by Calculated Risk on 4/05/2017 07:00:00 AM

Wednesday, April 05, 2017

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 31, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.34 percent from 4.33 percent, with points decreasing to 0.31 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity remains low - and would not increase significantly unless rates fall sharply.

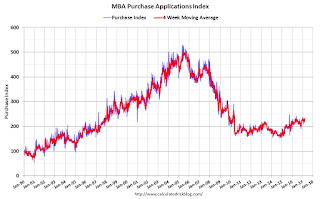

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates over the last few months, purchase activity is still up.

However refinance activity has declined significantly since rates increased.

Tuesday, April 04, 2017

Wednesday: ADP Employment, ISM non-Mfg Survey, FOMC Minutes

by Calculated Risk on 4/04/2017 08:52:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in March, down from 298,000 added in February.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 57.0 from 57.6 in February.

• Early: Reis Q1 2017 Office Survey of rents and vacancy rates.

• At 2:00 PM, FOMC Minutes for the Meeting of March 14 - 15, 2017

Annual Vehicle Sales: On Pace for First Decline Since 2009

by Calculated Risk on 4/04/2017 04:08:00 PM

Through March, light vehicle sales are on pace to decline about 2% in 2017 from the record year in 2016.

This would be the first annual decline in auto sales since 2009, but it would still be the fourth best year on record after 2016, 2015, and 2000.

This isn't a huge concern - most likely vehicle sales will move sideways at near record levels. But the economic boost from increasing auto sales is probably over.

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2017 are estimate at the pace of the first three months.

Reis: Mall Vacancy Rate mostly unchanged in Q1 2017

by Calculated Risk on 4/04/2017 12:41:00 PM

Reis reported that the vacancy rate for regional malls was 7.9% in Q1 2017, up from 7.8% in Q4, and up from 7.8% in Q1 2016. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 9.9% in Q1, unchanged from Q4, and unchanged from 9.9% in Q1 2016. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Economist Barbara Byrne Denham: Retail Vacancy Holds Steady at 9.9%; Rents Increase 0.3% in the Quarter. Effective rents decline in 19 metros across the U.S. while 25 see vacancy rate increase.

Despite dire reports of store closures in major brands across the country, the overall retail real estate statistics recorded very little change in the quarter as the neighborhood and community shopping center vacancy rate held steady at 9.9%, unchanged from year-end 2016 as well as from the first quarter of 2016. The average national asking rent increased 0.3% in the first quarter while effective rents, which net out landlord concessions, increased 0.4%.

Vacancy stayed flat in the quarter due to very low new retail construction. At 796,000 square feet, construction was the lowest since 2011. Net absorption, or the growth in occupancy, was also low at 1.25 million square feet.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Currently, both the strip mall and regional mall vacancy rates are mostly moving sideways at an elevated level.

Mall vacancy data courtesy of Reis.

CoreLogic: House Prices up 7.0% Year-over-year in February

by Calculated Risk on 4/04/2017 10:01:00 AM

Notes: This CoreLogic House Price Index report is for February. The recent Case-Shiller index release was for January. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 7 Percent in February 2017

Home prices nationwide, including distressed sales, increased year over year by 7 percent in February 2017 compared with February 2016 and increased month over month by 1 percent in February 2017 compared with January 2017, according to the CoreLogic HPI.

...

“Home prices and rents have risen the most in local markets with high demand and limited supply, such as Seattle, Portland and Denver,” said Dr. Frank Nothaft, chief economist for CoreLogic. “The rise in housing costs has been largest for lower-tier-priced homes. For example, from December to February in Seattle, the CoreLogic Home Price Index rose 12 percent and our single-family rent index rose 6 percent for all price tiers compared with the same period a year earlier. However, when looking at only lower-cost homes in Seattle, the price increase was 13 percent and the rent increase was 7 percent.”

“Home prices continue to grow at a torrid pace so far in 2017 and these gains are likely to continue well into the future,” said Frank Martell, president and CEO of CoreLogic. “Home prices are at peak levels in many major markets and the appreciation is being driven by a number of dynamics—high demand, stronger employment, lean supplies and affordability—that will continue to play out in the coming years. The CoreLogic Home Price Index is projecting an additional 5 percent rise in home prices nationally over the next 12 months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0% in February (NSA), and is up 7.0% over the last year.

This index is not seasonally adjusted, and this was another strong month-to-month increase.

