by Calculated Risk on 7/30/2019 09:22:00 PM

Tuesday, July 30, 2019

Wednesday: FOMC Announcement, ADP Employment, Chicago PMI

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 155,000 payroll jobs added in July, up from 102,000 added in June.

• At 9:45 AM, Chicago Purchasing Managers Index for July.

• At 2:00 PM, FOMC Meeting Announcement. The Fed is expected to announce a 25bps cut to the Fed Funds rate at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Energy expenditures as a percentage of PCE

by Calculated Risk on 7/30/2019 02:30:00 PM

Note: Back in early 2016, I noted that energy expenditures as a percentage of PCE had hit an all time low. Here is an update through the June 2019 PCE report released this morning.

Below is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through June 2019.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

In June 2019, energy expenditures as a percentage of PCE increased to 3.91% of PCE, up from the all time low of 3.65% in February 2016.

Energy as a percent of GDP has been generally trending down, and historically this is a low percentage of PCE for energy expenditures.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 7/30/2019 12:16:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through May 2019). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

NAR: "Pending Home Sales Climb 2.8% in June"

by Calculated Risk on 7/30/2019 10:04:00 AM

From the NAR: Pending Home Sales Climb 2.8% in June

Pending home sales continued to ascend in June, marking two consecutive months of growth, according to the National Association of Realtors®. Each of the four major regions recorded a rise in contract activity, with the West experiencing the highest surge.This was well above expectations of a 0.3% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, moved up 2.8% to 108.3 in June, up from 105.4 in May. Year-over-year contract signings jumped 1.6%, snapping a 17-month streak of annual decreases.

...

All regional indices are up from May and from one year ago. The PHSI in the Northeast rose 2.7% to 94.5 in June and is now 0.9% higher than a year ago. In the Midwest, the index grew 3.3% to 103.6 in June, 1.7% greater than June 2018.

Pending home sales in the South increased 1.3% to an index of 125.7 in June, which is 1.4% higher than last June. The index in the West soared 5.4% in June to 96.8 and increased 2.5% above a year ago.

emphasis added

Case-Shiller: National House Price Index increased 3.4% year-over-year in May

by Calculated Risk on 7/30/2019 09:10:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for May ("May" is a 3 month average of March, April and May prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Home Price Gains Dip to 3.4% According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.4% annual gain in May, down from 3.5% in the previous month. The 10-City Composite annual increase came in at 2.2%, down from 2.3% in the previous month. The 20-City Composite posted a 2.4% year-over-year gain, down from 2.5% in the previous month.

Las Vegas, Phoenix and Tampa reported the highest year-over-year gains among the 20 cities. In May, Las Vegas led the way with a 6.4% year-over-year price increase, followed by Phoenix with a 5.7% increase, and Tampa with a 5.1% increase. Seven of the 20 cities reported greater price increases in the year ending May 2019 versus the year ending April 2019.

...

Before seasonal adjustment, the National Index posted a month-over-month increase of 0.8% in May. The 10-City Composite posted a 0.5% increase and the 20-City Composite reported a 0.6% increase for the month. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in May. The 10-City and the 20-City Composites both reported a 0.1% increase. In May, 19 of 20 cities reported increases before seasonal adjustment, while 13 of 20 cities reported increases after seasonal adjustment.

“Nationally, year-over-year home price gains were lower in May than in April, but not dramatically so and a broad-based moderation continued,” says Philip Murphy, Managing Director and Global Head of Index Governance at S&P Dow Jones Indices. “Among 20 major U.S. city home price indices, the average YOY gain has been declining for the past year or so and now stands at the moderate nominal YOY rate of 3.1%.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.1% from the bubble peak, and up 0.1% in May (SA).

The Composite 20 index is 4.5% above the bubble peak, and up 0.1% (SA) in May.

The National index is 13.2% above the bubble peak (SA), and up 0.3% (SA) in May. The National index is up 53.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 2.2% compared to May 2018. The Composite 20 SA is up 2.4% year-over-year.

The National index SA is up 3.4% year-over-year.

Note: According to the data, prices increased in 14 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Personal Income increased 0.4% in June, Spending increased 0.3%

by Calculated Risk on 7/30/2019 08:40:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income increased $83.6 billion (0.4 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $69.7 billion (0.4 percent) and personal consumption expenditures (PCE) increased $41.0 billion (0.3 percent).The June PCE price index increased 1.4 percent year-over-year and the June PCE price index, excluding food and energy, increased 1.6 percent year-over-year.

Real DPI increased 0.3 percent in June and Real PCE increased 0.2 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through June 2019 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was above expectations, and the increase in PCE was at expectations.

PCE growth was solid in Q2, and inflation was below the Fed's target.

