by Calculated Risk on 4/09/2018 11:14:00 AM

Monday, April 09, 2018

Weather Adjusted Employment

Note: Before the employment report is released each month, Chicago Fed economist Francois Gourio provides an estimate of the impact of weather on employment (this has been very useful).

After the employment report is released, the San Francisco Fed has a model that shows weather adjusted employment. See: Weather-Adjusted Employment Change

This page provides estimates of weather-adjusted employment change in the United States for the past six months. Beginning with the official Bureau of Labor Statistics (BLS) series on the monthly change in total nonfarm payroll employment, we adjust for deviations of weather from seasonal norms following the methodology described in Wilson (2016).

The approach involves estimating the short-run effects of unusual weather on employment growth at the county level using historical data from January 1990 through December 2015. We then use the statistical model to estimate the effect of unusual weather in recent months on employment growth at the county level. We aggregate these county-level effects to the national level, weighting counties by employment levels, to yield estimates of the effect of unusual weather around the country on national employment growth. Finally, we translate these growth effects into level effects using the level of employment in November 2015 as an initial base.

The figure and table present three employment change series for the past six months. The first (left) group is the official BLS series. The other two are alternative estimates of weather-adjusted employment change calculated using our county-level statistical model estimated over the January 1990–December 2015 period. The second set of bars is shows the most recent county-level series (also shown in Figure 2 of van der List and Wilson 2016). The third set of bars is an extension of the county-level model that allows for each weather variable to have different marginal effects in each of the Census Bureau’s nine regions. For example, an inch of snowfall can have a different effect on employment growth in the South Atlantic region than it does in New England.

Click on graph for larger image.

Click on graph for larger image.This graph from the San Francisco Fed show employment gains as reported by the BLS (left graph), and two weather adjusted graphs.

The San Francisco Fed estimates weather reduced March employment by about 100,000 jobs.

There is also a table at the weather adjusted website.

Goldman: Economic Environment "Becoming Less Pleasant"

by Calculated Risk on 4/09/2018 09:31:00 AM

A few brief excerpts from a note by Goldman Sachs chief economist Jan Hatzius: Less Pleasant

The 103k jobs gain in March was well below expectations. Part of the miss reflects a greater-than-expected payback for prior strength in weather-sensitive sectors such as construction and retail. But other industries were also soft, prior months were revised down on net ... While growth is looking softer, it remains far from soft. ...

We view the widening of the LIBOR/OIS spread as a technical and mostly temporary consequence of the international provisions in the new tax law, rather than a sign of banking stress. ... Even if the LIBOR move is technical, one might worry about its direct impact on private-sector borrowing costs and hence aggregate demand. ...

...

Following President Trump’s threat of tariffs on another $100bn of imports from China, the risk of a broader trade confrontation has grown. ... it is harder to rule out continued escalation to a level that does ultimately have a first-order impact on the economy, either directly or (more likely) via tighter financial conditions.

In the end, we think the environment is becoming less pleasant but the baseline outlook for the economy and monetary policy hasn’t really changed much. Growth is a bit weaker, inflation is a bit higher, financial markets are definitely more volatile, and economic imbalances (especially in government finance) are starting to become more visible.

Sunday, April 08, 2018

Sunday Night Futures

by Calculated Risk on 4/08/2018 08:12:00 PM

Weekend:

• Schedule for Week of Apr 8, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 10, and DOW futures are up 90 (fair value).

Oil prices were down over the last week with WTI futures at $62.16 per barrel and Brent at $67.24 per barrel. A year ago, WTI was at $53, and Brent was at $55 - so oil prices are up about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon. A year ago prices were at $2.39 per gallon - so gasoline prices are up 26 cents per gallon year-over-year.

Leading Index for Commercial Real Estate Increases in March

by Calculated Risk on 4/08/2018 09:54:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Climbs in March

The Dodge Momentum Index moved 6.1% higher in March, rising to 155.0 (2000=100) from the revised February reading of 146.0. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. March’s gain was the result of a 9.6% increase in the commercial component – more than erasing the 5.1% decline it had seen the previous month. The gain in the institutional sector meanwhile was milder, moving 1.6% higher, following an 8.1% gain in February. During the first nine months of 2017, the overall Momentum Index made little progress. However, planning activity shot up in the fourth quarter, with that impetus continuing into the first three months of 2018. In the latest quarter the Momentum Index gained 5.1%.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 155.0 in March, up from 146.0 in February.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests further growth in 2018.

Saturday, April 07, 2018

Schedule for Week of Apr 8, 2018

by Calculated Risk on 4/07/2018 08:11:00 AM

The key economic report this week is the Consumer Price Index (CPI) on Wednesday.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for March.

8:30 AM: The Producer Price Index for March from the BLS. The consensus is a 0.1% increase in PPI, and a 0.2% increase in core PPI.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for March from the BLS. The consensus is for no change in CPI, and a 0.2% increase in core CPI.

2:00 PM: FOMC Minutes for the Meeting of March 20-21, 2018

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 242 thousand the previous week.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 6.312 million from 5.667 in December.

The number of job openings (yellow) were up 15.9% year-over-year, and Quits were up 3.2% year-over-year.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for April). The consensus is for a reading of 100.8, down from 101.4.

