by Calculated Risk on 1/09/2019 07:00:00 AM

Wednesday, January 09, 2019

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Rebound in Latest MBA Weekly Survey

Mortgage applications increased 23.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 4, 2019. This week’s results include an adjustment for the New Year’s Day holiday.

... The Refinance Index increased 35 percent from the previous week. The seasonally adjusted Purchase Index increased 17 percent from one week earlier. The unadjusted Purchase Index increased 59 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

“Mortgage rates fell across the board last week and applications rebounded sharply, after what was a slower than usual holiday period. The 30-year fixed-rate mortgage declined 10 basis points to 4.74 percent, the lowest since April 2018, and other loan types saw rate decreases of between 9 and 20 basis points,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “This drop in rates spurred a flurry of refinance activity – particularly for borrowers with larger loans – and pushed the average loan size on refinance applications to the highest in the survey (at $339,800). The surge in refinance activity also brought the refinance index to its highest level since last July.”

Added Kan, “Purchase applications had their strongest week in a month, finishing over four percent higher than a year ago, as both conventional and government purchase activity bounced back with solid gains after a sluggish holiday season.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to its lowest level since April 2018, 4.74 percent, from 4.84 percent, with points increasing to 0.47 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, January 08, 2019

Wednesday: FOMC Minutes

by Calculated Risk on 1/08/2019 07:55:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Minutes, Meeting of Dec 18-19

Lawler: Some Early Realtor/MLS Based Reports on Home Sales and Active Listings for December

by Calculated Risk on 1/08/2019 04:19:00 PM

The table below is from housing economist Tom Lawler: Some Early Realtor/MLS Based Reports on Home Sales and Active Listings for December

CR Note: Earlier I posted on "Seattle Area" that was data for all of King County. Tom Lawler breaks out the City of Seattle below.

Edit: The Seattle numbers were incorrect (from November, not December). These have been updated.

| MLS Home Sales | Active Listings | |||||

|---|---|---|---|---|---|---|

| Dec-18 | Dec-17 | % Chg | Dec-18 | Dec-17 | % Chg | |

| Denver Metro | 3,396 | 4,408 | -23.0% | 5,577 | 3,854 | 44.7% |

| Colorado Springs | 1,209 | 1,366 | -11.5% | 2,834 | 1,430 | 98.2% |

| NW Washington State | 6,374 | 7,462 | -14.6% | 12,275 | 8,553 | 43.5% |

| King County | 2,157 | 2,681 | -19.5% | 3,690 | 1,374 | 168.6% |

| City of Seattle | 627 | 810 | -22.6% | 1,111 | 299 | 271.6% |

| North Texas | 8,253 | 9,118 | -9.5% | 23,001 | 18,666 | 23.2% |

Seattle Area Real Estate in December: Sales Down 20% YoY, Inventory up 169% YoY

by Calculated Risk on 1/08/2019 03:12:00 PM

The Northwest Multiple Listing Service reported Attentive home buyers can find "good values and receptive sellers"

December brought few surprises for real estate brokers in Western Washington with holidays, fluctuating interest rates, and volatility in consumer confidence contributing to slower activity. Several leaders from Northwest Multiple Listing Service described 2018 as a transition year for residential real estate.The press release is for the Northwest. In King County, sales were down 19.5% year-over-year, and active inventory was up 169% year-over-year. This is another market with inventory increasing sharply year-over-year, but months-of-supply in King County is still on the low side at 1.7 months.

New data from the MLS show inventory in its 23-county market area dipped below two months of supply for the first time since July. A year-over-year comparison of the number of new listings, pending sales, and closed sales show drops overall, while prices rose from the same month a year ago.

Member-brokers added 3,631 new listings of single family homes and condominiums during December (10.4 percent fewer than a year ago), boosting total active listings to 12,275, up from the year-ago volume of 8,553. Pending sales were down about 8.4 percent from twelve months ago (5,677 versus 6,198), and the volume of closed sales dropped nearly 16.6 percent (6,374 versus 7,642).

For 2018, members of Northwest MLS reported completing 92,555 transactions, which compares with 99,345 closed sales during 2017 for a drop of about 6.8 percent. The median price on last year's closed sales of single family homes and condominiums combined was $402,000, up $32,000 (8.64 percent) from 2017.

...

The 12,275 active listings in the MLS database at year end was down from November when inventory totaled 15,830 properties, and down from 2018's peak of 19,526 listings at the end of September. Measured another way, there was 1.93 months of supply at the end of December, with four-to-six months typically considered to be a balanced market. A year ago there was only 1.12 months of supply. On a percentage basis, year-over-year inventory has climbed each month since May.

emphasis added

Las Vegas Real Estate in December: Sales Down 17% YoY, Inventory up 82% YoY

by Calculated Risk on 1/08/2019 12:38:00 PM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada housing market slowed down in December, GLVAR housing statistics for December 2018

The recent cooling trend continued through December for the local housing market, with stable home prices, fewer properties changing hands and more homes on the market than one year ago. So says a report released Tuesday by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were down 17.0% year-over-year from 3,204 in December 2017 to 2,658 in December 2018.

...

The total number of existing local homes, condos and townhomes sold during December was 2,658. Compared to one year ago, December sales were down 18.2 percent for homes and down 11.8 percent for condos and townhomes. GLVAR reported a total of 42,876 property sales in 2018, down from 45,388 in all of 2017.

...

While the number of local homes available for sale is still below what would normally be considered a balanced market, Southern Nevada now has more than a three-month housing supply. By the end of December, GLVAR reported 6,615 single-family homes listed for sale without any sort of offer. That’s up 72.9 percent from one year ago. For condos and townhomes, the 1,528 properties listed without offers in December represented a 132.9 percent jump from one year ago.

