by Calculated Risk on 10/08/2019 10:56:00 AM

Tuesday, October 08, 2019

Las Vegas Real Estate in September: Sales up 14% YoY, Inventory up 22% YoY

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices inch up as supply stays tight; GLVAR housing statistics for September 2019

The total number of existing local homes, condos and townhomes sold during September was 3,430. Compared to one year ago, September sales were up 12.9% for homes and up 19.5% for condos and townhomes.1) Overall sales were up 14.1% year-over-year to 3,430 in September 2019 from 3,005 in September 2018.

As for inventory, by the end of September, GLVAR reported 7,334 single-family homes listed for sale without any sort of offer. That’s up 19.3% from one year ago. For condos and townhomes, the 1,830 properties listed without offers in September represented a 35.0% increase from one year ago.

While the local housing supply is up from one year ago, Carpenter said it’s still well below the six-month supply that is considered to be a more balanced market. At the current sales pace, she said Southern Nevada has less than a three-month supply of homes available for sale.

...

[T]he number of so-called distressed sales remains near historically low levels. GLVAR reported that short sales and foreclosures combined accounted for just 2.0% of all existing local property sales in September. That compares to 2.5% of all sales one year ago and 5.2% two years ago.

emphasis added

2) Active inventory (single-family and condos) is up from a year ago, from a total of 7,504 in September 2018 to 9,164 in September 2019. Note: Total inventory was up 22% year-over-year. This is a significant increase in inventory, although the year-over-year increase is down substantially from earlier this year. And months of inventory is still low.

3) Low level of distressed sales.

Small Business Optimism Index Decreased in September

by Calculated Risk on 10/08/2019 08:49:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): September 2019 Report: Small Business Optimism Declines but Remains Historically High

The small business Optimism Index maintained a historically solid reading, but took a dip in September, falling 1.3 points to 101.8.

..

Job creation was firm in September, with an average addition of 0.10 workers per firm compared to 0.19 in August. Net job creation has faded steadily since February’s 0.52 workers per firm to 0.1, no surprise as “finding qualified workers” to fill job openings hit a record high of 27 percent in August. Finding qualified workers remains a top problem, with 23 percent reporting it as their number one problem, down 4 points from August’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 101.9 in September.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is a top problem.

Monday, October 07, 2019

Tuesday: Small Business Optimism, PPI, Fed Chair Powell Speaks

by Calculated Risk on 10/07/2019 09:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Might be Hitting Some Resistance

Mortgage rates moved lower every week for the past 3 weeks. They covered a respectable amount of ground during that time and ultimately erased most of September's damage by Friday afternoon.Tuesday:

In outright terms, September's weakness pushed the average 30yr fixed rate quote roughly 3/8ths of a percentage point (.375%) higher. The past 3 weeks have helped to claw back roughly 0.25% of that. [Most Prevalent Rates 30YR FIXED - 3.625%]

emphasis added

• At 6:00 AM, NFIB Small Business Optimism Index for September.

• At 8:30 AM, The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

• At 2:30 PM, Speech, Fed Chair Jerome Powell, Data Dependence in an Evolving Economy, At the 61st National Association for Business Economics (NABE) Annual Meeting - Trucks and Terabytes: Integrating the 'Old' and 'New' Economies, Denver, Colorado

A few comments on WaPo story: "Federal government has dramatically expanded exposure to risky mortgages"

by Calculated Risk on 10/07/2019 03:29:00 PM

First a few excerpts from the WaPo: Federal government has dramatically expanded exposure to risky mortgages

The federal government has dramatically expanded its exposure to risky mortgages, as federal officials over the past four years took steps that cleared the way for companies to issue loans that many borrowers might not be able to repay.First, the standard maximum total debt-to-income (DTI) ratio is 36% for Fannie. This can be increased to 45% if certain criteria are meet (higher credit scores, higher reserves), and even 50% in some circumstances (using DU: Desktop Underwrite). The article is pointing out that a larger percentage of borrowers now have total DTI above 36%, and that is a little concerning - since it means those borrowers are more leveraged.

…

Taxpayers are shouldering much of the risk, while a growing number of homeowners face debt payments that amount to nearly half of their monthly income, a threshold many experts consider too steep.

Roughly 30 percent of the loans Fannie Mae guaranteed last year exceeded this level, up from 14 percent in 2016, according to Urban Institute data. At the FHA, 57 percent of the loans it insured breached the high-risk echelon, jumping from 38 percent two years earlier.

