by Calculated Risk on 2/07/2018 09:40:00 AM

Wednesday, February 07, 2018

Las Vegas Real Estate in January: Sales Up 5% YoY, Inventory down 35%

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada home prices dip slightly in January, still up 11 percent from last year; GLVAR housing statistics for January 2018

Local home prices cooled off slightly in January but are still up more than 11 percent from one year ago, according to a report released today by the Greater Las Vegas Association of REALTORS® (GLVAR).1) Overall sales were up 5% year-over-year from 2,675 in January 2017 to 2,812 in January 2018.

...

By the end of January, GLVAR reported 3,718 single-family homes listed for sale without any sort of offer. That’s down 36.5 percent from one year ago. For condos and townhomes, the 634 properties listed without offers in January represented a 21.8 percent drop from one year ago.

“That’s the lowest our condo inventory has been since 2004,” he added.

The total number of existing local homes, condos and townhomes sold during January was 2,812. Compared to one year ago, January sales were up 5.5 percent for homes and up 3.8 percent for condos and townhomes.

...

GLVAR reported that 29.2 percent of all local properties sold in January were purchased with cash, compared to 29.8 percent one year ago. That’s less than half of the February 2013 peak of 59.5 percent, indicating that cash buyers and investors are still active, but have been playing a smaller role in the local housing market in recent years.

At the same time, the number of so-called distressed sales continues to decline. GLVAR reported that short sales and foreclosures combined accounted for 4.3 percent of all existing local home sales in January, compared to 11 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago, from a total of 6,663 in January 2017 to 4,352 in January 2018.

3) Fewer distressed sales.

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey

by Calculated Risk on 2/07/2018 08:38:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 2, 2018.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index remained unchanged from one week earlier. The unadjusted Purchase Index increased 7 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since April 2014, 4.50 percent, from 4.41 percent, with points increasing to 0.57 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

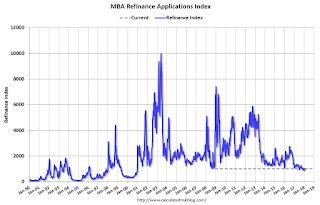

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

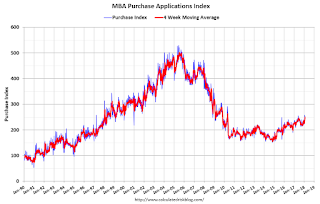

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, February 06, 2018

"Mortgage Rates Head Back Toward Recent Highs"

by Calculated Risk on 2/06/2018 06:29:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Head Back Toward Recent Highs

Mortgage rates were mixed today, with most lenders offering slightly better terms this morning compared to yesterday's mid-day levels. Things took a turn for the worse in the afternoon as the stock market recovery pulled money back out of bonds. [30YR FIXED - 4.375-4.5%]Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $20.0 billion in December.

Prime Working-Age Population At New Peak, First Time Since 2007

by Calculated Risk on 2/06/2018 02:19:00 PM

Update through January: The U.S. prime working age population peaked in 2007, and bottomed at the end of 2012. As of January 2018, according to the BLS, for the first time since 2007, there are now more people in the 25 to 54 age group than in 2007.

Demographics is a key reason GDP growth has been slow over the last decade.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through January 2018.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80s, or '90s we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should grow at 0.5% per year (depending on immigration policies), and this should boost economic activity.

BLS: Job Openings "Little changed" in December

by Calculated Risk on 2/06/2018 10:08:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 5.8 million on the last business day of December, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.5 million and 5.2 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.1 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.3 million in December. The quits rate was 2.2 percent. The number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for December, the most recent employment report was for January.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in December to 5.811 million from 5.978 in November.

The number of job openings (yellow) are up 4.9% year-over-year.

Quits are up 5.6% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are mostly moving sideways at a high level, and quits are increasing year-over-year. This is a solid report.

