by Calculated Risk on 3/18/2019 11:24:00 AM

Monday, March 18, 2019

Sacramento Housing in February: Sales Down 10% YoY, Active Inventory up 16% YoY

From SacRealtor.org: February sees increase in sales volume, sales price

The month closed with 1,015 total sales, a 13.5% increase from the 894 sales of January. Compared to the same month last year (1,131), the current figure is down 10.3%.CR Note: Inventory is still low - months of inventory is at 2.0 months, probably closer to 4 months would be normal - and this is the smallest YoY increase since January 2018.

...

The Active Listing Inventory decreased, falling 4.8% from 2,095 to 1,994 units. The Months of Inventory decreased 13% from 2.3 to 2 Months. [Note: Compared to February 2018, inventory is up 15.7%] .

...

The Average DOM (days on market) increased again, rising from 40 to 43. The Median DOM remained at 27. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.”

emphasis added

NAHB: Builder Confidence "Steady" in March

by Calculated Risk on 3/18/2019 10:04:00 AM

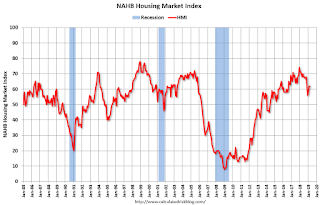

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 62 in March, unchanged from 62 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Holds Steady in March

Builder confidence in the market for newly-built single-family homes held steady at 62 in March, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“Builders report the market is stabilizing following the slowdown at the end of 2018 and they anticipate a solid spring home buying season,” said NAHB Chairman Greg Ugalde, a home builder and developer from Torrington, Conn.

“In a healthy sign for the housing market, more builders are saying that lower price points are selling well, and this was reflected in the government’s new home sales report released last week,” said NAHB Chief Economist Robert Dietz. “Increased inventory of affordably priced homes – in markets where government policies support such construction - will enable more entry-level buyers to enter the market.”

…

The HMI component charting sales expectations in the next six months rose three points to 71, the index gauging current sales conditions increased two points to 68, and the component measuring traffic of prospective buyers fell four points to 44. Looking at the three-month moving averages for regional HMI scores, the Northeast posted a five-point gain to 48, the South was up three points to 66 and West increased two points to 69. The Midwest posted a one-point decline to 51.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was close to the consensus forecast.

Sunday, March 17, 2019

Sunday Night Futures

by Calculated Risk on 3/17/2019 08:34:00 PM

Weekend:

• Schedule for Week of March 17, 2019

• FOMC Preview

Monday:

• 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up slightly over the last week with WTI futures at $58.39 per barrel and Brent at $67.07 per barrel. A year ago, WTI was at $62, and Brent was at $65 - so WTI oil prices are down less than 10% year-over-year, and Brent is up slightly.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.54 per gallon, so gasoline prices are unchanged year-over-year.

FOMC Preview

by Calculated Risk on 3/17/2019 12:19:00 PM

The consensus is that there will no change in policy at the FOMC meeting this week, and that the Fed will continue to emphasize "patience". Also the Fed is expected to announce the conclusion of the balance sheet runoff later this year (perhaps around September)

There might some slight downward revisions in the economic projections.

Here are the December FOMC projections.

The FOMC is projecting Q4 over the previous Q41, and 2018 came in at 3.1% real growth. (Note: Annual real GDP increased 2.9% in 2018)

Most analysts expect growth to slow in 2019, and Q1 forecasts are around 1% (many below 1%). So projections for 2019 might be revised down further.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.0 to 3.1 | 2.3 to 2.5 | 1.8 to 2.0 |

| Sep 2018 | 3.0 to 3.2 | 2.4 to 2.7 | 1.8 to 2.1 |

The unemployment rate was at 3.8% in February. (The unemployment rate averaged 3.8% in Q4 2018). The unemployment rate projection for 2019 will probably be unchanged or revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.7 | 3.5 to 3.7 | 3.5 to 3.8 |

| Sep 2018 | 3.7 | 3.4 to 3.6 | 3.4 to 3.8 |

As of December 2018, PCE inflation was up 1.7% from December 2017. This was below the projected range for 2018. However oil prices have stabilized (after falling sharply), and it seems likely any revision to 2019 projections will be minor.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 1.8 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.1 to 2.2 |

PCE core inflation was up 1.9% in December year-over-year. Any change to Core PCE inflation for 2019 will probably be minor.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 1.9 to 2.0 | 2.0 to 2.1 | 2.1 to 2.2 |

In general the data has been somewhat softer than the FOMC's December projections.

