by Calculated Risk on 12/05/2018 08:20:00 AM

Wednesday, December 05, 2018

Note: ADP Employment, ISM Non-Mfg Rescheduled to Thursday

Due to the national day of mourning for former President George H.W. Bush, the ADP Employment report, and the ISM non-manufacturing survey will be released on Thursday.

The Federal Reserve Beige Book will be released at 2 PM today as scheduled.

Fed Chair Jerome Powell's testimony on the economic outlook has been postponed.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 12/05/2018 07:00:00 AM

From the MBA: Mortgage Applications Rise in Latest MBA Weekly Survey

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 30, 2018. The results for the week ending November 23, 2018, included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 36 percent compared with the previous week and was 0.2 percent higher than the same week one year ago.

...

“Treasury rates continued to slide last week, driven mainly by concerns over slowing global economic growth and U.S. and China trade uncertainty. The 30-year fixed-rate fell for the third week in a row to 5.08 percent and has declined a total of nine basis points over this span,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Application activity increased over the week for both purchase and refinance loans, and were 10 percent and 7 percent higher, respectively, than the week before the Thanksgiving holiday. Additionally, we saw a decrease in the average loan size for purchase applications to the lowest since December 2017 ($298,000 from $313,000). This is perhaps an indication that there are fewer jumbo borrowers, or maybe first-time buyers are having better success reaching the market as we close out the year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.08 percent from 5.12 percent, with points decreasing to 0.44 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 0.2% year-over-year.

Tuesday, December 04, 2018

Wednesday: ADP Employment, ISM Non-Mfg, Beige Book

by Calculated Risk on 12/04/2018 08:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Deeper into 2 Month Lows as Stocks Swoon

On a somewhat frustrating note, mortgage rates didn't experience nearly as big of a move as the broader bond market. For instance, 10yr Treasuries--the most widely-used benchmark for longer-term interest rates) dropped 0.05% today. Mortgages only managed to drop by 0.02% in terms of effective rates. [30YR FIXED - 4.875]Wednesday:

emphasis added

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 175,000 jobs added, down from 227,000 in October.

• At 10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for a decrease to 59.0 from 60.3.

• POSTPONED: At 10:15 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Senate

• At 2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Excerpt from Toll Brothers Earnings Press Release

by Calculated Risk on 12/04/2018 05:03:00 PM

Via housing economist Tom Lawler: Excerpt from Toll Brothers Earnings Press Release

“In our fourth quarter, despite a healthy economy, we saw a moderation in demand. Fourth quarter contracts declined 15% in dollars and 13% in units compared to a difficult comp from one year ago. Fourth quarter demand slowed to a per community pace more consistent with FY 2016’s fourth quarter, which was still strong.Lawler adds: Toll Brothers’ fiscal fourth quarter (and fiscal year) ended October 31, 2018. For the three months ending 10/31/18 Toll Brothers’ net contracts in California totaled 226 (at an average contract price of $1,815,800), down 39.4% from the comparable quarter of 2017 (when the average contract price was $1,624,400).

“In November, we saw the market soften further, which we attribute to the cumulative impact of rising interest rates and the effect on buyer sentiment of well-publicized reports of a housing slowdown. We saw similar consumer behavior beginning in late 2013, when a rapid rise in interest rates temporarily tempered buyer demand before the market regained momentum.

“California has seen the biggest decline. Significant price appreciation over the past few years, fewer foreign buyers in certain communities, and the impact of rising interest rates all contributed to this slowdown. But California is the world’s fifth largest economy with diverse, job-creating industries, including vibrant technology companies, a large concentration of wealth, and desirable lifestyle options. With our attractive coastal California land, our leading brand, and the state’s constrained supply of housing, we continue to believe in our long-term position in the California market.”

November Vehicles Sales: 17.4 Million SAAR, On Pace to be unchanged in 2018

by Calculated Risk on 12/04/2018 02:59:00 PM

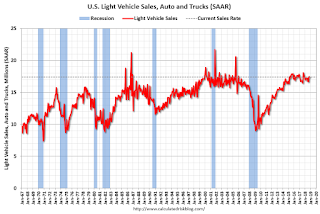

The BEA released their estimate of November vehicle sales. The BEA estimated sales of 17.40 million SAAR in November 2018 (Seasonally Adjusted Annual Rate), down 0.5% from the October sales rate, and down 0.7% from November 2017.

Through November, light vehicle sales are on pace to be mostly unchanged in 2018 compared to 2017.

This would make 2018 the fourth best year on record after 2016, 2015, 2000, and tied with 2017.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first eleven months.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

My guess is vehicle sales will finish the year with sales slightly lower than in 2017 (sales in late 2017 were boosted by buying following the hurricanes), and will probably be just over 17 million for the year (the lowest since 2014). But sales will be close to last year.

