by Calculated Risk on 12/17/2018 07:12:00 PM

Monday, December 17, 2018

Tuesday: Housing Starts

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed Despite Market Gains

Mortgage rates were fairly flat yet again today. Unlike Friday, today's market movement made a case for a bit of a drop. "Market gains" mean different things when talking about bonds/rates (as opposed to stocks). In today's case, bond markets improved while stocks lost ground.Tuesday:

...

we head into tomorrow at a slight advantage in terms of mortgage rates. In other words, if underlying bond markets were to hold completely flat overnight, the average lender would be able to offer slightly improved terms in the morning. Lenders who already repriced today (there were a few of them) would be the exception. [30YR FIXED - 4.75%]

emphasis added

• At 8:30 AM ET, Housing Starts for November. The consensus is for 1.222 million SAAR, down from 1.228 million SAAR.

California Bay Area Home Sales Decline 17% YoY in November, Inventory up 27% YoY

by Calculated Risk on 12/17/2018 02:20:00 PM

From Pacific Union chief economist Selma Hepp: Bay Area Housing Inventory Again Posted a Solid Increase in November

• Overall Bay Area home sales (single-family homes and condominiums) declined by 17 percent year over year in November, with all counties and price ranges posting decreases.

• Year to date, total 2018 sales are 5 percent below last year; however, sales of homes priced higher than $1 million are still trending above 2017 levels.

• Some communities — particularly Marin County’s San Anselmo and a few others in San Mateo and Contra Costa counties — continued to post more sales compared with last year.

• Inventory jumped by 27 percent year over year in November, with homes priced below $1 million up by 27 percent, homes priced between $1 million and $2 million up by 39 percent, and homes priced above $2 million up by 9 percent.

...

• Most of the inventory increases and price reductions were in areas that lack access to employment centers and transit corridors.

FOMC Preview

by Calculated Risk on 12/17/2018 12:05:00 PM

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, however the tone of the statement and press conference will likely be more dovish. There might be some dovish dissent at this meeting.

Observers will be looking for signs of a pause in the rate hikes - possibly even in Q1 - and also for a reduction in the number of projected hikes in 2019.

Here are the September FOMC projections.

Current projections for Q4 GDP are in mid-to-high 2% range. GDP increased at a 2.2% real annual rate in Q1, 4.2% in Q2, and 3.5% in Q3. The FOMC is projecting Q4 over the previous Q41, and using the current projections for Q4, this projects to around 3.1% to 3.2% for 2018.

However, most analysts expect growth to slow more than expected in 2019, and the FOMC might revise down projections for GDP in 2019.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Sep 2018 | 3.0 to 3.2 | 2.4 to 2.7 | 1.8 to 2.1 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

The unemployment rate was at 3.7% in November. So the unemployment rate projection for 2018 will probably be unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Sep 2018 | 3.7 | 3.4 to 3.6 | 3.4 to 3.8 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

As of October, PCE inflation was up 2.0% from October 2017. This is at the bottom of the projected range.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Sep 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 1.8% in October year-over-year. Core PCE inflation might be revised down for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Sep 2018 | 1.9 to 2.0 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

In general the data has been close, but somewhat softer, than the FOMC's September projections.

NAHB: Builder Confidence Declines in December

by Calculated Risk on 12/17/2018 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 56 in December, down from 60 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Drops Four Points Amid Concerns Over Housing Affordability

Builder confidence in the market for newly-built single-family homes fell four points to 56 in December on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) as concerns over housing affordability persist. Although this is the lowest HMI reading since May 2015, builder sentiment remains in positive territory.

“We are hearing from builders that consumer demand exists, but that customers are hesitating to make a purchase because of rising home costs,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La. “However, recent declines in mortgage interest rates should help move the market forward in early 2019.”

“The fact that builder confidence dropped significantly in areas of the country with high home prices shows how the growing housing affordability crisis is hurting the market,” said NAHB Chief Economist Robert Dietz. “This housing slowdown is an early indicator of economic softening, and it is important that builders manage supply-side costs to keep home prices competitive for buyers at different price points.”

...

All the HMI indices posted declines. The index measuring current sales conditions fell six points to 61, the component gauging expectations in the next six months dropped four points to 61, and the metric charting buyer traffic edged down two points to 43.

Looking at the three-month moving averages for regional HMI scores, the Midwest dropped two points to 55; the West and South both fell three points to 68 and 65, respectively; and the Northeast registered an eight-point drop to 50.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well below the consensus forecast and the lowest level for this index since 2015.

