by Calculated Risk on 8/22/2018 03:21:00 PM

Wednesday, August 22, 2018

AIA: "July architecture firm billings remain positive despite growth slowing"

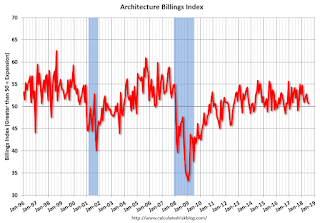

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: July architecture firm billings remain positive despite growth slowing

Architecture firm billings growth slowed again in July but remained positive overall for the tenth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for July was 50.7 compared to 51.3 in June. Any score over 50 represents billings growth. While July’s ABI shows that aggregate demand for architecture firm services continues to increase, much of that growth came from one region—the South.

“Billings at architecture firms in the South remained robust in July, offsetting declining billings in other regions of the country,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Despite the dip in the overall ABI number in July, firms are still reporting a healthy increase in new projects.”

...

• Regional averages: West (49.6), Midwest (49.3), South (55.2), Northeast (48.0)

• Sector index breakdown: multi-family residential (54.6), institutional (51.1), commercial/industrial (50.1), mixed practice (48.2)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.7 in July, down from 51.3 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and into 2019.

FOMC Minutes: "Trade disputes a potentially consequential downside risk", Yield Curve Discussion

by Calculated Risk on 8/22/2018 02:06:00 PM

Still on pace for 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, July 31-August 1, 2018:

Some participants noted that stronger underlying momentum in the economy was an upside risk; most expressed the view that an escalation in international trade disputes was a potentially consequential downside risk for real activity. Some participants suggested that, in the event of a major escalation in trade disputes, the complex nature of trade issues, including the entire range of their effects on output and inflation, presented a challenge in determining the appropriate monetary policy response. emphasis addedAnd on the yield curve:

Participants also discussed the possible implications of a flattening in the term structure of market interest rates. Several participants cited statistical evidence for the United States that inversions of the yield curve have often preceded recessions. They suggested that policymakers should pay close attention to the slope of the yield curve in assessing the economic and policy outlook. Other participants emphasized that inferring economic causality from statistical correlations was not appropriate. A number of global factors were seen as contributing to downward pressure on term premiums, including central bank asset purchase programs and the strong worldwide demand for safe assets. In such an environment, an inversion of the yield curve might not have the significance that the historical record would suggest; the signal to be taken from the yield curve needed to be considered in the context of other economic and financial indicators.

A Few Comments on July Existing Home Sales

by Calculated Risk on 8/22/2018 11:59:00 AM

Earlier: NAR: Existing-Home Sales Decline in July

A few key points:

1) This is a reasonable level for existing home sales, and doesn't suggest any significant weakness in housing or the economy. The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment.

2) Inventory is still very low, but was unchanged year-over-year (YoY) in July. Inventory for June was initially reported as up slightly year-over-year, but inventory was revised down. Following 37 consecutive months with a year-over-year decline in inventory, inventory was unchanged (a first since June 2015).

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in July. The consensus was for sales of 5.43 million SAAR, Lawler estimated the NAR would report 5.40 million SAAR in July, and the NAR actually reported 5.34 million.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in July (522,000, red column) were above sales in July 2017 (513,000, NSA).

Sales NSA through July (first seven months) are down about 1.6% from the same period in 2017.

This is a small YoY decline in sales to-date - but it is possible there has been an impact from higher interest rates and / or the changes to the tax law (eliminating property taxes write-off, etc).

Employment: Preliminary annual benchmark revision shows upward adjustment of 43,000 jobs

by Calculated Risk on 8/22/2018 10:45:00 AM

The BLS released the preliminary annual benchmark revision showing 43,000 additional payroll jobs as of March 2018. The final revision will be published when the January 2019 employment report is released in February 2019. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued in February 2019 with the publication of the January 2019 Employment Situation news release.Using the preliminary benchmark estimate, this means that payroll employment in March 2018 was 43,000 higher than originally estimated. In February 2019, the payroll numbers will be revised up to reflect the final estimate. The number is then "wedged back" to the previous revision (March 2017).

