by Calculated Risk on 9/14/2018 07:34:00 PM

Friday, September 14, 2018

Lawler: Single Family Rental Market Share Shrunk Significantly in 2017

From housing economist Tom Lawler: Single Family Rental Market Share Shrunk Significantly in 2017

ACS estimates suggest that the renter-occupied share of total occupied single-family detached homes fell to 16.13% in 2017 from 16.76% in 2016. This renter share was the lowest since 2011.

The ACS estimate of the number of renter-occupied single-family detached homes in 2017 was 12,172,265, down 294,869 from 2016.

Lawler: Household Estimates Conundrum Alive and Well

by Calculated Risk on 9/14/2018 04:22:00 PM

From housing economist Tom Lawler: Household Estimates Conundrum Alive and Well

One of the most vexing government data issues facing housing economists is the lack of any timely and reliable estimates of the number of US households. To be sure, there is no shortage of household estimates: in addition to the decennial Census counts, Census releases four different estimates of the number of US households. Unfortunately, the estimates not only differ materially, but also show different characteristics of households (e.g., by age) and often show different growth rates over time.

This issue, labeled by Census economists several years ago as the “household estimates conundrum,” was highlighted in the recent release of US household estimates from the 2017 American Community Survey (ACS), the 2017 American Housing Survey (AHS), and the 2018 (March) Current Population Survey Annual Social and Economic Supplement (CPS/ASEC). Below is a table showing estimates of the number of US households by age group from each of these surveys, as well as 2017 estimates from the Housing Vacancy Survey, a monthly supplement to the Current Population Survey.

| Different Estimates of the Number of US Households by Select Age Groups (000's) | |||||

|---|---|---|---|---|---|

| ACS 2017 | AHS 2017 | HVS 2017 | CPS/ASEC March 2018 | CPS/ASEC March 2017 | |

| Total | 120,063 | 121,190 | 119,273 | 127,586 | 126,224 |

| 15-24 | 4,334 | 4,274 | 5,932 | 6,211 | 6,239 |

| 25-34 | 18,107 | 17,716 | 19,399 | 20,264 | 20,109 |

| 35-44 | 20,553 | 20,740 | 20,051 | 21,576 | 21,500 |

| 45-54 | 22,671 | 23,220 | 21,387 | 22,542 | 22,808 |

| 55-64 | 23,705 | 24,690 | 22,551 | 24,020 | 23,770 |

| 65+ | 30,692 | 30,550 | 29,953 | 32,973 | 31,798 |

None of these surveys is designed directly to measure the number of households; rather, they are designed to estimate the characteristics of the household population and/or the housing stock. Household estimates are then “controlled” either to independent US population estimates (CPS/ASEC) or to independent US housing stock estimates (ACS, AHS, and HVS).

If the housing stock estimates are correct but a survey overstates the overall vacancy rate, and that survey is controlled to housing stock estimates, then that survey will understate the number of households. If the population estimates are correct but the survey understates the average US household size, then that survey will overstate the number of households. Comparisons of survey estimates with decennial Census 2010 counts indicated that the ACS and HVS understated the number of US households, and the CPS/ASEC overstated the number of US households.

Aside from the total estimates, what is especially striking about the different survey results is the vastly different age distributions of households. For example, the CPS-based household estimates show that the share of US households under 35 years old is about 21%, compared to the ACS’s 18.7% and the AHS’s 18.1%. Comparisons of the surveys to Decennial Census counts showed that CPS-based household estimates significantly overstated the number of younger householders, while the ACS understated somewhat the number of younger householders.

The issue of differences in household and vacancy rate estimates was a “hot topic” following the release of Census 2010 results, and there was a flurry of working papers earlier this decade on the topic (though the papers only focused on differences in Census 2010 and the 2010 ACS, even though CPS-based differences were even larger. Since 2013, however, research appears to have stalled, which is disturbing.

Q3 GDP Forecasts

by Calculated Risk on 9/14/2018 11:37:00 AM

From Merrill Lynch:

3Q GDP tracking received a 0.5pp boost from this morning's data, leaving us at 3.7%. 2Q remains at 4.4%. [Sept 14 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.4 percent on September 14, up from 3.8 percent on September 11. [Sept 14 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.2% for 2018:Q3 and 2.8% for 2018:Q4. [Sept 14 estimate]CR Note: It looks like GDP will be in the 3s in Q3.

