by Calculated Risk on 12/14/2018 07:46:00 PM

Friday, December 14, 2018

Oil Rigs Declined Slightly, More Expected

A few comments from Steven Kopits of Princeton Energy Advisors LLC on December 14, 2018:

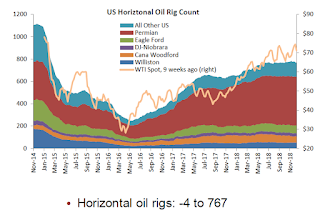

• Oil rigs fell, -4 to 873

• Horizontal oil rigs also declined, -4 to 767

• Breakeven to add rigs fell to around $75 WTI compared to $51.20 WTI on the screen as of the writing of this report.

• The model predicts we could see some big rig roll-offs in the next several weeks. An overall decline around 100 horizontal oil rigs by the end of February is not out of the question.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

By Request, and Just For Fun: Stock Market as Barometer of Policy Success

by Calculated Risk on 12/14/2018 05:44:00 PM

By request, here is an update to the chart showing market performance under Presidents Trump and Obama.

Note: I don't think the stock market is a great measure of policy performance, but some people do - and I'm having a little fun with them.

There are some observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 14% under Mr. Trump - compared to up 54% under Mr. Obama for the same number of market days.

Q4 GDP Forecasts: High 2s

by Calculated Risk on 12/14/2018 12:13:00 PM

From Merrill Lynch:

Core retail sales popped 0.9% mom in Nov with net upward revisions. Industrial production climbed 0.6% driven by utilities. These data boosted 4Q GDP tracking by 0.4pp to 2.9% qoq saar. [Dec 14 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 3.0 percent on December 14, up from 2.4 percent on December 7. The nowcast of fourth-quarter real personal consumption expenditures growth increased from 3.3 percent to 4.1 percent after this morning's retail sales report from the U.S. Census Bureau and this morning's industrial production release from the Federal Reserve Board of Governors. [Dec 14 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.4% for both 2018:Q4 and 2019:Q1. [Dec 14 estimate]CR Note: These early estimates suggest GDP in the high 2s for Q4.

Industrial Production Increased 0.6% in November

by Calculated Risk on 12/14/2018 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.6 percent in November after moving down 0.2 percent in October; the index for October was previously reported to have edged up 0.1 percent. In November, manufacturing production was unchanged, the output of mining increased 1.7 percent, and the index for utilities gained 3.3 percent. At 109.4 percent of its 2012 average, total industrial production was 3.9 percent higher in November than it was a year earlier. Capacity utilization for the industrial sector rose 0.4 percentage point in November to 78.5 percent, a rate that is 1.3 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is 1.3% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

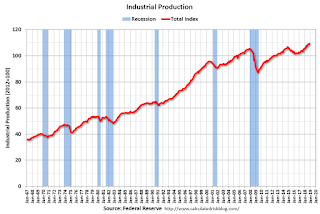

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 109.4. This is 26% above the recession low, and 4% above the pre-recession peak.

The increase in industrial production was above the consensus forecast, however the previous months were revised down. Capacity utilization was at consensus.

Retail Sales increased 0.2% in November

by Calculated Risk on 12/14/2018 08:37:00 AM

On a monthly basis, retail sales increased 0.2 percent from October to November (seasonally adjusted), and sales were up 4.2 percent from November 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $513.5 billion, an increase of 0.2 percent from the previous month, and 4.2 percent above November 2017.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.5% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.The increase in November was slightly above expectations; sales in September were revised down, revised up in October.

Thursday, December 13, 2018

Friday: Retail Sales, Industrial Production

by Calculated Risk on 12/13/2018 08:20:00 PM

Friday:

• At 8:30 AM ET: Retail sales for November will be released. The consensus is for a 0.1% increase in retail sales.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 78.5%.

LA area Port Traffic Decreases YoY in November

by Calculated Risk on 12/13/2018 02:14:00 PM

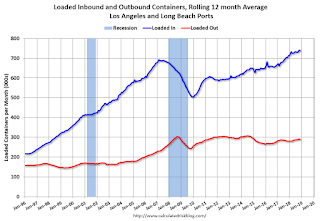

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 0.5% compared in November to the rolling 12 months ending in October. Outbound traffic was down 1.0% compared to the rolling 12 months ending in October.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing, and exports have mostly moved sideways over the last 6 or 7 years.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 12/13/2018 11:03:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 8 December

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 2-8 December 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 3-9 December 2017, the industry recorded the following:

• Occupancy: -0.8% to 60.4%

• Average daily rate (ADR): +1.3% to US$126.45

• Revenue per available room (RevPAR): +0.5% to US$76.38

…

Houston, Texas, saw the largest decrease in occupancy (-13.4% to 63.6%), which resulted in the second-largest drop in RevPAR (-14.3% to US$69.34).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

This is the fourth strong year in a row for hotel occupancy. The occupancy rate, year-to-date, is just ahead of the record year in 2017.

Seasonally, the occupancy rate will now decline through the end of the year.

Data Source: STR, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims decreased to 206,000

by Calculated Risk on 12/13/2018 08:34:00 AM

The DOL reported:

In the week ending December 8, the advance figure for seasonally adjusted initial claims was 206,000, a decrease of 27,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 231,000 to 233,000. The 4-week moving average was 224,750, a decrease of 3,750 from the previous week's revised average. The previous week's average was revised up by 500 from 228,000 to 228,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,750.

This was much lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, December 12, 2018

Thursday: Unemployment Claims

by Calculated Risk on 12/12/2018 07:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Could Go Even Higher

Mortgage rates rose more noticeably today as a part of a 3 day bounce after hitting the lowest levels in roughly 3 months at the end of last week. Whereas yesterday's increases weren't really worth mentioning, today's hurt--depending on the scenario. [30YR FIXED - 4.75%]Thursday:

emphasis added

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 231 thousand the previous week.