by Calculated Risk on 1/09/2019 02:10:00 PM

Wednesday, January 09, 2019

FOMC Minutes: "Committee could afford to be patient about further policy firming"

From the Fed: Minutes of the Federal Open Market Committee, December 18-19, 2018. A few excerpts:

With regard to the outlook for monetary policy beyond this meeting, participants generally judged that some further gradual increases in the target range for the federal funds rate would most likely be consistent with a sustained economic expansion, strong labor market conditions, and inflation near 2 percent over the medium term. With an increase in the target range at this meeting, the federal funds rate would be at or close to the lower end of the range of estimates of the longer-run neutral interest rate, and participants expressed that recent developments, including the volatility in financial markets and the increased concerns about global growth, made the appropriate extent and timing of future policy firming less clear than earlier. Against this backdrop, many participants expressed the view that, especially in an environment of muted inflation pressures, the Committee could afford to be patient about further policy firming. A number of participants noted that, before making further changes to the stance of policy, it was important for the Committee to assess factors such as how the risks that had become more pronounced in recent months might unfold and to what extent they would affect economic activity, and the effects of past actions to remove policy accommodation, which were likely still working their way through the economy.

Participants emphasized that the Committee's approach to setting the stance of policy should be importantly guided by the implications of incoming data for the economic outlook. They noted that their expectations for the path of the federal funds rate were based on their current assessment of the economic outlook. Monetary policy was not on a preset course; neither the pace nor the ultimate endpoint of future rate increases was known. If incoming information prompted meaningful reassessments of the economic outlook and attendant risks, either to the upside or the downside, their policy outlook would change. Various factors, such as the recent tightening in financial conditions and risks to the global outlook, on the one hand, and further indicators of tightness in labor markets and possible risks to financial stability from a prolonged period of tight resource utilization, on the other hand, were noted in this context.

emphasis added

No Bank Failures in 2018; First Time since 2006

by Calculated Risk on 1/09/2019 11:59:00 AM

In 2018, no FDIC insured banks failed. This was down from 8 in 2017. This is only the third time since the FDIC was founded in 1933 that there were no bank failures in a calendar year.

The great recession / housing bust / financial crisis related failures are behind us.

The first graph shows the number of bank failures per year since the FDIC was founded in 1933.

Typically about 7 banks fail per year.

This was the first year with no failures since 2006.

Note: There were a large number of failures in the '80s and early '90s. Many of these failures were related to loose lending, especially for commercial real estate. Also, a large number of the failures in the '80s and '90s were in Texas with loose regulation.

Even though there were more failures in the '80s and early '90s then during the recent crisis, the recent financial crisis was much worse (larger banks failed and were bailed out).

Then, during the Depression, thousands of banks failed. Note that the S&L crisis and recent financial crisis look small on this graph.

Black Knight Mortgage Monitor for November

by Calculated Risk on 1/09/2019 09:30:00 AM

Black Knight released their Mortgage Monitor report for November today. According to Black Knight, 3.71% of mortgages were delinquent in November, down from 4.55% in November 2017. Black Knight also reported that 0.52% of mortgages were in the foreclosure process, down from 0.66% a year ago.

This gives a total of 4.23% delinquent or in foreclosure.

Press Release: Black Knight: 550,000 Homeowners Regain Incentive to Refinance as Interest Rates Fall Slightly; Refinanceable Population Still Down Nearly 50 Percent from Last Year

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI) released its latest Mortgage Monitor Report, based upon its industry-leading loan-level mortgage performance database. As mortgage interest rates have dropped from multi-year highs in recent weeks, the number of homeowners with mortgages who could likely qualify for and see at least a 0.75 percent interest rate reduction by refinancing has increased by approximately 550,000. Ben Graboske, executive vice president of Black Knight’s Data & Analytics division, explained that although this number represents a relatively small share of outstanding mortgages, it is a sizeable increase from recent lows in the size of the refinanceable population.

“As recently as last month, the size of the refinanceable population fell to a 10-year low as interest rates hit multi-year highs,” said Graboske. “Rates have since pulled back, with the 30-year fixed rate falling to 4.55 percent as of the end of December. As a result, some 550,000 homeowners with mortgages who would not benefit from refinancing have now seen their interest rate incentive to refinance return. Even so, at 2.43 million, the refinanceable population is still down nearly 50 percent from last year. Still, the increase does represent a 29 percent rise from that 10-year low, which may provide some solace to a refinance market still reeling from multiple quarters of historically low – and declining – volumes.

