by Calculated Risk on 6/18/2018 10:06:00 AM

Monday, June 18, 2018

NAHB: Builder Confidence Decreases to 68 in June

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in June, down from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Slips Two Points as Lumber Prices Soar

Builder confidence in the market for newly built single-family homes fell two points to 68 in June on the NAHB/Wells Fargo Housing Market Index (HMI). The decline was due in large part to sharply elevated lumber prices, although sentiment remains on solid footing.

“Builders are optimistic about housing market conditions as consumer demand continues to grow,” said NAHB Chairman Randy Noel. “However, builders are increasingly concerned that tariffs placed on Canadian lumber and other imported products are hurting housing affordability. Record-high lumber prices have added nearly $9,000 to the price of a new single-family home since January 2017.”

“Improved economic growth, continued job creation and solid housing demand should spur additional single-family construction in the months ahead,” said NAHB Chief Economist Robert Dietz. “However, builders do need access to lumber and other construction materials at reasonable costs in order to provide homes at competitive price points, particularly for the entry-level market where inventory is most needed.”

...

All three HMI indexes inched down a single point in June. The index measuring current sales conditions fell to 75, the component gauging expectations in the next six months dropped to 76, and the metric charting buyer traffic edged down to 50.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 57 while the West and Midwest remained unchanged at 76 and 65, respectively. The South fell one point to 71.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a solid reading.

Hotels: Occupancy Rate decreased slightly Year-over-Year, On Record Annual Pace

by Calculated Risk on 6/18/2018 08:11:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 9 June

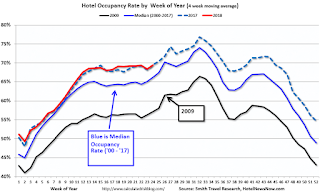

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 3-9 June 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 4-10 June 2017, the industry recorded the following:

• Occupancy: -0.2% to 72.9%

• Average daily rate (ADR): +2.5% to US$131.38

• Revenue per available room (RevPAR): +2.3% to US$95.82

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

On a seasonal basis, the occupancy rate will be solid during the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, June 17, 2018

Sunday Night Futures

by Calculated Risk on 6/17/2018 07:23:00 PM

Weekend:

• Schedule for Week of June 17, 2018

Monday:

• 10:00 AM ET, The June NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were down over the last week with WTI futures at $64.33 per barrel and Brent at $73.06 per barrel. A year ago, WTI was at $45, and Brent was at $46 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.89 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 60 cents per gallon year-over-year.

Oil Rigs: "A quiet week for rigs counts"

by Calculated Risk on 6/17/2018 08:11:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 15, 2018:

• Total oil rig counts rose 1 to 863

• Horizontal oil rigs added 2 to 765

...

• After a heady gain last week, the Permian gave back 4 rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Saturday, June 16, 2018

Schedule for Week of June 17, 2018

by Calculated Risk on 6/16/2018 08:15:00 AM

The key economic reports this week are May Housing Starts and Existing home sales.

For manufacturing, the Philly Fed manufacturing survey will be released this week.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for May.

8:30 AM: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.309 million SAAR, up from 1.287 million SAAR in April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:30 AM: Panel Discussion, Fed Chair Jerome Powell, Monetary Policy at a Time of Uncertainty and Tight Labor Markets, At the ECB Forum on Central Banking, Linhó Sintra, Portugal

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.56 million SAAR, up from 5.46 million in April.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.56 million SAAR, up from 5.46 million in April.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.47 million SAAR for May and that inventory will be down 5.2% year-over-year.

During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 218 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 26.0, down from 34.4.

9:00 AM: FHFA House Price Index for April 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

No major economic releases scheduled.

Friday, June 15, 2018

Goldman: "Upside Risk to Home Prices"

by Calculated Risk on 6/15/2018 05:51:00 PM

This is an interesting note today from Goldman Sachs economists Daan Struyven and Marty Young: Upside Risk to Home Prices (A few excerpts):

Home prices are growing at a 6.5% annual rate, the fastest pace since 2013. ... we review trends in housing demand, supply, and financing fundamentals and analyze their importance using city-level data.CR Note: It is important to note that this is an "upside risk" to Goldman's fairly low 3% forecast for 2018. My view was house prices would slow this year to the low-to-mid single digit range from the 6.2% annual gain in 2016 (Case-Shiller National Index). That was based on more inventory (it appears inventory has bottomed at a low level) and a little headwind from higher mortgage rates and tax changes.

On the demand side, we find that home prices are rising most rapidly in the strongest regional labor markets and we think a firm national job market will continue to be a tailwind. On the supply side, price growth is higher in the lowest vacancy markets and we expect national supply to remain constrained. On the financing side, we expect only a limited impact on home prices from higher interest rates—which mostly reflect strong growth—in the near term and find little evidence of a drag from reduced tax benefits of homeownership.

... Overall, we see the risks to our 3% home price growth forecast over the next year as skewed to the upside.

Q2 GDP Forecasts

by Calculated Risk on 6/15/2018 11:50:00 AM

From Merrill Lynch:

The data weighed on GDP tracking, with 1Q edging down to 2.4% qoq saar. 2Q held at 3.7%. [June 15 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.8 percent on June 14, up from 4.6 percent on June 8. [June 14 estimate]From the NY Fed Nowcasting Report

he New York Fed Staff Nowcast stands at 3.0% for 2018:Q2 and 2.8% for 2018:Q3. [June 15 estimate]CR Note: This is quite a range. These estimates suggest real annualized GDP in the 3% to 4.8% range in Q2.

BLS: Unemployment Rates Lower in 14 states in May

by Calculated Risk on 6/15/2018 10:21:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in May in 14 states and stable in 36 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Eleven states had jobless rate decreases from a year earlier and 39 states and the District had little or no change. The national unemployment rate edged down from April to 3.8 percent and was 0.5 percentage point lower than in May 2017.

...

Hawaii had the lowest unemployment rate in May, 2.0 percent. Alaska had the highest jobless rate, 7.2 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Industrial Production Decreased 0.1% in May

by Calculated Risk on 6/15/2018 09:21:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production edged down 0.1 percent in May after rising 0.9 percent in April. Manufacturing production fell 0.7 percent in May, largely because truck assemblies were disrupted by a major fire at a parts supplier. Excluding motor vehicles and parts, factory output moved down 0.2 percent. The index for mining rose 1.8 percent, its fourth consecutive month of growth; the output of utilities moved up 1.1 percent. At 107.3 percent of its 2012 average, total industrial production was 3.5 percent higher in May than it was a year earlier. Capacity utilization for the industrial sector decreased 0.2 percentage point in May to 77.9 percent, a rate that is 1.9 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.9% is 1.9% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in May to 107.3. This is 23% above the recession low, and 2% above the pre-recession peak.

NY Fed: Manufacturing "Business activity continued to grow strongly in New York State"

by Calculated Risk on 6/15/2018 08:33:00 AM

From the NY Fed: Empire State Manufacturing Survey

Manufacturing firms in New York State reported that business activity expanded at a faster pace than in May. The general business conditions index rose five points to 25.0, its highest level in several months. … The index for number of employees climbed ten points to 19.0, its highest level thus far in 2018, pointing to a pickup in employment levels.This was above the consensus forecast and a strong reading.

emphasis added