by Calculated Risk on 9/12/2018 07:00:00 AM

Wednesday, September 12, 2018

MBA: Mortgage Applications Decreased in Latest Weekly Survey, Refi Lowest Since 2000

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 7, 2018. This week’s results include an adjustment for the Labor Day holiday.

... The Refinance Index decreased 6 percent from the previous week to the lowest level since December 2000. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index decreased 11 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.84 percent from 4.80 percent, with points increasing to 0.46 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 11, 2018

Wednesday: PPI, Beige Book

by Calculated Risk on 9/11/2018 08:21:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for August from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Hurricanes and Economic Data

by Calculated Risk on 9/11/2018 04:25:00 PM

For everyone in North and South Carolina - stay safe!

Frequently there is a temporary slowdown in several major growth indicators following a large natural disaster. And usually there is a pretty rapid bounce back following the disaster.

It seems likely Hurricane Florence will negatively impact Q3 GDP, September employment and housing.

On employment: This week is the BLS reference week (includes the 12th). Hurricane Irma made landfall during the BLS reference week last year, and the BLS noted:

Hurricane Irma made landfall in Florida on September 10--during the reference period for both the establishment and household surveys--causing severe damage in Florida and other parts of the Southeast. Hurricane Harvey made landfall in Texas on August 25--prior to the September reference periods--resulting in severe damage in Texas and other areas of the Gulf Coast.Initially the BLS reported 33,000 jobs lost in September 2017, however this was eventually revised up to a gain of 14,000 jobs - keeping the job streak alive.

Our analysis suggests that the net effect of these hurricanes was to reduce the estimate of total nonfarm payroll employment for September. There was no discernible effect on the national unemployment rate.

Something similar might happen this year, with employment being depressed in September - then eventually being revised up, with a bounce back in October.

The first economic indicator to be impacted by the hurricane will probably be weekly unemployment claims. Last year, weekly claims jumped from 238,000 to 293,000 following hurricane Harvey. The size of the jump in claims for next week will give an idea of the impact on employment.

Another early indicator is usually car sales, with car sales falling to 16.45 million SAAR last August (the weakest month of 2017). Since so many cars were damaged from the flooding in Texas last year, sales bounced back sharply.

Stay safe. And expect any impacted indicator to rebound fairly quickly.

Leading Index for Commercial Real Estate "Falters" in August

by Calculated Risk on 9/11/2018 01:44:00 PM

From Dodge Data Analytics: Dodge Momentum Index Falters in August

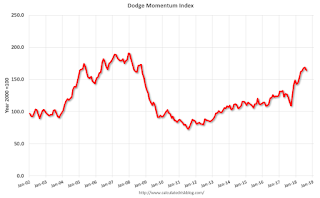

The Dodge Momentum Index fell 2.9% in August to 164.1 (2000=100) from the revised July reading of 169.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 164.1 in August, down from 169.0 in July.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests further growth into 2019.

BLS: Job Openings "Little Changed" in July

by Calculated Risk on 9/11/2018 10:08:00 AM

Notes: In July there were 6.939 million job openings, and, according to the July Employment report, there were 6.234 million unemployed. So, for the fourth consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015.

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.9 million on the last business day of July, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.5 million, respectively. Within separations, the quits rate was little changed at 2.4 percent and the layoffs and discharges rate was unchanged at 1.1 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in July at 3.6 million. The quits rate was 2.4 percent. The number of quits edged up for total private (+109,000) and was little changed for government. Quits increased in accommodation and food services (+61,000), other services (+49,000), and educational services (+12,000).

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in July to 6.939 million from 6.822 million in June.

The number of job openings (yellow) are up 12% year-over-year.

Quits are up 1% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a record level, and quits are increasing year-over-year. This was a strong report.

Small Business Optimism Index increased in August

by Calculated Risk on 9/11/2018 08:33:00 AM

From the National Federation of Independent Business (NFIB): August 2018 Report: Small Business Optimism Index

The NFIB Small Business Optimism Index soared to 108.8 in August, a new record in the survey’s 45-year history, topping the July 1983 highwater mark of 108.

..

After posting significant gains in employment in July, job creation slowed among small firms in August, perhaps because there were fewer workers available to hire because job openings hit a 45 year record high. Fifteen percent (down 2 points) reported increasing employment an average of 3.2 workers per firm and 10 percent (down 1 point) reported reducing employment an average of 2.4 workers per firm (seasonally adjusted). Sixty-two percent reported hiring or trying to hire (up 3 points), but 55 percent (up 3 points and 89 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill. A record 25 percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 2 points). Thirty-eight percent of all owners reported job openings they could not fill in the current period, a new survey record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 108.8 in August.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, September 10, 2018

Tuesday: Job Openings

by Calculated Risk on 9/10/2018 07:16:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Highest in Over a Month

Mortgage rates were slightly higher today, depending on the lender. Many lenders ended up raising rates last Friday afternoon as underlying bond markets weakened. The remaining lenders had more distance to cover in terms of getting caught up with market movements. The average lender is just slightly worse off. Unfortunately, that puts rates at the highest levels in more than a month. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for August.