From the NY Fed: Manufacturing "Business activity grew at a slower pace than in recent months in New York State"

by Calculated Risk on 12/17/2018 08:35:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew at a slower pace than in recent months in New York State, according to firms responding to the December 2018 Empire State Manufacturing Survey. The headline general business conditions index fell twelve points to 10.9.This was well below the consensus forecast, and the weakest reading since May 2017.

…

The index for number of employees jumped twelve points to 26.1, indicating very strong growth in employment levels, while the average workweek index was little changed at 8.0.

emphasis added

Sunday, December 16, 2018

Monday: NY Fed Mfg Survey, Homebuilder Survey

by Calculated Risk on 12/16/2018 08:38:00 PM

Weekend:

• Schedule for Week of December 16, 2018

Monday:

• At 8:30 AM ET: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 21.0, down from 23.3.

• At 10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 6 and DOW futures are up 58 (fair value).

Oil prices were down over the last week with WTI futures at $51.46 per barrel and Brent at $60.46 per barrel. A year ago, WTI was at $57, and Brent was at $64 - so WTI oil prices are down about 10%, and Brent prices down about 6% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.35 per gallon. A year ago prices were at $2.41 per gallon, so gasoline prices are down 6 cents per gallon year-over-year.

Sacramento Housing in November: Sales Down 7% YoY, Active Inventory up 23% YoY

by Calculated Risk on 12/16/2018 08:12:00 AM

From SacRealtor.org: November 2018 Statistics – Sacramento Housing Market – Single Family Homes, Median sales price increases, sales volume drops

November closed with 1,304 sales, a 9.3% decrease from the 1,413 sales of September. Compared to the same month last year (1,396), the current figure is down 6.6%. Of the 1,304 sales this month, 180 (13.8%) used cash financing, 791 (60.7%) used conventional, 225 (17.3%) used FHA, 76 (5.8%) used VA and 32 (2.5%) used Other types of financing.CR Note: Inventory is still low - months of inventory is at 2.1 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory decreased, dropping 11.3% from 3,060 to 2,714 units. [Note: Compared to November 2017, inventory is up 22.5%] The Months of Inventory remained at 2.1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart to the right reflects the Months of Inventory in each price range.

...

The Average DOM (days on market) continued its increase, rising from 30 to 36 from October to November. The Median DOM also increased, rising from 19 to 24. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,304 sales this month, 59% (770) were on the market for 30 days or less and 81.2% (1,060) were on the market for 60 days or less.

emphasis added

Saturday, December 15, 2018

Schedule for Week of December 16, 2018

by Calculated Risk on 12/15/2018 08:11:00 AM

The key economic reports this week are November Housing Starts, Existing Home Sales, the 3rd estimate of Q3 GDP, and November Personal income and outlays.

For manufacturing, the December New York, Philly and Kansas City Fed surveys, will be released this week.

Also, the FOMC meets this week and is expected to raise the Fed Funds rate 25bps.

8:30 AM: The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 21.0, down from 23.3.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 61, up from 60. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November.

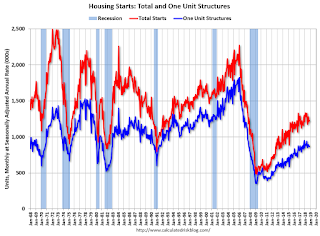

8:30 AM: Housing Starts for November. This graph shows single and total housing starts since 1968.

The consensus is for 1.222 million SAAR, down from 1.228 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, down from 5.22 million.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.19 million SAAR, down from 5.22 million.The graph shows existing home sales from 1994 through the report last month.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 206 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 17.5, up from 12.9.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Third estimate). The consensus is that real GDP increased 3.5% annualized in Q3, unchanged from the second estimate of GDP.

10:00 AM: Personal Income and Outlays for November. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for December). The consensus is for a reading of 97.5.

10:00 AM: State Employment and Unemployment (Monthly) for November 2018

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 14, 2018

Oil Rigs Declined Slightly, More Expected

by Calculated Risk on 12/14/2018 07:46:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on December 14, 2018:

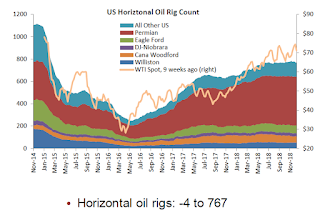

• Oil rigs fell, -4 to 873

• Horizontal oil rigs also declined, -4 to 767

• Breakeven to add rigs fell to around $75 WTI compared to $51.20 WTI on the screen as of the writing of this report.

• The model predicts we could see some big rig roll-offs in the next several weeks. An overall decline around 100 horizontal oil rigs by the end of February is not out of the question.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 12/14/2018 05:44:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 14% under Mr. Trump - compared to up 54% under Mr. Obama for the same number of market days.