by Calculated Risk on 2/02/2018 02:00:00 PM

Friday, February 02, 2018

Public and Private Sector Payroll Jobs During Presidential Terms

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just 12 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 12 months of Mr. Trump's term, the economy has added 2,099,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 12 months of Mr. Trump's term, the economy has added 15,000 public sector jobs.

After 12 months of Mr. Trump's presidency, the economy has added 2,114,000 jobs, about 386,000 behind the projection.

Update: "Scariest jobs chart ever"

by Calculated Risk on 2/02/2018 11:12:00 AM

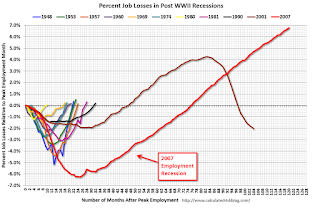

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the January 2018 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 6.8% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Comments on January Employment Report

by Calculated Risk on 2/02/2018 10:55:00 AM

The headline jobs number was above consensus expectations at 200 thousand, however the previously two months were revised down a combined 24 thousand. Overall this was a strong report, with a nice pickup in wage growth.

Earlier: January Employment Report: 200,000 Jobs Added, 4.1% Unemployment Rate

In January, the year-over-year employment change was 2.114 million jobs. This has been generally trending down, but is still solid year-over-year growth.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.9% YoY in January.

Wage growth had been trending up, although the acceleration in wage growth slowed in 2017.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) was essentially unchanged at 5.0 million in January. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons has been generally trending down, however the number increased slightly in January. The number working part time for economic reasons suggests a little slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that increased to 8.2% in January.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.42 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.52 million in December

This is the lowest level since April 2008.

This is trending down, but remains a little elevated.

The headline jobs number was solid, and the unemployment rate unchanged at a low level, and wage growth picked up - overall a strong report and a continuation of multi-year trends.

January Employment Report: 200,000 Jobs Added, 4.1% Unemployment Rate

by Calculated Risk on 2/02/2018 08:46:00 AM

From the BLS:

Total nonfarm payroll employment increased by 200,000 in January, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in construction, food services and drinking places, health care, and manufacturing.

...

The change in total nonfarm payroll employment for November was revised down from +252,000 to +216,000, and the change for December was revised up from +148,000 to +160,000. With these revisions, employment gains in November and December combined were 24,000 less than previously reported.

...

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 9 cents to $26.74, following an 11-cent gain in December. Over the year, average hourly earnings have risen by 75 cents, or 2.9 percent.

...

[Annual Revision] In accordance with annual practice, the establishment survey data released today have been benchmarked to reflect comprehensive counts of payroll jobs for March 2017. These counts are derived principally from the Quarterly Census of Employment and Wages (QCEW), which counts jobs covered by the Unemployment Insurance (UI) tax system. ... The total nonfarm employment level for March 2017 was revised upward by 146,000 (+138,000 on a not seasonally adjusted basis, or +0.1 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 200 thousand in January (private payrolls increased 196 thousand).

Payrolls for November and December were revised down by a combined 24 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In January the year-over-year change was 2.114 million jobs.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged in January at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was unchanged in January at 62.7%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio was unchanged at 60.1% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate was unchanged in January at 4.1%.

This was above the consensus expectations of 176,000 jobs, however the previous two months combined were revised down 24,000.

I'll have much more later ...

Thursday, February 01, 2018

Friday: Jobs, Jobs, Jobs and Wages

by Calculated Risk on 2/01/2018 07:31:00 PM

My January Employment Preview

Goldman: January Payrolls Preview

Friday:

• At 8:30 AM, Employment Report for January. The consensus is for an increase of 176,000 non-farm payroll jobs added in January, up from the 148,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 4.1%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 95.0, up from 94.4 in January.

U.S. Light Vehicle Sales decline to 17.1 million annual rate in January

by Calculated Risk on 2/01/2018 03:34:00 PM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.1 million SAAR in January.

That is down 1.2% from January 2017, and down 3.8% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 17.12 million SAAR from AutoData).

This was below the consensus forecast of 17.3 million for January.

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably decline again in 2018 after setting a new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

Goldman: January Payrolls Preview

by Calculated Risk on 2/01/2018 03:11:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate that nonfarm payrolls increased 205k in January, above consensus of +180k. Labor market fundamentals continue to appear solid, and we believe weather in the survey week improved sequentially from that of December, despite the “bomb cyclone” in the first week of the month.