A small decline - or no change - in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Update: Framing Lumber Prices Down Year-over-year

by Calculated Risk on 12/04/2018 11:50:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined from the record highs earlier in 2018, and are now down over 20% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through November 9, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down 22% from a year ago, and CME futures are down 29% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

CoreLogic: House Prices up 5.4% Year-over-year in October

by Calculated Risk on 12/04/2018 08:00:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports October Home Prices Increased by 5.4 Percent Year Over Year

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for October 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 5.4 percent year over year from October 2017. On a month-over-month basis, prices increased by 0.5 percent in October 2018. (September 2018 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the bottom of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates home prices will increase by 4.8 percent on a year-over-year basis from October 2018 to October 2019. On a month-over-month basis, home prices are expected to decrease by 0.7 percent from October to November 2018. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“Rising prices and interest rates have reduced home buyer activity and led to a gradual slowing in appreciation,” said Dr. Frank Nothaft, chief economist for CoreLogic. “October’s mortgage rates were the highest in seven and a half years, eroding buyer affordability. Despite higher interest rates, many renters view a home purchase as a way to build wealth through home-equity growth, especially in areas where rents are rising quickly. These include the Phoenix, Las Vegas and Orlando metro areas, where the CoreLogic Single-Family Rent Index rose 6 percent or more during the last 12 months.”

emphasis added

Monday, December 03, 2018

Tuesday: Corelogic House Prices

by Calculated Risk on 12/03/2018 09:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Now at 2-Month Lows

Mortgage rates didn't really improve today for the average lender, but they did manage to hit the lowest rates in 2 months on a technicality. The reason for this is simple. There was a big gap between the rates seen on October 2nd and October 3rd. Rates merely had to hold steady today in order to earn the "2-month" title. [30YR FIXED - 4.875]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for October.

Year-to-Date Performance: Employment, Vehicle Sales, New Home Sales

by Calculated Risk on 12/03/2018 03:33:00 PM

Here are three tables showing year-to-date performance for three key economic metrics: Employment, Vehicle Sales, and New Home Sales.

Each table shows measurements through the most recent report (October), full year, and percent change from the previous year.

Employment growth has picked up in 2017 and will likely be the 3rd best year since the great recession. Vehicle sales are mostly moving sideways year-over-year at a high level, and new home sales are up slightly.

Note: All data is based on monthly NSA data. Employment from the BLS, vehicle sales from BEA, and new home sales from Census.

| Employment Gains (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 851 | 1053 | |

| 2011 | 1744 | 2090 | 98.5% |

| 2012 | 1778 | 2151 | 2.9% |

| 2013 | 1987 | 2301 | 7.0% |

| 2014 | 2447 | 3005 | 30.6% |

| 2015 | 2214 | 2712 | -9.8% |

| 2016 | 1992 | 2344 | -13.6% |

| 2017 | 1797 | 2188 | -6.7% |

| 2018 | 2125 | NA | 18.3%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

| Vehicle Sales (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 9,545 | 11,555 | |

| 2011 | 10,505 | 12,742 | 10.3% |

| 2012 | 11,946 | 14,433 | 13.3% |

| 2013 | 12,939 | 15,530 | 7.6% |

| 2014 | 13,662 | 16,452 | 5.9% |

| 2015 | 14,443 | 17,396 | 5.7% |

| 2016 | 14,414 | 17,465 | 0.4% |

| 2017 | 14,151 | 17,135 | -1.9% |

| 2018 | 14,205 | NA | 0.4%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

| New Home Sales (000s) | |||

|---|---|---|---|

| Year | Through October | Full Year | YoY Change |

| 2010 | 279 | 322 | |

| 2011 | 258 | 305 | -5.3% |

| 2012 | 313 | 369 | 21.0% |

| 2013 | 366 | 429 | 16.3% |

| 2014 | 373 | 439 | 2.3% |

| 2015 | 427 | 501 | 14.1% |

| 2016 | 482 | 561 | 12.0% |

| 2017 | 518 | 613 | 9.3% |

| 2018 | 533 | NA | 2.9%1 |

| 1Year-over-year change for 2018 based on data through October. | |||

Construction Spending decreased slightly in October

by Calculated Risk on 12/03/2018 11:41:00 AM

From the Census Bureau reported that overall construction spending decreased slightly in October:

Construction spending during October 2018 was estimated at a seasonally adjusted annual rate of $1,308.8 billion, 0.1 percent below the revised September estimate of $1,310.8 billion. The October figure is 4.9 percent above the October 2017 estimate of $1,247.5 billion.Private spending decreased and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $998.7 billion, 0.4 percent below the revised September estimate of $1,003.0 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $310.2 billion, 0.8 percent above the revised September estimate of $307.8 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending had been increasing - although has declined recently - and is still 21% below the bubble peak.

Non-residential spending is 11% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 5% below the peak in March 2009, and 19% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 2%. Non-residential spending is up 6% year-over-year. Public spending is up 8% year-over-year.

This was below consensus expectations, and spending for August and September were revised down. A weak report.