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. For National CES employment series, the annual benchmark revisions over the last 10 years have averaged plus or minus two-tenths of one percent of total nonfarm employment. The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2018 total nonfarm employment of 43,000 (< 0.05 percent).

emphasis added

Construction was revised up by 42,000 jobs, and manufacturing revised down by 9,000 jobs.

This preliminary estimate showed 17,000 fewer private sector jobs, and 60,000 more government jobs (as of March 2018).

NAR: Existing-Home Sales Decline in July

by Calculated Risk on 8/22/2018 10:11:00 AM

From the NAR: Existing-Home Sales Slip 0.7 Percent in July

Existing-home sales subsided for the fourth straight month in July to their slowest pace in over two years, according to the National Association of Realtors®. The West was the only major region with an increase in sales last month.

Total existing-home saless, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 0.7 percent to a seasonally adjusted annual rate of 5.34 million in July from 5.38 million in June. With last month’s decline, sales are now 1.5 percent below a year ago and have fallen on an annual basis for five straight months.

...

Total housing inventory at the end of July decreased 0.5 percent to 1.92 million existing homes available for sale (unchanged from a year ago). Unsold inventory is at a 4.3-month supply at the current sales pace (also unchanged from a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.34 million SAAR) were 0.7% lower than last month, and were 1.5% below the July 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.92 million in July from 1.93 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.92 million in July from 1.93 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was unchanged year-over-year in July compared to July 2017.

Inventory was unchanged year-over-year in July compared to July 2017. Months of supply was at 4.3 months in July.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low, but appears to be bottoming. I'll have more later ...

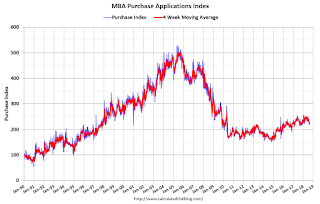

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 8/22/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 17, 2018.

... The Refinance Index increased six percent from the previous week. The seasonally adjusted Purchase Index increased three percent from one week earlier. The unadjusted Purchase Index increased one percent compared with the previous week and was one percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged from 4.81 percent, with points decreasing to 0.42 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 1% year-over-year.

Tuesday, August 21, 2018

Wednesday: Existing Home Sales, FOMC Minutes, BLS Benchmark Revision

by Calculated Risk on 8/21/2018 07:31:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.43 million SAAR, up from 5.38 million in June. Housing economist Tom Lawler estimates the NAR will reports sales of 5.40 million SAAR for July and that inventory will be down 1.0% year-over-year.

• At 10:00 AM, The BLS will release the 2018 CES Preliminary Benchmark Revision.

• At 2:00 PM, The Fed will release the FOMC Minutes for the Meeting of July 31-August 1, 2018

Look Ahead to Existing Home Sales for July

by Calculated Risk on 8/21/2018 03:41:00 PM

The NAR is scheduled to release Existing Home Sales for July at 10:00 AM tomorrow.

The consensus is for 5.43 million SAAR, up from 5.38 million in June. Housing economist Tom Lawler estimates the NAR will reports sales of 5.40 million SAAR for July and that inventory will be down 1.0% year-over-year. Based on Lawler's estimate, I expect existing home sales to be close to the consensus for July.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

As an example, for last month, May 2018, the consensus was for sales of 5.56 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated 5.47 million, and the NAR reported 5.43 million (the consensus missed by 130 thousand compared to 40 thousand for Lawler).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight years, the consensus average miss was 147 thousand, and Lawler's average miss was 68 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | --- |

| 1NAR initially reported before revisions. | |||

Duy: "Bostic Throws Down the Gauntlet"

by Calculated Risk on 8/21/2018 02:14:00 PM

Some more Fed Watch comments from Tim Duy: Bostic Throws Down the Gauntlet

Atlanta Federal Reserve President Raphael Bostic threw down the gauntlet today with a declaration to dissent any policy move that will invert the yield curve. He may get the chance to make good on that threat in December – his last meeting in his current rotation a voting member.CR Note: Currently the target range for the federal funds rate is 1.75% to 2%. With inflation running close to 2% by most measures, the real Fed Funds rate is still negative.

