by Calculated Risk on 12/02/2017 08:11:00 AM

Saturday, December 02, 2017

Schedule for Week of Dec 3, 2017

The key report this week is the November employment report on Friday.

Other key indicators include the October Trade deficit, and the November ISM non-manufacturing index.

No major economic releases scheduled.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through September. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $47.1 billion in October from $43.5 billion in September.

10:00 AM: the ISM non-Manufacturing Index for November. The consensus is for index to decrease to 59.0 from 60.1 in October.

10:00 AM: Corelogic House Price index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 192,000 payroll jobs added in November, down from 235,000 added in October.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand the previous week.

10:00 AM: The Q3 Quarterly Services Report from the Census Bureau.

12:00 PM: Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.0 billion in October.

8:30 AM: Employment Report for November. The consensus is for an increase of 185,000 non-farm payroll jobs added in November, down from the 261,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to be unchanged at 4.1%.

The consensus is for the unemployment rate to be unchanged at 4.1%.This graph shows the year-over-year change in total non-farm employment since 1968.

In October the year-over-year change was 2.04 million jobs.

A key will be the change in wages.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for December). The consensus is for a reading of 98.8, up from 98.5 in November.

Friday, December 01, 2017

Oil Rigs "Rigs continue to move ahead"

by Calculated Risk on 12/01/2017 07:35:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 1, 2017:

• Total US oil rigs were up 2 to 749, and up 20 over the last four weeks

• Horizontal oil rigs were up 3 to 648, up 22 in the last four weeks

...

• Once again, WTI appears to be closing on Brent from below, suggesting US excess inventories are thinning.

• The oil price direction remains firmly upward

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

U.S. Light Vehicle Sales at 17.35 million annual rate in November

by Calculated Risk on 12/01/2017 02:58:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.35 million SAAR in November.

That is down 1% from November 2016, and down 3.6% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 17.35 million SAAR from WardsAuto).

This was below the consensus forecast of 17.6 million for November (Note: Hurricane Harvey pushed down sales at the end of August, and sales bounced back in September, October and November).

Still - even with the recent bump in sales - vehicle sales will be down year-over-year in 2017, following two consecutive years of record sales.

Note: dashed line is current estimated sales rate.

Construction Spending increased in October

by Calculated Risk on 12/01/2017 11:22:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in October:

Construction spending during October 2017 was estimated at a seasonally adjusted annual rate of $1,241.5 billion, 1.4 percent above the revised September estimate of $1,224.6 billion. The October figure is 2.9 percent above the October 2016 estimate of $1,206.6 billion.Both private and public spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $949.9 billion, 0.6 percent above the revised September estimate of $943.8 billion ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $291.6 billion, 3.9 percent above the revised September estimate of $280.7 billion.

emphasis added

Click on graph for larger image.

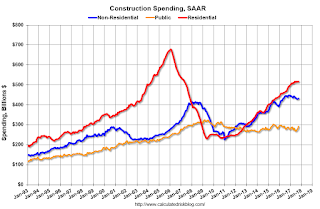

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 24% below the bubble peak.

Non-residential spending has been declining over the last year, but is 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 10% below the peak in March 2009, and 11% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7%. Non-residential spending is down 1% year-over-year. Public spending is up 2% year-over-year.

This was above the consensus forecast of a 0.5% increase for October, and public spending for the previous two months was revised up.

ISM Manufacturing index decreased to 58.2 in November

by Calculated Risk on 12/01/2017 10:03:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 58.2% in November, down from 58.7% in October. The employment index was at 59.7%, down from 59.8% last month, and the new orders index was at 64.0%, up from 63.4%.

From the Institute for Supply Management: November 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 102nd consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The November PMI® registered 58.2 percent, a decrease of 0.5 percentage point from the October reading of 58.7 percent. The New Orders Index registered 64 percent, an increase of 0.6 percentage point from the October reading of 63.4 percent. The Production Index registered 63.9 percent, a 2.9 percentage point increase compared to the October reading of 61 percent. The Employment Index registered 59.7 percent, a decrease of 0.1 percentage point from the October reading of 59.8 percent. The Supplier Deliveries Index registered 56.5 percent, a 4.9 percentage point decrease from the October reading of 61.4 percent. The Inventories Index registered 47 percent, a decrease of 1 percentage point from the October reading of 48 percent. The Prices Index registered 65.5 percent in November, a 3 percentage point decrease from the October level of 68.5, indicating higher raw materials prices for the 21st consecutive month. Comments from the panel reflect expanding business conditions, with New Orders and Production leading gains, employment expanding at a slower rate, order backlogs stable and expanding, and export orders all continuing to grow in November. Supplier deliveries continued to slow (improving), but at slower rates, and inventories continued to contract during the period. Price increases continued, but at a slower rate. The Customers’ Inventories Index improved but remains at low levels."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 58.4%, and suggests manufacturing expanded at a slower pace in November than in October.

