by Calculated Risk on 8/08/2018 02:10:00 PM

Wednesday, August 08, 2018

Mortgage Rates and Ten Year Yield

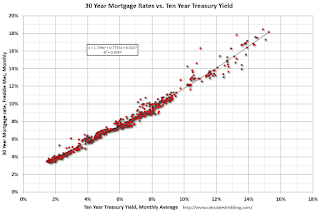

With the ten year yield getting close to 3%, there has been some discussion about whether mortgage rates would hit 5% soon. Based on an historical relationship, 30-year rates should currently be around 4.7%.

As of yesterday, Mortgage News Daily reported: Mortgage Rates Mostly Steady Today

Mortgage rates were roughly unchanged today. That would make this the 4th day in a row without any move higher in rates, and it would leave us at the lowest levels in roughly 2 weeks. [30YR FIXED - 4.625% - 4.75%]The graph shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

emphasis added

Currently the 10 year Treasury yield is just under 3%, and 30 year mortgage rates were at 4.60% according to the Freddie Mac survey last week.

Currently the 10 year Treasury yield is just under 3%, and 30 year mortgage rates were at 4.60% according to the Freddie Mac survey last week.To reach 5% (on the Freddie Mac survey), based on the historical relationship, the Ten Year yield would have to increase to about 3.3%.

Las Vegas Real Estate in July: Sales Up 4% YoY, Inventory up Slightly YoY

by Calculated Risk on 8/08/2018 09:47:00 AM

This is a key former distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices leveling off this summer, GLVAR housing statistics for July 2018

Local home prices are leveling off this summer as the housing supply has stopped shrinking but still remains tight. That’s according to a report released today by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were up 4.1% year-over-year from 3,798 in July 2017 to 3,955 in July 2018.

...

The total number of existing local homes, condos and townhomes sold during July was 3,955. Compared to one year ago, July sales were up 1.4 percent for homes and up 17.2 percent for condos and townhomes.

...

Southern Nevada now has less than a two-month supply of existing homes available for sale when a six-month supply is considered a balanced market. By the end of July, GLVAR reported 4,787 single-family homes listed for sale without any sort of offer. That’s up from June but still down 4.2 percent from one year ago. For condos and townhomes, the 878 properties listed without offers in July represented a hefty 40.5 percent increase from one year ago.

...

At the same time, the number of so-called distressed sales continues to drop. GLVAR reported that short sales and foreclosures combined accounted for 2.9 percent of all existing local home sales in July, down from 6.4 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is up slightly from a year ago, from a total of 5,620 in July 2017 to 5,665 in July 2018. Note: Total inventory was up 0.8% year-over-year - the first year-over-year increase since May 2016.

3) Fewer distressed sales.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 8/08/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 3, 2018.

... The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 2 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.84 percent, with points remaining unchanged at 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

This is the lowest level since December 2000.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 2% year-over-year.

Tuesday, August 07, 2018

CBO: Monthly Budget Review for July 2018

by Calculated Risk on 8/07/2018 06:28:00 PM

As expected, the deficit is increasing significantly.

From the CBO: Monthly Budget Review for July 2018

The federal budget deficit was $682 billion for the first 10 months of fiscal year 2018, CBO estimates, $116 billion more than the shortfall recorded during the same period last year. Revenues and outlays were 1 percent and 4 percent higher, respectively, than in the same period in fiscal year 2017.Next year the deficit will probably be close to $1 Trillion (about 4.6% of GDP).

As was the case last year, this year’s outlays were affected by shifts in the timing of certain payments that otherwise would have been due on a weekend. If not for those shifts, outlays and the deficit through July would have been larger, by roughly $40 billion, both this year and last year—but the year-to-year changes would not have been very different.

CBO expects that the deficit, receipts, and outlays for fiscal year 2018 will be largely consistent with amounts in its adjusted April baseline, which were reported in An Analysis of the President’s 2019 Budget in May 2018. At that time, CBO projected a deficit of $793 billion, outlays of $4,131 billion, and receipts of $3,339 billion.

U.S. Heavy Truck Sales up 13% Year-over-year in July

by Calculated Risk on 8/07/2018 12:59:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the July 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 464 thousand SAAR in July, down from 485 thousand SAAR in June, and up from 409 thousand SAAR in July 2017.

BLS: Job Openings "Little Changed" in June

by Calculated Risk on 8/07/2018 10:07:00 AM

Notes: In June there were 6.662 million job openings, and, according to the June Employment report, there were 6.564 million unemployed. So, for the third consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015.

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 6.7 million on the last business day of June, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.7 million and 5.5 million, respectively. Within separations, the quits rate was unchanged at 2.3 percent and the layoffs and discharges rate was little changed at 1.2 percent. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed in June at 3.4 million. The quits rate was 2.3 percent. The number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased slightly in June to 6.662 million from 6.659 million in May.

The number of job openings (yellow) are up 9% year-over-year.

Quits are up 7% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a high level, and quits are increasing year-over-year. This was a strong report.

CoreLogic: House Prices up 6.8% Year-over-year in June

by Calculated Risk on 8/07/2018 08:57:00 AM

Notes: This CoreLogic House Price Index report is for June. The recent Case-Shiller index release was for May. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports June Home Prices Increased by 6.8 Percent, Millennials Identify Affordability as Biggest Hurdle

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for June 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 6.8 percent year over year from June 2017 to June 2018. On a month-over-month basis, prices increased by 0.7 percent in June 2018 compared with May 2018, according to the CoreLogic HPI.CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is near the top end of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 5.1 percent on a year-over-year basis from June 2018 to June 2019. On a month-over-month basis, home prices are expected to be flat from June to July 2018. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The rise in home prices and interest rates over the past year have eroded affordability and are beginning to slow existing home sales in some markets,” said Dr. Frank Nothaft, chief economist for CoreLogic. “For June, we found in CoreLogic public records data that home sales in the San Francisco Bay Area and Southern California were down 9 and 12 percent, respectively, from one year earlier. Further increases in home prices and mortgage rates over the next year will likely dampen sales and home-price growth.”

emphasis added

Monday, August 06, 2018

Tuesday: Job Openings

by Calculated Risk on 8/06/2018 07:43:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drift Modestly Lower

Mortgage rates were slightly lower for the 3rd straight business day, but not for any particular reason. Because of the relatively narrow range, rates are now technically as low as they've been since July 25th for the average lender. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for June from the BLS. Jobs openings decreased in May to 6.638 million from 6.840 million in April.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $16.0 billion in June.

Annual Vehicle Sales: On Pace to decline slightly in 2018

by Calculated Risk on 8/06/2018 12:01:00 PM

The BEA released their estimate of July vehicle sales. The BEA estimated sales of 16.68 million SAAR in July 2018 (Seasonally Adjusted Annual Rate), down 3.1% from the June sales rate, and down slightly from July 2017.

Through July, light vehicle sales are on pace to be down slightly in 2018 compared to 2017.

This would make 2018 the sixth best year on record after 2016, 2015, 2000, 2017 and 2001.

My guess is vehicle sales will finish the year with sales lower than in 2017 (sales in late 2017 were boosted by buying following the hurricanes). A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first seven months.

Update: Framing Lumber Prices Fall from Record Highs, Up 20% Year-over-year

by Calculated Risk on 8/06/2018 10:13:00 AM

Here is another monthly update on framing lumber prices. Lumber prices declined in July from the recent record highs, but are still up sharply year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through July 27, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 15% from a year ago, and CME futures are up about 23% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Tariffs on lumber, steel and aluminum are impacting housing costs. And rising costs - both material and labor - are headwinds for the building industry this year.