by Calculated Risk on 3/06/2019 11:23:00 AM

Wednesday, March 06, 2019

Las Vegas Real Estate in February: Sales Down 7% YoY, Inventory up 105% YoY

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local home prices dip below $300,000 as homes sell at slower pace, GLVAR housing statistics for February 2019

Local home prices dipped below $300,000 in February while fewer properties changed hands and more homes were on the market than one year ago. That’s according to a report released Wednesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 7% year-over-year from 2,704 in February 2018 to 2,508 in February 2019.

...

The total number of existing local homes, condos and townhomes sold during February was 2,508. Compared to one year ago, February sales were down 7.6 percent for homes and down 5.9 percent for condos and townhomes.

...

At the current sales pace, Carpenter said Southern Nevada now has less than a four-month supply of homes available for sale. That’s up sharply from one year ago, but still below what would normally be considered a balanced market. By the end of February, GLVAR reported 7,134 single-family homes listed for sale without any sort of offer. That’s up 95.3 percent from one year ago. For condos and townhomes, the 1,754 properties listed without offers in February represented a 158.3 percent jump from one year ago.

...

The number of so-called distressed sales also continues to drop. GLVAR reported that short sales and foreclosures combined accounted for just 2.6 percent of all existing local property sales in February. That’s down from 3.8 percent of all sales one year ago and 10.6 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,332 in February 2018 to 8,888 in February 2019. Note: Total inventory was up 105% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

Trade Deficit increased to $59.8 Billion in December

by Calculated Risk on 3/06/2019 08:44:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $59.8 billion in December, up $9.5 billion from $50.3 billion in November, revised.

December exports were $205.1 billion, $3.9 billion less than November exports. December imports were $264.9 billion, $5.5 billion more than November imports.

Click on graph for larger image.

Click on graph for larger image.Exports decreased and imports increased in December.

Exports are 24% above the pre-recession peak and unchanged compared to December 2017; imports are 14% above the pre-recession peak, and up 3% compared to December 2017.

In general, trade has been picking up, although exports have declined slightly recently.

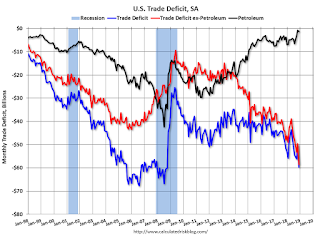

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $50.27 in December, down from $57.54 in November, and down from $52.08 in December 2017.

The trade deficit with China increased to $36.8 billion in December, from $30.8 billion in December 2017.

ADP: Private Employment increased 183,000 in February

by Calculated Risk on 3/06/2019 08:20:00 AM

Private sector employment increased by 183,000 jobs from January to February according to the February ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was close to the consensus forecast for 180,000 private sector jobs added in the ADP report.

...

“We saw a modest slowdown in job growth this month,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Midsized companies have been the strongest performer for the past year. There was a sharp decline in small business growth as these firms continue to struggle with offering competitive wages and benefits.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The economy has throttled back and so too has job growth. The job slowdown is clearest in the retail and travel industries, and at smaller companies. Job gains are still strong, but they have likely seen their high watermark for this expansion.”

The BLS report for January will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in February.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 3/06/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 1, 2019. The results for the week ending February 22, 2019, included an adjustment for the Washington's Birthday (Presidents’ Day) holiday.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 1 percent higher than the same week one year ago.

...

“Slightly higher mortgages rates last week led to a decrease in application volume. Furthermore, the average loan size for purchase applications increased to a record high, led by a rise in the average size of conventional loans. This suggests that move-up and higher-end buyers have so far become a greater share of the spring market,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “Overall, conventional purchase loans are up 2.1 percent relative to last year, indicating that homebuyers continue to be inspired by the stable rate environment and the modest increase in housing supply.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.67 percent from 4.65 percent, with points increasing to 0.44 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Rates would have to fall further for a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 1% year-over-year.

Tuesday, March 05, 2019

Wednesday: ADP Employment, Trade Deficit, Beige Book

by Calculated Risk on 3/05/2019 07:05:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in February, down from 213,000 added in January.

• At 8:30 AM, Trade Balance report for December from the Census Bureau. The consensus is the trade deficit to be $57.6 billion. The U.S. trade deficit was at $49.3 billion in November.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

A few Comments on December New Home Sales

by Calculated Risk on 3/05/2019 01:18:00 PM

First, this report was for December; the January report will be released on March 14th.

New home sales for December were reported at 621,000 on a seasonally adjusted annual rate basis (SAAR). This was above the consensus forecast, however the three previous months were revised down.