Industrial Production Increased 0.4% in August

by Calculated Risk on 9/14/2018 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 0.4 percent in August for its third consecutive monthly increase. Manufacturing output moved up 0.2 percent on the strength of a 4.0 percent rise for motor vehicles and parts; motor vehicle assemblies jumped to an annual rate of 11.5 million units, the strongest reading since April. Excluding the gain in motor vehicles and parts, factory output was unchanged. The output of utilities advanced 1.2 percent, and mining production increased 0.7 percent; the index for mining last decreased in January. At 108.2 percent of its 2012 average, total industrial production was 4.9 percent higher in August than it was a year earlier. Capacity utilization for the industrial sector moved up in August to 78.1 percent, a rate that is 1.7 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is 1.7% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in August to 108.2. This is 24% above the recession low, and 3% above the pre-recession peak.

The increase in industrial production was at the consensus forecast - however July was revised down, and capacity utilization was below consensus.

Retail Sales increased 0.1% in August

by Calculated Risk on 9/14/2018 08:38:00 AM

On a monthly basis, retail sales increased 0.1 percent from July to August (seasonally adjusted), and sales were up 6.6 percent from August 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for August 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $509.0 billion, an increase of 0.1 percent from the previous month, and 6.6 percent above August 2017. Total sales for the June 2018 through August 2018 period were up 6.5 percent from the same period a year ago. The June 2018 to July 2018 percent change was revised from up 0.5 percent to up 0.7 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 0.1% in August.

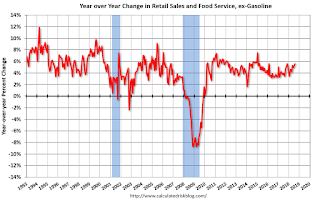

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.6% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.6% on a YoY basis.The increase in August was well below expectations, however sales in June and July were revised up.

Thursday, September 13, 2018

Friday: Retail Sales, Industrial Production

by Calculated Risk on 9/13/2018 06:44:00 PM

Friday:

• At 8:30 AM ET, Retail sales for August will be released. The consensus is for a 0.4% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 78.3%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for September).

Housing Inventory Tracking

by Calculated Risk on 9/13/2018 03:38:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was unchanged year-over-year (YoY) in July, this followed 37 consecutive months with a YoY decline.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento (through August) and also Phoenix (through July) and total existing home inventory as reported by the NAR (through July).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 22% year-over-year in July (inventory was still very low), and has increased YoY for eleven consecutive months.

Also note that inventory was up 20% YoY in Las Vegas in August (red), the second consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up slightly in Houston in August (but the YoY change might be distorted by Hurricane Harvey last year).

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally (but still very low).

Sacramento Housing in August: Sales Down 3.3% YoY, Active Inventory up 22% YoY

by Calculated Risk on 9/13/2018 01:59:00 PM

From SacRealtor.org: Inventory continues upward trend, sales price stalls for 3rd month

August closed with 1,676 sales, a 4.9% increase from the 1,566 sales of July. Compared to August last year (1,734), the current figure is a 3.3% decrease.CR Note: Inventory is still low, but up significantly year-over-year in Sacramento.

The Active Listing Inventory increased 10.2% from July to August, up from 2,875 to 3,167 units. [inventory is up 22.1% YoY from 2,593 in August 2017]. The Months of Inventory increased from 1.8 to 1.9 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

The Average DOM (days on market) increased from 22 to 24 from July to August and the Median DOM increased from 12 to 14. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,676 sales this month, 74.2% (1,244) were on the market for 30 days or less and 91% (1,526) were on the market for 60 days or less.

emphasis added

Key Measures Show Inflation Decreased on YoY Basis in August

by Calculated Risk on 9/13/2018 12:20:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.7% annualized rate) in August. The 16% trimmed-mean Consumer Price Index rose 0.2% (1.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for August here. Motor fuel increased at a 42% annual rate in August.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.7% annualized rate) in August. The CPI less food and energy rose 0.1% (1.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.2%. Core PCE is for July and increased 2.0% year-over-year.

On a monthly basis, median CPI was at 1.7% annualized, trimmed-mean CPI was at 1.9% annualized, and core CPI was at 1.0% annualized.

Using these measures, inflation decreased on a year-over-year basis in August. Overall, these measures are at or above the Fed's 2% target.

Early Look at 2019 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 9/13/2018 09:11:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.9 percent over the last 12 months to an index level of 246.336 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2017, the Q3 average of CPI-W was 239.668.

Last year was the highest Q3 average, so we have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 2.9% year-over-year in August, and although this is very early - we need the data for September - my current guess is COLA will probably be just under 3% this year, the largest annual increase since 2011.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2017 yet, but wages probably increased again in 2017. If wages increased the average of the last three years, then the contribution base next year will increase to around $132,000 in 2019, from the current $128,400.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).