Monday, July 29, 2019

Tuesday: Personal Income & Outlays, Case-Shiller House Prices, Pending Home Sales

by Calculated Risk on 7/29/2019 07:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Start Slow, But Risks Increase Throughout The Week

Mortgage rates moved back down, albeit just slightly, into last week's range. … Bigger changes will require bigger swings in the underlying bond market. The potential for such changes increases exponentially throughout the week as a slew of important data and events hit the wires. Headliners include Wednesday's Fed rate decision and Friday's big jobs report. [Most Prevalent Rates 30YR FIXED - 3.875%]Tuesday:

emphasis added

• At 8:30 AM ET, Personal Income and Outlays, June 2019. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:00 AM, S&P/Case-Shiller House Price Index for May. The consensus is for a 2.6% year-over-year increase in the Comp 20 index for May.

• At 10:00 AM, Pending Home Sales Index for June. The consensus is for a 0.3% increase in the index.

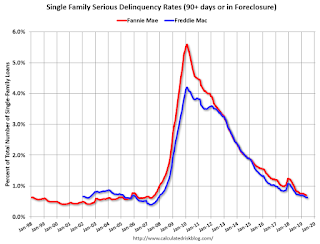

Freddie Mac: Mortgage Serious Delinquency Rate unchanged in June

by Calculated Risk on 7/29/2019 04:42:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in June was 0.63%, unchanged from 0.63% in May. Freddie's rate is down from 0.82% in June 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This equals the lowest serious delinquency rate for Freddie Mac since November 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.4% to 0.6% range - so this is close to a bottom.

Note: Fannie Mae will report for June soon.

FOMC Preview

by Calculated Risk on 7/29/2019 01:54:00 PM

Expectations are the FOMC will cut the Fed Funds rate 25bp at the meeting this week.

Here are some comment from Professor Tim Duy: It’s Rate Cut Week

Bottom Line: Look for 25bp from the Fed this week with a signal that they are prepared to do more but that they remain data dependent and are not committed to a specific policy path.And from Goldman Sachs chief economist Jan Hatzius:

The FOMC will almost certainly cut the funds rate on July 31. We expect a 25bp move because virtually all of the signals from the committee point that way. … Growth, employment, and inflation remain close to the Fed’s goals and the data have consistently surprised on the upside since the June FOMC meeting. Meanwhile, financial conditions are already very easy, and our new analysis of the role of credit market sentiment suggests that further easing could raise financial stability concerns down the road. For these reasons, while a September cut remains our baseline, it is far from a done deal.As Hatzius noted the data "have surprised on the upside since the June FOMC meeting". For review are the June FOMC projections.

Q1 real GDP growth was at 3.1% annualized, and Q2 at 2.1%. So far this year, growth has been above the FOMC projections.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.0 | 1.8 to 2.0 |

| Mar 2019 | 1.9 to 2.2 | 1.8 to 2.0 | 1.7 to 2.0 |

The unemployment rate was at 3.7% in June. The unemployment rate projection for Q2 2019 might be a little high.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Jun 2019 | 3.6 to 3.7 | 3.6 to 3.9 | 3.7 to 4.1 |

| Mar 2019 | 3.6 to 3.8 | 3.5 to 3.9 | 3.6 to 4.0 |

The June PCE report will be released tomorrow. As of May 2019, PCE inflation was up 1.5% from May 2018. Recent data suggests PCE inflation will increase a little.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in May year-over-year. Something to check in the report to be released tomorrow.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.1 |

Dallas Fed: "Texas Manufacturing Continues Moderate Expansion"

by Calculated Risk on 7/29/2019 10:36:00 AM

From the Dallas Fed: Texas Manufacturing Continues Moderate Expansion

Texas factory activity continued to expand in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, moved from 8.9 to 9.3, indicating output growth continued at roughly the same pace as in June.This was the last of the regional Fed surveys for July.

Other measures of manufacturing activity suggested a slightly faster expansion in July. The new orders index edged up to 5.5, and the growth rate of orders index rebounded into positive territory, climbing nine points to 2.7. The capacity utilization index inched up to 11.2, and the shipments index jumped nine points to 10.2.

Perceptions of broader business conditions were less negative in July. The general business activity index rose six points but remained in negative territory for a third month in a row, coming in at -6.3. The company outlook index rose five points to -0.9, with the near-zero reading indicating that the share of firms noting a worsened outlook roughly equaled the share noting an improved outlook. The index measuring uncertainty regarding companies’ outlooks retreated 12 points from its June peak, coming in at 9.7.

Labor market measures suggested robust growth in employment and work hours in July. The employment index rose seven points to 16.0, a reading well above average. Twenty-four percent of firms noted net hiring, while 8 percent noted net layoffs. The hours worked index pushed further above average as well with a reading of 6.6.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

The regional surveys were weak again in July, and based on these regional surveys, it seems likely the ISM manufacturing index will be weak again. The ISM survey will be released on Thursday, and the consensus is for the ISM to be at 51.9, up from 51.7 in June.