by Calculated Risk on 8/25/2017 01:41:00 PM

Friday, August 25, 2017

Vehicle Sales Forecast: Sixth consecutive month below 17 million SAAR

The automakers will report July vehicle sales on Friday, September 1st.

Note: There were 27 selling days in August 2017, there were 26 in August 2016.

From WardsAuto: Forecast: U.S. Auto Market Continues Downward Trend in August

A WardsAuto forecast calls for U.S. automakers to deliver 1.51 million light vehicles in August. ... The report puts the seasonally adjusted annual rate of sales for August at 16.5 million units, below the 17.1 million SAAR in same-month 2016 and 16.7 million in prior-month 2017.Overall sales through July are down about 3% from the record level in 2016.

...

Light-vehicle inventory stood at 3.86 million units at the end of July, up 9.4% from year-ago and about 15% higher than necessary with current sales rates. The streak of record-high stock is expected to continue with 3.8 million units at the end of August, 7.5% greater than same-month 2016. This will leave automakers with a 69 days’ supply, same as prior-month, but well above year-ago’s 62. Slowdowns in production and higher sales incentives through September are expected to narrow the gap between supply and demand.

emphasis added

Freddie Mac: Mortgage Serious Delinquency rate unchanged in July

by Calculated Risk on 8/25/2017 11:30:00 AM

Freddie Mac reported that the Single-Family serious delinquency rate in July was at 0.85%, unchanged from 0.85% in June. Freddie's rate is down from 1.08% in July 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This ties last month as the lowest serious delinquency rate since April 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still generally declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for July soon.

Yellen: "Financial Stability a Decade after the Onset of the Crisis"

by Calculated Risk on 8/25/2017 10:08:00 AM

From Fed Chair Janet Yellen: Financial Stability a Decade after the Onset of the Crisis. A few excerpts (here Dr. Yellen argues for keeping most of existing regulations put in place after the financial crisis):

Is This Safer System Supporting Growth?

I suspect many in this audience would agree with the narrative of my remarks so far: The events of the crisis demanded action, needed reforms were implemented, and these reforms have made the system safer. Now--a decade from the onset of the crisis and nearly seven years since the passage of the Dodd-Frank Act and international agreement on the key banking reforms--a new question is being asked: Have reforms gone too far, resulting in a financial system that is too burdened to support prudent risk-taking and economic growth?

The Federal Reserve is committed individually, and in coordination with other U.S. government agencies through forums such as the FSOC and internationally through bodies such as the Basel Committee on Banking Supervision and the FSB, to evaluating the effects of financial market regulations and considering appropriate adjustments. Furthermore, the Federal Reserve has independently taken steps to evaluate potential adjustments to its regulatory and supervisory practices. For example, the Federal Reserve initiated a review of its stress tests following the 2015 cycle, and this review suggested changes to reduce the burden on participating institutions, especially smaller institutions, and to better align the supervisory stress tests with regulatory capital requirements. In addition, a broader set of changes to the new financial regulatory framework may deserve consideration. Such changes include adjustments that may simplify regulations applying to small and medium-sized banks and enhance resolution planning.

More broadly, we continue to monitor economic conditions, and to review and conduct research, to better understand the effect of regulatory reforms and possible implications for regulation. I will briefly summarize the current state of play in two areas: the effect of regulation on credit availability and on changes in market liquidity.

The effects of capital regulation on credit availability have been investigated extensively. Some studies suggest that higher capital weighs on banks' lending, while others suggest that higher capital supports lending. Such conflicting results in academic research are not altogether surprising. It is difficult to identify the effects of regulatory capital requirements on lending because material changes to capital requirements are rare and are often precipitated, as in the recent case, by financial crises that also have large effects on lending.

Given the uncertainty regarding the effect of capital regulation on lending, rulemakings of the Federal Reserve and other agencies were informed by analyses that balanced the possible stability gains from greater loss-absorbing capacity against the possible adverse effects on lending and economic growth. This ex ante assessment pointed to sizable net benefits to economic growth from higher capital standards--and subsequent research supports this assessment. The steps to improve the capital positions of banks promptly and significantly following the crisis, beginning with the 2009 Supervisory Capital Assessment Program, have resulted in a return of lending growth and profitability among U.S. banks more quickly than among their global peers.

While material adverse effects of capital regulation on broad measures of lending are not readily apparent, credit may be less available to some borrowers, especially homebuyers with less-than-perfect credit histories and, perhaps, small businesses. In retrospect, mortgage borrowing was clearly too easy for some households in the mid-2000s, resulting in debt burdens that were unsustainable and ultimately damaging to the financial system. Currently, many factors are likely affecting mortgage lending, including changes in market perceptions of the risk associated with mortgage lending; changes in practices at the government-sponsored enterprises and the Federal Housing Administration; changes in technology that may be contributing to entry by nonbank lenders; changes in consumer protection regulations; and, perhaps to a limited degree, changes in capital and liquidity regulations within the banking sector. These issues are complex and interact with a broader set of challenges related to the domestic housing finance system.