We forecast a stable unemployment rate of 4.1% in tomorrow’s report ... We estimate average hourly earnings increased 0.2% month-over-month and 2.6% year-over-year ...

emphasis added

January Employment Preview

by Calculated Risk on 2/01/2018 12:01:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus, according to Bloomberg, is for an increase of 175,000 non-farm payroll jobs in January (with a range of estimates between 150,000 to 205,000), and for the unemployment rate to be unchanged at 4.1%.

The BLS reported 148,000 jobs added in December.

Here is a summary of recent data:

• The ADP employment report showed an increase of 234,000 private sector payroll jobs in January. This was well above consensus expectations of 176,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in January to 54.2%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll increased about 3,000 in January. The ADP report indicated manufacturing jobs increased 12,000 in January.

The ISM non-manufacturing employment index will be released next Monday.

• Initial weekly unemployment claims averaged 234,500 in January, down from 241,750 in December. For the BLS reference week (includes the 12th of the month), initial claims were at 216,000, down from 245,000 during the reference week in December.

The significant decrease during the reference week suggests a stronger employment report in January than in December.

• The final January University of Michigan consumer sentiment index decreased to 94.4 from the December reading of 95.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: In general, these reports suggest a solid employment report. There was some weather issues early in the month, but mostly before the reference week. My guess - probably influenced by the low number of unemployment claims during the reference week - is that the employment report will be above the consensus in January.

Note from the BLS: "Effective with the release of The Employment Situation for January 2018 on February 2, 2018, the establishment survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2017 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2016 and seasonally adjusted data beginning with January 2013 are subject to revision. Consistent with standard practice, some historical data may be subject to revisions resulting from issues identified during the benchmark process." The preliminary benchmark revision showed an increase of 95,000 jobs.

Construction Spending increased in December

by Calculated Risk on 2/01/2018 11:19:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in December:

Construction spending during December 2017 was estimated at a seasonally adjusted annual rate of $1,253.3 billion, 0.7 percent above the revised November estimate of $1,245.1 billion. The December figure is 2.6 percent above the December 2016 estimate of $1,221.6 billion.Both private and public spending increased in December:

Spending on private construction was at a seasonally adjusted annual rate of $963.2 billion, 0.8 percent above the revised November estimate of $955.9 billion ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $290.0 billion, 0.3 percent above the revised November estimate of $289.1 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 22% below the bubble peak.

Non-residential spending has been declining over the last year, but is 5% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 11% below the peak in March 2009, and 10% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6%. Non-residential spending is down 3% year-over-year. Public spending is up 4% year-over-year.

This was above the consensus forecast of a 0.5% increase for December, however spending for the previous two months was revised down.

ISM Manufacturing index decreased to 59.1 in January

by Calculated Risk on 2/01/2018 10:04:00 AM

The ISM manufacturing index indicated expansion in January. The PMI was at 59.1% in January, down from 59.3% in December. The employment index was at 54.2%, down from 57.2% last month, and the new orders index was at 65.4%, down from 67.4%.

From the Institute for Supply Management: January 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in January, and the overall economy grew for the 105th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The January PMI® registered 59.1 percent, a decrease of 0.2 percentage point from the seasonally adjusted December reading of 59.3 percent. The New Orders Index registered 65.4 percent, a decrease of 2 percentage points from the seasonally adjusted December reading of 67.4 percent. The Production Index registered 64.5 percent, a 0.7 percentage point decrease compared to the seasonally adjusted December reading of 65.2 percent. The Employment Index registered 54.2 percent, a decrease of 3.9 percentage points from the seasonally adjusted December reading of 58.1 percent. The Supplier Deliveries Index registered 59.1 percent, a 1.9 percentage point increase from the seasonally adjusted December reading of 57.2 percent. The Inventories Index registered 52.3 percent, an increase of 3.8 percentage points from the December reading of 48.5 percent. The Prices Index registered 72.7 percent in January, a 4.4 percentage point increase from the December reading of 68.3 percent, indicating higher raw materials prices for the 23rd consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.7%, and suggests manufacturing expanded at a slightly slower pace in January than in December.

A solid report.