by Calculated Risk on 1/07/2019 04:43:00 PM

Monday, January 07, 2019

Oil Rigs Declined, More Expected

A few comments from Steven Kopits of Princeton Energy Advisors LLC on January 4, 2019:

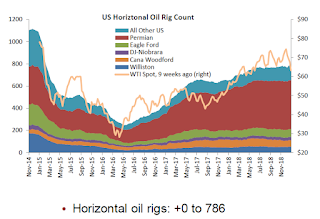

• Oil rigs fell, -8 to 877

• Notwithstanding, horizontal oil rigs held their ground, +0 to 786

• The Permian, interestingly enough, added one hz oil rig to a new high of 442

• Breakeven to add rigs fell to around $60 WTI compared to $47 WTI on the screen as of the writing of this report. To appearances, the operators stopped adding rigs on the way up at $65, and perhaps may not substantially cut rigs until oil fell below $65, which would imply cuts coming through next week.

• The model continues to predict big rig roll-offs in the next several weeks.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

by Calculated Risk on 1/07/2019 02:18:00 PM

Earlier I posted some questions for this year: Ten Economic Questions for 2019. I've added some thoughts, and a few predictions for each question.

I do this every year to outline what I expect, and then - if the story changes - I can change my view. All of the previous questions were about key parts of the economy; economic growth, job growth, wages, and especially housing.

This last question is probably the key downside risk to the economy.

1) Administration Policy: These are dangerous times. When Mr. Trump was elected, I was not too concerned about the short term (Luckily the economy was in good shape, and the cupboard was full). But after almost two years of chaos - and the loss of some stabilizing cabinet officers - I'm more concerned. Will Mr. Trump negatively impact the economy in 2019?

To state the obvious: Mr. Trump is a thin-skinned narcissistic ignoramus. He tries to make everything about himself. He thinks he knows everything better than everyone else. He reacts viciously to the slightest criticism. And he stopped reading and studying decades ago. Not a good combination of traits.

So far Mr. Trump has had a limited negative impact on the economy. The tariffs are dumb, his immigration policy a negative, and the tax changes didn't deliver as promised. Fortunately the cupboard was full when Trump took office, and luckily there hasn't been a significant crisis.

This year is a little more scary. There are fewer sane voices in the administration to temper Mr. Trump's impulses. And Mr. Trump will likely find himself under even more intense scrutiny this year both from the new Congress, and the many investigations into Mr. Trump's activities.

How will he react to this increased pressure? What if there is a geopolitical or financial crisis? Will he keep the government shutdown for an extended period? Will he keep escalating the trade war?

These are all unknowns (although we know he would react poorly). My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.

Here are the Ten Economic Questions for 2019 and a few predictions:

• Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

• Question #2 for 2019: How much will the economy grow in 2019?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

• Question #4 for 2019: What will the unemployment rate be in December 2019?

• Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

• Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

• Question #7 for 2019: How much will wages increase in 2019?

• Question #8 for 2019: How much will Residential Investment increase?

• Question #9 for 2019: What will happen with house prices in 2019?

• Question #10 for 2019: Will housing inventory increase or decrease in 2019?

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 1/07/2019 12:35:00 PM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs in early 2018, and are now down about 25% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through December 14, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 22% from a year ago, and CME futures are down 25% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

ISM Non-Manufacturing Index decreased to 57.6% in December

by Calculated Risk on 1/07/2019 10:12:00 AM

The December ISM Non-manufacturing index was at 57.6%, down from 60.7% in November. The employment index decreased in November to 56.3%, from 58.4%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: December 2018 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in December for the 107th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: “The NMI® registered 57.6 percent, which is 3.1 percentage points lower than the November reading of 60.7 percent. This represents continued growth in the non-manufacturing sector, at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.9 percent, 5.3 percentage points lower than the November reading of 65.2 percent, reflecting growth for the 113th consecutive month, at a slower rate in December. The New Orders Index registered 62.7 percent, 0.2 percentage point higher than the reading of 62.5 percent in November. The Employment Index decreased 2.1 percentage points in December to 56.3 percent from the November reading of 58.4 percent. The Prices Index decreased 6.7 percentage points from the November reading of 64.3 percent to 57.6 percent, indicating that prices increased in December for the 34th consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector’s growth rate cooled off in December. Respondents indicate that there still is concern about tariffs, despite the hold on increases by the U.S. and China. Also, comments reflect that capacity constraints have lessened; however, employment-resource challenges remain. Respondents are mostly optimistic about overall business conditions.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in December than in November.