The index is still 3.7% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for five consecutive years since turning positive year-over-year in February 2012.

Trade Deficit declines to $43.6 Billion in February

by Calculated Risk on 4/04/2017 08:42:00 AM

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $43.6 billion in February, down $4.6 billion from $48.2 billion in January, revised. February exports were $192.9 billion, $0.4 billion more than January exports. February imports were $236.4 billion, $4.3 billion less than January imports.The first graph shows the monthly U.S. exports and imports in dollars through February 2017.

Click on graph for larger image.

Click on graph for larger image.Imports decreased and exports increased in February.

Exports are 16% above the pre-recession peak and up 7% compared to February 2016; imports are 2% above the pre-recession peak, and up 4% compared to February 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.25 in February, up from $43.94 in January, and up from $27.48 in February 2016. The petroleum deficit has generally been declining and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China decreased to $23.0 billion in February, from $28.1 billion in February 2016. Some of the decrease this year was probably due to the timing of the Chinese New Year. In general the deficit with China has been declining.

Monday, April 03, 2017

Lawler: Updated Population Projections = Slower Growth, Less Robust Housing Recovery

by Calculated Risk on 4/03/2017 05:11:00 PM

From housing economist Tom Lawler (note: this is work in process, but here are some initial findings)

In assessing the intermediate and/or long-term outlook for the US economy, housing, entitlement spending, tax revenues, and a host of other variables, a Major input to analysts’ forecasts are projections of the US population – not, of course, just the totals, but the composition of the population, especially by age. Analysts often use “official” Census projections, which include detailed projections by age, gender, and race/ethnicity, to project other key variables such as labor force growth, household formations, tax revenues, etc. Unfortunately, the last official Census population projection available to the public was released in late 2014 (and its “starting point” was the “vintage 2013” population estimate), and since then (1) “actual” population growth has been significantly lower than these projections, and (2) the outlook for population growth has changed drastically. As such, the latest available “official” Census population projections are not very useful to analysts or policymakers, and any economic/housing/other forecasts based on these outdated population projections is of little use as well.

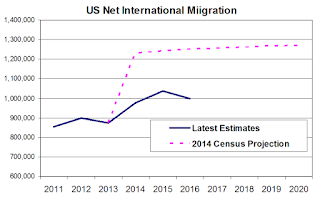

One of the major reasons the 2014 Census population projections are of limited value relates to (1) the “unusually” high projections for net international migration (which were way above the latest estimates for the last few years) ; and (2) the implications of Donald Trump’s election for net international migration over the next several years.

On the first point, in its 2014 population projection Census assumed that net international migration from 2014 to 2016 would average 1.241 million a year, a sizable increase from the annual average of about 876,000 in the previous three years. According to the latest estimates (“vintage 2016,” released late last year), net international migration averaged 1.004 million from 2014 to 2016. (The vintage 2016 estimates incorporated an improved methodology for estimating foreign-born emigration, which reduced previous estimates of net international immigration. (See LEHC, 2/7/2017)). As such, the cumulative net international migration assumption in Census’ 2014 projection for the 2014 to 2016 period was about 710,000 higher than the latest estimate for that period.

On the second point, in the 2014 Census population projections the average annual net international migration assumption from 2017 to 2020 was 1.264 million. With the election of Donald Trump, however, virtually no competent analysts believe that such a projection is plausible. While it is extremely difficult to translate various Trump officials’ statements into actual projections of net international migration, it seems to safe to safe that a “best guess” projection from now through 2020 would be massively lower than the Census 2014 projections.

Another reason (not nearly as important) why one might think that the Census 2014 projections need to be updated related to its assumptions on the number of deaths in the US. In the 2014 projections, the projected number of deaths per year was 2.619 million in 2015 and 2.650 million in 2016. The most recent estimates are than deaths in the US totaled 2.687 million in 2015 and 2.746 million. The 2016 jump surprised and worried many analysts, and folks are still “digging into” the numbers, However, there is good reason to believe that the 2014 Census projection for the number of deaths from 2017 to 2020 (death projections increase each year, mainly reflecting the aging population) are too low.

Finally, the Census 2014 projections for the number of births was 3.999 million in 2015 and 4.027 million in 2016, what the latest estimates for these years are 3.983 million and 3.978 million, respectively. (These differences have virtually no impact on projections of, say, the labor force or the number of households through 2020.)

