by Calculated Risk on 8/01/2017 02:47:00 PM

Tuesday, August 01, 2017

U.S. Light Vehicle Sales at 16.76 million annual rate in July

Based on an estimate from WardsAuto, light vehicle sales were at a 16.76 million SAAR in July.

That is down 6% from July 2016, and up 1% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 16.76 million SAAR mostly from WardsAuto).

This was close to the consensus forecast of 16.8 million for July.

After two consecutive years of record sales, vehicle sales will be down in 2017.

Note: dashed line is current estimated sales rate.

Construction Spending decreased in June

by Calculated Risk on 8/01/2017 11:57:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased in June:

Construction spending during June 2017 was estimated at a seasonally adjusted annual rate of $1,205.8 billion, 1.3 percent below the revised May estimate of $1,221.6 billion. The June figure is 1.6 percent above the June 2016 estimate of $1,186.4 billion.Private and public spending both decreased in June:

Spending on private construction was at a seasonally adjusted annual rate of $940.7 billion, 0.1 percent below the revised May estimate of $941.3 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $265.1 billion, 5.4 percent below the revised May estimate of $280.3 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 26% below the bubble peak.

Non-residential spending is now 6% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 19% below the peak in March 2009, and only slightly above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 9%. Non-residential spending is up 1% year-over-year. Public spending is down 9% year-over-year.

This was well below the consensus forecast of a 0.5% increase for June, and spending for previous months were revised down. A weak report.

ISM Manufacturing index decreased to 56.3 in July

by Calculated Risk on 8/01/2017 10:06:00 AM

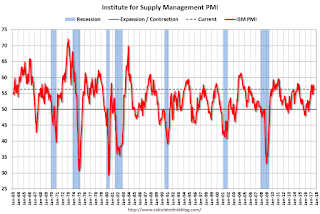

The ISM manufacturing index indicated expansion in July. The PMI was at 56.3% in July, down from 57.8% in June. The employment index was at 55.2%, down from 57.2% last month, and the new orders index was at 60.4%, down from 63.5%.

From the Institute for Supply Management: July 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July, and the overall economy grew for the 98th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The July PMI® registered 56.3 percent, a decrease of 1.5 percentage points from the June reading of 57.8 percent. The New Orders Index registered 60.4 percent, a decrease of 3.1 percentage points from the June reading of 63.5 percent. The Production Index registered 60.6 percent, a 1.8 percentage point decrease compared to the June reading of 62.4 percent. The Employment Index registered 55.2 percent, a decrease of 2 percentage points from the June reading of 57.2 percent. The Supplier Deliveries Index registered 55.4 percent, a 1.6 percentage point decrease from the June reading of 57 percent. The Inventories Index registered 50 percent, an increase of 1 percentage point from the June reading of 49 percent. The Prices Index registered 62 percent in July, an increase of 7 percentage points from the June reading of 55 percent, indicating higher raw materials prices for the 17th consecutive month, with a faster rate of increase in July compared with June. Comments from the panel generally reflect expanding business conditions, with new orders, production, employment, backlog and exports all growing in July compared to June, as well as supplier deliveries slowing (improving) and inventories unchanged during the period."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly below expectations of 56.4%, and suggests manufacturing expanded at a slower pace in July than in June.

Still a solid report.

Personal Income decreased slightly in June, Spending increased less than 0.1%

by Calculated Risk on 8/01/2017 09:29:00 AM

The BEA released the Personal Income and Outlays report for June:

Personal income decreased $3.5 billion (less than -0.1 percent) in June according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) decreased $4.2 billion (less than -0.1 percent) and personal consumption expenditures (PCE) increased $8.1 billion (0.1 percent).The June PCE price index increased 1.4 percent year-over-year and the June PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

...

Real PCE increased less than 0.1 percent. The PCE price index increased less than 0.1 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through June 2017 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was below expectations, and the increase in PCE was close to expectations.

Monday, July 31, 2017

Tuesday: Personal Income, ISM Mfg, Construction Spending, Vehicle Sales

by Calculated Risk on 7/31/2017 09:08:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Modestly Lower Despite Flat Markets

Mortgage rates moved modestly lower today, despite an absence of improvement in underlying bond markets. ... The coming days bring increasingly important economic reports. These have the power to create more market movement than we saw at the end of last week and thus, a bigger change in mortgage rates, for better or worse. For now, things have been holding exceptionally steady with an average top tier 30yr fixed rate of 4.0%.Tuesday:

• At 8:30 AM ET, Personal Income and Outlays for June. The consensus is for a 0.4% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 56.4, down from 57.8 in June. The ISM manufacturing index indicated expansion at 57.8% in June. The employment index was at 57.2%, and the new orders index was at 63.5%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for July. The consensus is for light vehicle sales to be 16.8 million SAAR in July, up from 16.5 million in June (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since December 2007

by Calculated Risk on 7/31/2017 04:58:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.01% in June, from 1.04% in May. The serious delinquency rate is down from 1.32% in June 2016.

