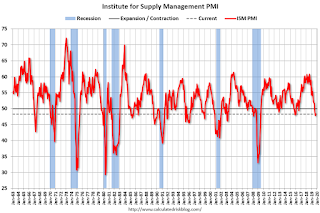

ISM Manufacturing index at 48.3 in October

The ISM manufacturing index indicated contraction in October. The PMI was at 48.3% in October, up from 47.8% in September. The employment index was at 47.7%, up from 46.3% last month, and the new orders index was at 49.1%, up from 47.3%.

From the Institute for Supply Management: October 2019 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in October, and the overall economy grew for the 126th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The October PMI® registered 48.3 percent, an increase of 0.5 percentage point from the September reading of 47.8 percent. The New Orders Index registered 49.1 percent, an increase of 1.8 percentage points from the September reading of 47.3 percent. The Production Index registered 46.2 percent, down 1.1 percentage points compared to the September reading of 47.3 percent. The Backlog of Orders Index registered 44.1 percent, down 1 percentage point compared to the September reading of 45.1 percent. The Employment Index registered 47.7 percent, a 1.4-percentage point increase from the September reading of 46.3 percent. The Supplier Deliveries Index registered 49.5 percent, a 1.6-percentage point decrease from the September reading of 51.1 percent. The Inventories Index registered 48.9 percent, an increase of 2 percentage points from the September reading of 46.9 percent. The Prices Index registered 45.5 percent, a 4.2-percentage point decrease from the September reading of 49.7 percent. The New Export Orders Index registered 50.4 percent, a 9.4-percentage point increase from the September reading of 41 percent. The Imports Index registered 45.3 percent, a 2.8-percentage point decrease from the September reading of 48.1 percent.

“Comments from the panel reflect an improvement from the prior month, but sentiment remains more cautious than optimistic. October was the third consecutive month of PMI® contraction, at a slower rate compared to September. Demand contracted, with the New Orders Index contracting marginally, the Customers’ Inventories Index moving into ‘about right’ territory and the Backlog of Orders Index contracting for the sixth straight month (and at a faster rate). The New Export Orders Index surged into expansion territory, likely contributing to the slowing contraction of the New Orders Index. Consumption (measured by the Production and Employment indexes) contracted, due primarily to lack of demand, but contributed positively (a combined +0.3-percentage point increase) to the PMI® calculation. Inputs — expressed as supplier deliveries, inventories and imports — were again lower in October, due primarily to supplier delivery contraction offset by improvements in inventories. This resulted in a combined 0.4-percentage point net improvement in the Supplier Deliveries and Inventories indexes. Imports contraction quickened. Overall, inputs indicate (1) supply chains are meeting demand and (2) companies are more confident that materials received will be consumed in a reasonable time period. Prices decreased for the fifth consecutive month, at a faster rate.”

“Global trade remains the most significant cross-industry issue. Food, Beverage & Tobacco Products remains the strongest industry sector and Transportation Equipment the weakest sector. Overall, sentiment this month remains cautious regarding near-term growth,” says Fiore.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations of 49.0%, and suggests manufacturing contracted further in October.

October Employment Report: 148,000 Jobs Added ex-Census, 3.6% Unemployment Rate

by Calculated Risk on 11/01/2019 08:44:00 AM

From the BLS:

Total nonfarm payroll employment rose by 128,000 in October, and the unemployment rate was little changed at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in food services and drinking places, social assistance, and financial activities. Within manufacturing, employment in motor vehicles and parts decreased due to strike activity. Federal government employment was down, reflecting a drop in the number of temporary jobs for the 2020 Census.

...

Federal government employment was down by 17,000 over the month, as 20,000 temporary workers who had been preparing for the 2020 Census completed their work.

...

The change in total nonfarm payroll employment for August was revised up by 51,000 from +168,000 to +219,000, and the change for September was revised up by 44,000 from +136,000 to +180,000. With these revisions, employment gains in August and September combined were 95,000 more than previously reported.

...

In October, average hourly earnings for all employees on private nonfarm payrolls rose by 6 cents to $28.18. Over the past 12 months, average hourly earnings have increased by 3.0 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 148 thousand in October ex-Census (private payrolls increased 131 thousand).

Payrolls for August and September were revised up 95 thousand combined.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.093 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased in October to 63.3%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.

The Labor Force Participation Rate increased in October to 63.3%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics and long term trends.The Employment-Population ratio was unchanged at 61.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate increased in October to 3.6%.

This was well above consensus expectations of 93,000 jobs added, and August and September were revised up by 95,000 combined. A strong report, especially considering the GM strike, Census layoffs, and the upward revisions.

I'll have much more later ...

Thursday, October 31, 2019

Friday: Employment Report, ISM Manufacturing, Construction Spending

by Calculated Risk on 10/31/2019 07:06:00 PM

Note: It appears temporary Census hiring will have little impact on the October employment report.

