by Calculated Risk on 10/31/2019 01:35:00 PM

Thursday, October 31, 2019

October Employment Preview: Take the Under

Special Notes on GM Strike and Decennial Census: The GM strike has ended, but 48,000 workers were on strike during the BLS reference week. There was probably some spillover to suppliers and others - and the strike will probably reduce October employment by close to 75,000 jobs. The strike is over, and these jobs will return in November. No worries.

Over the last two months, the Census Bureau increased the number of temporary workers by 26,000. This phase of the Decennial Census was supposed to end mid-October, and it is possible that some of these workers were let go prior to the BLS reference week. If so, the headline number should be adjusted for these hires, see: How to Report the Monthly Employment Number excluding Temporary Census Hiring

Given these special events, it is possible (but unlikely) that we will see a negative headline employment number for October.

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for an increase of 90,000 non-farm payroll jobs in October, and for the unemployment rate to increase to 3.6%.

Last month, the BLS reported 136,000 jobs added in September (including 1,000 temporary Census hires).

Here is a summary of recent data:

• The ADP employment report showed an increase of 125,000 private sector payroll jobs in October. This was below consensus expectations of 139,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth below expectations.

• The ISM Manufacturing and non-manufacturing reports have not been released for October.

• Initial weekly unemployment claims averaged 215,000 in October, up from 213,000 in September. For the BLS reference week (includes the 12th of the month), initial claims were at 218,000, up from 210,000 during the reference week the previous month.

This suggest a few more layoffs (during the reference week) in October than September..

• The final October University of Michigan consumer sentiment index increased to 95.5 from the September reading of 93.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• The BofA job tracker was weak in October suggesting 41K jobs lost in October.

• Conclusion: Based primarily on the BofA job tracker, and the GM strike, I expect job gains below expectations.

Q3 2019 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2019 11:22:00 AM

The BEA has released the underlying details for the Q3 initial GDP report.

The BEA reported that investment in non-residential structures decreased at a 15.3% annual pace in Q3.

Investment in petroleum and natural gas exploration decreased in Q3 compared to Q2, and was down 16% year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q3, and is up 6% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 37% year-over-year in Q3 - and at a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased in Q3, but lodging investment is up 6% year-over-year.

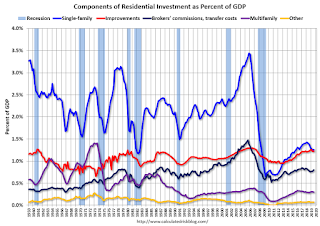

Usually single family investment is the top category, although home improvement was the top category for five consecutive years following the housing bust. Then investment in single family structures was back on top, however it is close between single family and home improvement.

Even though investment in single family structures has increased from the bottom, single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect some further increases.

Investment in single family structures was $272 billion (SAAR) (about 1.3% of GDP)..

Investment in multi-family structures decreased in Q3.

Investment in home improvement was at a $264 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.2% of GDP). Home improvement spending has been solid.

Personal Income increased 0.3% in September, Spending increased 0.2%

by Calculated Risk on 10/31/2019 08:49:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $50.2 billion (0.3 percent) in September according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $55.7 billion (0.3 percent) and personal consumption expenditures (PCE) increased $24.3 billion (0.2 percent).The September PCE price index increased 1.3 percent year-over-year and the September PCE price index, excluding food and energy, increased 1.7 percent year-over-year.

Real DPI increased 0.3 percent in September and Real PCE increased 0.2 percent. The PCE price index decreased less than 0.1 percent. Excluding food and energy, the PCE price index increased less than 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through September 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income, and the increase in PCE, was at expectations.

PCE growth was decent in Q3, and inflation was below the Fed's target.

Weekly Initial Unemployment Claims increased to 218,000

by Calculated Risk on 10/31/2019 08:38:00 AM

The DOL reported:

In the week ending October 26, the advance figure for seasonally adjusted initial claims was 218,000, an increase of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 212,000 to 213,000. The 4-week moving average was 214,750, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 215,000 to 215,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 214,750.

