by Calculated Risk on 11/25/2018 10:53:00 AM

Sunday, November 25, 2018

Climate Change Report

This is a critical threat and should be a nonpartisan issue.

Here is the Fourth National Climate Assessment. An excerpt on the economic impact:

In the absence of significant global mitigation action and regional adaptation efforts, rising temperatures, sea level rise, and changes in extreme events are expected to increasingly disrupt and damage critical infrastructure and property, labor productivity, and the vitality of our communities. Regional economies and industries that depend on natural resources and favorable climate conditions, such as agriculture, tourism, and fisheries, are vulnerable to the growing impacts of climate change. Rising temperatures are projected to reduce the efficiency of power generation while increasing energy demands, resulting in higher electricity costs. The impacts of climate change beyond our borders are expected to increasingly affect our trade and economy, including import and export prices and U.S. businesses with overseas operations and supply chains. Some aspects of our economy may see slight near-term improvements in a modestly warmer world. However, the continued warming that is projected to occur without substantial and sustained reductions in global greenhouse gas emissions is expected to cause substantial net damage to the U.S. economy throughout this century, especially in the absence of increased adaptation efforts. With continued growth in emissions at historic rates, annual losses in some economic sectors are projected to reach hundreds of billions of dollars by the end of the century—more than the current gross domestic product (GDP) of many U.S. states.

Saturday, November 24, 2018

Schedule for Week of November 25, 2018

by Calculated Risk on 11/24/2018 08:11:00 AM

The key reports this week are October New Home sales, and the second estimate of Q3 GDP.

Other key indicators include Personal Income and Outlays for October and Case-Shiller house prices for September.

For manufacturing, the Dallas and Richmond Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for September.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.3% year-over-year increase in the Comp 20 index for September.

9:00 AM: FHFA House Price Index for September 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 3nd quarter 2018 (Second estimate). The consensus is that real GDP increased 3.5% annualized in Q3, unchanged from the advance estimate of GDP.

10:00 AM: New Home Sales for October from the Census Bureau.

10:00 AM: New Home Sales for October from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 575 thousand SAAR, up from 553 thousand in September.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

12:00 PM: Speech by Fed Chair Jerome Powell, The Federal Reserve's Framework for Monitoring Financial Stability, At The Economic Club of New York Signature Luncheon, New York, New York

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 218 thousand initial claims, down from 224 thousand the previous week.

8:30 AM: Personal Income and Outlays for October. The consensus is for a 0.4% increase in personal income, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: Pending Home Sales Index for October. The consensus is for a 0.5% increase in the index.

2:00 PM: The Fed will release the FOMC Minutes for the Meeting of November 7-8, 2018

9:45 AM: Chicago Purchasing Managers Index for November. The consensus is for a reading of 58.0, down from 58.4 in October.

Friday, November 23, 2018

"Is a Recession Coming?"

by Calculated Risk on 11/23/2018 02:46:00 PM

Derek Thompson at The Atlantic asked me about my views on an imminent recession in this excellent overview: Is a Recession Coming?

Thompson concluded:

If you’re going to worry, you should worry about three things: exports, China, and maybe the looming shadow of corporate debt. But nothing in the economy seems to predict an imminent recession.For more on the joke about Kudlow, see: Larry Kudlow is usually wrong

Or at least that was my conclusion before Bill McBride sent me a follow-up email.

“Just saw Larry Kudlow’s remarks. Maybe I’m wrong!”

Oil Prices Down Year-over-year

by Calculated Risk on 11/23/2018 11:37:00 AM

From CNBC: Oil plunges 7% to lowest level in more than a year

Oil prices slumped on Friday to their lowest levels in more than a year, deepening a rapid seven-week sell-off that has plunged crude futures deep into a bear market.

…

International benchmark Brent crude dropped $3.52, or 5.6 percent, to $59.08 at 10:20 a.m. ET. The contract hit $58.92, its lowest level since Oct. 27, 2017, earlier in the session.

U.S. benchmark West Texas Intermediate crude fell $3.59, or 6.6 percent, to $51.04. WTI briefly slid about 7 percent to $50.60, its weakest price since Oct. 12, 2017.

Click on graph for larger image

Click on graph for larger imageThe first graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $50.92 per barrel today, and Brent is at $58.77.

Prices collapsed in 2008 due to the financial crisis, and then increased as the economy recovered. Oil prices collapsed again in 2014 and 2015, mostly due to oversupply.

Last year oil prices rose sharply again.

The second graph shows the year-over-year change in WTI based on data from the EIA.

The second graph shows the year-over-year change in WTI based on data from the EIA.Six times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY. Oil prices are volatile!

Currently WTI is down 10% year-over-year.

Although the U.S. is still a net importer of oil, oil production has increased significantly in the U.S.. Declining oil prices negatively impact certain regions and segments (like heavy truck sales).

Thursday, November 22, 2018

Five Economic Reasons to be Thankful

by Calculated Risk on 11/22/2018 08:31:00 AM

With a Hat Tip to Neil Irwin (he started doing this several years ago) ... here are five economic reasons to be thankful this Thanksgiving ...

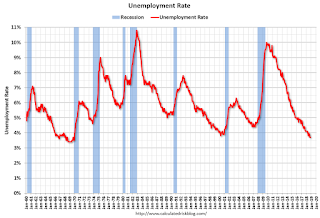

1) Low unemployment rate.

The unemployment rate declined to 3.7% in October. The unemployment rate is down from 4.1% in October 2017 (a year ago), and is down from the cycle peak of 10.0% in October 2009.

