by Calculated Risk on 5/23/2019 10:19:00 AM

Thursday, May 23, 2019

New Home Sales decreased to 673,000 Annual Rate in April, March Revised up to New Cycle High

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 692 thousand.

The previous three months were revised up.

"Sales of new single‐family houses in April 2019 were at a seasonally adjusted annual rate of 673,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 6.9 percent below the revised March rate of 723,000, but is 7.0 percent above the April 2018 estimate of 629,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.9 months from 5.6 months in March.

The months of supply increased in April to 5.9 months from 5.6 months in March. The all time record was 12.1 months of supply in January 2009.

This is near the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of April was 332,000. This represents a supply of 5.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2019 (red column), 66 thousand new homes were sold (NSA). Last year, 61 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was close to expectations of 678 thousand sales SAAR, and sales in the three previous months were revised up significantly. And sales in March were revised up to a new cycle high. I'll have more later today.

Weekly Initial Unemployment Claims Decrease to 211,000

by Calculated Risk on 5/23/2019 08:32:00 AM

The DOL reported:

In the week ending May 18, the advance figure for seasonally adjusted initial claims was 211,000, a decrease of 1,000 from the previous week's unrevised level of 212,000. The 4-week moving average was 220,250, a decrease of 4,750 from the previous week's unrevised average of 225,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,250.

This was below the consensus forecast.

Wednesday, May 22, 2019

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 5/22/2019 07:04:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 212 thousand last week.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for 678 thousand SAAR, down from 692 thousand in March.

• At 11:00 AM, the Kansas City Fed manufacturing survey for May.

FOMC Minutes: "A patient approach ... would likely remain appropriate for some time"

by Calculated Risk on 5/22/2019 02:08:00 PM

From the Fed: Minutes of the Federal Open Market Committee, April 30, 2019, and continued on Wednesday, May 1, 2019. A few excerpts:

Participants discussed the potential policy implications of continued low inflation readings. Many participants viewed the recent dip in PCE inflation as likely to be transitory, and participants generally anticipated that a patient approach to policy adjustments was likely to be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective. Several participants also judged that patience in adjusting policy was consistent with the Committee's balanced approach to achieving its objectives in current circumstances in which resource utilization appeared to be high while inflation continued to run below the Committee's symmetric 2 percent objective. However, a few participants noted that if the economy evolved as they expected, the Committee would likely need to firm the stance of monetary policy to sustain the economic expansion and keep inflation at levels consistent with the Committee's objective, or that the Committee would need to be attentive to the possibility that inflation pressures could build quickly in an environment of tight resource utilization. In contrast, a few other participants observed that subdued inflation coupled with real wage gains roughly in line with productivity growth might indicate that resource utilization was not as high as the recent low readings of the unemployment rate by themselves would suggest. Several participants commented that if inflation did not show signs of moving up over coming quarters, there was a risk that inflation expectations could become anchored at levels below those consistent with the Committee's symmetric 2 percent objective—a development that could make it more difficult to achieve the 2 percent inflation objective on a sustainable basis over the longer run. Participants emphasized that their monetary policy decisions would continue to depend on their assessments of the economic outlook and risks to the outlook, as informed by a wide range of data.

In their consideration of the economic outlook, members noted that financial conditions had improved since the turn of the year, and many uncertainties affecting the U.S. and global economic outlooks had receded, though some risks remained. Despite solid economic growth and a strong labor market, inflation pressures remained muted. Members continued to view sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective as the most likely outcomes for the U.S. economy. In light of global economic and financial developments and muted inflation pressures, members concurred that the Committee could be patient as it determined what future adjustments to the target range for the federal funds rate may be appropriate to support those outcomes.

After assessing current conditions and the outlook for economic activity, the labor market, and inflation, members decided to maintain the target range for the federal funds rate at 2-1/4 to 2-1/2 percent. Members agreed that in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee would assess realized and expected economic conditions relative to the Committee's maximum-employment and symmetric 2 percent inflation objectives. They reiterated that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. More generally, members noted that decisions regarding near-term adjustments of the stance of monetary policy would appropriately remain dependent on the evolution of the outlook as informed by incoming data.

Members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time, especially in an environment of moderate economic growth and muted inflation pressures, even if global economic and financial conditions continued to improve.

emphasis added

Philly Fed: State Coincident Indexes increased in 44 states in April

by Calculated Risk on 5/22/2019 12:11:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2019. Over the past three months, the indexes increased in 46 states and decreased in four, for a three-month diffusion index of 84. In the past month, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a one-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In April, 44 states had increasing activity (including minor increases).