Credit appears broadly available to small businesses with solid credit histories, although indicators point to some difficulties facing firms with weak credit scores and insufficient credit histories. Small business formation is critical to economic dynamism and growth. Smaller firms rely disproportionately on lending from smaller banks, and the Federal Reserve has been taking steps and examining additional steps to reduce unnecessary complexity in regulations affecting smaller banks.

Finally, many financial market participants have expressed concerns about the ability to transact in volume at low cost--that is, about market liquidity, particularly in certain fixed-income markets such as that for corporate bonds. Market liquidity for corporate bonds remains robust overall, and the healthy condition of the market is apparent in low bid-ask spreads and the large volume of corporate bond issuance in recent years. That said, liquidity conditions are clearly evolving. Large dealers appear to devote less of their balance sheets to holding inventories of securities to facilitate trades and instead increasingly facilitate trades by directly matching buyers and sellers. In addition, algorithmic traders and institutional investors are a larger presence in various markets than previously, and the willingness of these institutions to support liquidity in stressful conditions is uncertain. While no single factor appears to be the predominant cause of the evolution of market liquidity, some regulations may be affecting market liquidity somewhat. There may be benefits to simplifying aspects of the Volcker rule, which limits proprietary trading by banking firms, and to reviewing the interaction of the enhanced supplementary leverage ratio with risk-based capital requirements. At the same time, the new regulatory framework overall has made dealers more resilient to shocks, and, in the past, distress at dealers following adverse shocks has been an important factor driving market illiquidity. As a result, any adjustments to the regulatory framework should be modest and preserve the increase in resilience at large dealers and banks associated with the reforms put in place in recent years.

emphasis added

Thursday, August 24, 2017

Friday: Durable Goods, Jackson Hole Symposium, Yellen Speech

by Calculated Risk on 8/24/2017 08:46:00 PM

Here is the program for the 2017 Jackson Hole Economic Symposium, "Fostering a Dynamic Global Economy.

Friday:

• At 8:30 AM ET, Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.7% decrease in durable goods orders.

• At 10:00 AM ET, Speech by Fed Chair Janet L. Yellen, Financial Stability, At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

• At 3:00 PM ET, Mario Draghi Luncheon Address, President, European Central Bank at Jackson Hole.

Black Knight: Foreclosure inventory below 400,000 for the first time since February 2007

by Calculated Risk on 8/24/2017 04:20:00 PM

CR Note: The month-to-month increase in delinquencies is mostly seasonal (happens every July).

From Black Knight: Black Knight Financial Services’ First Look at July 2017 Mortgage Data

• Foreclosure inventory fell by 12,000 in July, bringing the total below 400,000 for the first time since February 2007According to Black Knight's First Look report for July, the percent of loans delinquent increased 2.8% in July compared to June, and declined 13.5% year-over-year.

• Active foreclosure inventory has declined by 28 percent (more than 150,000) over the past 12 months

• July’s 53,300 foreclosure starts mark the second lowest (next to April 2017) monthly volume since the start of 2005

• Early-stage mortgage delinquencies experienced a slight seasonal uptick in July

The percent of loans in the foreclosure process declined 3.0% in July and were down 28.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.90% in July, up from 3.80% in June.

The percent of loans in the foreclosure process declined in July to 0.78%.

The number of delinquent properties, but not in foreclosure, is down 300,000 properties year-over-year, and the number of properties in the foreclosure process is down 152,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| July 2017 | June 2017 | July 2016 | July 2015 | |

| Delinquent | 3.90% | 3.80% | 4.51% | 4.71% |

| In Foreclosure | 0.78% | 0.82% | 1.09% | 1.40% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,986,000 | 1,932,000 | 2,286,000 | 2,389,000 |

| Number of properties in foreclosure pre-sale inventory: | 398,000 | 410,000 | 550,000 | 711,000 |

| Total Properties | 2,384,000 | 2,342,000 | 2,836,000 | 3,100,000 |

A Few Comments on July Existing Home Sales

by Calculated Risk on 8/24/2017 02:20:00 PM

Earlier: NAR: "Existing-Home Sales Slide 1.3 Percent in July"

First, as usual, housing economist Tom Lawler's estimate was much closer to the NAR report than the consensus. So the decline in sales in July was no surprise for CR readers.

Inventory is still very low and falling year-over-year (down 9.0% year-over-year in July). Inventory has declined year-over-year for 26 consecutive months. I started the year expecting inventory would be increasing year-over-year by the end of 2017. That now seems unlikely.

