by Calculated Risk on 1/31/2018 07:00:00 AM

Wednesday, January 31, 2018

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 26, 2018.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since March 2017, 4.41 percent, from 4.36 percent, with points increasing to 0.56 from 0.54 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

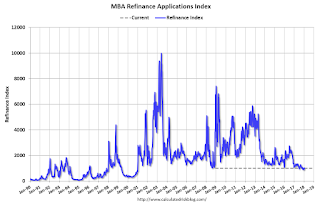

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, January 30, 2018

Wednesday: FOMC Annoucement, ADP Employment, Pending Home Sales, Chicago PMI

by Calculated Risk on 1/30/2018 07:46:00 PM

From Merrill Lynch on FOMC announcement:

The FOMC meeting on 31 January is likely to send a modestly hawkish signal, as FOMC officials become more convinced of the shift from the disinflation of 2017 and emphasize the momentum in the real economy. The FOMC will only have the statement to communicate updated views, as there is no press conference or Summary of Economic Projections (SEP). This will mark Janet Yellen's last FOMC meeting as Chair.Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 195,000 payroll jobs added in January, down from 250,000 added in December.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 64.0, down from 67.6 in December.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.4% increase in the index.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 1/30/2018 05:24:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

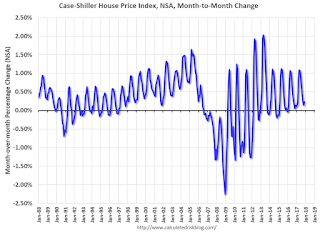

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through November 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Freddie Mac: Mortgage Serious Delinquency Rate Increased Sharply in December due to Hurricanes

by Calculated Risk on 1/30/2018 01:57:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in December was 1.08%, up sharply from 0.95% in November. Freddie's rate is up from 1.00% in December 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This increase in the delinquency rate was due to the hurricanes - no worries about the overall market - and we might see a further increase over the next month or so (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range..

Note: Fannie Mae will report for December soon.

Real House Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/30/2018 12:57:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in November

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 6.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 11.6% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In November, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $282,000 today adjusted for inflation (41%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to February 2006 levels.

Real House Prices

In real terms, the National index is back to September 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.

HVS: Q4 2017 Homeownership and Vacancy Rates

by Calculated Risk on 1/30/2018 10:53:00 AM

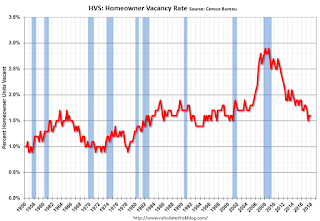

The Census Bureau released the Residential Vacancies and Homeownership report for Q4 2017.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.2% in Q4, from 63.9% in Q3.

I'd put more weight on the decennial Census numbers - and given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Case-Shiller: National House Price Index increased 6.2% year-over-year in November

by Calculated Risk on 1/30/2018 09:12:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3 month average of September, October and November prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Cities in the West: Seattle, Las Vegas and San Francisco Lead Gains in S&P Corelogic Case-Shiller Home Price Indices

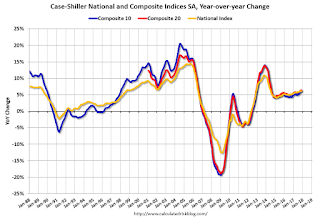

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in November, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.1%, up from 5.9% the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.3% the previous month.

Seattle, Las Vegas, and San Francisco reported the highest year-over-year gains among the 20 cities. In November, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.6% increase, and San Francisco with a 9.1% increase. Six cities reported greater price increases in the year ending November 2017 versus the year ending October 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in November. The 10-City and 20-City Composites reported increases of 0.3% and 0.2%, respectively. After seasonal adjustment, the National Index recorded a 0.7% month-over-month increase in November. The 10-City and 20-City Composites posted 0.8% and 0.7% month-over-month increases, respectively. Ten of 20 cities reported increases in November before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continue to rise three times faster than the rate of inflation,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index year-over-year increases have been 5% or more for 16 months; the 20-City index has climbed at this pace for 28 months. Given slow population and income growth since the financial crisis, demand is not the primary factor in rising home prices. Construction costs, as measured by National Income and Product Accounts, recovered after the financial crisis, increasing between 2% and 4% annually, but do not explain all of the home price gains. From 2010 to the latest month of data, the construction of single family homes slowed, with single family home starts averaging 632,000 annually. This is less than the annual rate during the 2007-2009 financial crisis of 698,000, which is far less than the long-term average of slightly more than one million annually from 1959 to 2000 and 1.5 million during the 2001-2006 boom years. Without more supply, home prices may continue to substantially outpace inflation.”

