by Calculated Risk on 4/05/2017 02:10:00 PM

Wednesday, April 05, 2017

FOMC Minutes: "A change to the Committee's reinvestment policy would likely be appropriate later this year"

From the Fed: Minutes of the Federal Open Market Committee, March 14 - 15, 2017. Excerpts:

Provided that the economy continued to perform about as expected, most participants anticipated that gradual increases in the federal funds rate would continue and judged that a change to the Committee's reinvestment policy would likely be appropriate later this year. Many participants emphasized that reducing the size of the balance sheet should be conducted in a passive and predictable manner. ...

...

When the time comes to implement a change to reinvestment policy, participants generally preferred to phase out or cease reinvestments of both Treasury securities and agency MBS. Policymakers also discussed the potential benefits and costs of approaches that would either phase out or cease all at once reinvestments of principal from these securities. An approach that phased out reinvestments was seen as reducing the risks of triggering financial market volatility or of potentially sending misleading signals about the Committee's policy intentions while only modestly slowing reductions in the Committee's securities holdings. An approach that ended reinvestments all at once, however, was generally viewed as easier to communicate while allowing for somewhat swifter normalization of the size of the balance sheet. To promote rapid normalization of the size and composition of the balance sheet, one participant preferred to set a minimum pace for reductions in MBS holdings and, if and when necessary, to sell MBS to maintain such a pace.

Nearly all participants agreed that the Committee's intentions regarding reinvestment policy should be communicated to the public well in advance of an actual change. It was noted that the Committee would continue its deliberations on reinvestment policy during upcoming meetings and would release additional information as it becomes available. In that context, several participants indicated that, when the Committee announces its plans for a change to its reinvestment policy, it would be desirable to also provide more information to the public about the Committee's expectations for the size and composition of the Federal Reserve's assets and liabilities in the longer run.

emphasis added

Reis: Office Vacancy Rate "steady" in Q1 at 15.8%

by Calculated Risk on 4/05/2017 12:13:00 PM

Reis released their Q1 2017 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged at 15.8% in Q1, from 15.8% in Q4. This is down from 16.0% in Q1 2016, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham: Office Vacancy Holds Steady at 15.8%; Rents Increase 0.5% in the Quarter. Vacancy Increases in 42 U.S. Metros, but only 10 See Effective Rent Decline.

The office market held steady in the first quarter as vacancy was flat at 15.8%, the same as the previous quarter and down from 16.0% a year ago. The vacancy rate has fallen less than 200 basis points from a high of 17.6% in 2010.

The national average asking rent increased 0.5% in the first quarter while effective rents, which net out landlord concessions, increased 0.4%. At $32.13 per square foot, the average rent increased only 1.8% from the first quarter of 2016: this is the slowest annual rate of office rent growth since 2011.

Net absorption was 4.9 million square feet in the first quarter, down from an average net absorption of 9.4 million square feet per quarter in 2016. Construction was also low at 7.9 million square feet, down from an average of 8.8 million square feet in 2016. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 15.8% in Q1. The office vacancy rate is at the lowest level since early 2009, but remains elevated.

Office vacancy data courtesy of Reis.

ISM Non-Manufacturing Index decreased to 55.2% in March

by Calculated Risk on 4/05/2017 10:04:00 AM

The March ISM Non-manufacturing index was at 55.2%, down from 57.6% in February. The employment index decreased in March to 51.6%, from 55.2%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:March 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 87th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 55.2 percent, which is 2.4 percentage points lower than the February reading of 57.6 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 58.9 percent, 4.7 percentage points lower than the February reading of 63.6 percent, reflecting growth for the 92nd consecutive month, at a slower rate in March. The New Orders Index registered 58.9 percent, 2.3 percentage points lower than the reading of 61.2 percent in February. The Employment Index decreased 3.6 percentage points in March to 51.6 percent from the February reading of 55.2 percent. The Prices Index decreased 4.2 percentage points from the February reading of 57.7 percent to 53.5 percent, indicating prices increased for the 12th consecutive month, at a slower rate in March. According to the NMI®, 15 non-manufacturing industries reported growth in March. The sector continues to reflect growth; however, the rate of growth has declined since last month. The majority of respondents’ comments indicate a positive outlook on business conditions and the overall economy. There were several comments about the uncertainty of future government policies on health care, trade and immigration, and the potential impact on business."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in March than in February.

ADP: Private Employment increased 263,000 in March

by Calculated Risk on 4/05/2017 08:15:00 AM

Private sector employment increased by 263,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was well above the consensus forecast for 170,000 private sector jobs added in the ADP report.

...

“The U.S. labor market finished the first quarter on a strong note,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Consumer dependent industries including healthcare, leisure and hospitality, and trade had strong growth during the month.”

Mark Zandi, chief economist of Moody’s Analytics said, “Job growth is off to a strong start in 2017. The gains are broad based but most notable in the goods producing side of the economy including construction, manufacturing and mining.”