My October Employment Preview: Take the Under

Friday:

• At 8:30 AM ET, Employment Report for October. The consensus is for 93,000 jobs added, and for the unemployment rate to increase to 3.6%.

Note: The GM strike and supplier cutbacks (now settled) will probably subtract close to 75,000 jobs in October.

• At 10:00 AM, ISM Manufacturing Index for October. The consensus is for 49.0%, up from 47.8%.

• At 10:00 AM, Construction Spending for September. The consensus is for 0.2% increase in spending.

Fannie Mae: Mortgage Serious Delinquency Rate increased slightly in September

by Calculated Risk on 10/31/2019 04:42:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency increased slightly to 0.68% in September, from 0.68% in August. The serious delinquency rate is down from 0.82% in September 2018.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 2.53% are seriously delinquent. For loans made in 2005 through 2008 (4% of portfolio), 4.24% are seriously delinquent, For recent loans, originated in 2009 through 2018 (94% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through a few poor performing loans from the bubble years.

The increase in the delinquency rate in late 2017 was due to the hurricanes - there were no worries about the overall market.

I expect the serious delinquency rate will probably decline to 0.4 to 0.6 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

October Employment Preview: Take the Under

by Calculated Risk on 10/31/2019 01:35:00 PM

Special Notes on GM Strike and Decennial Census: The GM strike has ended, but 48,000 workers were on strike during the BLS reference week. There was probably some spillover to suppliers and others - and the strike will probably reduce October employment by close to 75,000 jobs. The strike is over, and these jobs will return in November. No worries.

Over the last two months, the Census Bureau increased the number of temporary workers by 26,000. This phase of the Decennial Census was supposed to end mid-October, and it is possible that some of these workers were let go prior to the BLS reference week. If so, the headline number should be adjusted for these hires, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

Given these special events, it is possible (but unlikely) that we will see a negative headline employment number for October.

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for an increase of 90,000 non-farm payroll jobs in October, and for the unemployment rate to increase to 3.6%.

Last month, the BLS reported 136,000 jobs added in September (including 1,000 temporary Census hires).

Here is a summary of recent data:

• The ADP employment report showed an increase of 125,000 private sector payroll jobs in October. This was below consensus expectations of 139,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM Manufacturing and non-manufacturing reports have not been released for October.

• Initial weekly unemployment claims averaged 215,000 in October, up from 213,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 218,000, up from 210,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in October than September..

• The final October University of Michigan consumer sentiment index increased to 95.5 from the September reading of 93.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker was weak in October suggesting 41K jobs lost in October.

• Conclusion: Based primarily on the BofA job tracker, and the GM strike, I expect job gains below expectations.

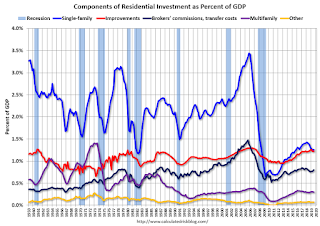

Q3 2019 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2019 11:22:00 AM

The BEA has released the underlying details for the Q3 initial GDP report.

The BEA reported that investment in non-residential structures decreased at a 15.3% annual pace in Q3.

Investment in petroleum and natural gas exploration decreased in Q3 compared to Q2, and was down 16% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q3, and is up 6% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 37% year-over-year in Q3 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q3, but lodging investment is up 6% year-over-year.

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases.

Investment in single family structures was $272 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures decreased in Q3.

Investment in home improvement was at a $264 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.2% of GDP). Home improvement spending has been solid.

Personal Income increased 0.3% in September, Spending increased 0.2%

by Calculated Risk on 10/31/2019 08:49:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $50.2 billion (0.3 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $55.7 billion (0.3 percent) and personal consumption expenditures (PCE) increased $24.3 billion (0.2 percent).The September PCE price index increased 1.3 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.7 percent year-over-year.

Real DPI increased 0.3 percent in September and Real PCE increased 0.2 percent. The PCE price index decreased less than 0.1 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income, and the increase in PCE, was at expectations.

PCE growth was decent in Q3, and inflation was below the Fed's target.

Weekly Initial Unemployment Claims increased to 218,000

by Calculated Risk on 10/31/2019 08:38:00 AM

The DOL reported:

In the week ending October 26, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 212,000 to 213,000. The 4-week moving average was 214,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 215,000 to 215,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,750.

This was higher than the consensus forecast.

Wednesday, October 30, 2019

Thursday: Personal Income & Outlays, Unemployment Claims

by Calculated Risk on 10/30/2019 06:57:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 212,000 last week.

• Also at 8:30 AM, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 48.0, up from 47.1 in September.

FOMC Statement: 25bp Decrease

by Calculated Risk on 10/30/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in September indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports remain weak. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against this action were: Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range at 1-3/4 percent to 2 percent.

emphasis added