…

Bottom Line: My sense is that the majority of the Fed would find more reasons to ignore than embrace the signal from a 10-2 yield curve inversion. They will fall back on the basic theory that this time is different because the curve inverts at a lower level of rates than in previous inversions. If the yield curve doesn’t stop them from continuing rate hikes, what will? Certainly a clear slowdown in activity would do the trick. But that is obvious. Less obvious is the possibility that they pause after reaching their estimates of neutral even if the data remains consistent with above-trend growth. That would require something of a leap of faith by Powell & Co. that the lagged impacts of tightening had yet to materialize in a slower pace of activity.

Demographics, Unemployment Rate and Inflation

by Calculated Risk on 8/21/2018 08:42:00 AM

Update: Here is a paper on this topic by Adam Ozimek using US metro data Population Growth and Inflation

"Overall, these results suggest that slowing population growth can be a headwind for inflation and help explain why inflation has remained stubbornly weak in some places."In early 2015, I wrote about the possible relationship between Demographics, Unemployment Rate and Inflation. An excerpt (at that time the unemployment rate was at 5.7%):

If we look at the annual change in the prime working age population, there is one other period similar to the current situation - the early-to-mid 60s.Recently there has been more research on this topic. From Mikael Juselius and Előd Takáts at the BIS, May 2018: The enduring link between demography and inflation

…

The key is the prime working age population was declining in the early part of this decade and has only started increasing again recently.

This is very similar to what happened in the 60s.

In the early 60s, there was a slow increase in the prime working age population until the baby boomers started pouring into the labor force.

[This] graph shows the unemployment rate and year-over-year change in inflation in the 1960s.

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4%. There could be several demographics reasons for the low inflation (in addition to policy reasons). As an example, maybe older workers were being replaced by younger workers who made less (just like today), and maybe the slow increase in the prime working age population put less pressure on resources.

Demographic shifts, such as population ageing, have been suggested as possible explanations for the past decade’s low inflation. We exploit cross-country variation in a long panel to identify age structure effects in inflation, controlling for standard monetary factors. A robust relationship emerges that accords with the lifecycle hypothesis. That is, inflationary pressure rises when the share of dependants increases and, conversely, subsides when the share of working age population increases. This relationship accounts for the bulk of trend inflation, for instance, about 7 percentage points of US disinflation since the 1980s. It predicts rising inflation over the coming decades.And from Elena Bobeica, Eliza Lis, Christiane Nickel, Yiqiao Sun at the ECB January 2017: Demographics and inflation

emphasis added

Most euro area countries have entered an unprecedented ageing process: life expectancy continues to rise and fertility rates have declined, while retirement age in the last twenty to thirty years hardly increased. This implies an ever smaller fraction of the working age population in total population, leading to changes in consumption and saving behaviours and having an important impact on the macroeconomy. In this paper we focus on the relationship between demographic change and inflation. We find that based on a cointegrated VAR model there is a positive long-run relationship between inflation and the growth rate of working-age population as a share in total population in the euro area countries as a whole, but also in the US and Germany. We also find that this relation is mitigated by the effect of monetary policy, which we account for by including the short-term interest rate in our analysis. One caveat of the analysis could be that the empirical relationship as found does not sufficiently take into account changes in policy settings following the high inflation experiences in the 1970s. Our findings support the view that demographic trends are among the forces that shape the economic environment in which monetary policy operates. This is particularly relevant for countries, like many in Europe, that face an ageing process.Note: For some different views, see the comments in this post by Tyler Cowen at Marginal Revolution: Does demography predict inflation?