by Calculated Risk on 11/06/2017 06:11:00 PM

Monday, November 06, 2017

Tuesday: Job Openings

From Matthew Graham at Mortgage News Daily: Mortgage Rates Drift Calmly Down to 3-Week Lows

Mortgage rates continued lower today, despite a blatant lack of underlying motivation in financial markets. By that, I mean that we haven't seen any obvious cause and effect relationships between news, economic data, and bond market movements (which, in turn, drive interest rate movements). Instead, bonds moved of their own volition. While the move was modest, it was the 6th improvement in the past 7 business days. The net effect is the best mortgage rate offerings in 3 weeks.Tuesday:

Several of the more aggressive lenders are again quoting top tier 30yr fixed rates of 3.875% while many remain at 4.0%.

• At 10:00 AM ET, Job Openings and Labor Turnover Survey for September from the BLS.

• Also at 10:00 AM, Corelogic House Price index for September.

• At 2:30 PM, Speech by Fed Chair Janet Yellen, Acceptance Remarks, At the presentation of the Paul H. Douglas Award for Ethics in Government, Washington, D.C.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.4 billion in September.

NAHB: Builder Confidence decreases for the 55+ Housing Market in Q3

by Calculated Risk on 11/06/2017 01:35:00 PM

This is a quarterly index that was released last week by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: 55+ Housing Builders and Developers Stay Confident in Third Quarter

Builder confidence in the single-family 55+ housing market continued to be positive in the third quarter of 2017, according to the National Association of Home Builders (NAHB) 55+ Housing Market Index (HMI), released [last week].

While the index measuring builder confidence in the single-family 55+ market dropped from a reading of 66 in the second quarter to 59 this quarter, it’s the 14th quarter in a row in which the reading was above 50, the break-even point at which more respondents see conditions as good than poor.

The effects of destructive hurricanes and a series of wildfires earlier this fall are likely reflected in this quarter’s survey, which was conducted in September, said Dennis Cunningham, chairman of NAHB’s 55+ Housing Industry Council and president of ActiveWest Builders in Coeur d’Alene, Idaho.

“However, this is a temporary effect. Overall confidence remains high and builders continue to be optimistic about the 55+ market in the long run.”

...

“The decline in the 55+ single-family HMI is consistent with slight softening of other measures of single-family construction seen recently, driven by the effect of the natural disasters on top of ongoing issues with the supply of labor, lots and some building materials,” said NAHB Chief Economist Robert Dietz. “However, market conditions on balance remain favorable, and we expect gradual continued growth in the 55+ housing sector.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q3 2017. And reading above 50 indicates that more builders view conditions as good than as poor. The index decreased to 59 in Q3 down from 66 in Q2.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 11/06/2017 10:55:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through October 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 25% from a year ago, and CME futures are up about 45% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

It looks like we will see record prices in 2018.

Hotel Occupancy Rate increases YoY, On Pace for Record Year

by Calculated Risk on 11/06/2017 08:35:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 28 October

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 22-28 October 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 23-29 October 2016, the industry recorded the following:

• Occupancy: +4.0% to 69.8%

• Average daily rate (ADR): +2.6% to US$129.44

• Revenue per available room (RevPAR): +6.7% to US$90.32

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+34.9% to 85.9%), ADR (+14.0% to US$120.89) and RevPAR (+53.8% to US$103.82). Post-Hurricane Harvey demand continues to drive performance levels in the market.

Tampa/St. Petersburg, Florida, experienced the second-highest increase in occupancy (+13.4% to 77.7%) and the second-largest rise in RevPAR (+23.9% to US$94.42).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will probably push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Sunday, November 05, 2017

Sunday Night Futures

by Calculated Risk on 11/05/2017 08:06:00 PM

Something to watch: What is happening in Saudi Arabia?

Weekend:

• Schedule for Week of Nov 5, 2017

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were up over the last week with WTI futures at $55.82 per barrel and Brent at $62.27 per barrel. A year ago, WTI was at $44, and Brent was at $43 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.53 per gallon. A year ago prices were at $2.22 per gallon - so gasoline prices are up 31 cents per gallon year-over-year.