“In fact, through the third quarter of 2018, refinances made up just 36 percent of mortgage originations, an 18-year low. And of course, as refinances decline, the purchase share of the market rises correspondingly. So now, in the most purchase-dominant market we’ve seen this century, we need to ask whether the shift in originations will have any impact on mortgage performance. The short answer, based on historical trends, is that it certainly bears close watching. Refinances have tended to perform significantly better than purchase mortgages in recent years. When we take a look back and apply today’s blend of originations to prior vintages, the impact becomes clear. A market blend matching today's would have resulted in an increase in the number of non-current mortgages by anywhere from two percent in 2017 to more than a 30 percent rise in 2012, when refinances made up more than 70 percent of all lending. As today’s market shifts to a purchase-heavy blend of lending, Black Knight will continue to keep a close eye on the data for signs of how – or if – this impacts mortgage performance moving forward.”

Leveraging the latest data from the Black Knight Home Price Index, the report also finds that flattening home price growth over the last four months has led to the slowest annual appreciation rates in nearly three years.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph from the Mortgage Monitor that compares Black Knight's estimate of home price appreciation and 30 year mortgage rates.

From Black Knight:

• Home prices were effectively flat M/M (+0.01%) in October, and in fact had been so over the prior four months (+0.01%)

• While fall and winter are typically slow times of the year for home price growth, this is the most tepid 4-month stretch of growth in nearly four years

• Annual home price gains continue to slow, decelerating by 1.3% over the past 8 months, from a 4-year high of 6.7% in February to 5.4% Y/Y in October and slowing rapidly

• Additional near-term pressure may be on the way as affordability hit a new low point as interest rates rose to 4.87% on average in NovemberThere is much more in the mortgage monitor.

• Rates have since pulled back noticeably in December, bringing the average monthly payment to buy the average-priced home down $46 from November's 11-year high

• Even with December's pullback, it still takes $141 more per month (+13%) in principal and interest (assuming 20% down) to purchase the average home than 12 months ago

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/09/2019 07:00:00 AM

From the MBA: Mortgage Applications Rebound in Latest MBA Weekly Survey

Mortgage applications increased 23.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 4, 2019. This week’s results include an adjustment for the New Year’s Day holiday.

... The Refinance Index increased 35 percent from the previous week. The seasonally adjusted Purchase Index increased 17 percent from one week earlier. The unadjusted Purchase Index increased 59 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

“Mortgage rates fell across the board last week and applications rebounded sharply, after what was a slower than usual holiday period. The 30-year fixed-rate mortgage declined 10 basis points to 4.74 percent, the lowest since April 2018, and other loan types saw rate decreases of between 9 and 20 basis points,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “This drop in rates spurred a flurry of refinance activity – particularly for borrowers with larger loans – and pushed the average loan size on refinance applications to the highest in the survey (at $339,800). The surge in refinance activity also brought the refinance index to its highest level since last July.”

Added Kan, “Purchase applications had their strongest week in a month, finishing over four percent higher than a year ago, as both conventional and government purchase activity bounced back with solid gains after a sluggish holiday season.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to its lowest level since April 2018, 4.74 percent, from 4.84 percent, with points increasing to 0.47 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, January 08, 2019

Wednesday: FOMC Minutes

by Calculated Risk on 1/08/2019 07:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Meeting of Dec 18-19

Lawler: Some Early Realtor/MLS Based Reports on Home Sales and Active Listings for December

by Calculated Risk on 1/08/2019 04:19:00 PM

The table below is from housing economist Tom Lawler: Some Early Realtor/MLS Based Reports on Home Sales and Active Listings for December

CR Note: Earlier I posted on "Seattle Area" that was data for all of King County. Tom Lawler breaks out the City of Seattle below.

Edit: The Seattle numbers were incorrect (from November, not December). These have been updated.

| MLS Home Sales | Active Listings | |||||

|---|---|---|---|---|---|---|

| Dec-18 | Dec-17 | % Chg | Dec-18 | Dec-17 | % Chg | |

| Denver Metro | 3,396 | 4,408 | -23.0% | 5,577 | 3,854 | 44.7% |

| Colorado Springs | 1,209 | 1,366 | -11.5% | 2,834 | 1,430 | 98.2% |

| NW Washington State | 6,374 | 7,462 | -14.6% | 12,275 | 8,553 | 43.5% |

| King County | 2,157 | 2,681 | -19.5% | 3,690 | 1,374 | 168.6% |

| City of Seattle | 627 | 810 | -22.6% | 1,111 | 299 | 271.6% |

| North Texas | 8,253 | 9,118 | -9.5% | 23,001 | 18,666 | 23.2% |

Seattle Area Real Estate in December: Sales Down 20% YoY, Inventory up 169% YoY

by Calculated Risk on 1/08/2019 03:12:00 PM

The Northwest Multiple Listing Service reported Attentive home buyers can find "good values and receptive sellers"

December brought few surprises for real estate brokers in Western Washington with holidays, fluctuating interest rates, and volatility in consumer confidence contributing to slower activity. Several leaders from Northwest Multiple Listing Service described 2018 as a transition year for residential real estate.The press release is for the Northwest. In King County, sales were down 19.5% year-over-year, and active inventory was up 169% year-over-year. This is another market with inventory increasing sharply year-over-year, but months-of-supply in King County is still on the low side at 1.7 months.

