by Calculated Risk on 5/02/2018 07:04:00 PM

Wednesday, May 02, 2018

Thursday: Trade Deficit, Unemployment Claims, ISM non-Mfg Survey

From Matthew Graham at Mortgage News Daily: Mortgage Rates Uninspired by Fed or Economic Data

Mortgage rates were flat to slightly higher today, depending on the lender. The average lender was quoting the same rates as yesterday, but with slightly higher upfront costs (or a lower credit, depending on your scenario). That said, if you could only choose one word to describe the movement, it would be "flat." [30YR FIXED - 4.625%-4.75%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 209 thousand the previous week.

• Also at 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to be at $50.0 billion in March from $57.6 billion in February.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for index to decrease to 58.5 from 58.8 in March.

The FOMC's Symmetric 2 Percent Inflation Objective

by Calculated Risk on 5/02/2018 03:54:00 PM

A few excerpts from Tim Duy at Fed Watch: Fed Holds Rates Steady

The most important news from the FOMC statement was the hint that the Fed would not overreact with substantial policy changes in response to inflation readings modestly above 2 percent. ...And from Merrill Lynch:

... Most notable was the addition of “symmetric” in this line:

Inflation on a 12-month basis is expected to run near the Committee’s symmetric 2 percent objective over the medium term.Inflation is now very near the Fed’s target and it is reasonable to expect some overshooting of that target. Central bankers are reminding market participants that the inflation target is symmetric such that they will tolerate reasonable short-run deviations from target in the near term. In other words, don’t freak out if inflation exceeds 2 percent as that alone will not drive the Fed to change policy.

As was widely expected, the FOMC kept the fed funds target range unchanged at 1.50-1.75%. The most significant change in the statement came in the second paragraph where the Committee included the word "symmetric" in characterizing its inflation target. This is consistent with the March SEP which showed that the median forecast was expecting core inflation to hit 2.1% in 2019-2020, allowing for inflation to rise slightly above its target in the medium run. The inclusion of the word "symmetric" helped offset the more hawkish tone in the prior paragraph which highlighted that core inflation is moving closer to 2%. In our view, the FOMC's balanced tone reemphasizes its expectations to adjust the path of policy gradually throughout the current hiking cycle.

emphasis added

FOMC Statement: No Change in Policy

by Calculated Risk on 5/02/2018 02:01:00 PM

Information received since the Federal Open Market Committee met in March indicates that the labor market has continued to strengthen and that economic activity has been rising at a moderate rate. Job gains have been strong, on average, in recent months, and the unemployment rate has stayed low. Recent data suggest that growth of household spending moderated from its strong fourth-quarter pace, while business fixed investment continued to grow strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace in the medium term and labor market conditions will remain strong. Inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term. Risks to the economic outlook appear roughly balanced.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data. Voting for the FOMC monetary policy action were Jerome H. Powell, Chairman; William C. Dudley, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Loretta J. Mester; Randal K. Quarles; and John C. Williams.

emphasis added

Annual Vehicle Sales: On Pace to be unchanged in 2018

by Calculated Risk on 5/02/2018 10:54:00 AM

The BEA released their estimate of April vehicle sales this morning. The BEA estimated sales of 17.07 million SAAR in April 2018 (Seasonally Adjusted Annual Rate), down 1.7% from the March sales rate, and up slightly from April 2017.

Through April, light vehicle sales are on pace to be unchanged in 2018 compared to 2017.

This would still make 2018 tied with 2017 for the fourth best year on record after 2016, 2015, and 2000.

My guess is vehicle sales will finish the year with sales lower than in 2017. A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first four months.

ADP: Private Employment increased 204,000 in April

by Calculated Risk on 5/02/2018 08:18:00 AM

Private sector employment increased by 204,000 jobs from March to April according to the April ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 193,000 private sector jobs added in the ADP report.

...

“The labor market continues to maintain a steady pace of strong job growth with little sign of a slowdown,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “However, as the labor pool tightens it will become increasingly difficult for employers to find skilled talent. Job gains in the highskilled professional and business services industry accounted for more than half of all jobs added this month. The construction industry, which also relies on skilled labor, continued its six month trend of steady job gains as well.”

