by Calculated Risk on 3/26/2018 09:28:00 AM

Monday, March 26, 2018

Chicago Fed "Index points to a pickup in economic growth in February"

From the Chicago Fed: Index points to a pickup in economic growth in February

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.88 in February from +0.02 in January. All four broad categories of indicators that make up the index increased from January, and three of the four categories made positive contributions to the index in February. The index’s three-month moving average, CFNAI-MA3, increased to +0.37 in February from +0.16 in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in February (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, March 25, 2018

Sunday Night Futures

by Calculated Risk on 3/25/2018 07:20:00 PM

Weekend:

• Schedule for Week of Mar 25, 2018

Monday:

• At 8:30 AM ET Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for March.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 7, and DOW futures are up 80 (fair value).

Oil prices were up over the last week with WTI futures at $65.86 per barrel and Brent at $70.50 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.61 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 32 cents per gallon year-over-year.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/25/2018 08:41:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 17 March

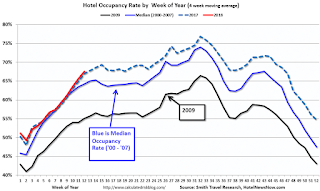

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 12-18 March 2017, the industry recorded the following:

• Occupancy: +1.0 at 70.7%

• Average daily rate (ADR): +2.8% to US$133.76

• Revenue per available room (RevPAR): +3.9% to US$94.55

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fifth overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 24, 2018

Schedule for Week of Mar 25, 2018

by Calculated Risk on 3/24/2018 11:11:00 AM

The key economic reports this week are the third estimate of Q4 GDP, Personal Income and Outlays for February, and Case-Shiller house prices.

Also the Q1 quarterly Reis surveys for office and malls will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for February. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.

9:00 AM ET: S&P/Case-Shiller House Price Index for January.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the December 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for January.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for March. This is the last of the regional surveys for March.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Early: Reis Q1 2018 Apartment Survey of rents and vacancy rates.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Third estimate). The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the second estimate of 2.3%.

10:00 AM: Pending Home Sales Index for February. The consensus is for a 2.7% increase in the index.

Early: Reis Q1 2018 Office Survey of rents and vacancy rates.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 229 thousand the previous week.

8:30 AM: Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for March. The consensus is for a reading of 63.2, up from 61.9 in February.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 102.0, unchanged from 102.0 in February.

Early: Reis Q1 2018 Mall Survey of rents and vacancy rates.

Off-topic: "March, Vote, Change the World!"

by Calculated Risk on 3/24/2018 08:11:00 AM

To find a local march, here is the March for Our Lives website. Make a difference today!

A stunning article from the WaPo: U.S. School Shootings

Beginning with Columbine in 1999, more than 187,000 students attending at least 193 primary or secondary schools have experienced a shooting on campus during school hours, according to a year-long Washington Post analysis. This means that the number of children who have been shaken by gunfire in the places they go to learn exceeds the population of Eugene, Ore., or Fort Lauderdale, Fla.March. Vote. Change the World.

Friday, March 23, 2018

Oil Rigs "Signs of life in the minor plays"

by Calculated Risk on 3/23/2018 06:58:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Mar 23, 2018:

• Total US oil rigs were up this week, +4 to 804

• Horizontal oil rigs were up, +1 to 708

...

• The Permian continues to perform relatively well overall, although only one horizontal rig has been added there in the last six weeks.

• The Cana Woodford was absolutely hammered again, now below its July peak

• The minor ‘Other’ plays have come back to life, with horizontal oil rigs there above last July’s peak for the first time

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Phoenix Real Estate in February: Sales up 8%, Inventory down 12% YoY

by Calculated Risk on 3/23/2018 03:40:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in February were up 7.7% year-over-year (including homes, condos and manufactured homes).

2) Active inventory is now down 12.1% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller. With flat inventory in 2016, prices were up 4.8%.

This is the sixteenth consecutive month with a YoY decrease in inventory, and prices rose a little faster in 2017 compared to 2016 (5.6% in 2017 compared to 4.8% in 2016).

| February Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Feb-2008 | 3,445 | --- | 650 | 18.9% | 57,3051 | --- |

| Feb-2009 | 5,477 | 59.0% | 2,188 | 39.9% | 52,013 | -9.2% |

| Feb-2010 | 6,595 | 20.4% | 2,997 | 45.4% | 42,388 | -18.5% |

| Feb-2011 | 7,171 | 8.7% | 3,776 | 52.7% | 40,666 | -4.1% |

| Feb-2012 | 7,249 | 1.1% | 3,616 | 49.9% | 23,736 | -41.6% |

| Feb-2013 | 6,618 | -8.7% | 3,053 | 46.1% | 21,718 | -8.5% |

| Feb-2014 | 5,476 | -17.3% | 1,939 | 35.4% | 29,899 | 37.7% |

| Feb-2015 | 5,970 | 9.0% | 1,784 | 29.9% | 27,382 | -8.4% |

| Feb-2016 | 5,816 | -2.6% | 1,688 | 29.0% | 27,202 | -0.7% |

| Feb-2017 | 6,547 | 12.6% | 1,696 | 25.9% | 24,275 | -10.8% |

| Feb-2018 | 7,052 | 7.7% | 1,978 | 28.0% | 21,339 | -12.1% |

| 1 February 2008 probably included pending listings | ||||||

BLS: Unemployment Rates Lower in 7 states in February; California, Maine, Mississippi and Wisconsin at New Series Lows

by Calculated Risk on 3/23/2018 01:36:00 PM

Earlier from the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in February in 7 states and stable in 43 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Fifteen states had jobless rate decreases from a year earlier and 35 states and the District had little or no change. The national unemployment rate was unchanged from January at 4.1 percent but was 0.6 percentage point lower than in February 2017.

...

Hawaii had the lowest unemployment rate in February, 2.1 percent. The rates in California (4.3 percent), Maine (2.9 percent), Mississippi (4.5 percent), and Wisconsin (2.9 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Thirteen states have reached new all time lows since the end of the 2007 recession. These thirteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Kentucky, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.3%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

A few Comments on February New Home Sales

by Calculated Risk on 3/23/2018 11:34:00 AM

New home sales for January were reported at 618,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, however the three previous months were revised up.

I'd like to see data for a few more months before blaming higher interest rates, or a negative impact from the new tax law, as the cause of sluggish new home sales.

Earlier: New Home Sales at 618,000 Annual Rate in February.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 2% through February compared to the same period in 2017. Disappointing growth, but no worries - yet!

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 618,000 Annual Rate in February

by Calculated Risk on 3/23/2018 10:12:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 618 thousand.

The previous three months were revised up.

"Sales of new single-family houses in February 2018 were at a seasonally adjusted annual rate of 618,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 0.6 percent below the revised January rate of 622,000, but is 0.5 percent above the February 2017 estimate of 615,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in February to 5.9 months from 5.8 months in January.

The months of supply increased in February to 5.9 months from 5.8 months in January. The all time record was 12.1 months of supply in January 2009.

This is at the top end of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of February was 305,000. This represents a supply of 5.9 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2018 (red column), 51 thousand new homes were sold (NSA). Last year, 51 thousand homes were sold in February.

The all time high for February was 109 thousand in 2005, and the all time low for February was 22 thousand in 2011.

This was below expectations of 626,000 sales SAAR, however the previous months were revised up. I'll have more later today.