Sunday, January 06, 2019

Sunday Night Futures

by Calculated Risk on 1/06/2019 07:20:00 PM

Weekend:

• Schedule for Week of January 6, 2019

Monday:

• At 10:00 AM, the ISM non-Manufacturing Index for December. The consensus is for a decrease to 58.4 from 60.7.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 14 and DOW futures are up 150 (fair value).

Oil prices were up over the last week with WTI futures at $48.84 per barrel and Brent at $57.96 per barrel. A year ago, WTI was at $62, and Brent was at $68 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.22 per gallon. A year ago prices were at $2.48 per gallon, so gasoline prices are down 26 cents per gallon year-over-year.

The Impact of the Government Shutdown on the January Employment Report

by Calculated Risk on 1/06/2019 08:01:00 AM

If the government shutdown continues through this coming week, then the unemployment rate in the January report will be negatively impacted. This is a key week since it is the reference week for the BLS report (contains the 12th of the month). If the shutdown continues through next weekend, Federal employees who are on furlough will be counted as unemployed in the January report (CPS, Household survey).

However, the furloughed employees still have jobs, so their positions will still be counted in the CES (Establishment survey). So the headline employment number will not be directly impacted.

The closest example to the current situation is the October 2013 government shutdown that lasted from October 1st through October 17th (there are differences in what was shutdown). From the October 2013 employment report:

Among the unemployed, however, the number who reported being on temporary layoff increased by 448,000. This figure includes furloughed federal employees who were classified as unemployed on temporary layoff under the definitions used in the household survey.If the government shutdown continues, then the unemployment rate will probably bump up to 4.0% or 4.1% in the January report. Assuming the shutdown ends soon thereafter, the change in the unemployment rate will be reversed in the February report.

Update Jan 10, 2019: As far as the headline jobs number from the CES (Establishment survey), the jobs were people who are working without pay will still be counted. For the furloughed employees, it is different. Since they are not being paid, the positions will not be counted - UNLESS - legislation is passed that provides for back pay. If the legislation is passed, even after the reference week, the furloughed positions will be counted in the CES (headline jobs number). This is what has happened in previous shutdowns.

So, for the unemployment number, it depends on what happens this week.

For the headline jobs number, it depends on what legislation is eventually passed.

Saturday, January 05, 2019

Schedule for Week of January 6th

by Calculated Risk on 1/05/2019 08:11:00 AM

Special Note on Government Shutdown: If the Government shutdown continues, then some releases will be delayed. As an example, this week, the report on International Trade (trade deficit) will not be released if the government remains shutdown.

The key report this week is the December CPI report on Friday.

10:00 AM: the ISM non-Manufacturing Index for December. The consensus is for a decrease to 58.4 from 60.7.

6:00 AM: NFIB Small Business Optimism Index for December.

8:30 AM: Trade Balance report for November from the Census Bureau.

8:30 AM: Trade Balance report for November from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for November from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in October to 7.079 million from 6.960 million in September.

The number of job openings (yellow) were up 17% year-over-year, and Quits were up 9% year-over-year.

3:00 PM: Consumer Credit from the Federal Reserve.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes, Meeting of Dec 18-19

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, down from 231 thousand the previous week.

8:30 AM: The Producer Price Index for December from the BLS.

12:45 PM: Discussion, Fed Chair Jerome Powell, At the Economic Club of Washington, D.C., Washington, D.C.

8:30 AM: The Consumer Price Index for November from the BLS. The consensus is for 0.1% decrease in CPI, and a 0.2% increase in core CPI.

New Home Sales (Census) for November from the Census Bureau. The consensus was for 560 thousand SAAR, up from 544 thousand in October.

Construction Spending (Census) for November. The consensus was for a 0.3% increase in construction spending.

Light vehicle sales (BEA) for December. The consensus was for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

Friday, January 04, 2019

AAR: December Rail Carloads up 2.9% YoY, Intermodal Up 5.0% YoY

by Calculated Risk on 1/04/2019 06:11:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