But this is nothing like lending during the bubble.

Remember the worst loans during the bubble were the private label loans that layered all kinds of risk. (note: Read Tanta's piece "Reflections on Alt-A"). We aren't seeing any of the crazy private label loans that we saw back then. There are people trying to blame Fannie and Freddie, but in reality the GSE's were more victims than cause of the housing bubble.

My view is Fannie and Freddie shouldn't be loosening standards, but I don't think these mortgages are that "risky".

Update: Framing Lumber Prices Mostly Unchanged Year-over-year

by Calculated Risk on 10/07/2019 12:05:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now mostly unchnaged year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through Aug 16, 2019 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 7% from a year ago, and CME futures are up 1% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November - although there is quite a bit of seasonal variability.

The trade war is a factor with reports that lumber exports to China have declined by 40% since last September.

Black Knight Mortgage Monitor for August: National Delinquency Rate near Series Low

by Calculated Risk on 10/07/2019 08:55:00 AM

Black Knight released their Mortgage Monitor report for August today. According to Black Knight, 3.45% of mortgages were delinquent in August, down from 3.52% in August 2018. Black Knight also reported that 0.48% of mortgages were in the foreclosure process, down from 0.54% a year ago.

This gives a total of 3.93% delinquent or in foreclosure.

Press Release: Black Knight Mortgage Monitor: Lower Interest Rate Environment Boosts Home Affordability to Nearly Three-Year High; Home Price Growth Flat in August

Today, the Data & Analytics division of Black Knight, Inc. released its latest Mortgage Monitor Report, based upon the company’s industry-leading mortgage performance, housing and public records datasets. This month, Black Knight’s analysts examined the impact of recent interest rate declines on home affordability, finding yet another situation where rate shifts in either direction have profound impact. As Black Knight Data & Analytics President Ben Graboske explained, the current lower interest rate environment has provided a boost to potential homebuyers.

“Back in November 2018, we were reporting on home affordability hitting a nine-year low,” said Graboske. “Interest rates were nearing 5%, pushing the share of national median income required to make the principal and interest (P&I) payments on the purchase of the average-priced home to 23.7%. While still below long-term averages, that made housing the least affordable it had been since 2009, spurring a noticeable and extended slowdown in home price growth. In the time since, rates have tumbled and the affordability outlook has improved significantly. That payment-to-income ratio is now 20.7%, which is the second lowest it has been in 20 months, behind only August of this year, and about 4.5% below the long-term, pre-crisis norm. To help quantify the boost this has given to homebuyers, consider that today’s prevailing 30-year rate has cut the monthly P&I payment to purchase the average-priced home by 10% – about $124 per month – from November. Put another way, the decline in rates since November has been enough to boost buying power by $46,000 while keeping monthly P&I payments the same.

“Despite falling interest rates and steadily improving affordability over the preceding eight months, annual home price growth held flat in August at 3.8% after rising for the first time in 17 months in July. It remains to be seen if this is merely a lull in what could be a reheating housing market, or a sign that low interest rates and stronger affordability may not be enough to muster another meaningful rise in home price growth across the U.S. That the strongest gains in – and strongest levels of – affordability were in August and early September could bode well for September/October housing numbers. As such, we’ll be keeping a close eye on the numbers coming out of the Black Knight Home Price Index over the coming months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that shows the National delinquency rate over time.

From Black Knight:

• The national delinquency rate currently stands at 3.45%, within 0.09% of the record low set in May 2019 and 0.94% below the pre-recession August average of 4.39%The second graph shows 90-day defaults vs foreclosure starts:

• The month’s relatively flat movement in mortgage delinquencies (-0.15%) is fairly typical behavior for August

• Over the past 18 years, delinquencies have fallen by 0.2% on average for the month, making August the most seasonally neutral month

• In contrast, September tends to see the largest seasonal upward pressure on delinquency rates of any month (+5.2% on average since 2000), so upward movement next month would not be surprising

• Foreclosure starts hit an 18-year low in August, but defaults have shown signs of upward movement in recent monthsThere is much more in the mortgage monitor.