The BLS report for March will be released Friday, and the consensus is for 178,000 non-farm payroll jobs added in March.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/05/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 31, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.34 percent from 4.33 percent, with points decreasing to 0.31 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and would not increase significantly unless rates fall sharply.

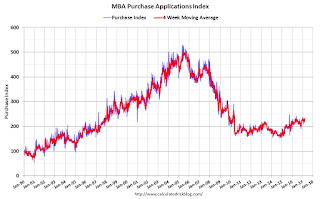

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still up.

However refinance activity has declined significantly since rates increased.

Tuesday, April 04, 2017

Wednesday: ADP Employment, ISM non-Mfg Survey, FOMC Minutes

by Calculated Risk on 4/04/2017 08:52:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in March, down from 298,000 added in February.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 57.0 from 57.6 in February.

• Early: Reis Q1 2017 Office Survey of rents and vacancy rates.

• At 2:00 PM, FOMC Minutes for the Meeting of March 14 - 15, 2017

Annual Vehicle Sales: On Pace for First Decline Since 2009

by Calculated Risk on 4/04/2017 04:08:00 PM

Through March, light vehicle sales are on pace to decline about 2% in 2017 from the record year in 2016.

This would be the first annual decline in auto sales since 2009, but it would still be the fourth best year on record after 2016, 2015, and 2000.

This isn't a huge concern - most likely vehicle sales will move sideways at near record levels. But the economic boost from increasing auto sales is probably over.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2017 are estimate at the pace of the first three months.

Reis: Mall Vacancy Rate mostly unchanged in Q1 2017

by Calculated Risk on 4/04/2017 12:41:00 PM

Reis reported that the vacancy rate for regional malls was 7.9% in Q1 2017, up from 7.8% in Q4, and up from 7.8% in Q1 2016. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 9.9% in Q1, unchanged from Q4, and unchanged from 9.9% in Q1 2016. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Economist Barbara Byrne Denham: Retail Vacancy Holds Steady at 9.9%; Rents Increase 0.3% in the Quarter. Effective rents decline in 19 metros across the U.S. while 25 see vacancy rate increase.

Despite dire reports of store closures in major brands across the country, the overall retail real estate statistics recorded very little change in the quarter as the neighborhood and community shopping center vacancy rate held steady at 9.9%, unchanged from year-end 2016 as well as from the first quarter of 2016. The average national asking rent increased 0.3% in the first quarter while effective rents, which net out landlord concessions, increased 0.4%.

Vacancy stayed flat in the quarter due to very low new retail construction. At 796,000 square feet, construction was the lowest since 2011. Net absorption, or the growth in occupancy, was also low at 1.25 million square feet.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Currently, both the strip mall and regional mall vacancy rates are mostly moving sideways at an elevated level.

Mall vacancy data courtesy of Reis.

CoreLogic: House Prices up 7.0% Year-over-year in February

by Calculated Risk on 4/04/2017 10:01:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 7 Percent in February 2017

Home prices nationwide, including distressed sales, increased year over year by 7 percent in February 2017 compared with February 2016 and increased month over month by 1 percent in February 2017 compared with January 2017, according to the CoreLogic HPI.

...

“Home prices and rents have risen the most in local markets with high demand and limited supply, such as Seattle, Portland and Denver,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The rise in housing costs has been largest for lower-tier-priced homes. For example, from December to February in Seattle, the CoreLogic Home Price Index rose 12 percent and our single-family rent index rose 6 percent for all price tiers compared with the same period a year earlier. However, when looking at only lower-cost homes in Seattle, the price increase was 13 percent and the rent increase was 7 percent.”

“Home prices continue to grow at a torrid pace so far in 2017 and these gains are likely to continue well into the future,” said Frank Martell, president and CEO of CoreLogic. “Home prices are at peak levels in many major markets and the appreciation is being driven by a number of dynamics—high demand, stronger employment, lean supplies and affordability—that will continue to play out in the coming years. The CoreLogic Home Price Index is projecting an additional 5 percent rise in home prices nationally over the next 12 months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0% in February (NSA), and is up 7.0% over the last year.

This index is not seasonally adjusted, and this was another strong month-to-month increase.

The index is still 3.7% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for five consecutive years since turning positive year-over-year in February 2012.

Trade Deficit declines to $43.6 Billion in February

by Calculated Risk on 4/04/2017 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.6 billion in February, down $4.6 billion from $48.2 billion in January, revised. February exports were $192.9 billion, $0.4 billion more than January exports. February imports were $236.4 billion, $4.3 billion less than January imports.The first graph shows the monthly U.S. exports and imports in dollars through February 2017.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in February.

Exports are 16% above the pre-recession peak and up 7% compared to February 2016; imports are 2% above the pre-recession peak, and up 4% compared to February 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.25 in February, up from $43.94 in January, and up from $27.48 in February 2016. The petroleum deficit has generally been declining and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China decreased to $23.0 billion in February, from $28.1 billion in February 2016. Some of the decrease this year was probably due to the timing of the Chinese New Year. In general the deficit with China has been declining.