by Calculated Risk on 4/26/2018 10:06:00 AM

Thursday, April 26, 2018

HVS: Q1 2018 Homeownership and Vacancy Rates

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2018.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate was unchanged at 64.2% in Q1, from 64.2% in Q4.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Weekly Initial Unemployment Claims decrease to 209,000

by Calculated Risk on 4/26/2018 08:33:00 AM

The DOL reported:

In the week ending April 21, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 24,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 232,000 to 233,000. The 4-week moving average was 229,250, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 231,250 to 231,500.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 229,250.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, April 25, 2018

Thursday: Unemployment Claims, Durable Goods, Housing Vacancies and Homeownership

by Calculated Risk on 4/25/2018 08:17:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 232 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

• At 10:00 AM, the Q1 2018 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for March.

NMHC: Apartment Market Tightness Index remained negative for Tenth Consecutive Quarter

by Calculated Risk on 4/25/2018 02:29:00 PM

From the National Multifamily Housing Council (NMHC): April NMHC Quarterly Survey Shows Greater Supply Improving Affordability

Apartment market conditions were uneven, according to results from the April National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (38), Sales Volume (43) and Debt Financing (36) Indexes landed below the breakeven level of 50, while the Equity Financing Index decreased to 54.

“Apartment markets continue to send mixed signals,” said NMHC Chief Economist Mark Obrinsky. “While respondents indicated more markets are loosening than tightening, this was focused in markets that have experienced greater supply. So, the message is clear, if unsurprising: Increasing supply improves affordability.”

The Market Tightness Index increased two points to 38. This was the tenth consecutive quarter of overall declining conditions. Thirty-eight percent of respondents reported looser market conditions than three months prior, compared to only 14 percent who reported tighter conditions. Meanwhile, nearly half of respondents (47 percent) felt that conditions were no different from last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the tenth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 4/25/2018 01:40:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through February 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Philly Fed: State Coincident Indexes increased in 47 states in March

by Calculated Risk on 4/25/2018 11:29:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2018. Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96. In the past month, the indexes increased in 47 states, decreased in one, and remained stable in two, for a one-month diffusion index of 92.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is mostly green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

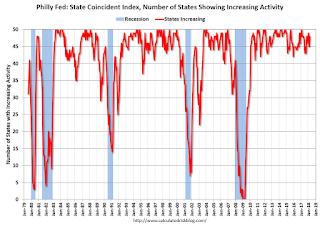

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In March, 48 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Chemical Activity Barometer "Eases" in April

by Calculated Risk on 4/25/2018 09:50:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Eases Following Six Consecutive Monthly Gains; Trends Suggest Growth into Early 2019

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), slipped 0.1 percent in April to 121.6 percent on a three-month moving average (3MMA) basis. This follows six consecutive monthly gains and a dip from the barometer’s highest point since modeling began. The barometer remains up 3.8 percent on a 3MMA compared to a year earlier.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has been solid over the last year, suggesting further gains in industrial production in 2018.

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey

by Calculated Risk on 4/25/2018 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 20, 2018.

... The Refinance Index decreased 0.3 percent from the previous week. The seasonally adjusted Purchase Index was unchanged from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 11 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since September 2013, 4.73 percent, from 4.66 percent, with points increasing to 0.49 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 11% year-over-year.

Tuesday, April 24, 2018

"Mortgage Rates Push Farther Into 4-Year Highs"

by Calculated Risk on 4/24/2018 09:26:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Push Farther Into 4-Year Highs

Mortgage rates moved somewhat higher again today, thus pushing them farther into the highest levels in more than 4 years. [30YR FIXED - 4.625%-4.75%]Here is a table from Mortgage News Daily:

emphasis added

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2017

by Calculated Risk on 4/24/2018 05:17:00 PM

IMPORTANT NOTE: The data below is based on the Census 2017 estimates. Housing economist Tom Lawler has pointed out some questions about the Census estimates, see: Lawler: "New Long-Term Population Projections Show Slower Growth than Previous Projections but Are Still Too High"

Four years ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

In 2016, I followed up with Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29" and

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030.

Note: For the impact on housing, also see: Demographics: Renting vs. Owning

Last week the Census Bureau released the population estimates for 2017, and I've updated the table from the previous post (replacing 2015 with 2017 data).

The table below shows the top 11 cohorts by size for 2010, 2017 (released this month), and Census Bureau projections for 2020 and 2030.

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2017 | 2020 | 2030 |

| 1 | 45 to 49 years | 25 to 29 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 20 to 24 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 55 to 59 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 30 to 34 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 50 to 54 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 35 to 39 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 15 to 19 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 45 to 49 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | 60 to 64 years | 50 to 54 years | 50 to 54 years |

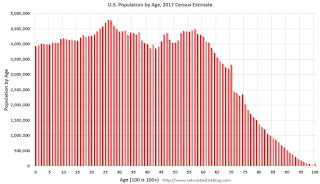

Click on graph for larger image.

This graph, based on the 2017 population estimate, shows the U.S. population by age in July 2017 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2017, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2017 the millennials have taken over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2017 | 2020 | 2030 | |

| 1 | 50 | 26 | 29 | 39 |

| 2 | 49 | 27 | 30 | 40 |

| 3 | 20 | 25 | 28 | 38 |

| 4 | 19 | 28 | 27 | 37 |

| 5 | 47 | 24 | 31 | 36 |

| 6 | 46 | 23 | 26 | 35 |

| 7 | 48 | 57 | 32 | 41 |

| 8 | 51 | 29 | 25 | 30 |

| 9 | 18 | 56 | 35 | 34 |

| 10 | 52 | 32 | 34 | 33 |