by Calculated Risk on 6/08/2017 12:19:00 PM

Thursday, June 08, 2017

Fed's Flow of Funds: Household Net Worth increased in Q1

The Federal Reserve released the Q1 2017 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth increased in Q1 2017 compared to Q4 2016:

The net worth of households and nonprofits rose to $94.8 trillion during the first quarter of 2017. The value of directly and indirectly held corporate equities increased $1.3 trillion and the value of real estate increased $0.5 trillion.Household net worth was at $94.8 trillion in Q1 2017, up from $92.5 trillion in Q4 2016.

The Fed estimated that the value of household real estate increased to $23.5 trillion in Q1. The value of household real estate is now above the bubble peak in early 2006 - but not adjusted for inflation, and this also includes new construction.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is higher than the peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q1 2017, household percent equity (of household real estate) was at 58.3% - up from Q4, and the highest since Q1 2006. This was because of an increase in house prices in Q1 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 58.3% equity - and about 3 million homeowners still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $44 billion in Q1.

Mortgage debt has declined by $1.22 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was up in Q1, and is above the average of the last 30 years (excluding bubble). However, mortgage debt as a percent of GDP, continues to decline.

CoreLogic: "3.1 million Homes were still in negative equity" at end of Q1 2017

by Calculated Risk on 6/08/2017 09:45:00 AM

From CoreLogic: CoreLogic® Reports Nearly 9 Million Borrowers Have Regained Equity Since the Height of the Crisis in 2011

Rising home prices led to improvements in home equity, with 91 thousand residential properties regaining equity in Q1 2017. The number of mortgaged residential properties with equity is now at 48.2 million.On states:

An additional 0.6 million properties would regain equity if home prices rose another 5 percent.

...

CoreLogic® analysis indicates that approximately 3.1 million homes, or 6.1 percent of all residential properties with a mortgage, were still in negative equity at the end of the first quarter of 2017. Negative equity means that a borrower owes more on a home than it is worth. These properties may be referred to as underwater or upside down.

emphasis added

"Nevada [12.4%, down from 17.5% in Q1 2016], Florida [11.1%, down from 15.0%], Illinois [10.5%], New Jersey [10.2%], and Connecticut [9.9%] account for 32.6 percent of negative equity in the United States."Note: The share of negative equity is still high in Nevada and Florida, but down from a year ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q1 2017 compared to Q4 2016.

In Q1 2017, 2.4% of properties had 25% or more negative equity. In Q1 2016, 3.0% had 25% or more negative equity. For reference, about five years ago, in Q3 2012, almost 10% of residential properties had 25% or more negative equity.

A year ago, in Q1 2016, there were 4.1 million properties with negative equity - now there are 3.1 million. A significant change.

Weekly Initial Unemployment Claims decrease to 245,000

by Calculated Risk on 6/08/2017 08:34:00 AM

The DOL reported:

In the week ending June 3, the advance figure for seasonally adjusted initial claims was 245,000, a decrease of 10,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 248,000 to 255,000. The 4-week moving average was 242,000, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 1,750 from 238,000 to 239,750.The previous week was revised up by 7,000.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 242,000.

This was above the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, June 07, 2017

Thursday: Unemployment Claims, Q1 Flow of Funds Report

by Calculated Risk on 6/07/2017 07:53:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, down from 248 thousand the previous week.

• At 10:00 AM, The Q1 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

Prime Working-Age Population near 2007 Peak

by Calculated Risk on 6/07/2017 03:59:00 PM

The prime working age population peaked in 2007, and bottomed at the end of 2012. As of May 2017, there were still fewer people in the 25 to 54 age group than in 2007.

At the beginning of this year - based on demographics - it looked like the prime working age (25 to 54) would probably hit a new peak in 2017.

However, since the beginning of the year, the prime working age population has declined slightly.

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story. Here is a graph of the prime working age population (25 to 54 years old) from 1948 through May 2017.

Note: This is population, not work force.

There was a huge surge in the prime working age population in the '70s, '80s and '90s.

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The good news is the prime working age group should start growing at 0.5% per year - and this should boost economic activity.

Zillow Forecast: "Zillow’s April Case-Shiller forecast expects growth of 5.6 percent in the national index"

by Calculated Risk on 6/07/2017 10:36:00 AM

The Case-Shiller house price indexes for March were released last week. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: April Case-Shiller Forecast: Tapping on the Brakes

Home prices will finally catch a break in April, when Zillow’s April Case-Shiller forecast expects growth of 5.6 percent in the national index, slightly slower than its 5.8 percent year-over-year climb in March. The seasonally adjusted month-over-month pace also is forecast to drop, to 0.2 percent in April following a 0.3 percent climb in March.The year-over-year change for the Case-Shiller National index will probably be smaller in April than in March.

Annual growth in the smaller 10- and 20-city indices — which was flat in March — is expected to accelerate slightly: The 10-city forecast is for a 5.4 percent gain in annual growth for April, following 5.2 percent annual growth in March. The 20-city index is projected to gain 6.1 percent in April, below its 5.9 percent annual gain in March.

The 10-city index is forecast to climb a seasonally adjusted 0.5 percent in April from March, following 0.9 percent monthly growth between February and March. Growth in the 20-city index is expected to slow on a seasonally adjusted, month-over-month basis, rising 0.6 percent in April after a 0.9 percent climb in March.

Zillow’s April Case-Shiller forecast is shown below. These forecasts are based on [last week’s] March Case-Shiller data release and the April 2017 Zillow Home Value Index. The April S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, June 27.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 6/07/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 7.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 2, 2017. This week’s results included an adjustment for the Memorial Day holiday.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 10 percent from one week earlier to its highest level since May 2010. The unadjusted Purchase Index decreased 14 percent compared with the previous week and was 6 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.17 percent, with points decreasing to 0.32 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up 6% year-over-year.

Tuesday, June 06, 2017

30 Year Fixed Mortgage Rates Fall Below 4%

by Calculated Risk on 6/06/2017 05:23:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unexpectedly Fall to 2017 Lows (Again)

Mortgage rates unexpectedly fell to new 7-month lows today, following bond market gains in the overnight hours (Asian and European trading sessions).Here is a table from Mortgage News Daily:

...

The average lender is now quoting conventional 30yr fixed rates in the high 3% range on top tier scenarios. The range is fairly wide between lenders as some were better positioned for these market movements than others. That means the same scenario could see a rate as low as 3.75% at one lender and 4.125% at another with the same closing costs.

It continues to be the case that Thursday's events have the biggest potential to push rates higher or lower.

emphasis added

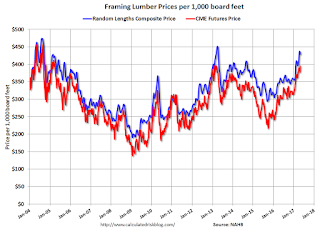

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 6/06/2017 02:43:00 PM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices in 2017 are up solidly year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early June 2017 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 14% from a year ago, and CME futures are up about 17% year-over-year.

BLS: Job Openings "increased to a series high" in April

by Calculated Risk on 6/06/2017 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to a series high of 6.0 million on the last business day of April, the U.S. Bureau of Labor Statistics reported today. Over the month, hires decreased to 5.1 million and separations edged down to 5.0 million. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.1 percent and 1.1 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits edged down to 3.0 million (-111,000) in April.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for April, the most recent employment report was for May.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in April to 6.044 million from 5.785 million in March. Job openings are at a new series high.

The number of job openings (yellow) are up 7% year-over-year.

Quits are up 4 year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another solid report.