“Looking across the 20 cities covered here, those that enjoyed the fastest price increases before the 2007-2009 financial crisis are again among those cities experiencing the largest gains. San Diego, Los Angeles, Miami and Las Vegas, price leaders in the boom before the crisis, are again seeing strong price gains. They have been joined by three cities where prices were above average during the financial crisis and continue to rise rapidly – Dallas, Portland OR, and Seattle.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 3.6% from the peak, and up 0.8% in November (SA).

The Composite 20 index is off slightly from the peak, and up 0.8% (SA) in November.

The National index is 6.4% above the bubble peak (SA), and up 0.7% (SA) in November. The National index is up 43.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.1% compared to November 2016. The Composite 20 SA is up 6.4% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, January 29, 2018

"Mortgage Rates Surge to Highest Levels in More Than 3 Years"

by Calculated Risk on 1/29/2018 07:00:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Surge to Highest Levels in More Than 3 Years

Mortgage rates are in trouble. This will come as no surprise to regular readers. For the past few weeks, rates made several successive runs up to the highest levels in more than 9 months. It was really only the spring of 2017 that stood in the way of rates being the highest since early 2014. After Friday marked another "highest in 9 months" day, it would only have taken a moderate movement to break into the "3+ year" territory. The move ended up being even bigger.Tuesday:

From a week and a half ago, most borrowers are now looking at another eighth of a percentage point higher in rate. In total, rates are up the better part of half a point since December 15th. [30YR FIXED - 4.375-4.5%]

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for November. The consensus is for a 6.4% year-over-year increase in the Comp 20 index for November.

• At 10:00 AM, Q4 Housing Vacancies and Homeownership from the Census Bureau.

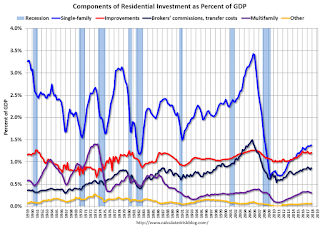

Q4 2017 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 1/29/2018 04:39:00 PM

The BEA has released the underlying details for the Q4 advance GDP report.

The BEA reported that investment in non-residential structures increased at a 6.8% annual pace in Q4. This is a turnaround from early last year when non-residential investment declined due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration increased substantially in Q4, from a $55 billion annual rate in Q4 2016 to a $107 billion annual rate in Q4 2017 - but is still down from a recent peak of $165 billion in Q4 2014.

Without the increase in petroleum and natural gas exploration, non-residential investment would be down year-over-year.

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices decreased in Q4, and is down 7% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was up 4% year-over-year in Q4. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased in Q4, and lodging investment is up 5% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the last four years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $272 billion (SAAR) (about 1.4% of GDP), and was up in Q4 compared to Q3.

Investment in home improvement was at a $238 billion Seasonally Adjusted Annual Rate (SAAR) in Q4 (about 1.2% of GDP). Home improvement spending has been solid.

NMHC: Apartment Market Tightness Index remained negative for Ninth Consecutive Quarter

by Calculated Risk on 1/29/2018 02:44:00 PM

From the National Multifamily Housing Council (NMHC): Apartment Markets Remain Soft in the January NMHC Quarterly Survey

Apartment market conditions continued to soften according to results from the January National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions. The Market Tightness (36), Sales Volume (40) and Debt Financing (38) Indexes landed below the breakeven level of 50, while the Equity Financing Index increased to 58. In addition, the survey found that half of respondents expect green financing to increase in 2018.

“The latest survey results underscored the prevailing view at our recent Apartment Strategies Conference that we are late in the current cycle,” said NMHC Chief Economist Mark Obrinsky. “While some seasonality comes into play, the Market Tightness Index was a little below its long-term January average, indicating market conditions are slightly weaker than normal. Demand for apartments overall remains strong and equity capital still looks favorably on the apartment sector. However, many owners are satisfied with their holdings and more inclined to stand pat.”

The Market Tightness Index decreased one point to 36 – the ninth consecutive quarter of declining conditions. Just 14 percent reported tighter conditions compared to the previous three months, compared to 42 percent of senior executives who reported looser conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the ninth consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.