Inventory is a key metric to watch. More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

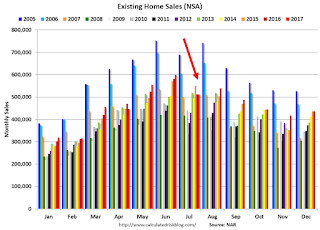

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in July (red column) were the same as July 2016. (NSA).

Note that sales NSA are now in the seasonally strong period (March through September).

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

MBA: Mortgage Delinquency Rate in Q2 at Lowest Level Since 2000

by Calculated Risk on 8/24/2017 11:30:00 AM

From the MBA: Delinquencies and Foreclosures Continue to Decline in Q2 2017

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.24 percent of all loans outstanding at the end of the second quarter of 2017. The delinquency rate was down 47 basis points from the previous quarter, and was 42 basis points lower than one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.

The percentage of loans on which foreclosure actions were started during the second quarter was 0.26 percent, a decrease of four basis points from the previous quarter, and six basis points lower than one year ago.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 1.29 percent, down 10 basis points from the previous quarter and 35 basis points lower than one year ago.

The serious delinquency rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.49 percent in the second quarter, down 27 basis points from the previous quarter and 62 basis points lower than one year ago.

Mortgage delinquencies decreased in the second quarter of 2017 across all loan types - conventional, FHA and VA - on a seasonally-adjusted basis. The conventional delinquency rate dropped to 3.47 percent from 4.04 percent in the first quarter, reaching its lowest level since 2005. The FHA delinquency rate decreased to 7.94 percent from 8.09 percent in the first quarter, reaching its lowest level since 1996. The VA delinquency rate dropped to 3.72 percent from 3.90 percent in the first quarter, reaching its lowest level since 1979.

Marina Walsh, MBA's Vice President of Industry Analysis, offered the following commentary on the survey results:

"In the second quarter of 2017, the overall delinquency rate was at its lowest level since the second quarter of 2000. The foreclosure inventory rate was at its lowest level since the first quarter of 2007. In addition, the seriously delinquent rate, which combines loans that are 90 days or more past due with those loans in the process of foreclosure, dropped to a ten-year low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

Note that the overall delinquency rate is the lowest since 2000.

The percent of loans 30 and 60 days delinquent decreased in Q2, and is below the normal historical level.

The 90 day bucket decreased in Q2, but remains a little elevated.

The percent of loans in the foreclosure process continues to decline, and is close to normal levels.

Kansas City Fed: Regional Manufacturing Activity "Expanded Moderately" in August

by Calculated Risk on 8/24/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Moderately

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded at a faster pace and expectations remained solid.The Kansas City region was hit hard by the sharp decline in oil prices, but activity started expanding last year when oil prices increased. Now growth is moderate with oil prices mostly moving sideways.

“Factories reported acceleration in activity in August to the fastest pace since March,” said Wilkerson. “Many firms also reported plans to raise finished goods prices in coming months.”

...

The month-over-month composite index was 16 in [August], up from 10 in July and 11 in June. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased solidly at durable goods plants, particularly for electronics, metals, and aircraft products, while nondurable goods activity rose more modestly. Most month-over-month indexes increased over the previous month. The production index jumped from 4 to 22, and shipments, new orders, and order backlog indexes rebounded strongly after falling last month. The employment index has remained basically unchanged for the past three months, while the new orders for exports index edged higher. The finished goods inventory index fell from 7 to 2, while the raw materials inventory index was unchanged.

emphasis added

NAR: "Existing-Home Sales Slide 1.3 Percent in July"

by Calculated Risk on 8/24/2017 10:13:00 AM

From the NAR: Existing-Home Sales Slide 1.3 Percent in July

Listings in July typically went under contract in under 30 days for the fourth consecutive month because of high buyer demand, but existing-home sales ultimately pulled back as large declines in the Northeast and Midwest outweighed sales increases in the South and West, according to the National Association of Realtors®.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 1.3 percent to a seasonally adjusted annual rate of 5.44 million in July from a downwardly revised 5.51 million in June. July’s sales pace is still 2.1 percent above a year ago, but is the lowest of 2017.

...

Total housing inventory at the end of July declined 1.0 percent to 1.92 million existing homes available for sale, and is now 9.0 percent lower than a year ago (2.11 million) and has fallen year-over-year for 26 consecutive months. Unsold inventory is at a 4.2-month supply at the current sales pace, which is down from 4.8 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July (5.44 million SAAR) were 1.3% lower than last month, and were 2.1% above the July 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.92 million in July from 1.94 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.92 million in July from 1.94 million in June. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 9.0% year-over-year in July compared to July 2016.

Inventory decreased 9.0% year-over-year in July compared to July 2016. Months of supply was at 4.2 months in July.

As expected, sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 8/24/2017 08:32:00 AM

The DOL reported:

In the week ending August 19, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 2,000 from the previous week's unrevised level of 232,000. The 4-week moving average was 237,750, a decrease of 2,750 from the previous week's unrevised average of 240,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 237,750.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.