This was higher than the consensus forecast.

Wednesday, October 30, 2019

Thursday: Personal Income & Outlays, Unemployment Claims

by Calculated Risk on 10/30/2019 06:57:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 212,000 last week.

• Also at 8:30 AM, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for October. The consensus is for a reading of 48.0, up from 47.1 in September.

FOMC Statement: 25bp Decrease

by Calculated Risk on 10/30/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in September indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports remain weak. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. The Committee will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against this action were: Esther L. George and Eric S. Rosengren, who preferred at this meeting to maintain the target range at 1-3/4 percent to 2 percent.

emphasis added

Q3 GDP: Investment

by Calculated Risk on 10/30/2019 10:07:00 AM

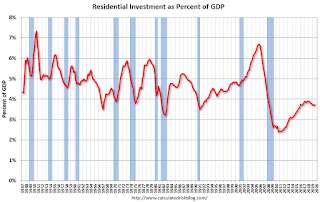

Investment was weak again in Q3, although residential investment picked up (increased at a 5.1% annual rate).

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) increased in Q3 (5.1% annual rate in Q3). Equipment investment decreased at a 3.8% annual rate, and investment in non-residential structures decreased at a 15.3% annual rate.

On a 3 quarter trailing average basis, RI (red) is up slightly, equipment (green) is slightly negative, and nonresidential structures (blue) is also down.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP increased in Q3, however RI has generally been increasing. RI as a percent of GDP is close to the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 1.9% Annualized Rate in Q3

by Calculated Risk on 10/30/2019 08:34:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2019 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the third quarter of 2019, according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 2.0 percent. ...The advance Q3 GDP report, with 1.9% annualized growth, was slightly above expectations.

The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), federal government spending, residential fixed investment, state and local government spending, and exports that were partly offset by negative contributions from nonresidential fixed investment and private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the third quarter reflected decelerations in PCE, federal government spending, and state and local government spending, and a larger decrease in nonresidential fixed investment. These movements were partly offset by a smaller decrease in private inventory investment, and upturns in exports and in residential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at 2.9% annualized rate in Q3, down from 4.6% in Q2. Residential investment (RI) increased at a 5.1% rate in Q3. Equipment investment decreased at a 3.8% annualized rate, and investment in non-residential structures decreased at a 15.3% pace.

I'll have more later ...

ADP: Private Employment increased 125,000 in October

by Calculated Risk on 10/30/2019 08:19:00 AM

Private sector employment increased by 125,000 jobs from September to October according to the October ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in tota ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was below the consensus forecast for 139,000 private sector jobs added in the ADP report.

...

“While job growth continues to soften, there are certain segments of the labor market that remain strong,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “The goods producing sector showed weakness; however, the healthcare industry and midsized companies had solid gains.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth has throttled way back over the past year. The job slowdown is most pronounced at manufacturers and small companies. If hiring weakens any further, unemployment will begin to rise.”

The BLS report will be released Friday, and the consensus is for 93,000 non-farm payroll jobs added in October.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 10/30/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 25, 2019.

... The Refinance Index decreased 1 percent from the previous week and was 134 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“The 10-year Treasury rate rose slightly last week, as markets expected more progress toward a trade deal between the U.S. and China. Mortgage rates increased for the second straight week as a result, with the 30-year fixed rate climbing to 4.05 percent – the highest level since the end of July,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Mortgage applications were mostly unchanged, with purchase activity rising 2 percent and refinances decreasing less than 1 percent. Purchase applications continued to run at a stronger pace than last year, finishing a robust 10 percent higher than a year ago. Considering how much lower rates are compared to the end of 2018, purchase applications should continue showing solid year-over-year gains.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.05 percent from 4.02 percent, with points decreasing to 0.37 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity - but declined a little recently with higher rates. Mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.