• While August’s 85K defaults were 15% below the prerecession (2000-2005) average for this time of year, default volume was up by 6% from the same time last year

• Defaults have been relatively flat year-over-year or up slightly in each of the past five months

• One contributing factor has been the severe early-2018 flooding in the Midwest, with defaults in the region rising by 10% from the year prior » August also saw defaults increase in the south (+8%) and the Northeast (+4.5%)

• Though default activity remains historically low, this is a trend worth watching

Sunday, October 06, 2019

Sunday Night Futures

by Calculated Risk on 10/06/2019 09:34:00 PM

Weekend:

• Schedule for Week of October 6, 2019

Monday:

• At 3:00 PM, Consumer Credit from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 17 and DOW futures are down 140 (fair value).

Oil prices were down over the last week with WTI futures at $52.65 per barrel and Brent at $58.11 barrel. A year ago, WTI was at $74, and Brent was at $85 - so oil prices are down about 25% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.64 per gallon. A year ago prices were at $2.91 per gallon, so gasoline prices are down 27 cents year-over-year.

Hotels: Occupancy Rate "Dipped" Year-over-year

by Calculated Risk on 10/06/2019 12:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 28 September

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 22-28 September 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 September 2018, the industry recorded the following:

• Occupancy: -0.4% to 71.2%

• Average daily rate (ADR): -0.5% to US$136.63

• Revenue per available room (RevPAR): -0.8% to US$97.26

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now increase during the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, October 05, 2019

Schedule for Week of October 6, 2019

by Calculated Risk on 10/05/2019 08:11:00 AM

The key report this week is the September CPI on Thursday.

Fed Chair Jerome Powell speaks on data dependence on Tuesday.

3:00 PM: Consumer Credit from the Federal Reserve.

6:00 AM: NFIB Small Business Optimism Index for September.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is for a 0.1% increase in PPI, and a 0.2% increase in core PPI.

2:30 PM: Speech, Fed Chair Jerome Powell, Data Dependence in an Evolving Economy, At the 61st National Association for Business Economics (NABE) Annual Meeting - Trucks and Terabytes: Integrating the 'Old' and 'New' Economies, Denver, Colorado

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS.

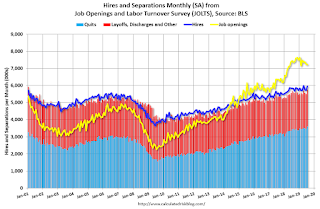

10:00 AM ET: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 7.217 million from 7.248 million in June.

The number of job openings (yellow) were down 3% year-over-year, and Quits were up 3% year-over-year.

2:00 PM: FOMC Minutes, Meeting of September 17-18, 2019

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, down from 219,000 last week.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for October).

Friday, October 04, 2019

AAR: September Rail Carloads down 7.0% YoY, Intermodal Down 4.6% YoY

by Calculated Risk on 10/04/2019 04:56:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

There’s still no relief in sight for U.S. rail traffic. Total originated U.S. rail carloads fell 7.0% in September 2019 from September 2018, their eighth straight year-over-year decline. In the third quarter, total carloads were down 5.4%; for the year through September, they were down 3.8%.

…

Intermodal was weak too — originations were down 4.6% in September, down 5.8% in the Q3 2019 (the biggest quarterly percentage decline since Q3 2009); and down 4.1% for the year to date.

…

Most economists would probably also agree that returning to some semblance of order on the international trade front is the single most important thing that would push the seesaw to the faster growth side. That would also help railroads, of course, because, as we discussed last month, the ongoing trade war and accompanying uncertainty has had the most direct impact on manufacturing and commodity related industries that are heavily served by railroads.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year changes in U.S. Carloads.

U.S. rail traffic continues to falter. Total carloads originated were 992,542 in September 2019, down 7.0%, or 74,172 carloads, from September 2018. It was the eighth straight monthly year-over-year decline and the second biggest percentage decline in those eight months. In the third quarter, total carloads were down 5.4%. For the first nine months of 2019, total U.S. carloads were down 3.8%, or 384,418 carloads, from 2018.

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):Rail intermodal remains weak too. Total originations in September were 1.06 million, down 5.9% (65,989 containers and trailers) from September 2018. Weekly average intermodal originations in September 2019 were 265,371, the lowest for September since 2016. Intermodal was down 5.8% in Q3 2019 from Q3 2018; that’s the biggest quarterly percentage decline for intermodal since Q3 2009. In 2019 through September, intermodal was down 4.1% (441,953 units) from last year, though year-to-date intermodal volume through September (10.39 million units) was the second highest ever (behind 2018).