New data from the MLS show inventory in its 23-county market area dipped below two months of supply for the first time since July. A year-over-year comparison of the number of new listings, pending sales, and closed sales show drops overall, while prices rose from the same month a year ago.

Member-brokers added 3,631 new listings of single family homes and condominiums during December (10.4 percent fewer than a year ago), boosting total active listings to 12,275, up from the year-ago volume of 8,553. Pending sales were down about 8.4 percent from twelve months ago (5,677 versus 6,198), and the volume of closed sales dropped nearly 16.6 percent (6,374 versus 7,642).

For 2018, members of Northwest MLS reported completing 92,555 transactions, which compares with 99,345 closed sales during 2017 for a drop of about 6.8 percent. The median price on last year's closed sales of single family homes and condominiums combined was $402,000, up $32,000 (8.64 percent) from 2017.

...

The 12,275 active listings in the MLS database at year end was down from November when inventory totaled 15,830 properties, and down from 2018's peak of 19,526 listings at the end of September. Measured another way, there was 1.93 months of supply at the end of December, with four-to-six months typically considered to be a balanced market. A year ago there was only 1.12 months of supply. On a percentage basis, year-over-year inventory has climbed each month since May.

emphasis added

Las Vegas Real Estate in December: Sales Down 17% YoY, Inventory up 82% YoY

by Calculated Risk on 1/08/2019 12:38:00 PM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada housing market slowed down in December, GLVAR housing statistics for December 2018

The recent cooling trend continued through December for the local housing market, with stable home prices, fewer properties changing hands and more homes on the market than one year ago. So says a report released Tuesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 17.0% year-over-year from 3,204 in December 2017 to 2,658 in December 2018.

...

The total number of existing local homes, condos and townhomes sold during December was 2,658. Compared to one year ago, December sales were down 18.2 percent for homes and down 11.8 percent for condos and townhomes. GLVAR reported a total of 42,876 property sales in 2018, down from 45,388 in all of 2017.

...

While the number of local homes available for sale is still below what would normally be considered a balanced market, Southern Nevada now has more than a three-month housing supply. By the end of December, GLVAR reported 6,615 single-family homes listed for sale without any sort of offer. That’s up 72.9 percent from one year ago. For condos and townhomes, the 1,528 properties listed without offers in December represented a 132.9 percent jump from one year ago.

...

The number of so-called distressed sales continues to drop each year. GLVAR reported that short sales and foreclosures combined accounted for just 2.9 percent of all existing local property sales in December, compared to 3.6 percent of all sales one year ago and 11 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,483 in December 2017 to 8,143 in December 2018. Note: Total inventory was up 81.6% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

BLS: Job Openings decrease to 6.9 Million in November

by Calculated Risk on 1/08/2019 10:07:00 AM

Notes: In November there were 6.888 million job openings, and, according to the November Employment report, there were 6.018 million unemployed. So, for the eighth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings fell to 6.9 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged down to 5.7 million, quits edged down to 3.4 million, and total separations were little changed at 5.5 million. Within separations, the quits rate and the layoffs and discharges rate were unchanged at 2.3 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits edged down in November to 3.4 million (-112,000). The quits rate was 2.3 percent. The quits level edged down for total private (-122,000) and was little changed for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in November to 6.888 million from 7.131 million in October.

The number of job openings (yellow) are up 16% year-over-year.

Quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

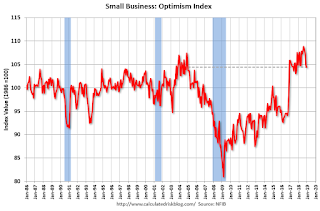

Small Business Optimism Index decreased in December

by Calculated Risk on 1/08/2019 09:47:00 AM

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): December 2018 Report: Small Business Optimism Index

The Small Business Optimism Index was basically unchanged in December, drifting down 0.4 points to 104.4. Job openings set a new record high, job creation plans strengthened, and inventory investment plans surged. On the downside, expected real sales growth and expected business conditions in six months accounted for the decline in the Index.

..

Job creation was solid in December with a net addition of 0.25 workers per firm (including those making no change in employment), up from 0.19 in November and the best reading since July. ... Twenty-three percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, down 2 points from last month’s record high reading. Thirty-nine percent of all owners reported job openings they could not fill in the current period, up 5 points and a new record high. Labor markets are still exceptionally tight.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.4 in December.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.