Still a solid report.

Thursday, November 30, 2017

Friday: Vehicle Sales, ISM Mfg Index, Construction Spending

by Calculated Risk on 11/30/2017 07:47:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit 1-Month Highs

Mortgage rates actually continued higher today at the same quicker pace seen yesterday. Due to the relatively narrow range during November, rates are now in line with their highest levels in more than a month whereas they were at 2-week lows just 2 days ago. The average lender is now quoting conventional 30yr fixed rates of 4.0% on top tier scenarios, with a few outliers at 3.875% and 4.125%. A few days ago, 3.875% was nearly as prevalent.Tuesday:

• At 10:00 AM ET, ISM Manufacturing Index for November. The consensus is for the ISM to be at 58.4, down from 58.7 in October. In October, the employment index was at 59.8%, and the new orders index was at 63.4%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to be 17.6 million SAAR in November, down from 18.0 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate unchanged in October

by Calculated Risk on 11/30/2017 04:18:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 1.01% in October, from 1.01% in September. The serious delinquency rate is down from 1.21% in October 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 2.82% are seriously delinquent. For loans made in 2005 through 2008 (7% of portfolio), 5.91% are seriously delinquent, For recent loans, originated in 2009 through 2017 (89% of portfolio), only 0.33% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

In the short term - over the next couple of months - the delinquency rate will probably increase slightly due to the hurricanes. After the hurricane bump, maybe the rate will decline another 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Freddie Mac reported earlier.

Earlier: Chicago PMI "Softens" in November

by Calculated Risk on 11/30/2017 02:28:00 PM

Earlier from the Chicago PMI: Chicago Business Barometer Softens to 63.9 in November

The MNI Chicago Business Barometer eased to 63.9 in November, down from 66.2 in October, to stand at the lowest level in three months.This was close to the consensus forecast of 64.0, and still a solid reading.

Despite receding from October’s six-and-a-half year high, optimism among businesses recorded the fourth highest outturn this year. The Barometer has expanded for 21 straight months and is poised to see out 2017 in solid fashion.

...

“Despite November’s fall, the MNI Chicago Business Barometer remains on track to deliver the first full year of expansion in three years. Firms seem to have navigated through the worst of the bad weather conditions in recent months, though supplier deliveries rising to a thirteen-year high and persistent, high input costs suggests the effects are yet to fully dissipate away,” said Jamie Satchi, Economist at MNI Indicators.

emphasis added

Hotel Occupancy Rate Increased Year-over-Year, On Pace for Record Year

by Calculated Risk on 11/30/2017 11:49:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 November

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 19-25 November 2017, according to data from STR.Note: The hurricanes continue to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 20-26 November 2016, the industry recorded the following:

• Occupancy: +1.4% to 51.4%

• Average daily rate (ADR): +2.0% to US$109.99

• Revenue per available room (RevPAR): +3.4% to US$56.52

Among the Top 25 Markets, Houston, Texas, reported the largest increase in all three key performance metrics: occupancy (+32.8% to 56.0%), ADR (+16.0% to US$92.58) and RevPAR (+54.1% to US$51.86).

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Personal Income increased 0.4% in October, Spending increased 0.3%

by Calculated Risk on 11/30/2017 08:48:00 AM

The BEA released the Personal Income and Outlays report for October:

Personal income increased $65.1 billion (0.4 percent) in October according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $66.1 billion (0.5 percent) and personal consumption expenditures (PCE) increased $34.4 billion (0.3 percent).The October PCE price index increased 1.6 percent year-over-year and the October PCE price index, excluding food and energy, increased 1.4 percent year-over-year.

...

Real DPI increased 0.3 percent in October and Real PCE increased 0.1 percent. The PCE price index increased 0.1 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through October 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly above expectations, and the increase in PCE was at expectations.