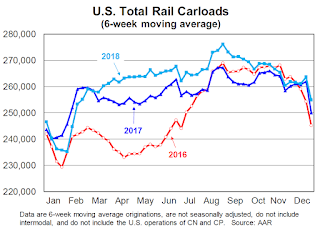

U.S. freight rail traffic in December and the full year 2018 was mixed, but for the most part was positive. Intermodal finished the year strong, rising 5.0% in December 2018. The first and second weeks of December (weeks 49 and 50 of the year) were the two highest-volume intermodal months in history, exceeding 300,000 units in a single week for the first time. Intermodal set a new annual record in 2018: total volume was 14.47 million containers and trailers, up 5.5%, or 751,217 units, over 2017. Total carloads, meanwhile, rose 2.9% in December 2018 over December 2017, their 9th year-over-year increase in 2018. For the full year, total carloads were up 1.8%, or 238,857 carloads.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads (excluding the U.S. operations of Canadian railroads) originated 1.022 million carloads in December 2018, up 2.9%, or 29,139 carloads, over December 2017. December was the ninth yearover- year monthly increase for total carloads in 2018 and reversed a slight decline in November. Total carloads averaged 255,495 per week in December 2018, the most for December since 2014.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1.10 million containers and trailers in December 2018, up 5.0% over December 2017. Weekly average intermodal volume in December 2018 was 274,029, easily the highest weekly average for December for intermodal in history. In fact, the first and second weeks of December 2018 (weeks 49 and 50 of the year) were the highest volume intermodal weeks in history for U.S. railroads, regardless of month, with 303,225 and 301,407 intermodal units originated, respectively. That’s the first time ever that intermodal originations exceeded 300,000 in a single week. So much for intermodal peaking in September or October. The top 10 intermodal weeks in history were all in 2018, as were nine of the top ten intermodal months2018 was another record year for intermodal traffic.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 1/04/2019 05:04:00 PM

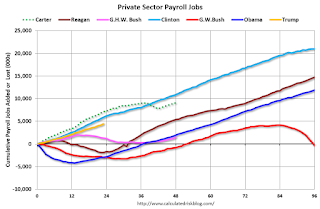

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (23 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 23 months of Mr. Trump's term, the economy has added 4,475,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 23 months of Mr. Trump's term, the economy has added 92,000 public sector jobs.

After 23 months of Mr. Trump's presidency, the economy has added 4,567,000 jobs, about 225,000 behind the projection.

How can the unemployment rate increase if the economy is adding so many jobs?

by Calculated Risk on 1/04/2019 01:57:00 PM

FAQ: How can the unemployment rate rise if the economy is adding so many jobs?

The BLS reported this morning that the economy added 312,000 jobs, but the unemployment rate increased to 3.9% from 3.7% in November.

This data comes from two separate surveys. The unemployment Rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

The jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of approximately 634,000 business establishments nationwide.

These are very different surveys: the CPS gives the total number of employed (and unemployed including the alternative measures), and the CES gives the total number of positions (excluding some categories like the self-employed, and a person working two jobs counts as two positions).

A couple of key concepts (from the BLS):

The CES employment series are estimates of nonfarm wage and salary jobs, not an estimate of employed persons; an individual with two jobs is counted twice by the payroll survey. The CES employment series excludes employees in agriculture, private households, and the self-employed.And the CPS:

emphasis added

Employed people are those who worked as paid employees; were self employed in their own business, profession, or farm; worked without pay for at least 15 hours in a family business or farm; or were temporarily absent from their jobs.So in December, the headline CES number showed a gain of 312,000 non-farm private jobs (by the definitions above). The CPS showed an increase of 142,000 employed people.

The household survey - employment measure includes categories of workers that are not covered by the payroll survey:

the self-employed

workers in private households

agricultural workers

unpaid workers in family businesses

workers on leave without pay during the reference period

Unemployed people are those who had no employment (as defined above) during the reference week; were available for work at that time; and had made specific efforts to find employment in the prior 4 weeks. People laid off from a job and expecting to be recalled are included among the unemployed but unlike the other unemployed, they need not have been looking for employment.

These two surveys are almost always different, and both are useful.

But the unemployment rate increased, even though the CPS showed an increase in employed people. How can that be?

The CPS also showed an increase in the Civilian Labor Force Level by 419,000. And an increase in the number of unemployed people (U-3) of 276,000.

The unemployment rate is a ratio, with the numerator the number of unemployed, and the denominator the Civilian Labor Force - so these changes in both numbers increased the unemployment rate to 3.9% (rounded).

Here are the numbers (000s):

| November | December | Change | |

|---|---|---|---|

| Civilian Labor Force | 162,821 | 163,240 | 419 |

| Unemployed | 6,018 | 6,294 | 276 |

| Unemployment Rate | 3.70% | 3.86% | 0.16% |

If you want more details, see Monthly Employment Situation Report: Quick Guide to Methods and Measurement Issues

So remember, the jobs and unemployment rate come from two different surveys and are different measurements (one for positions, the other for people). Some months the numbers may not seem to make sense (added jobs and increasing unemployment rate), but over time the numbers will work out.