AIA: "Slight rebound for architecture billings in April"

by Calculated Risk on 5/22/2019 10:16:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Slight rebound for architecture billings in April

Following a sizable decrease in demand for design services in March, the April Architecture Billings Index (ABI) climbed back into positive territory according to a new report today from The American Institute of Architects (AIA).

AIA’s ABI score for April showed a small increase in design services at 50.5 in April, which is up from 47.8 in March. Any score above 50 indicates an increase in billings. Additionally, business conditions remained strong at firms located in the South. Despite this and the positive overall billings score, most regional and sector indictors continue to display decreasing demand for design services.

“In contrast to 2018, conditions throughout the construction sector recently have become more unsettled,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Though we may not be at a critical inflection point, the next several months of billing data will be indicative of the health of the industry going into 2020.”

...

• Regional averages: South (51.6); Midwest (49.3); West (49.0); Northeast (45.1)

• Sector index breakdown: mixed practice (53.2); institutional (49.2); multi-family residential (47.4); commercial/industrial (46.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.5 in April, up from 47.8 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 11 of the previous 12 months, suggesting a further increase in CRE investment in 2019.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 5/22/2019 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 17, 2019.

... The Refinance Index increased 8 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 7 percent higher than the same week one year ago.

...

“Mortgage rates fell for the fourth straight week, with the 30-year fixed rate mortgage hitting its lowest level since January 2018, leading to a rebound in refinances. The refinance index increased 8 percent to its highest level in over a month, and once again there was an increase in average refinance loan sizes, as borrowers with larger balances responded accordingly to lower rates,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Purchase activity declined again, but remained around 7 percent higher than a year ago. We’re keeping a close eye on whether there may be some adverse effects of the ongoing global trade disputes on overall demand. Some potential homebuyers may be delaying their home search until there’s more certainty.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.33 percent from 4.40 percent, with points increasing to 0.43 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

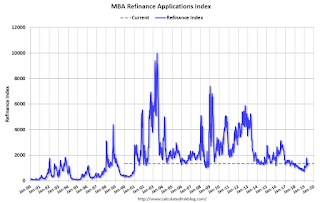

Click on graph for larger image.The first graph shows the refinance index since 1990.

Once mortgage rates fell more than 50 bps from the highs of last year, a number of recent buyers were able to refinance. But it would take another significant decrease in rates to see a further increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 7% year-over-year.

Tuesday, May 21, 2019

Wednesday: FOMC Minutes

by Calculated Risk on 5/21/2019 08:14:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of April 30-May 1, 2019

Chemical Activity Barometer Increased Slightly in May

by Calculated Risk on 5/21/2019 04:07:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Shows Third Monthly Gain in May

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.4 percent in May on a three-month moving average (3MMA) basis, the third monthly gain after several weak months. On a year-over-year (Y/Y) basis, the barometer is up 0.5 percent (3MMA).

...

"Year-earlier comparisons have turned positive in recent months, and while trade tensions, slowing economic growth overseas, and soft economic reports in the U.S. have created uncertainty that has weighed on business investment, the CAB signals gains in U.S. commercial and industrial activity through mid-2019, albeit at a moderate pace,” said Kevin Swift, chief economist at ACC. “There is some possibility of improving activity in the closing months of the year.”

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

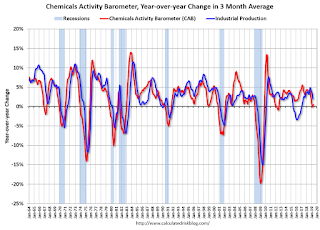

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB suggests that the YoY increase in industrial production will probably slow further.

Comments on April Existing Home Sales

by Calculated Risk on 5/21/2019 01:28:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 5.19 million in April

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

Overall, this is still a somewhat reasonable level for existing home sales. No worries.

2) Inventory is still low, and was only up 1.7% year-over-year (YoY) in April. This was the ninth consecutive month with a year-over-year increase in inventory, although the YoY increase was smaller in April than in the six previous months.

3) Year-to-date sales are down about 4.9% compared to the same period in 2018. On an annual basis, that would put sales around 5.1 million in 2019. Sales slumped at the end of 2018 and in January 2019 due to higher mortgage rates, the stock market selloff, and fears of an economic slowdown (unfounded).

The comparisons will be easier towards the end of the year.

Sales NSA in April (455,000, red column) were below sales in April 2018 (460,000, NSA), but sales were higher than in April 2017..