Saturday, March 16, 2019

Schedule for Week of March 17, 2019

by Calculated Risk on 3/16/2019 08:12:00 AM

The key report this week is February existing home sales.

For manufacturing, the March Philly Fed manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 63, up from 62. Any number above 50 indicates that more builders view sales conditions as good than poor.

No major economic releases scheduled. Note: Housing Starts for February will be released on March 26th.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, down from 229 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of 4.4, up from -4.1.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.08 million SAAR, up from 4.94 million.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.08 million SAAR, up from 4.94 million.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for February 2019

Friday, March 15, 2019

LA area Port Traffic Down Year-over-year in February

by Calculated Risk on 3/15/2019 05:55:00 PM

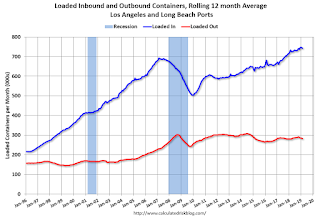

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.8% in February compared to the rolling 12 months ending in January. Outbound traffic was down 1.2% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 8 years.

Q1 GDP Forecasts: Slightly Positive

by Calculated Risk on 3/15/2019 12:54:00 PM

From Goldman Sachs:

We lowered our Q1 GDP tracking estimate by two tenths to +0.4%. [March 15 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 1.4% for 2019:Q1 and 1.5% for 2019:Q2. [Mar 15 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 0.4 percent on March 13, up from 0.2 percent on March 11. [Mar 13 estimate]CR Note: These early estimates suggest GDP will be slightly positive in Q1.

BLS: Job Openings Increased to 7.6 Million in January

by Calculated Risk on 3/15/2019 10:12:00 AM

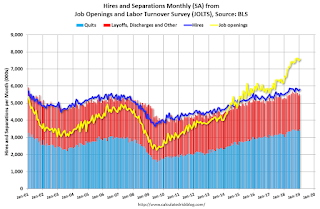

Notes: In January there were 7.581 million job openings, and, according to the January Employment report, there were 6.535 million unemployed. So, for the eleventh consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 7.6 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in January at 3.5 million. The quits rate was 2.3 percent. The quits level was little changed for total private but increased for government

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 7.581 million from 7.479 million in December.

The number of job openings (yellow) are up 15% year-over-year.

Quits are up 15% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

Industrial Production Increased 0.1% in February

by Calculated Risk on 3/15/2019 09:21:00 AM

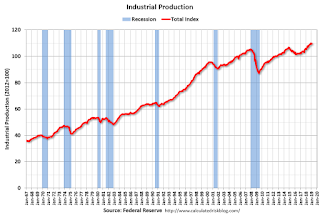

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged up 0.1 percent in February after decreasing 0.4 percent in January. Manufacturing production fell 0.4 percent in February for its second consecutive monthly decline. The index for utilities rose 3.7 percent, while the index for mining moved up 0.3 percent. At 109.7 percent of its 2012 average, total industrial production was 3.5 percent higher in February than it was a year earlier. Capacity utilization for the industrial sector edged down 0.1 percentage point in February to 78.2 percent, a rate that is 1.6 percentage points below its long-run (1972–2018) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.2% is 1.6% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 109.7. This is 26% above the recession low, and 4.1% above the pre-recession peak.

The increase in industrial production and decrease in capacity utilization were below consensus.

NY Fed: Manufacturing "Business activity grew only slightly in New York State"

by Calculated Risk on 3/15/2019 08:45:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity expanded only slightly. The general business conditions index fell five points to 3.7, its third consecutive monthly reading below 10, suggesting that growth has remained quite a bit slower so far this year than it was for most of 2018.This was below the consensus forecast.

The index for number of employees climbed ten points to 13.8, pointing to an increase in employment levels, though the average workweek index turned negative for the first time since 2016. emphasis added