by Calculated Risk on 5/05/2017 12:55:00 PM

Friday, May 05, 2017

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the final months of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just two months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,937,000 more private sector jobs at the end of Mr. Obama's first term. At the end of his second term, there were 11,756,000 more private sector jobs than when Mr. Obama initially took office.

During the first three months of Mr. Trump's term, the economy has added 493,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first three months of Mr. Trump's term, the economy has added 29,000 public sector jobs.

After three months, the economy has added 522,000 jobs, about 100,000 behind the projection.

Comment: A Solid Employment Report

by Calculated Risk on 5/05/2017 09:59:00 AM

The headline jobs number was above expectations, however there were combined small downward revisions to the previous two months.

There was plenty of good news - especially with the unemployment rate falling to 4.4% (although the participation rate declined slightly), and U-6 falling to 8.6%. Overall this was a solid report.

Earlier: April Employment Report: 211,000 Jobs, 4.4% Unemployment Rate

In April, the year-over-year change was 2.24 million jobs. Decent job growth.

Average Hourly Earnings

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 2.5% YoY in April.

Wage growth has generally been trending up.

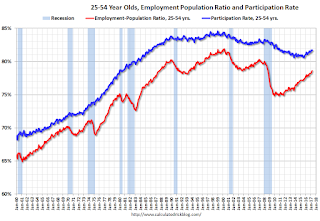

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was unchanged in April at 81.7%, and the 25 to 54 employment population ratio increased to 78.6%.

The participation rate has been trending down for this group since the late '90s, however, with more younger workers (and fewer older workers), the participation rate might move up some more.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 281,000 to 5.3 million in April. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find full-time jobs.The number of persons working part time for economic reasons decreased in April. The number working part time for economic reasons suggests a little slack still in the labor market. This is the lowest level since April 2008.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 8.6% in April. This is the lowest level for U-6 since November 2007.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.63 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 1.69 million in March.

This was the lowest number since June 2008.

This is generally trending down, but still a little elevated.

Although U-6,the number of persons employed part time for economic reasons, and the number of long term unemployed are still a little elevated, it appears the economy is nearing full employment. Overall this was a solid report.

April Employment Report: 211,000 Jobs, 4.4% Unemployment Rate

by Calculated Risk on 5/05/2017 08:43:00 AM

From the BLS:

Total nonfarm payroll employment increased by 211,000 in April, and the unemployment rate was little changed at 4.4 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in leisure and hospitality, health care and social assistance, financial activities, and mining.

...

The change in total nonfarm payroll employment for February was revised up from +219,000 to +232,000, and the change for March was revised down from +98,000 to +79,000. With these revisions, employment gains in February and March combined were 6,000 lower than previously reported.

...

In April, average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $26.19. Over the year, average hourly earnings have risen by 65 cents, or 2.5 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 211 thousand in April (private payrolls increased 194 thousand).

Payrolls for February and March were revised down by a combined 6 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In April, the year-over-year change was 2.24 million jobs. This is a decent year-over-year gain.

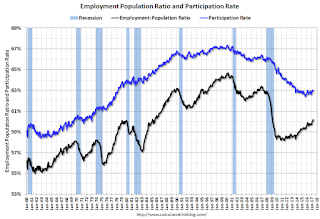

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was decreased in April to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Labor Force Participation Rate was decreased in April to 62.9%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics. The Employment-Population ratio increased to 60.2% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in April to 4.4%.

This was above expectations of 185,000 jobs, however the previous two months were revised down slightly.

I'll have much more later ...

Thursday, May 04, 2017

Friday: Jobs and Wages

by Calculated Risk on 5/04/2017 06:31:00 PM

Earlier:

My April Employment Preview: Mixed Signals

and Goldman: April Employment Preview

Friday:

• At 8:30 AM ET, Employment Report for April. The consensus is for an increase of 185,000 non-farm payroll jobs added in April, up from the 98,000 non-farm payroll jobs added in March. The consensus is for the unemployment rate to increase to 4.6%.

• At 3:00 PM, Consumer credit from the Federal Reserve. The consensus is for a $15.6 billion increase in credit.

Goldman: April Payrolls Preview

by Calculated Risk on 5/04/2017 03:15:00 PM

A few excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls increased by 200k in April, somewhat above consensus of +190k. Our forecast reflects encouraging labor market fundamentals and a favorable swing in the weather, partially offset by slowing job growth in the retail sector.CR Note: My employment preview is here.

We estimate the unemployment rate remained stable at 4.5%, based on our expectation that household employment will hold on to its sharp year-to-date gains. Finally, we expect average hourly earnings to increase 0.3% month over month and 2.7% year over year, reflecting the interaction of firming wage growth with positive calendar effects.