CoreLogic: House Prices up 6.6% Year-over-year in December

by Calculated Risk on 2/06/2018 09:15:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports December Home Prices Up More Than 6 Percent Year-Over-Year for Fifth Consecutive Month

CoreLogic® ... today released its CoreLogic Home Price Index (HPI™) and HPI Forecast™ for December 2017, which shows home prices are up both year over year and month over month. Home prices nationally increased year over year by 6.6 percent from December 2016 to December 2017, and on a month-over-month basis home prices increased by 0.5 percent in December 2017 compared with November 2017, according to the CoreLogic HPI.CR Note: The YoY increase has been in the 5% to 7% range for the last couple of years. This is towards the top end of that range.

Looking ahead, the CoreLogic HPI Forecast indicates that home prices will increase by 4.3 percent on a year-over-year basis from December 2017 to December 2018, and on a month-over-month basis home prices are expected to decrease by 0.4 percent from December 2017 to January 2018. The CoreLogic HPI Forecast is a projection of home prices using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The number of homes for sale has remained very low,” said Dr. Frank Nothaft, chief economist for CoreLogic. “Job growth lowered the unemployment rate to 4.1 percent by year’s end, the lowest level in 17 years. Rising income and consumer confidence has increased the number of prospective homebuyers. The net result of rising demand and limited for-sale inventory is a continued appreciation in home prices.”

emphasis added

The year-over-year comparison has been positive for almost six consecutive years since turning positive year-over-year in February 2012.

Trade Deficit at $53.1 Billion in December

by Calculated Risk on 2/06/2018 08:43:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $53.1 billion in December, up $2.7 billion from $50.4 billion in November, revised. December exports were $203.4 billion, $3.5 billion more than November exports. December imports were $256.5 billion, $6.2 billion more than November imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in December.

Exports are 23% above the pre-recession peak and up 7% compared to December 2016; imports are 10% above the pre-recession peak, and up 10% compared to December 2016.

Trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $52.10 in December, up from $50.10 in November, and up from $41.40 in December 2016. The petroleum deficit had been declining for years (although the petroleum deficit has been fairly steady for the last few years) this is the major reason the overall deficit has mostly moved sideways since early 2012 - although the overall deficit is increasing again.

The trade deficit with China increased to $30.8 billion in December, from $27.7 billion in December 2016.

Monday, February 05, 2018

Tuesday: Trade Deficit, Job Openings

by Calculated Risk on 2/05/2018 07:14:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Catch a Break After Stock Market Rout

Mortgage rates caught a break today, moving back near last Thursday's levels as bonds (which underlie rates) benefited from today's extreme market volatility. ...Tuesday:

Unfortunately, the scope of the improvement in rates was nowhere near that of the stock market rout. The average lender is back in line with last Thursday afternoon in terms of today's mortgage rate quotes. Last Thursday afternoon--at the time--was still the worst day in several years. [30YR FIXED - 4.375-4.5%]

emphasis added

• At 8:30 AM ET, Trade Balance report for December from the Census Bureau. The consensus is for the U.S. trade deficit to be at $51.9 billion in December from $50.5 billion in November.

• At 10:00 AM, Job Openings and Labor Turnover Survey for December from the BLS. Jobs openings decreased in November to 5.879 million from 5.925 in October. The number of job openings were up 4.4% year-over-year, and Quits were up 3.1% year-over-year.

Market Update

by Calculated Risk on 2/05/2018 04:29:00 PM

Update: Framing Lumber Prices Up Sharply Year-over-year, At Record Prices

by Calculated Risk on 2/05/2018 12:56:00 PM

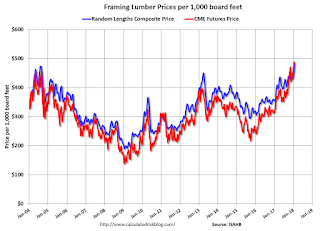

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and now prices are above the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early February 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 31% from a year ago, and CME futures are up about 39% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Rising costs - both material and labor - will be headwinds for the building industry this year.