Friday, April 06, 2018

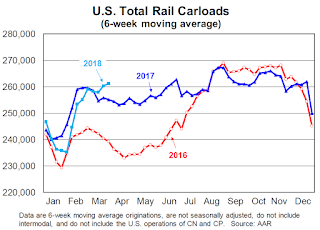

AAR: Rail Carloads Up 3.6% YoY, Best March Ever for Intermodal

by Calculated Risk on 4/06/2018 06:13:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Intermodal did great in March: container plus trailer volume was up 6.5% (66,151 units) over last year, the 14th straight year-over-year monthly gain. Average weekly intermodal volume in March 2018 was easily the most for any March in history. Total U.S. rail carloads were up 3.6% (36,157 carloads) in March 2018 over March 2017, the best percentage gain in nine months.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Light blue is 2018.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,050,653 carloads in March 2018, up 36,157 carloads, or 3.6%, over March 2017. That’s just the second year-over-year monthly gain in the past nine months (December 2017 was the other). Weekly average carloads in March 2018 were 262,663, the most for March since 2014.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1,082,239 containers and trailers in March 2018, up 6.5%, or 66,151 units, over March 2017. It was easily the best March in history for U.S. intermodal.

For the first three months of 2018, U.S. intermodal volume was up 5.5%, or 181,304 units, over the same period in 2017. At this point, there’s no reason to think this won’t be a record year for intermodal, breaking the record set last year.

Oil Rigs "Are the Permian's Go-Go Days Ending?"

by Calculated Risk on 4/06/2018 04:15:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 6, 2018:

• Total US oil rigs were up sharply this week, +11 to 808.

• Horizontal oil rigs were up, +17 to 717.

...

• The Permian horizontal oil rig count is essentially unchanged in two months. Are we reaching some limit there? Does Conoco’s sale of non-core Permian assets suggest the go-go days are ending?

• All the other basins, major and minor, are essentially back at the prior peak of July 2017

• The overall impression is of risks gathering to the downside

• The Brent spread is near $5 / barrel again – quite bullish

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Fed Chair Powell: The Outlook for the U.S. Economy

by Calculated Risk on 4/06/2018 01:34:00 PM

Note: You can Watch Live on YouTube, At the Economic Club of Chicago, Chicago, Illinois

From Fed Chair Jerome Powell: The Outlook for the U.S. Economy

Unemployment has fallen from 10 percent at its peak in October 2009 to 4.1 percent, the lowest level in nearly two decades. Seventeen million jobs have been created in this expansion, and the monthly pace of job growth remains more than sufficient to employ new entrants to the labor force. The labor market has been strong, and my colleagues and I on the Federal Open Market Committee (FOMC) expect it to remain strong. Inflation has continued to run below the FOMC's 2 percent objective but we expect it to move up in coming months and to stabilize around 2 percent over the medium term.

...

Over the next few years, we will continue to aim for 2 percent inflation and for a sustained economic expansion with a strong labor market. As I mentioned, my FOMC colleagues and I believe that, as long as the economy continues broadly on its current path, further gradual increases in the federal funds rate will best promote these goals. It remains the case that raising rates too slowly would make it necessary for monetary policy to tighten abruptly down the road, which could jeopardize the economic expansion. But raising rates too quickly would increase the risk that inflation would remain persistently below our 2 percent objective. Our path of gradual rate increases is intended to balance these two risks.

Of course, our views about appropriate monetary policy in the months and years ahead will be informed by incoming economic data and the evolving outlook. If the outlook changes, so too will monetary policy. Our overarching objective will remain the same: fostering a strong economy for all Americans--one that provides plentiful jobs and low and stable inflation.

emphasis added

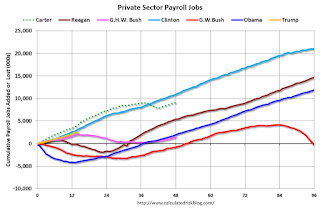

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 4/06/2018 12:59:00 PM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just 14 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 14 months of Mr. Trump's term, the economy has added 2,521,000 private sector jobs.

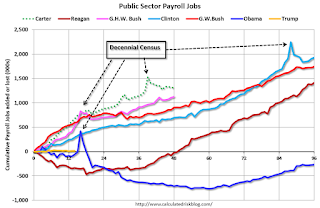

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 14 months of Mr. Trump's term, the economy has added 13,000 public sector jobs.

After 14 months of Mr. Trump's presidency, the economy has added 2,534,000 jobs, about 383,000 behind the projection.

Comments on March Employment Report

by Calculated Risk on 4/06/2018 09:59:00 AM

The headline jobs number at 103,000 for March was well below consensus expectations of 175 thousand, and the previously two months were revised down a combined 50 thousand. Looking at just March, this was a disappointing employment report.

However some of weakness was due to payback from the nice weather in February (as expected in my jobs preview). Job growth has been solid for the first three months of 2018.

Earlier: March Employment Report: 103,000 Jobs Added, 4.1% Unemployment Rate

In March, the year-over-year employment change was 2.261 million jobs. This has been generally trending down, but is still solid year-over-year growth.

Average Hourly Earnings

Wage growth was about as expected in March, although hourly wages for February were revised down slightly. From the BLS:

"In March, average hourly earnings for all employees on private nonfarm payrolls rose by 8 cents to $26.82. Over the year, average hourly earnings have increased by 71 cents, or 2.7 percent."

Click on graph for larger image.

Click on graph for larger image.This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.7% YoY in March.

Wage growth had been trending up, although growth has been moving sideways recently.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in March at 82.1%, and the 25 to 54 employment population ratio decreased to 79.2%.

The participation rate had been trending down for this group since the late '90s, however, with more younger workers (and fewer 50+ age workers), the prime participation rate might move up some more.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 5.0 million in March. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or because they were unable to find full- time jobs."The number of persons working part time for economic reasons has been generally trending down, and the number decreased in March. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that was decreased to 8.0% in March. This is the lowest level for U-6 since last November.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.322 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.397 million in February.

This is the lowest level since October 2007.

This is trending down, but remains a little elevated.

The headline jobs number was disappointing, however the weakness was probably related to payback due to the nice weather in February. For the first three months of 2018, job growth has been solid.