Below is a table showing Census 2014 projections for 2016 (July 1), compared to the “vintage 2016” estimates.

| July 1, 2016 US Resident Population, Current Estimate vs. Census 2014 Projection | |||

|---|---|---|---|

| Current Estimate | Census 2014 Projection | Difference | |

| Total | 323,127,513 | 323,995,528 | -868,015 |

| 18 Years or older | 249,485,228 | 250,293,421 | -808,193 |

Census has not yet released “vintage 2016” estimates on the detailed characteristics of the population (including more detailed age data, as well as revisions for previous years.) Attempting to estimate the vintage 2016 age distribution of the population is actually quite challenging, because there were downward revisions to previous years, mainly reflecting downward revisions in net international migration. Using Census based assumptions on the age distributions of immigrants, as well as using Census based on assumptions of death rates by age (adjusted to equal newly revised estimates, I have attempted to estimate the “vintage” 2016 population estimates by age. My estimates, compared to Census 2014 projections for 2016, are shown below.

| July 1 2016 US Resident Population by Selected Age Groups (000's) | |||

|---|---|---|---|

| Based on Vintage 2016* | Census 2014 Projections | Difference | |

| Total | 323,128 | 323,996 | -868 |

| 0-14 | 60,963 | 61,037 | -74 |

| 15-24 | 43,468 | 43,613 | -145 |

| 25-34 | 44,630 | 44,865 | -235 |

| 35-44 | 40,512 | 40,578 | -66 |

| 45-54 | 42,840 | 42,864 | -24 |

| 55-64 | 41,519 | 41,619 | -100 |

| 65-74 | 28,635 | 28,747 | -112 |

| 75+ | 20,560 | 20,673 | -113 |

| *LEHC Estimate. Totals may not add up due to rounding | |||

Looking ahead to 2020, the net international migration assumptions imbedded in the Census 2014 US population projections through 2020 are unreasonably high. Trying to gauge what more “realistic” assumptions under a Trump administration is, unfortunately, a rather difficult exercise. E.g., some statements on potential actions, if taken at face value and implemented, would effectively imply net international out-migration over the next few years!

Rather than attempting to make specific forecasts about net international migration through 2020, I am instead show what population projections by age would look like under two different scenarios, shown below, and compare them to projections from the Census 2014 projections. (Note: each year’s forecast is from July 1st of the previous year to June 30th of the following year, so 2017 only has three months left).

| Net Immigration: Three Scenarios | |||

|---|---|---|---|

| Census 2014 Projection | Sorta Trumpy | Really Trumpy | |

| 2017 | 1,256,000 | 850,000 | 750,000 |

| 2018 | 1,262,000 | 600,000 | 0 |

| 2019 | 1,267,000 | 600,000 | 0 |

| 2020 | 1,271,000 | 600,000 | 0 |

Below are estimates of the US resident population by selected age groups for each scenario. (Note: The starting point for the “Trumpy”scenarios are based on Vintage 2016 estimates, while the “Census 2014 Projection” starting point reflects that release’s projection for 2016. Also, the “Trumpy” scenarios use updated estimates for annual deaths and births).

| US Resident Population by Age Group Under Various Scenarios, 2016-2020 (million's) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 0-14 | 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65-74 | 75+ | ||

| Census 2014 | 7/2016 | 324.0 | 61.0 | 43.6 | 44.9 | 40.6 | 42.9 | 41.6 | 28.7 | 20.7 |

| 7/2020 | 334.5 | 61.6 | 43.1 | 46.9 | 42.6 | 40.8 | 43.0 | 33.1 | 23.4 | |

| Dif | 10.5 | 0.5 | -0.5 | 2.0 | 2.1 | -2.0 | 1.4 | 4.3 | 2.7 | |

| Sorta Trumpy | 7/2016 | 323.1 | 61.0 | 43.5 | 44.6 | 40.5 | 42.8 | 41.5 | 28.6 | 20.6 |

| 7/2020 | 330.3 | 60.7 | 42.5 | 45.9 | 42.2 | 40.6 | 42.7 | 32.8 | 23.1 | |

| Dif | 7.2 | -0.2 | -1.0 | 1.3 | 1.6 | -2.3 | 1.2 | 4.1 | 2.5 | |

| Really Trumpy | 7/2016 | 323.1 | 61.0 | 43.5 | 44.6 | 40.5 | 42.8 | 41.5 | 28.6 | 20.6 |

| 7/2020 | 328.5 | 60.5 | 41.9 | 45.4 | 41.9 | 40.4 | 42.6 | 32.7 | 23.1 | |

| Dif | 5.3 | -0.5 | -1.5 | 0.7 | 1.4 | -2.4 | 1.1 | 4.0 | 2.5 | |

Assuming no material change either in labor force participation rates of headship rates by age, here is what annual growth rates in select measures would look like under these scenarios.