This is the lowest level for the unemployment rate since 1969!

Also, this is the largest decline in the unemployment rate, from cycle peak-to-trough, since the BLS started tracking the unemployment rate in 1948. (In the early '80s, the unemployment rate declined from 10.8% to 5.0%; a decline of 5.8 percentage points. The current decline from 10.0% to 3.7% is 6.3 percentage points!)

2) Low unemployment claims.

Here is a graph of initial weekly unemployment claims.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims is at 218,500.

The low level of claims suggests relatively few layoffs.

3) Job Openings Near Series High.

There were 7.0 million job openings in September. This is close to the series high of 7.29 million in August 2018.

For the sixth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015 (almost 4 years).

Also Quits are up 11% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

More job openings, and rising quits, are positive signs for the labor market.

4) Wages have been increasing at a faster rate.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.1% YoY in October.

Wage growth has generally been trending up for several years.

5) Household Debt burdens are near record lows.

Household debt burdens have declined sharply since the great recession.

The Household debt service ratio was at 13.2% in 2007, and has fallen to a series low of 9.84% in Q2 2018 (most recent data).

The overall Debt Service Ratio decreased in Q2 2018, and has been moving sideways and is at a series low. Note: The financial obligation ratio (FOR) was declined in Q2 and is also near a series low (not shown).

The DSR for mortgages (blue) is also at a series low (since at least 1980). This ratio increased rapidly during the housing bubble, and continued to increase until 2007.

This data suggests aggregate household cash flow has improved.

Happy Thanksgiving to All!

Wednesday, November 21, 2018

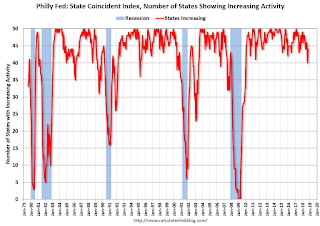

Philly Fed: State Coincident Indexes increased in 42 states in October

by Calculated Risk on 11/21/2018 03:06:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2018. Over the past three months, the indexes increased in 43 states, decreased in four states, and remained stable in three, for a three-month diffusion index of 78. In the past month, the indexes increased in 42 states, decreased in five states, and remained stable in three, for a one-month diffusion index of 74.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In October, 44 states had increasing activity (including minor increases).

Comments on October Existing Home Sales

by Calculated Risk on 11/21/2018 12:23:00 PM

Earlier: NAR: Existing-Home Sales Increased to 5.22 million in October

Two key points:

1) The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Overall this is a reasonable level for existing home sales, and the recent weakness is no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 2.8% year-over-year (YoY) in October. This was the third consecutive year-over-year increase in inventory, and the largest YoY increase since late 2014.

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase much more and still be at normal levels. No worries.

Sales NSA in October (446,000, red column) were below sales in October 2017 (458,000, NSA), but were the second highest since the housing bubble.

Sales NSA through October (first ten months) are down about 2.1% from the same period in 2017.

This is a small YoY decline in sales to-date - it is likely that higher mortgage rates are impacting sales, and it is possible there has been an impact from the changes to the tax law (eliminating property taxes write-off, etc).

NAR: Existing-Home Sales Increased to 5.22 million in October

by Calculated Risk on 11/21/2018 10:11:00 AM

From the NAR: Existing-Home Sales Increase for the First Time in Six Months

Existing-home sales increased in October after six straight months of decreases, according to the National Association of Realtors®. Three of four major U.S. regions saw gains in sales activity last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 1.4 percent from September to a seasonally adjusted rate of 5.22 million in October. Sales are now down 5.1 percent from a year ago (5.5 million in October 2017).

...

Total housing inventory at the end of October decreased from 1.88 million in September to 1.85 million existing homes available for sale, but that represents an increase from 1.80 million a year ago. Unsold inventory is at a 4.3-month supply at the current sales pace, down from 4.4 last month and up from 3.9 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.2 million SAAR) were up 1.4% from last month, but were 5.1% below the October 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.85 million in October from 1.88 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.85 million in October from 1.88 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 2.8% year-over-year in October compared to October 2017.

Inventory was up 2.8% year-over-year in October compared to October 2017. Months of supply was at 4.3 months in October.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Weekly Initial Unemployment Claims increased to 224,000

by Calculated Risk on 11/21/2018 08:33:00 AM

The DOL reported:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 224,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 5,000 from 216,000 to 221,000. The 4-week moving average was 218,500, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 1,250 from 215,250 to 216,500.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 218,500.

This was higher than the consensus forecast. The low level of claims suggest few layoffs.

MBA: Mortgage Applications Decreased Slightly in Latest Weekly Survey

by Calculated Risk on 11/21/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 16, 2018. This week’s results do not include an adjustment for the Veterans’ Day holiday.

... The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 5 percent lower than the same week one year ago.

...

“Treasury rates declined last week, as equity markets continued to see large swings amidst investor concerns over global economic growth. As a result, mortgage rates inched back across most loan types, including the 15-year fixed-rate mortgage, 5/1 ARM, and 30-year jumbo mortgage rate. The 30-year fixed rate mortgage also declined, stopping a run of six straight weekly increases,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Mortgage applications saw mixed results last week. Purchase applications increased to their highest level in five weeks, but despite the pause in rates, refinance activity dropped again and remained at its lowest level since 2000.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.16 percent from 5.17 percent, with points decreasing to 0.48 from 0.55 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 5% year-over-year.