by Calculated Risk on 11/20/2018 01:57:00 PM

Tuesday, November 20, 2018

John Burns: Builder Confidence "Feels more like a 50 to me"

Yesterday the NAHB reported that builder confidence declined sharply to 60 in November from 68 in October.

Here are some interesting comments on confidence via twitter from John Burns, CEO of John Burns Real Estate Consulting (a premier RE consulting firm).

John Burns wrote:

"Our survey of new home buyer traffic and expected new home sales from 200+ of the exact same builders. Green is the last 4 Octobers. Hard to believe NAHB that HMI is a 60. Feels more like a 50 (normal) to me."Here is the graph that Burns posted:

Click on graph for larger image.

Click on graph for larger image.

Comments on October Housing Starts

by Calculated Risk on 11/20/2018 10:20:00 AM

Earlier: Housing Starts Increased to 1.228 Million Annual Rate in October

Housing starts in October were slightly below expectations, however starts for August and September were revised up. Overall this was close to expectations.

The housing starts report released this morning showed starts were up 1.5% in October compared to September (September starts were revised up), and starts were down 2.9% year-over-year compared to October 2017.

Single family starts were down 2.6% year-over-year.

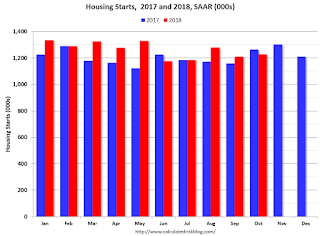

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 2.9% in October compared to October 2017.

Through nine months, starts are up 5.6% year-to-date compared to the same period in 2017. That is a decent increase.

Note that 2017 finished strong, so the year-over-year comparisons are difficult in Q4.

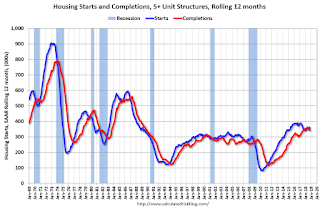

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

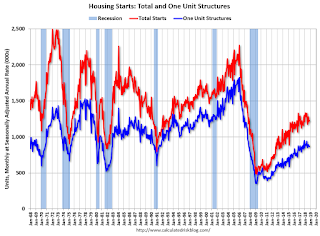

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect further of increases in single family starts and completions.

Housing Starts Increased to 1.228 Million Annual Rate in October

by Calculated Risk on 11/20/2018 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,228,000. This is 1.5 percent above the revised September estimate of 1,210,000, but is 2.9 percent below the October 2017 rate of 1,265,000. Single‐family housing starts in October were at a rate of 865,000; this is 1.8 percent below the revised September figure of 881,000. The October rate for units in buildings with five units or more was 343,000.

Building Permits:

Privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,263,000. This is 0.6 percent below the revised September rate of 1,270,000 and is 6.0 percent below the October 2017 rate of 1,343,000. Single‐family authorizations in October were at a rate of 849,000; this is 0.6 percent below the revised September figure of 854,000. Authorizations of units in buildings with five units or more were at a rate of 376,000 in October.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in October compared to September. Multi-family starts were down year-over-year in October.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) decreased in October, and were down 2.6% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in October were slightly below expectations, however starts for August and September were revised up..

I'll have more later ...

Monday, November 19, 2018

Tuesday: Housing Starts

by Calculated Risk on 11/19/2018 07:22:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Maintain Recent Lows

Mortgage rates unexpectedly dropped to their lowest levels in more than a month as of last Friday. That assertion is at odds with quite a few media reports that cited Freddie Mac's weekly survey data saying that rates were essentially unchanged from the previous week. This occurred because Freddie's survey only captures the first few days of any given week and most of last week's improvement took place on Thursday and Friday. As such, this week's Freddie surveys should reflect that nice drop in rates.Tuesday:

How nice is "nice?" In absolute terms, we're talking about something slightly less than an eighth of a percentage point in terms of a typical 30yr fixed rate from the average lender. That's actually a fairly quick move relative to the average pace of mortgage rate movement. In any event, it's the nicest drop we've seen in more than a month, and it brings us to the lowest levels in more than a month as well. The caveat is that we're still fairly close to the long-term highs (highest since 2011).[30YR FIXED - 4.875-5.0%]

emphasis added

• At 8:30 AM: Housing Starts for October. The consensus is for 1.240 million SAAR, up from 1.201 million SAAR.

California Bay Area Home Sales Decline 8% YoY in October, Inventory up 21% YoY

by Calculated Risk on 11/19/2018 02:45:00 PM

Here are some Bay Area stats from Pacific Union chief economist Selma Hepp:

• Bay Area home sales dipped by 8 percent year over year in October; however, the 19 percent increase from September was the highest monthly increase between September and October going back to 1990.

• Santa Clara County and East Bay counties continued to lead the sales declines, while San Francisco activity remained steady on an annual basis.

• Sales of higher priced homes -- $2 million-plus -- rebounded notably, up by 24 percent from October 2017 following a September drop.

• Inventory grew by 21 percent year over year, with almost half of the increase -- or more than 1,100 homes -- priced below $1 million.