| Population Growth | Labor Force Growth | Household Growth | |

|---|---|---|---|

| Census 2014 | 0.80% | 0.51% | 1.19% |

| Sorta Trumpy | 0.55% | 0.26% | 1.00% |

| Really Trumpy | 0.41% | 0.09% | 0.86% |

Obviously, a projection for overall economic activity under the “really Trumpy” scenario would probably be significantly slower than projections based using Census 2014 projections, unless either (1) labor force participation rates increased significantly, or (2) productivity growth increased materially. For those who prefer numerical rather than % change numbers for households, a “unchanged” headship rate projection using Census 2014 population projections translates into about 1.48 million net household formations per year from 2016 to 2010, while the “Really Trumpy” scenarios translates into about 1.06 net household formations per year over than same period.

Of course, these “Trumpy” projections are based on “seat of the pants” projections of net international migration, combined with incorporation of updated “actuals” for 2016 as well as updated projections for births and death, and different net international migration projections would produce different population/labor forece/household projections. For entities who produce such forecasts and cite them for various purposes and whose latest forecast was based on the Census 2014 population projection report, however, they should either (1) send out a note that their latest forecasts are no longer valid, or (2) develop new projections based on more realistic assumptions.

U.S. Light Vehicle Sales at 16.5 million annual rate in March

by Calculated Risk on 4/03/2017 03:23:00 PM

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 16.53 million SAAR in March.

That is down slightly from March 2016, and down 5% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 17.47 million SAAR from WardsAuto).

This was well below the consensus forecast of 17.4 million for March.

After two consecutive years of record sales, it looks like sales will be down or move sideways in 2017.

Note: dashed line is current estimated sales rate.

Construction Spending increased in February

by Calculated Risk on 4/03/2017 12:05:00 PM

Earlier today, the Census Bureau reported that overall construction spending increased in February:

Construction spending during February 2017 was estimated at a seasonally adjusted annual rate of $1,192.8 billion, 0.8 percent above the revised January estimate of $1,183.8 billion. The February figure is 3.0 percent above the February 2016 estimate of $1,157.7 billion.Both private and public spending increased in February:

Spending on private construction was at a seasonally adjusted annual rate of $917.3 billion, 0.8 percent above the revised January estimate of $910.0 billion. ...

In February, the estimated seasonally adjusted annual rate of public construction spending was $275.5 billion, 0.6 percent above the revised January estimate of $273.9 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, and is still 29% below the bubble peak.

Non-residential spending is now 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 15% below the peak in March 2009, and only 5% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6%. Non-residential spending is up 8% year-over-year. Public spending is down 8% year-over-year.

Looking forward, all categories of construction spending should increase in 2017.

This was close to the consensus forecast of a 1.0% increase for February.

ISM Manufacturing index decreased to 57.2 in March

by Calculated Risk on 4/03/2017 10:04:00 AM

The ISM manufacturing index indicated expansion in March. The PMI was at 57.2% in March, down from 57.7% in February. The employment index was at 58.9%, up from 54.2% last month, and the new orders index was at 64.5%, down from 65.1%.

From the Institute for Supply Management: March 2017 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in March, and the overall economy grew for the 94th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: "The March PMI® registered 57.2 percent, a decrease of 0.5 percentage point from the February reading of 57.7 percent. The New Orders Index registered 64.5 percent, a decrease of 0.6 percentage point from the February reading of 65.1 percent. The Production Index registered 57.6 percent, 5.3 percentage points lower than the February reading of 62.9 percent. The Employment Index registered 58.9 percent, an increase of 4.7 percentage points from the February reading of 54.2 percent. Inventories of raw materials registered 49 percent, a decrease of 2.5 percentage points from the February reading of 51.5 percent. The Prices Index registered 70.5 percent in March, an increase of 2.5 percentage points from the February reading of 68 percent, indicating higher raw materials prices for the 13th consecutive month. Consistent with generally positive comments from the panel, all 18 industries reported growth in new orders for the month of March."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was close to expectations of 57.1%, and suggests manufacturing expanded at as slightly slower pace in March than in February.

Another solid report.