by Calculated Risk on 1/26/2018 08:36:00 AM

Friday, January 26, 2018

BEA: Real GDP increased at 2.6% Annualized Rate in Q4

From the BEA: Gross Domestic Product: Fourth Quarter 2017 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.6 percent in the fourth quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.The advance Q4 GDP report, with 2.6% annualized growth, was below expectations.

...

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, residential fixed investment, state and local government spending, and federal government spending that were partly offset by a negative contribution from private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP growth in the fourth quarter reflected a downturn in private inventory investment that was partly offset by accelerations in PCE, exports, nonresidential fixed investment, state and local government spending, and federal government spending, and an upturn in residential fixed investment. Imports, which are a subtraction in the calculation of GDP, turned up.

emphasis added

Personal consumption expenditures (PCE) increased at 3.8% annualized rate in Q4, up from 2.2% in Q3. Residential investment (RI) increased at a 11.6% pace. Equipment investment increased at a 11.4% annualized rate, and investment in non-residential structures decreased at a 1.4% pace.

I'll have more later ...

Thursday, January 25, 2018

Friday: GDP, Durable Goods

by Calculated Risk on 1/25/2018 08:22:00 PM

Friday:

• At 8:30 AM ET, Gross Domestic Product, 4th quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.9% annualized in Q4, down from 3.2% in Q3.

• Also at 8:30 AM, Durable Goods Orders for November from the Census Bureau. The consensus is for a 0.8% increase in durable goods orders.

Q4 GDP Forecasts

by Calculated Risk on 1/25/2018 05:13:00 PM

The advance estimate of Q4 GDP will be released tomorrow, Friday, January 26th. The consensus is that real GDP increased 2.9% annualized in Q4, down from 3.2% in Q3.

Here are a couple of estimates, from the Altanta Fed: GDPNow

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.4 percent on January 25, unchanged from January 18.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.9% for 2017:Q4 and 3.1% for 2018:Q1.CR Note: It looks likely that GDP will be around or over 3% again in Q4.

A few Comments on December New Home Sales

by Calculated Risk on 1/25/2018 12:34:00 PM

New home sales for December were reported at 625,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, and the three previous months were revised down significantly.

On an annual basis, sales were up 8.3% in 2017 compared to 2016. This was a solid year-over-year gain. Here is a table of new home sales since the bubble peak in 2005.

| New Home Sales (000s) | ||

|---|---|---|

| New Home Sales | Change | |

| 2005 | 1,283 | --- |

| 2006 | 1,051 | -18.1% |

| 2007 | 776 | -26.2% |

| 2008 | 485 | -37.5% |

| 2009 | 375 | -22.7% |

| 2010 | 323 | -13.9% |

| 2011 | 306 | -5.3% |

| 2012 | 368 | 20.3% |

| 2013 | 429 | 16.6% |

| 2014 | 437 | 1.9% |

| 2015 | 501 | 14.7% |

| 2016 | 561 | 12.0% |

| 2017 | 608 | 8.3% |

Sales were up 14.1% year-over-year in December.

Earlier: New Home Sales decrease to 625,000 Annual Rate in December.

Click on graph for larger image.

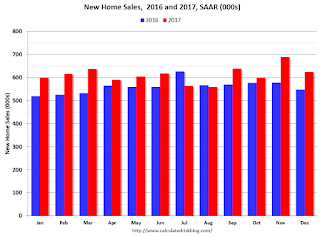

Click on graph for larger image.This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate).

For 2017, new home sales are up 8.3% compared to 2016.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through December 2017. This graph starts in 1994, but the relationship had been fairly steady back to the '60s. Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Growth Strengthened Further" in January

by Calculated Risk on 1/25/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Growth Strengthened Further

The Federal Reserve Bank of Kansas City released the January Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that growth in Tenth District manufacturing activity strengthened further, and expectations for future activity increased.So far all of the regional Fed surveys have been solid in January, although only the Kansas City index has been above the December levels (most indexes suggest slower growth in January than in December).

“We saw faster growth this month despite some firms noting negative effects from extremely cold weather, and several price indexes rose considerably,” said Wilkerson.

...

The month-over-month composite index was 16 in January, higher than 13 in December and 15 in November. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Growth in factory activity improved at both durable and non-durable goods plants, particularly for machinery, aircraft, chemicals, and plastics. Most month-over-month indexes also increased. The shipments, new orders, and order backlog indexes all rose moderately. The employment index inched higher from 16 to 18, while the production index was unchanged. The raw materials inventory index climbed from 7 to 15, and the finished goods inventory index moved into positive territory.

emphasis added

New Home Sales decrease to 625,000 Annual Rate in December

by Calculated Risk on 1/25/2018 10:19:00 AM

The Census Bureau reports New Home Sales in December were at a seasonally adjusted annual rate (SAAR) of 625 thousand.

