by Calculated Risk on 7/31/2017 10:03:00 AM

Monday, July 31, 2017

NAR: Pending Home Sales Index increased 1.5% in June, up 0.5% year-over-year

From the NAR: Pending Home Sales Recover in June, Grow 1.5 Percent

After declining for three straight months, pending home sales reversed course in June as all major regions, except for the Midwest, saw an increase in contract activity, according to the National Association of Realtors®.This was above expectations of a 0.9% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in July and August.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, climbed 1.5 percent to 110.2 in June from an upwardly revised 108.6 in May. At 0.5 percent, the index last month increased annually for the first time since March.

...

The PHSI in the Northeast inched forward 0.7 percent to 98.0 in June, and is now 2.9 percent above a year ago. In the Midwest the index decreased 0.5 percent to 104.0 in June, and is now 3.4 percent lower than June 2016.

Pending home sales in the South rose 2.1 percent to an index of 126.0 in June and are now 2.6 percent above last June. The index in the West grew 2.9 percent in June to 101.5, but is still 1.1 percent below a year ago.

emphasis added

Sunday, July 30, 2017

Sunday Night Futures

by Calculated Risk on 7/30/2017 08:04:00 PM

Weekend:

• Schedule for Week of July 30, 2017

Monday:

• At 9:45 AM ET, Chicago Purchasing Managers Index for July. The consensus is for a reading of 62.0, down from 65.7 in June.

• At 10:00 AM, Pending Home Sales Index for May. The consensus is for a 0.9% increase in the index.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for July.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are down 1, and DOW futures are down 11 (fair value).

Oil prices were up over the last week with WTI futures at $49.95 per barrel and Brent at $52.76 per barrel. A year ago, WTI was at $42, and Brent was at $41 - so oil prices are up about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.31 per gallon - a year ago prices were at $2.14 per gallon - so gasoline prices are up 17 cents per gallon year-over-year.

July 2017: Unofficial Problem Bank list declines to 134 Institutions

by Calculated Risk on 7/30/2017 09:01:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 2017.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2017. It was a quiet month for changes to the list as only three banks were removed that lowered the total count from 137 to 134 institutions. Aggregate assets fell by $2.4 billion to $32.8 billion. A year ago, the list held 196 institutions with assets of $58.9 billion. Actions were terminated against Gibraltar Private Bank & Trust Co., Coral Gables, FL ($1.6 billion); Dieterich Bank, N.A., Dieterich, IL ($617 million); and Washita State Bank, Burns Flat, OK ($114 million).

Saturday, July 29, 2017

Schedule for Week of July 30, 2017

by Calculated Risk on 7/29/2017 08:21:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include the July ISM manufacturing and non-manufacturing indexes, July auto sales, and the June Trade Deficit.

9:45 AM: Chicago Purchasing Managers Index for July. The consensus is for a reading of 62.0, down from 65.7 in June.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.9% increase in the index.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for July.

8:30 AM: Personal Income and Outlays for June. The consensus is for a 0.4% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 56.4, down from 57.8 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 56.4, down from 57.8 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 57.8% in June. The employment index was at 57.2%, and the new orders index was at 63.5%.

10:00 AM: Construction Spending for June. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to be 16.8 million SAAR in July, up from 16.5 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to be 16.8 million SAAR in July, up from 16.5 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 175,000 payroll jobs added in July, up from 158,000 added in June.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 244 thousand initial claims, unchanged from 244 thousand the previous week.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.9 from 57.4 in June.

8:30 AM: Employment Report for July. The consensus is for an increase of 180,000 non-farm payroll jobs added in July, down from the 222,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to decline to 4.3%.

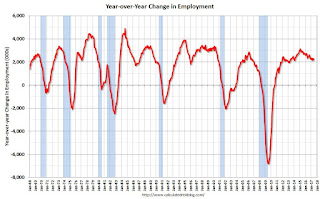

The consensus is for the unemployment rate to decline to 4.3%.This graph shows the year-over-year change in total non-farm employment since 1968.

In June, the year-over-year change was 2.24 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for June from the Census Bureau.

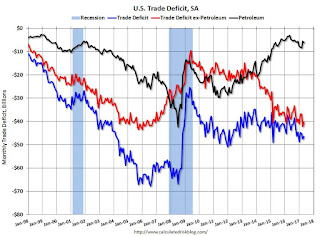

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $44.5 billion in June from $46.5 billion in May.

Friday, July 28, 2017

Oil Rigs "Back in action"

by Calculated Risk on 7/28/2017 05:10:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 28, 2017:

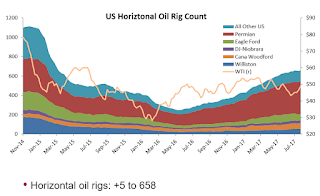

• Total US oil rigs were up 2 to 766

• Horizontal oil rigs were up 5 to 658

...