...

The number of so-called distressed sales continues to drop each year. GLVAR reported that short sales and foreclosures combined accounted for just 2.9 percent of all existing local property sales in December, compared to 3.6 percent of all sales one year ago and 11 percent two years ago.

emphasis added

2) Active inventory (single-family and condos) is up sharply from a year ago, from a total of 4,483 in December 2017 to 8,143 in December 2018. Note: Total inventory was up 81.6% year-over-year. This is a significant increase in inventory, although months-of-supply is still somewhat low.

3) Fewer distressed sales.

BLS: Job Openings decrease to 6.9 Million in November

by Calculated Risk on 1/08/2019 10:07:00 AM

Notes: In November there were 6.888 million job openings, and, according to the November Employment report, there were 6.018 million unemployed. So, for the eighth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 4 years).

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings fell to 6.9 million on the last business day of November, the U.S. Bureau of Labor Statistics reported today. Over the month, hires edged down to 5.7 million, quits edged down to 3.4 million, and total separations were little changed at 5.5 million. Within separations, the quits rate and the layoffs and discharges rate were unchanged at 2.3 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits edged down in November to 3.4 million (-112,000). The quits rate was 2.3 percent. The quits level edged down for total private (-122,000) and was little changed for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for November, the most recent employment report was for December.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in November to 6.888 million from 7.131 million in October.

The number of job openings (yellow) are up 16% year-over-year.

Quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings remain at a high level, and quits are still increasing year-over-year. This was a solid report.

Small Business Optimism Index decreased in December

by Calculated Risk on 1/08/2019 09:47:00 AM

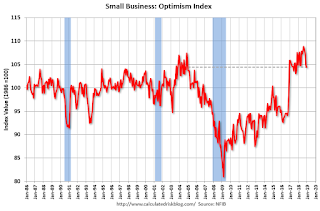

CR Note: Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): December 2018 Report: Small Business Optimism Index

The Small Business Optimism Index was basically unchanged in December, drifting down 0.4 points to 104.4. Job openings set a new record high, job creation plans strengthened, and inventory investment plans surged. On the downside, expected real sales growth and expected business conditions in six months accounted for the decline in the Index.

..

Job creation was solid in December with a net addition of 0.25 workers per firm (including those making no change in employment), up from 0.19 in November and the best reading since July. ... Twenty-three percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem, down 2 points from last month’s record high reading. Thirty-nine percent of all owners reported job openings they could not fill in the current period, up 5 points and a new record high. Labor markets are still exceptionally tight.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.4 in December.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

Monday, January 07, 2019

Tuesday: Job Openings, Trade Deficit (Postponed)

by Calculated Risk on 1/07/2019 07:51:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Continue Rising From Long-Term Lows

Mortgage rates were higher again today, extending a 2-day move from the lowest levels since early 2018. The size and pace of the late 2018 improvements introduced the risk of a bounce even before last Friday's key events. [30YR FIXED - 4.5%]Tuesday:

emphasis added

• At 6:00 AM: NFIB Small Business Optimism Index for December.

• At 8:30 AM: POSTPONED Trade Balance report for November from the Census Bureau. The consensus is the trade deficit to be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

• At 10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS.

• At 3:00 PM: Consumer Credit from the Federal Reserve.

Oil Rigs Declined, More Expected

by Calculated Risk on 1/07/2019 04:43:00 PM

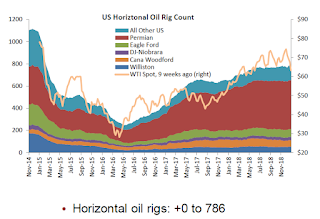

A few comments from Steven Kopits of Princeton Energy Advisors LLC on January 4, 2019:

• Oil rigs fell, -8 to 877

• Notwithstanding, horizontal oil rigs held their ground, +0 to 786

• The Permian, interestingly enough, added one hz oil rig to a new high of 442

• Breakeven to add rigs fell to around $60 WTI compared to $47 WTI on the screen as of the writing of this report. To appearances, the operators stopped adding rigs on the way up at $65, and perhaps may not substantially cut rigs until oil fell below $65, which would imply cuts coming through next week.

• The model continues to predict big rig roll-offs in the next several weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

by Calculated Risk on 1/07/2019 02:18:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I've added some thoughts, and a few predictions for each question.

I do this every year to outline what I expect, and then - if the story changes - I can change my view. All of the previous questions were about key parts of the economy; economic growth, job growth, wages, and especially housing.

This last question is probably the key downside risk to the economy.

1) Administration Policy: These are dangerous times. When Mr. Trump was elected, I was not too concerned about the short term (Luckily the economy was in good shape, and the cupboard was full). But after almost two years of chaos - and the loss of some stabilizing cabinet officers - I'm more concerned. Will Mr. Trump negatively impact the economy in 2019?

To state the obvious: Mr. Trump is a thin-skinned narcissistic ignoramus. He tries to make everything about himself. He thinks he knows everything better than everyone else. He reacts viciously to the slightest criticism. And he stopped reading and studying decades ago. Not a good combination of traits.

So far Mr. Trump has had a limited negative impact on the economy. The tariffs are dumb, his immigration policy a negative, and the tax changes didn't deliver as promised. Fortunately the cupboard was full when Trump took office, and luckily there hasn't been a significant crisis.

This year is a little more scary. There are fewer sane voices in the administration to temper Mr. Trump's impulses. And Mr. Trump will likely find himself under even more intense scrutiny this year both from the new Congress, and the many investigations into Mr. Trump's activities.

How will he react to this increased pressure? What if there is a geopolitical or financial crisis? Will he keep the government shutdown for an extended period? Will he keep escalating the trade war?

These are all unknowns (although we know he would react poorly). My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?