This is the lowest serious delinquency rate since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is somewhat under 1%.

The Fannie Mae serious delinquency rate has fallen 0.31 percentage points over the last year, and at that rate of improvement, the serious delinquency rate should be below 1% next month.

Note: Freddie Mac reported earlier.

Earlier: Chicago PMI decreased in July

by Calculated Risk on 7/31/2017 01:26:00 PM

Earlier from the Chicago PMI: July Chicago Business Barometer at 58.9 vs 65.7 in June

The MNI Chicago Business Barometer fell to 58.9 in July from 65.7 in June, the lowest level in three months.This was below the consensus forecast of 62.0, but still a solid reading.

...

“MNI’s July Chicago Business Barometer should be viewed in the context of the underlying, upward trend in business sentiment witnessed since early 2016. Key indicators, despite reversing their June reading, remain above their respective averages set over the last twelve months, and point towards robust confidence among U.S firms,” said Jamie Satchi, Economist at MNI Indicators.

emphasis added

Dallas Fed: "Texas Manufacturing Activity Strengthens" in July

by Calculated Risk on 7/31/2017 10:41:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens, Outlooks Improve

Texas factory activity increased again in July, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose 11 points to 22.8, indicating output grew at a faster pace than in June.This was the last of the regional Fed surveys for July.

Other measures of current manufacturing activity also indicated a pickup in growth. The new orders and the growth rate of orders indexes rose several points each, coming in at 16.1 and 12.2, respectively. The capacity utilization index moved up to 18.1 and the shipments index increased three points to 11.6.

Perceptions of broader business conditions improved again in July, with a sharp pickup in outlooks. The general business activity index edged up to 16.8, marking a 10th consecutive positive reading. The company outlook index jumped 15 points to 25.9, reaching its highest level since 2010.

Labor market measures indicated slightly stronger employment gains and longer workweeks this month. The employment index has been positive all year and edged up to 11.2, its highest reading since the end of 2015. Twenty-one percent of firms noted net hiring, compared with 9 percent noting net layoffs. The hours worked index ticked up to 9.8.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

Based on these regional surveys, it seems likely the ISM manufacturing index will decrease in July compared to June (to be released tomorrow, August 1st). The consensus is for the ISM index to decrease to 56.4 in July from 57.8 in June.

NAR: Pending Home Sales Index increased 1.5% in June, up 0.5% year-over-year

by Calculated Risk on 7/31/2017 10:03:00 AM

From the NAR: Pending Home Sales Recover in June, Grow 1.5 Percent

After declining for three straight months, pending home sales reversed course in June as all major regions, except for the Midwest, saw an increase in contract activity, according to the National Association of Realtors®.This was above expectations of a 0.9% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 1.5 percent to 110.2 in June from an upwardly revised 108.6 in May. At 0.5 percent, the index last month increased annually for the first time since March.

...

The PHSI in the Northeast inched forward 0.7 percent to 98.0 in June, and is now 2.9 percent above a year ago. In the Midwest the index decreased 0.5 percent to 104.0 in June, and is now 3.4 percent lower than June 2016.

Pending home sales in the South rose 2.1 percent to an index of 126.0 in June and are now 2.6 percent above last June. The index in the West grew 2.9 percent in June to 101.5, but is still 1.1 percent below a year ago.

emphasis added

Sunday, July 30, 2017

Sunday Night Futures

by Calculated Risk on 7/30/2017 08:04:00 PM

Weekend:

• Schedule for Week of July 30, 2017

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for July. The consensus is for a reading of 62.0, down from 65.7 in June.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.9% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 1, and DOW futures are down 11 (fair value).

Oil prices were up over the last week with WTI futures at $49.95 per barrel and Brent at $52.76 per barrel. A year ago, WTI was at $42, and Brent was at $41 - so oil prices are up about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.31 per gallon - a year ago prices were at $2.14 per gallon - so gasoline prices are up 17 cents per gallon year-over-year.