April Employment Preview

by Calculated Risk on 5/04/2017 11:59:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for April. The consensus, according to Bloomberg, is for an increase of 185,000 non-farm payroll jobs in April (with a range of estimates between 150,000 to 225,000), and for the unemployment rate to increase to 4.6%.

The BLS reported 98,000 jobs added in March.

Here is a summary of recent data:

• The ADP employment report showed an increase of 177,000 private sector payroll jobs in April. This was slightly above expectations of 170,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth close to expectations.

• The ISM manufacturing employment index decreased in April to 52.0%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased by about 10,000 in April. The ADP report indicated 11,000 manufacturing jobs added in April.

The ISM non-manufacturing employment index decreased in April to 51.4%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 110,000 in April.

Combined, the ISM indexes suggests employment gains of about 100,000. This suggests employment growth BELOW expectations.

• Initial weekly unemployment claims averaged 243,000 in April, down from 250,000 in March. For the BLS reference week (includes the 12th of the month), initial claims were at 243,000, down from 261,000 during the reference week in March.

The decrease during the reference week suggests fewer layoffs during the reference week in April than in March. This suggests a somewhat stronger employment report in April than in March.

• The final April University of Michigan consumer sentiment index increased slightly to 97.0 from the March reading of 96.9. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and politics.

• Conclusion: None of the indicators alone is very good at predicting the initial BLS employment report. The ADP report suggests a decent report, however the ISM surveys suggest weaker job growth. Weekly unemployment claims suggest slightly stronger job growth. I'll take the under for April.

Trade Deficit declines slightly to $43.7 Billion in March

by Calculated Risk on 5/04/2017 08:51:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.7 billion in March, down $0.1 billion from $43.8 billion in February, revised. March exports were $191.0 billion, $1.7 billion less than February exports. March imports were $234.7 billion, $1.7 billion less than February imports.The first graph shows the monthly U.S. exports and imports in dollars through March 2017.

Click on graph for larger image.

Click on graph for larger image.Imports and exports decreased in March.

Exports are 15% above the pre-recession peak and up 9% compared to March 2016; imports are 1% above the pre-recession peak, and up 7% compared to March 2016.

In general, trade has been picking up, but has declined slightly the last two months.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $46.26 in March, up from $45.25 in February, and up from $27.68 in March 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012. However, recently, the petroleum deficit has been increasing.

The trade deficit with China increased to $24.6 billion in March, from $20.9 billion in March 2016. Some of the increase this year was probably due to the timing of the Chinese New Year. In general the deficit with China has been declining.

Weekly Initial Unemployment Claims decrease to 238,000

by Calculated Risk on 5/04/2017 08:34:00 AM

The DOL reported:

In the week ending April 29, the advance figure for seasonally adjusted initial claims was 238,000, a decrease of 19,000 from the previous week's unrevised level of 257,000. The 4-week moving average was 243,000, an increase of 750 from the previous week's unrevised average of 242,250.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 243,000.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, May 03, 2017

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 5/03/2017 06:40:00 PM

From Merrill Lynch on FOMC announcement:

The FOMC communicated today a lack of concern about the recent slowdown in economic data, describing it as "transitory" while "the fundamentals underpinning the continued growth of consumption remained solid". Not surprisingly then the statement was interpreted as hawkish relative to market expectations, as the Treasury curve bear flattened (10-year Treasury yield was 4bps higher while 30-year was flat) and the dollar appreciated.Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 246 thousand initial claims, down from 257 thousand the previous week.

• Also at 8:30 AM, Trade Balance report for March from the Census Bureau. The consensus is for the U.S. trade deficit to be at $44.5 billion in March from $43.6 billion in February.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for March. The consensus is a 0.4% increase in orders.

FOMC Statement: No Change to Policy, Q1 Weakness "likely to be transitory"

by Calculated Risk on 5/03/2017 02:03:00 PM

As expected ...

FOMC Statement:

Information received since the Federal Open Market Committee met in March indicates that the labor market has continued to strengthen even as growth in economic activity slowed. Job gains were solid, on average, in recent months, and the unemployment rate declined. Household spending rose only modestly, but the fundamentals underpinning the continued growth of consumption remained solid. Business fixed investment firmed. Inflation measured on a 12-month basis recently has been running close to the Committee's 2 percent longer-run objective. Excluding energy and food, consumer prices declined in March and inflation continued to run somewhat below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term. Near-term risks to the economic outlook appear roughly balanced. The Committee continues to closely monitor inflation indicators and global economic and financial developments.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 3/4 to 1 percent. The stance of monetary policy remains accommodative, thereby supporting some further strengthening in labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction, and it anticipates doing so until normalization of the level of the federal funds rate is well under way. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions. Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Patrick Harker; Robert S. Kaplan; Neel Kashkari; and Jerome H. Powell.

emphasis added