by Calculated Risk on 12/27/2017 10:10:00 AM

Wednesday, December 27, 2017

NAR: Pending Home Sales Index Increased Slightly in November, Up 0.8% Year-over-year

From the NAR: Pending Home Sales Inch Up 0.2 Percent in November

ending home sales were mostly unmoved in November, but did squeak out a minor gain both on a monthly and annualized basis, according to the National Association of Realtors®. Heading into 2018, existing-home sales and price growth are forecast to slow, primarily because of the altered tax benefits of homeownership affecting some high-cost areas.This was above expectations of a 0.8% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in December and January.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 0.2 percent to 109.5 in November from 109.3 in October. With last month’s modest increase, the index remains at its highest reading since June (110.0), and is now 0.8 percent above a year ago.

...

The PHSI in the Northeast jumped 4.1 percent to 98.9 in November, and is now 1.1 percent above a year ago. In the Midwest the index rose 0.4 percent to 105.8 in November, and is now 0.8 percent higher than November 2016.

Pending home sales in the South decreased 0.4 percent to an index of 123.1 in November but are still 2.5 percent higher than last November. The index in the West declined 1.8 percent in November to 100.4, and is now 2.3 percent below a year ago.

emphasis added

Tuesday, December 26, 2017

Wednesday: Pending Home Sales

by Calculated Risk on 12/26/2017 08:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Seasonally Sideways

Mortgage rates were lifeless today as financial markets drifted sideways. [30YR FIXED - 4.125%] Although rates CAN move during the last week of December when there's an imbalance between buyers and sellers in bond markets, that's the exception to the rule. We tend to see days exactly like today with effectively zero change in lender rates sheets compared to the previous business day (in this case, last Friday).Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. (might not be released this week due to holidays)

• At 10:00 AM, Pending Home Sales Index for November. The consensus is for a 0.8% decrease in the index.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/26/2017 04:20:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

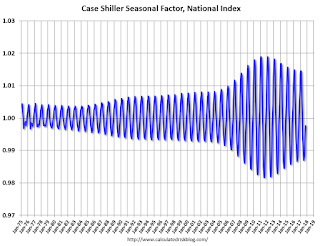

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in October

by Calculated Risk on 12/26/2017 01:18:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in October

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 5.7% above the previous bubble peak. However, in real terms, the National index (SA) is still about 12.2% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In October, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,400 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to January 2006 levels.

Real House Prices

In real terms, the National index is back to September 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to September 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.

Richmond and Dallas Fed: Manufacturing Expansion Solid in December

by Calculated Risk on 12/26/2017 10:38:00 AM

From the Richmond Fed: Fifth District Manufacturing Firms Reported Moderate Growth in December

According to the latest survey by the Federal Reserve Bank of Richmond, Fifth District manufacturing firms saw moderate growth in December. The composite index moved down from its record high November reading of 30 to 20 but remained positive, indicating continued growth. The decrease in the composite index resulted from declines in the indexes for shipments and new orders; but the third component, employment, increased in December. Indicators of wages and inventories also rose.From the Dallas Fed: Texas Manufacturing Activity Shows Robust Growth

emphasis added

Texas factory activity expanded strongly in December, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, spiked 18 points to 32.8, reaching its highest level in more than 11 years.These were the last of the regional Fed surveys for December.

Other measures of manufacturing activity also pointed to more rapid growth in December. The new orders index jumped 10 points to 30.1, another 11-year high, and the growth rate of orders index moved up to 21.4. The capacity utilization index increased nine points to 26.3, and the shipments index rose from 16.7 to 21.5 this month.

Perceptions of broader business conditions were markedly more positive in December. The general business activity index and the company outlook index posted double-digit increases, coming in at 29.7 and 31.5, respectively. Both represent highs last seen in 2006.

Labor market measures suggested more rapid employment growth and longer workweeks this month. The employment index came in at 20.4, up 14 points from November. More than 30 percent of firms noted net hiring, compared with 11 percent noting net layoffs. The hours worked index shot up to 23.3, a 12-year high.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through December) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will be strong again in December (to be released Wednesday, Jan 3rd).

Case-Shiller: National House Price Index increased 6.2% year-over-year in October

by Calculated Risk on 12/26/2017 09:14:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for October ("October" is a 3 month average of August, September and October prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: October S&P CoreLogic Case-Shiller National Home Price NSA Index Continues Steady Gains in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.2% annual gain in October, up from 6.1% in the previous month. The 10-City Composite annual increase came in at 6.0%, up from 5.7% the previous month. The 20-City Composite posted a 6.4% year-over-year gain, up from 6.2% the previous month.