AAR: Rail Carloads decreased Slightly, Intermodal at Record Levels, in October

by Calculated Risk on 11/05/2017 08:19:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

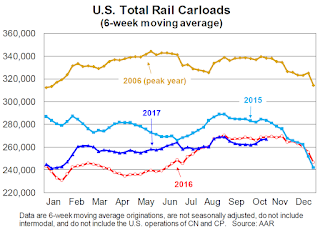

If you care about total U.S. rail carloads, October 2017 was not a particularly good month — total carloads were down 0.1%, or 1,220 carloads, from October 2016. Average weekly total carloads in October 2017 (266,444) were the lowest for October since sometime before 1988 when our records begin. Three main reasons for October’s decline? Coal (down 4.9%, or 17,764 carloads); grain (down 11.8%, or 12,528 carloads); and petroleum products (down 4.9%, or 1,989 carloads). But if you care about rail carloads as a gauge for the health of the U.S. economy, October 2017 was actually pretty good. That’s because carloads of coal, grain, and petroleum products tend to rise and fall for reasons that have little to do with the state of the economy. If you exclude them, U.S. rail carloads in October 2017 were up 5.6%, or 31,061 carloads, over October 2016. That’s the biggest such increase since January 2015 and supports the view that the economy has picked up steam lately. The fact that October 2017 was the best month in history for intermodal (in terms of average weekly container and trailer volume) is another good sign.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,065,777 carloads in October 2017, down 0.1%, or 1,220 carloads, from October 2016. Total carloads averaged 266,444 per week in October 2017, the lowest weekly average for October since sometime prior to 1988, when our data begin. October saw the fourth straight year-over-year monthly decline for total carloads.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):U.S. railroads originated 1.14 million containers and trailers in October 2017, up 6.4%, or 68,328 units, over October 2016. Average weekly volume in October 2017 of 286,039 intermodal units was the most in history, ahead of August 2017 (280,216) and June 2015 (279,285). In week 42, the third week of October, intermodal volume was 291,046 units, the highest single week in U.S. rail history.

Saturday, November 04, 2017

Schedule for Week of Nov 5, 2017

by Calculated Risk on 11/04/2017 08:11:00 AM

This will be a light week for economic data.

No economic releases scheduled.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM ET: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in August to 6.082 million from 6.140 in July.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 2% year-over-year.

10:00 AM: Corelogic House Price index for September.

2:30 PM: Speech by Fed Chair Janet Yellen, Acceptance Remarks, At the presentation of the Paul H. Douglas Award for Ethics in Government, Washington, D.C.

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.4 billion in September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 232 thousand initial claims, up from 229 thousand the previous week.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 100.0, down from 100.7 in October.

Friday, November 03, 2017

Oil Rigs "Rigs counts were off this week"

by Calculated Risk on 11/03/2017 06:43:00 PM

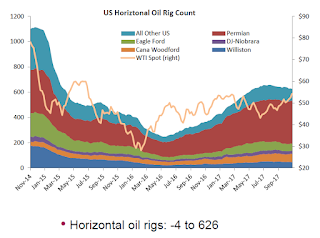

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Nov 3, 2017:

• Rigs counts were off this week

• Total US oil rigs were down, -8 to 729

• Horizontal oil rigs fell, -4 to 626, the lowest since May

...

• Oil rigs will begin to see a marked recovery heading into December

• The gap between Brent and WTI continues above $6 / barrel, with WTI now at $55 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 11/03/2017 03:23:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just nine months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,510,000 under President G.H.W. Bush (light purple), and 11,756,000 under President Obama (dark blue).

During the first nine months of Mr. Trump's term, the economy has added 1,419,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first nine months of Mr. Trump's term, the economy has added 50,000 public sector jobs.

After nine months of Mr. Trump's presidency, the economy has added 1,469,000 jobs, about 406,000 behind the projection.

Earlier: ISM Non-Manufacturing Index increased to 60.1% in October

by Calculated Risk on 11/03/2017 01:03:00 PM

Earlier: The October ISM Non-manufacturing index was at 60.1%, up from 59.8% in September. The employment index increased in October to 57.5%, from 56.8%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: October 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in October for the 94th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 60.1 percent, which is 0.3 percentage point higher than the September reading of 59.8 percent. This represents continued growth in the non-manufacturing sector at a slightly faster rate. This is the highest NMI® reading since the index’s debut in 2008. The highest reading among pre-2008 composite index calculations is 61.3 percent in August 2005. The Non-Manufacturing Business Activity Index increased to 62.2 percent, 0.9 percentage point higher than the September reading of 61.3 percent, reflecting growth for the 99th consecutive month, at a slightly faster rate in October. The New Orders Index registered 62.8 percent, 0.2 percentage point lower than the reading of 63 percent in September. The Employment Index increased 0.7 percentage point in October to 57.5 percent from the September reading of 56.8 percent. The Prices Index decreased by 3.6 percentage points from the September reading of 66.3 percent to 62.7 percent, indicating prices increased in October for the fifth consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The non-manufacturing sector has reflected the third consecutive month of strong growth. Respondent comments continue to indicate a positive outlook for business conditions, and the economy as we begin the fourth quarter."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests faster expansion in October than in September.