• At 10:00 AM, Job Openings and Labor Turnover Survey for July from the BLS.

Las Vegas: Visitor Traffic down 1.2%, Convention Attendance down 5.1% compared to same Period in 2017

by Calculated Risk on 9/10/2018 02:17:00 PM

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2017, visitor traffic declined 1.7% compared to 2016, but was still 8% above the pre-recession peak.

Convention attendance set a new record in 2017, but is down 5.1% in 2018 compared to the same period in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Convention attendance was down 5.1% through July compared to the same period in 2017.

Visitor traffic was down 1.2% through July compared to the same period in 2017.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the declines in 2017 and 2018 are a little concerning for the Vegas area.

Hotels: Occupancy Rate On Pace for Record Year

by Calculated Risk on 9/10/2018 12:28:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 1 September

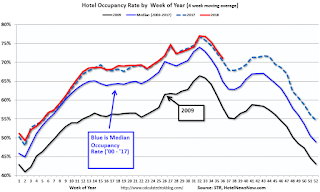

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 26 August through 1 September 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 27 August through 2 September 2017, the industry recorded the following:

• Occupancy: +1.6% to 67.0%

• Average daily rate (ADR): +3.0% to US$125.16

• Revenue per available room (RevPAR): +4.6% to US$83.88

...

In comparison with the week that followed the landfall of Hurricane Harvey in 2017, Houston, Texas, reported the steepest declines in ADR (-4.2% to US$95.94) and RevPAR (-19.2% to US$55.94). The market also matched for the largest drop in occupancy (-15.6% to 58.3%).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is just ahead of the record year in 2017.

Note: 2017 finished strong due to the impact of the hurricanes, but the overall occupancy was up this week year-over-year even though the Houston area saw a sharp year-over-year decline (boosted last year by Hurricane Harvey).

Data Source: STR, Courtesy of HotelNewsNow.com

Black Knight Mortgage Monitor for July

by Calculated Risk on 9/10/2018 10:12:00 AM

Black Knight released their Mortgage Monitor report for July today. According to Black Knight, 3.61% of mortgages were delinquent in July, down from 3.74% in June 2017. Black Knight also reported that 0.57% of mortgages were in the foreclosure process, down from 0.78% a year ago.

This gives a total of 4.18% delinquent or in foreclosure.

Press Release: Black Knight’s July 2018 Mortgage Monitor

Today, the Data & Analytics division of Black Knight, Inc.released its latest Mortgage Monitor Report, based on data as of the end of July 2018. This month, Black Knight looked at full Q2 2018 data to revisit the nation’s equity landscape. Despite the slowdown in the rate of home price appreciation seen throughout the second quarter, total tappable equity – the amount of equity available to homeowners with mortgages to borrow against before hitting a maximum 80 percent combined loan-to-value ratio – reached a record high. As Ben Graboske, executive vice president of Black Knight’s Data & Analytics division explained, even though Q2 2018 experienced the fourth strongest quarterly gain in equity since the housing recovery began, the slowing in growth observed was noteworthy.

“As the second quarter came to a close, the total amount of tappable equity available to homeowners with mortgages surpassed the $6 trillion mark for the first time in history,” said Graboske. “There is now $636 billion more tappable equity available than at the start of 2018, and nearly three times as much compared to the bottom of the market in 2012. Despite the noticeable slowing in home price appreciation over the past four months that Black Knight has reported on recently, some 44 million homeowners now have equity that could be tapped via cash-out refinances or home equity lines of credit (HELOCs). Although total available equity broke an all-time record, we observed strong and unseasonable quarterly slowing in equity growth. While Q2’s $256 billion increase in tappable equity was the fourth strongest quarterly growth since the housing recovery began, the decline from Q1’s $381 billion was significant, particularly given that historically, Q1 and Q2 are responsible for the bulk of equity growth in any given year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows their estimate of "tappable equity".

From Black Knight:

• Despite slower home price growth, tappable equity surpassed $6 trillion for the first time in Q2 2018

• There is now 2.7X as much tappable equity as at the bottom of the housing market in 2012 and 21% more than at the pre-crisis peak in 2006

The second graph shows First Lien mortgage activity:

• First lien mortgage originations rose 20% from Q1 due to seasonal growth in purchase lending, but were down 7% from Q2 2017 by dollar volumeThere is much more in the mortgage monitor.

• Purchase lending saw a slightly lower-than-average 49% seasonal increase from the first quarter and remained relatively flat from one year ago

• The number of purchase originations rose 2.0% year-over-year, and purchase lending was up marginally by volume as well

• Refinance originations dropped to $117B for the lowest quarterly total since Q1 2014, and at 484K, Q2 saw the fewest refinance loans originated in more than 17 years

• Refinance loans made up just 25% of Q2 originations by volume, the lowest such share in 18 years