Seattle, Las Vegas, and San Diego reported the highest year-over-year gains among the 20 cities. In October, Seattle led the way with a 12.7% year-over-year price increase, followed by Las Vegas with a 10.2% increase, and San Diego with an 8.1% increase. Nine cities reported greater price increases in the year ending October 2017 versus the year ending September 2017

...

Before seasonal adjustment, the National Index, 10-City and 20-City Composites all posted a monthover-month gain of 0.2% in October. After seasonal adjustment, the National Index, 10-City and 20-City Composites all recorded a 0.7% month-over-month increase in October. Eleven of 20 cities reported increases in October before seasonal adjustment, while all 20 cities reported increases after seasonal adjustment.

“Home prices continue their climb supported by low inventories and increasing sales,” says David M. Blitzer, Managing Director & Chairman of the Index Committee at S&P Dow Jones Indices. “Nationally, home prices are up 6.2% in the 12 months to October, three times the rate of inflation. Sales of existing homes dropped 6.1% from March through September; they have since rebounded 8.4% in November. Inventories measured by months-supply of homes for sale dropped from the tight level of 4.2 months last summer to only 3.4 months in November.

“Underlying the rising prices for both new and existing homes are low interest rates, low unemployment and continuing economic growth. Some of these favorable factors may shift in 2018. The Fed is widely expected to raise the Fed funds rate three more times to reach 2% by the end of the New Year. Since home prices are rising faster than wages, salaries, and inflation, some areas could see potential home buyers compelled to look at renting. Data published by the Urban Institute suggests that in some West coast cities with rapidly rising home prices, renting is more attractive than buying.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 4.4% from the peak, and up 0.7% in October (SA).

The Composite 20 index is off 1.7% from the peak, and up 0.7% (SA) in October.

The National index is 5.7% above the bubble peak (SA), and up 0.7% (SA) in October. The National index is up 43.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 6.0% compared to October 2016. The Composite 20 SA is up 6.4% year-over-year.

The National index SA is up 6.2% year-over-year.

Note: According to the data, prices increased in all 20 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, December 25, 2017

Monday Night Futures

by Calculated Risk on 12/25/2017 09:27:00 PM

Weekend:

• Schedule for Week of Dec 24, 2017

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for October (note: Some sites show this released on Wednesday during the Holidays) The consensus is for a 6.2% year-over-year increase in the Comp 20 index for October.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for December. This is the last of the regional surveys for December.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 1, and DOW futures are down 34 (fair value).

Oil prices were up over the last week with WTI futures at $58.52 per barrel and Brent at $65.31 per barrel. A year ago, WTI was at $52, and Brent was at $54 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.44 per gallon. A year ago prices were at $2.28 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.

Happy Holidays!

by Calculated Risk on 12/25/2017 10:34:00 AM

Happy Holidays and Merry Christmas to All!

Whose woods these are I think I know."Stopping by Woods on a Snowy Evening" by Robert Frost

His house is in the village though;

He will not see me stopping here

To watch his woods fill up with snow.

My little horse must think it queer

To stop without a farmhouse near

Between the woods and frozen lake

The darkest evening of the year.

He gives his harness bells a shake

To ask if there is some mistake.

The only other sound’s the sweep

Of easy wind and downy flake.

The woods are lovely, dark and deep,

But I have promises to keep,

And miles to go before I sleep,

And miles to go before I sleep.

There is no snow or even rain in California. Oh well.

Enjoy the season!

Sunday, December 24, 2017

Oil Rigs "A modest gain in horizontal oil rigs"

by Calculated Risk on 12/24/2017 05:45:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 22, 2017:

• Total US oil rigs were flat at 747

• Horizontal oil rigs, however, were up 1 to 655

• Horizontal rigs saw quite a bit of shuffling, with the major basins +10 and the minor basins -9. This probably reflects redeployment at this point and should be considered a tactical, rather than strategic, development

...

• We expect the rig count to surge upward in the next four weeks, with some weeks exceeding +10 horizontal oil rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Hotel Occupancy Rate Increased Year-over-Year, 2017 will be Record Occupancy Year

by Calculated Risk on 12/24/2017 11:00:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 16 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 10-16 December 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 December 2016, the industry recorded the following:

• Occupancy: +4.5% to 56.4%

• Average daily rate (ADR): +3.5% to US$115.67

• Revenue per available room (RevPAR): +8.1% to US$65.24

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).This is seasonally the weakest time of the year for hotel occupancy.

With the year almost over, the annual occupancy rate is ahead of the previous record year in 2015. The strong finish to the year was due to the impact of the hurricanes.

Data Source: STR, Courtesy of HotelNewsNow.com