• With oil prices now over $49, operators are both above breakeven and in a position to hedge future production. Expect a return to rig additions at these prices.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Freddie Mac: Mortgage Serious Delinquency rate declined in June, Lowest since April 2008

by Calculated Risk on 7/28/2017 02:09:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in June was at 0.85%, down from 0.87% in May. Freddie's rate is down from 1.08% in June 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate since April 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Although the rate is still declining, the rate of decline has slowed.

Maybe the rate will decline another 0.2 to 0.3 percentage points or so to a cycle bottom, but this is pretty close to normal.

Note: Fannie Mae will report for June soon.

Q2 GDP: Investment

by Calculated Risk on 7/28/2017 11:12:00 AM

First, the BEA released revisions of GDP data from 2014 through Q1 2017. In general, GDP was revised up slightly, although residential investment was revised down a little. Not a significant change.

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased at a 6.8% annual rate in Q1. Equipment investment increased at a 8.2% annual rate, and investment in non-residential structures increased at a 4.9% annual rate.

On a 3 quarter trailing average basis, RI (red), equipment (green), and nonresidential structures (blue) are all positive.

I'll post more on the components of non-residential investment once the supplemental data is released.

I expect investment to be solid going forward, and for the economy to continue to grow.

The second graph shows residential investment as a percent of GDP.

Residential Investment as a percent of GDP decreased in Q2, but has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase for the next few years.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

Still no worries.

BEA: Real GDP increased at 2.6% Annualized Rate in Q2

by Calculated Risk on 7/28/2017 08:35:00 AM

From the BEA: Gross Domestic Product: Second Quarter 2017 (Advance Estimate)

Real gross domestic product increased at an annual rate of 2.6 percent in the second quarter of 2017, according to the "advance" estimate released by the Bureau of Economic Analysis. In the first quarter, real GDP increased 1.2 percent (revised).The advance Q2 GDP report, with 2.6% annualized growth, was at expectations.

...

The increase in real GDP in the second quarter reflected positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, exports, and federal government spending that were partly offset by negative contributions from private residential fixed investment, private inventory investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP growth in the second quarter reflected a smaller decrease in private inventory investment, an acceleration in PCE, and an upturn in federal government spending. These movements were partly offset by a downturn in residential fixed investment and decelerations in exports and in nonresidential fixed investment.

emphasis added

Personal consumption expenditures (PCE) increased at 2.8% annualized rate in Q2, up from 1.9% in Q1. Residential investment (RI) decreased at a 6.8% pace. Equipment investment increased at a 8.2% annualized rate, and investment in non-residential structures increased at a 5.2% pace.

I'll have more later ...

Thursday, July 27, 2017

Friday: GDP

by Calculated Risk on 7/27/2017 07:04:00 PM

From Merrill Lynch:

On balance, [inventory] data added 0.3pp to 2Q GDP tracking, bringing us up to 2.4% heading into tomorrow's advance release.From the Altanta Fed: GDPNow

The final GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2017 is 2.8 percent on July 27, up from 2.5 percent on July 19. The forecast of the contribution of inventory investment to second-quarter growth increased from 0.54 percentage points to 0.82 percentage points after this morning's advance reports on durable manufacturing and wholesale and retail inventories from the U.S. Census Bureau.Friday:

• At 8:30 AM ET, Gross Domestic Product, 2nd quarter 2017 (Advance estimate). The consensus is that real GDP increased 2.6% annualized in Q2, up from 1.4% in Q1.

• At 10:00 AM, University of Michigan's Consumer sentiment index (final for July). The consensus is for a reading of 93.1, unchanged from the preliminary reading 93.1.

Vehicle Sales Forecast: Fifth consecutive month below 17 million SAAR

by Calculated Risk on 7/27/2017 01:45:00 PM

The automakers will report July vehicle sales on Tuesday, August 1st.

Note: There were 26 selling days in July 2017, the same as in July 2016.

From WardsAuto: Forecast: July U.S. LV Sales Fall Behind Year-Ago

A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 16.9 million-unit seasonally adjusted annual rate in July, following June’s 16.4 million SAAR and resulting in a 5-month streak of sub-17 million figures. July’s SAAR would be significantly lower than the 17.8 million recorded in same-month 2016.Overall sales are down about 3% from the record level in 2016.

...

The industry continues to deal with declining sales and rising inventory ... U.S. dealers entered July with ... 73 days’ supply, while a total in the low 60s is considered healthy for this time of year.

emphasis added