Mark Zandi, chief economist of Moody’s Analytics, said, “Despite rising trade tensions, more volatile financial markets, and poor weather, businesses are adding a robust more than 200,000 jobs per month. At this pace, unemployment will soon be in the threes, which is rarified and risky territory, as the economy threatens to overheat.”

The BLS report for April will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in April.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/02/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 27, 2018.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 5 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since September 2013, 4.80 percent, from 4.73 percent, with points increasing to 0.53 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 5% year-over-year.

Tuesday, May 01, 2018

Wednesday: FOMC Announcement, ADP Employment

by Calculated Risk on 5/01/2018 07:00:00 PM

From Tim Duy at Fed Watch: Set To Stay On Current Path

The Federal Open Market Committee begins their two-day meeting this morning, an effort that will almost certainly culminate with steady rates and fairly limited alterations to the accompanying FOMC statement. The underlying message is “steady as she goes.” We have yet to see data break meaningfully to either side of the Fed’s forecast such to expect a change in the pace of rate hikes. With the economic data continuing to support the broad contours of the Federal Reserve’s forecast, we should expect the Fed to remain on track to hike policy rates by 25bp each quarter for the remainder of this year.CR Note: At some point I expect the Fed to announce a press conference after every FOMC meeting.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 193,000 payroll jobs added in April, down from 241,000 added in March.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

U.S. Light Vehicle Sales decrease to 17.15 million annual rate in April

by Calculated Risk on 5/01/2018 03:36:00 PM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.15 million SAAR in April.

That is up 1% year-over-year from April 2017, and down 1.4% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for April (red, light vehicle sales of 17.15 million SAAR from AutoData).

This was slightly above the consensus forecast for April.

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably move sideways or decline in 2018 after setting new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

Q1 2018 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 5/01/2018 01:38:00 PM

The BEA has released the underlying details for the Q1 advance GDP report.

The BEA reported that investment in non-residential structures increased at a 12.3% annual pace in Q1. Investment in petroleum and natural gas exploration increased substantially recently, from a $55 billion annual rate in Q4 2016 to a $118 billion annual rate in Q1 2018 - but is still down from a recent peak of $165 billion in Q4 2014.

Without the increase in petroleum and natural gas exploration, non-residential investment would be essentially unchanged year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices increased in Q1, and is up 1% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down slightly year-over-year in Q1. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q1, and lodging investment is up 14% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the last four years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $280 billion (SAAR) (about 1.4% of GDP), and was up in Q1 compared to Q4.

Investment in multi-family structures declined in Q1.

Investment in home improvement was at a $243 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.2% of GDP). Home improvement spending has been solid.

Construction Spending decreased 1.7% in March

by Calculated Risk on 5/01/2018 10:50:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in March:

Construction spending during March 2018 was estimated at a seasonally adjusted annual rate of $1,284.7 billion, 1.7 percent below the revised February estimate of $1,306.4 billion. The March figure is 3.6 percent above the March 2017 estimate of $1,239.6 billion.Private spending decreased and public spending was essentially unchanged in March:

Spending on private construction was at a seasonally adjusted annual rate of $987.5 billion, 2.1 percent below the revised February estimate of $1,009.1 billion. ...

In March, the estimated seasonally adjusted annual rate of public construction spending was $297.2 billion, nearly the same as the revised February estimate of $297.3 billion.

emphasis added

Click on graph for larger image.

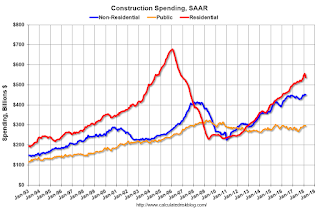

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 21% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 9% below the peak in March 2009, and 13% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5%. Non-residential spending is up 2% year-over-year. Public spending is up 3% year-over-year.

This was below the consensus forecast of a 0.5% increase for March, however spending for the previous two months was revised up.