by Calculated Risk on 11/30/2017 08:33:00 AM

Thursday, November 30, 2017

Weekly Initial Unemployment Claims decrease to 238,000

The DOL reported:

In the week ending November 25, the advance figure for seasonally adjusted initial claims was 238,000, a decrease of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 239,000 to 240,000. The 4-week moving average was 242,250, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 239,750 to 240,000.The previous week was revised up.

Claims taking procedures continue to be disrupted in the Virgin Islands

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 242,250.

This was slightly lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, November 29, 2017

Thursday: Unemployment Claims, Personal Income and Outlays, Chicago PMI

by Calculated Risk on 11/29/2017 08:55:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for October. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for a reading of 64.0, down from 66.2 in October.

Policy Mistakes

by Calculated Risk on 11/29/2017 06:27:00 PM

Over the last 20 years or so, we've seen several policy mistakes. The worst, of course, was the decision to invade Iraq (I opposed the Iraq war, and was shouted down and called names like "Saddam lover" for questioning the veracity of the information). Note: I started this blog in January 2005, and one of my earliest non-housing posts was "A Desolation called Peace" (I'm still angry).

From an economic perspective, the errors include the failure to properly regulate the banks and mortgage lenders, the Bush tax cuts, the original TARP proposal, and some minor mistakes in 2009 like the homebuyers tax credit and "cash-for-clunkers". Also the premature pivot to austerity in 2010, and the failure to pass infrastructure spending programs in the following years, were clear policy mistakes.

We'd better off if we hadn't made these mistakes, but we survived.

The current tax cut bill is another clear policy mistake.

First, if we look at the business cycle and the deficit, economic theory suggests that the government should increase the deficit during economic downturns, and work down the deficit during expansions. The economy is currently in the mid-to-late stage of a recovery, so decreasing the deficit makes sense now - not increasing the deficit.

Are there any fiscal conservatives left in the GOP? There are definitely no deficit hawks!

Also, a key problem in the US is income and wealth inequality. How does this bill address these issues? It does the opposite.

Oh well, it looks like the US is about to make another policy mistake that will have to be reversed in a few years.

Freddie Mac: Mortgage Serious Delinquency rate unchanged in October

by Calculated Risk on 11/29/2017 12:43:00 PM

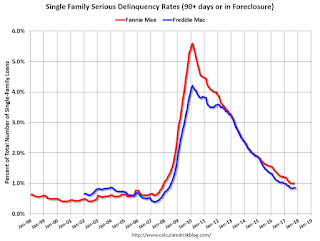

Freddie Mac reported that the Single-Family serious delinquency rate in October was at 0.86%, unchanged from 0.86% in September. Freddie's rate is down from 1.03% in October 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The recent slight increase in the delinquency rate was probably due to the hurricanes - and we might see a further increase over the next couple of months (These are serious delinquencies).

After the hurricane bump, maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for October soon.

NAR: Pending Home Sales Index increase in October, Down 0.6% Year-over-year

by Calculated Risk on 11/29/2017 10:07:00 AM

From the NAR: Pending Home Sales Strengthen 3.5 Percent in October

Pending home sales rebounded strongly in October following three straight months of diminishing activity, but still continued their recent slide of falling behind year ago levels, according to the National Association of Realtors®. All major regions except for the West saw an increase in contract signings last month.This was above expectations of a 1.0% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 3.5 percent to 109.3 in October from a downwardly revised 105.6 in September. The index is now at its highest reading since June (110.0), but is still 0.6 percent below a year ago.

...

The PHSI in the Northeast inched forward 0.5 percent to 95.0 in October, but is still 1.9 percent below a year ago. In the Midwest the index increased 2.8 percent to 105.8 in October, but remains 0.9 percent lower than October 2016.

Pending home sales in the South jumped 7.4 percent to an index of 123.6 in October and are now 2.0 percent higher than last October. The index in the West decreased 0.7 percent in October to 101.6, and is now 4.4 percent below a year ago.

emphasis added

Q3 GDP Revised up to 3.3% Annual Rate

by Calculated Risk on 11/29/2017 08:34:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.3 percent in the third quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised down from 2.4% to 2.3%. Residential investment was revised up slightly from -6.0% to -5.1%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 3.0 percent. With this second estimate for the third quarter, the general picture of economic growth remains the same; nonresidential fixed investment, state and local government spending, and private inventory investment were revised up from the prior estimate ...

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 11/29/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

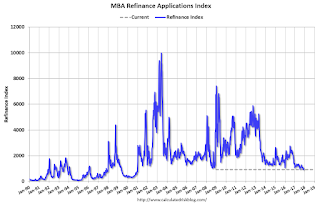

Mortgage applications decreased 3.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 24, 2017. This week’s results include an adjustment for the Thanksgiving holiday.

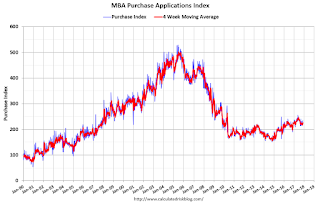

... The Refinance Index decreased 8 percent from the previous week to its lowest level since January 2017. The seasonally adjusted Purchase Index increased 2 percent from one week earlier to its highest level since September 2017. The unadjusted Purchase Index decreased 32 percent compared with the previous week and was 6 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged from the week prior at 4.20 percent, with points decreasing to 0.34 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 6% year-over-year.

Tuesday, November 28, 2017

Wednesday: GDP, Pending Home Sales, Fed Chair Yellen

by Calculated Risk on 11/28/2017 08:01:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 3rd quarter 2017 (Second estimate). The consensus is that real GDP increased 3.3% annualized in Q3, up from 3.0% in the advance report.

• At 10:00 AM, Testimony, Fed Chair Janet Yellen, Economic Outlook, Joint Economic Committee, U.S. Congress

• Also at 10:00 AM, Pending Home Sales Index for October. The consensus is for a 1.0% increase in the index.

Zillow Case-Shiller Forecast: More Solid House Price Gains in October

by Calculated Risk on 11/28/2017 04:16:00 PM

The Case-Shiller house price indexes for September were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: Case-Shiller September Results and October Forecast: Underbuilding Continues to Take a Toll

The primary Case-Shiller indices paint a picture of a national housing market that’s largely stable and maybe even a bit boring from 50,000 feet, with home prices growing at roughly the same pace for the past year or more.The year-over-year change for the Case-Shiller National index will be about the same in October as in September. Zillow is forecasting larger year-over-year increases for both the 10-city and 20-city indexes in October.

The U.S. National Index for September showed an annual increase in home prices of 6.2 percent. The month-over-month increase from August was 0.7 percent.

The 10-city composite gained 5.7 percent annually and 0.6 percent from August to September, while the 20-city composite grew 6.2 percent annually and 0.5 percent month-over-month. Seattle, Las Vegas, and San Diego continued to post the largest annual gains among the 20-city composite, climbing 12.9 percent, 9 percent and 8.2 percent, respectively.

But the real action is on the sidelines. Demand is coming first and foremost from buyers in the entry-level and mid-market segments, but available inventory is largely concentrated at the high end – causing the nation’s most affordable homes to grow in value at more than twice the pace of homes at the top of the market. The past two months have shown promising signs of life from builders who have had difficulty meeting intense demand in the face of rising land, lumber and labor prices – but it’s going to take a lot more than two good months to erase a housing deficit accumulated from years of underbuilding.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/28/2017 02:35:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through September 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.