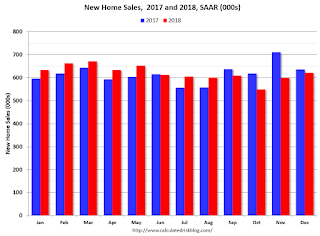

Even with the weakness at the end of 2018, sales increased 1.5% in 2018 compared to 2017. I expect sales to be around the same level in 2019 as in 2018 (not fall off a cliff), and my guess is we haven't seen the peak of this cycle yet.

On Inventory: Months of inventory is now above the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales increased to 621,000 Annual Rate in December.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

The comparison for November and December were difficult (sales in November 2017 were especially strong).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

The "distressing gap" graph shows existing home sales (left axis) through January and new home sales (right axis) through December 2018. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) through January and new home sales (right axis) through December 2018. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next few years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

BEA: February Vehicles Sales at 16.6 Million SAAR

by Calculated Risk on 3/05/2019 12:11:00 PM

The BEA released their estimate of February vehicle sales. The BEA estimated sales of 16.53 million SAAR in February 2019 (Seasonally Adjusted Annual Rate), down 0.8% from the January sales rate, and down 2.3% from February 2018.

2019 is off to a slow start for vehicle sales; averaging 16.6 million through February (average of seasonally adjusted rate).

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 were the fourth best ever, but 2019 is off to a slow start.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

This means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

ISM Non-Manufacturing Index increased to 59.7% in February

by Calculated Risk on 3/05/2019 10:46:00 AM

The February ISM Non-manufacturing index was at 59.7%, up from 56.7% in January. The employment index decreased in February to 55.2%, from 57.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2019 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 109th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 59.7 percent, which is 3 percentage points higher than the January reading of 56.7 percent. This represents continued growth in the non-manufacturing sector, at a faster rate. The Non-Manufacturing Business Activity Index increased to 64.7 percent, 5 percentage points higher than the January reading of 59.7 percent, reflecting growth for the 115th consecutive month, at a faster rate in February. The New Orders Index registered 65.2 percent, 7.5 percentage points higher than the reading of 57.7 percent in January. The Employment Index decreased 2.6 percentage points in February to 55.2 percent from the January reading of 57.8 percent. The Prices Index decreased 5 percentage points from the January reading of 59.4 percent to 54.4 percent, indicating that prices increased in February for the 21st consecutive month. According to the NMI®, all 18 non-manufacturing industries reported growth. The non-manufacturing sector’s growth rate rebounded in February after cooling off in January. Respondents are concerned about the uncertainty of tariffs, capacity constraints and employment resources; however, they remain mostly optimistic about overall business conditions and the economy.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in February than in January.

New Home Sales increased to 621,000 Annual Rate in December

by Calculated Risk on 3/05/2019 10:15:00 AM

Note: This release is for December (this was delayed due to the government shutdown). The January report is scheduled for March 14th.

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 621 thousand.

The previous three months were revised down significantly.

"Sales of new single‐family houses in December 2018 were at a seasonally adjusted annual rate of 621,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.7 percent above the revised November rate of 599,000, but is 2.4 percent below the December 2017 estimate of 636,000.

An estimated 622,000 new homes were sold in 2018. This is 1.5 percent above the 2017 figure of 613,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply decreased in December to 6.6 months from 6.7 months in November.

The months of supply decreased in December to 6.6 months from 6.7 months in November. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of December was 344,000. This represents a supply of 6.6 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2018 (red column), 44 thousand new homes were sold (NSA). Last year, 45 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in 1966 and 2010.

This was above expectations of 591,000 sales SAAR, however the previous months were revised down. I'll have more later today.

CoreLogic: House Prices up 4.4% Year-over-year in January

by Calculated Risk on 3/05/2019 08:33:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports January Home Prices Increased by 4.4 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for January 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.4 percent year over year from January 2018. On a month-over-month basis, prices increased by 0.1 percent in January 2019. (December 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, the CoreLogic HPI Forecast indicates that the 2019 annual average home price will increase 3.4 percent above the 2018 annual average. On a month-over-month basis, home prices are expected to decrease by 0.9 percent from January 2019 to February 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The spike in mortgage interest rates last fall chilled buyer activity and led to a slowdown in home sales and price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Fixed-rate mortgage rates have dropped 0.6 percentage points since November 2018 and today are lower than they were a year ago. With interest rates at this level, we expect a solid home-buying season this spring.”

emphasis added

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.

CR Note: The CoreLogic YoY increase had been in the 5% to 7% range for the last few years. This is the slowest twelve-month home-price growth rate since August 2012.The year-over-year comparison has been positive for almost seven consecutive years since turning positive year-over-year in February 2012.