• Lower-priced inventory rose by 18 percent - the largest increase following 15 months of double-digit percent declines.

• Buyers of homes priced below $1 million are decidedly restrained, with the fewest homes selling for more than asking price since January 2017.

• There were more price reductions across the region and at all price ranges, with lower-priced homes posting the largest share of reductions in the past three years.

Sacramento Housing in October: Sales Down 4.8% YoY, Active Inventory up 21% YoY

by Calculated Risk on 11/19/2018 12:51:00 PM

From SacRealtor.org: October 2018 Statistics – Sacramento Housing Market – Single Family Homes, Sales volume increases, median sales price dips

October closed with 1,413 sales, a 9.1% increase from the 1,318 sales of September. Compared to the same month last year (1,510), the current figure is down 4.8%. Of the 1,413 sales this month, 179 (12.4%) used cash financing, 910 (63.3%) used conventional, 230 (16%) used FHA, 92 (6.4%) used VA and 27 (1.9%) used Other types of financing.CR Note: Inventory is still low - months of inventory is at 2.1 months, probably closer to 4 months would be normal - however inventory is up significantly year-over-year in Sacramento.

...

The Active Listing Inventory decreased, dropping 5.4% from 3,236 to 3,060 units. [note: year-over-year inventory is up 20.7%] The Months of Inventory decreased from 2.5 to 2.1 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

...

The Average DOM (days on market) continued its increase, rising from 26 to 30 from September to October. The Median DOM also increased, rising from 15 to 19. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,438 sales this month, 65.6% (944) were on the market for 30 days or less and 85.9% (1,236) were on the market for 60 days or less.

emphasis added

NAHB: Builder Confidence Declines in November

by Calculated Risk on 11/19/2018 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 60 in November, down from 68 in October. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Drops as Housing Affordability Issues Rise

Growing affordability concerns resulted in builder confidence in the market for newly-built single-family homes falling eight points to 60 in November on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). Despite the sharp drop, builder sentiment still remains in positive territory.

“Builders report that they continue to see signs of consumer demand for new homes but that customers are taking a pause due to concerns over rising interest rates and home prices,” said NAHB Chairman Randy Noel, a custom home builder from LaPlace, La.

“For the past several years, shortages of labor and lots along with rising regulatory costs have led to a slow recovery in single-family construction,” said NAHB Chief Economist Robert Dietz. “While home price growth accommodated increasing construction costs during this period, rising mortgage interest rates in recent months coupled with the cumulative run-up in pricing has caused housing demand to stall.”

With the prospect of future interest rate hikes in store, Dietz said that builders have adopted a more cautious approach to market conditions and urged policymakers to take note.

“Recent policy statements on economic conditions have lacked commentary on housing, even as housing affordability has hit a 10-year low,” said Dietz. “Given that housing leads the economy, policymakers need to focus more on residential market conditions.”

...

All of the major HMI indices posted declines. The index measuring current sales conditions fell seven points to 67, the component gauging expectations in the next six months dropped 10 points to 65 and the metric charting buyer traffic registered an eight-point drop to 45.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 58. The Midwest edged one point lower to 57, the South declined two points to 68 and the West dropped three points to 71.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was well below the consensus forecast, but still a decent reading.

Sunday, November 18, 2018

Sunday Night Futures

by Calculated Risk on 11/18/2018 07:58:00 PM

Weekend:

• Schedule for Week of November 18, 2018

• Existing Home Sales for October: Take the Over

Monday:

• At 10:00 AM, The November NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $57.07 per barrel and Brent at $67.31 per barrel. A year ago, WTI was at $56, and Brent was at $61 - so WTI oil prices are up slightly, and Brent prices up about 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.60 per gallon. A year ago prices were at $2.54 per gallon, so gasoline prices are up 6 cents per gallon year-over-year.

Existing Home Sales for October: Take the Over

by Calculated Risk on 11/18/2018 11:46:00 AM

The NAR is scheduled to release Existing Home Sales for October at 10:00 AM on Wednesday, November 21st.

The consensus is for 5.20 million SAAR, up from 5.15 million in September. Housing economist Tom Lawler estimates the NAR will reports sales of 5.31 million SAAR for October and that inventory will be up 2.8% year-over-year. Based on Lawler's estimate, I expect existing home sales to be above the consensus for October.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in September 2018, the consensus was for sales of 5.30 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 5.20 million, and the NAR reported 5.15 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight years, the consensus average miss was 144 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | --- |

| 1NAR initially reported before revisions. | |||

Saturday, November 17, 2018

Schedule for Week of November 18, 2018

by Calculated Risk on 11/17/2018 08:11:00 AM

The key economic reports this week are October Housing Starts and Existing Home Sales.

Happy Thanksgiving!

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 68, unchanged from 68. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.240 million SAAR, up from 1.201 million SAAR.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 213 thousand initial claims, down from 216 thousand the previous week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 2.4% decrease in durable goods orders.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.20 million SAAR, up from 5.15 million.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.20 million SAAR, up from 5.15 million.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.31 million SAAR for October and that inventory will be up 2.8% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November). The consensus is for a reading of 98.3.

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close early at 1:00 PM ET.