The previous three months combined were revised down significantly.

"Sales of new single-family houses in December 2017 were at a seasonally adjusted annual rate of 625,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 9.3 percent below the revised November rate of 689,000, but is 14.1 percent above the December 2016 estimate of 548,000.

An estimated 608,000 new homes were sold in 2017. This is 8.3 percent above the 2016 figure of 561,000.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in December to 5.7 months from 4.9 months in November.

The months of supply increased in December to 5.7 months from 4.9 months in November. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of December was 295,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

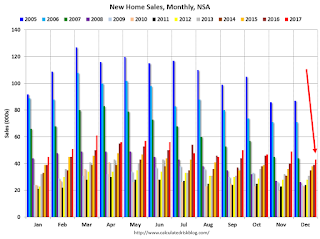

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In December 2017 (red column), 43 thousand new homes were sold (NSA). Last year, 39 thousand homes were sold in December.

The all time high for December was 87 thousand in 2005, and the all time low for December was 23 thousand in 1966 and 2010.

This was well below expectations of 683,000 sales SAAR, and the previous months combined were revised down significantly. I'll have more later today.

Weekly Initial Unemployment Claims increase to 233,000

by Calculated Risk on 1/25/2018 08:34:00 AM

The DOL reported:

In the week ending January 20, the advance figure for seasonally adjusted initial claims was 233,000, an increase of 17,000 from the previous week's revised level. The previous week's level was revised down by 4,000 from 220,000 to 216,000. The 4-week moving average was 240,000, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised down by 1,000 from 244,500 to 243,500.The previous week was revised down.

The claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 240,000.

This was much lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, January 24, 2018

Thursday: New Home Sales, Unemployment Claims

by Calculated Risk on 1/24/2018 07:22:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 220 thousand the previous week.

• At 10:00 AM, New Home Sales for December from the Census Bureau. The consensus is for 683 thousand SAAR, down from 733 thousand in November.

• At 11:00 AM, the Kansas City Fed manufacturing survey for December.

Review: Here are the Ten Economic Questions for 2018 and a few predictions:

• Question #1 for 2018: How much will the economy grow in 2018?

• Question #2 for 2018: Will job creation slow further in 2018?

• Question #3 for 2018: What will the unemployment rate be in December 2018?

• Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

• Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

• Question #6 for 2018: How much will wages increase in 2018?

• Question #7 for 2018: How much will Residential Investment increase?

• Question #8 for 2018: What will happen with house prices in 2018?

• Question #9 for 2018: Will housing inventory increase or decrease in 2018?

• Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

LA area Port Traffic Increases in December

by Calculated Risk on 1/24/2018 03:40:00 PM

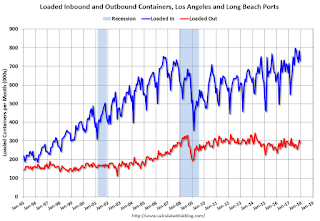

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

From the Port of Long Beach: State of the Port Celebrates Cargo Record

The Port of Long Beach roared back from unprecedented challenges to notch its busiest year ever in 2017, moving 7.54 million twenty-foot equivalent units, an increase of more than 11 percent ...The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.8% compared to the rolling 12 months ending in November. Outbound traffic was up 0.1% compared to the rolling 12 months ending in November.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Trade has been strong - especially inbound - and setting record volumes most months recently.

In general imports have been increasing, and exports are mostly moving sideways to slightly down recently.

A Few Comments on December Existing Home Sales

by Calculated Risk on 1/24/2018 11:24:00 AM

Earlier: NAR: "Existing-Home Sales Fade in December; 2017 Sales Up 1.1 Percent"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in December. The consensus was for sales of 5.75 million SAAR in December. Lawler estimated 5.66 million, and the NAR reported 5.57 million.

"Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.66 million in December, down 2.6% from November’s preliminary pace"2) Inventory is still very low and falling year-over-year (down 10.3% year-over-year in December). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases. This was the 31st consecutive month with a year-over-year decline in inventory.

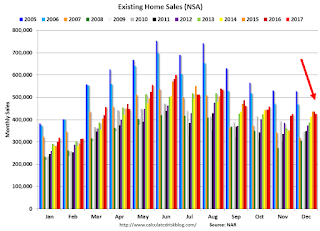

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in December (427,000, red column) were below sales in December 2016 (437,000, NSA) and also below sales in December 2015 (436,000, NSA).

This is the lowest sales NSA since December 2014.

Sales NSA will be lower through February.

We will probably have to wait until March - at the earliest - to draw any conclusions about the impact of the new tax law on home sales.