by Calculated Risk on 12/01/2016 07:05:00 PM

Thursday, December 01, 2016

November Employment Preview

Friday:

• At 8:30 AM ET, Employment Report for November. The consensus is for an increase of 170,000 non-farm payroll jobs added in November, up from the 161,000 non-farm payroll jobs added in October. The consensus is for the unemployment rate to be unchanged at 4.9%.

Earlier I posted an employment preview from Goldman Sachs.

Here is a summary of recent data:

• The ADP employment report showed an increase of 216,000 private sector payroll jobs in November. This was well above expectations of 160,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth above expectations.

• The ISM manufacturing employment index decreased in November to 52.3%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll decreased about 7,000 in November. The ADP report indicated 10,000 manufacturing jobs lost in November.

The ISM non-manufacturing employment index will not be released until next week.

• Initial weekly unemployment claims averaged 251,000 in November, down from 258,000 in October. For the BLS reference week (includes the 12th of the month), initial claims were at 233,000, down from 252,000 during the reference week in October.

The decrease during the reference suggests less labor stress in November than in October. This is positive for the employment report.

• The final November University of Michigan consumer sentiment index increased to 93.8 from the October reading of 87.2. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and weekly claims suggest stronger job growth. There also might be a little bounce back from Hurricane related weakness in October.

My guess is the November report will be above the consensus forecast.

U.S. Light Vehicle Sales decrease to 17.75 million annual rate in November

by Calculated Risk on 12/01/2016 03:58:00 PM

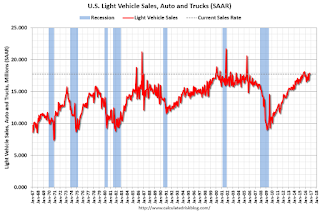

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 17.75 million SAAR in November.

That is down about 2% from November 2015, and down 0.9% from the 17.91 million annual sales rate last month.

From John Sousanis at WardsAuto November 2016 U.S. LV Sales Thread: Light Trucks, Extra Days Boost November Volumes

With two extra selling days in November, U.S. automakers outpaced same-month year-ago sales on a volume basis, despite a 4.6% decline in the daily sales rate (DSR).

Strong light-truck sales were a key factor in November sales, as the industry delivered 1,372,402 LVs - 48,904 more than it did a year-ago, over the course of 25 selling days (vs. 23 last year).

...

Year-to-date sales for the industry reached 15.783 million units, giving the first 11 months of 2016 a lead of just 17,542 units over like-2015 heading into December - and keeping alive the prospect that 2016 will break the single-year sales record set last year.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 17.75 million SAAR from WardsAuto).

This was at the consensus forecast.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Sales for 2016 - through the first eleven months - are close to unchanged from the comparable period last year.

After increasing significantly for several years following the financial crisis, auto sales are now moving mostly sideways ...

Goldman's November NFP Preview

by Calculated Risk on 12/01/2016 02:46:00 PM

A few excerpts from Goldman Sachs' November Payroll Preview by economists Avisha Thakkar and Daan Struyven:

We forecast that nonfarm payroll growth increased to 200k in November, after an increase of 161k in October. We have revised up our forecast from 180k previously reflecting stronger data this week, in particular the ADP report. Our above-consensus forecast reflects an improvement in most labor market indicators last month, positive weather effects and possible residual seasonality.The November employment report will be released tomorrow, and the consensus is for an increase of 170,000 non-farm payroll jobs in November, and for the unemployment rate to be unchanged at 4.9%.

We expect a one-tenth decline in the U3 unemployment rate to 4.8%. Average hourly earnings likely rose at a softer 0.1% last month, primarily due to negative calendar effects, below the strong gain of 0.4% in October. The year-over-year rate is likely to edge down to 2.7%.

emphasis added

Construction Spending increased in October

by Calculated Risk on 12/01/2016 12:19:00 PM

Earlier today, the Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2016 was estimated at a seasonally adjusted annual rate of $1,172.6 billion, 0.5 percent above the revised September estimate of $1,166.5 billion. The October figure is 3.4 percent above the October 2015 estimate of $1,134.4 billion.Private spending decreased and public spending increased in October:

During the first 10 months of this year, construction spending amounted to $972.2 billion, 4.5 percent above the $930.7 billion for the same period in 2015.

Spending on private construction was at a seasonally adjusted annual rate of $885.9 billion, 0.2 percent below the revised September estimate of $887.4 billion ...September was revised up to no change from a 0.5% decrease, and August revised up sharply to a 0.5% increase from -0.5%.

In October, the estimated seasonally adjusted annual rate of public construction spending was $286.8 billion, 2.8 percent above the revised September estimate of $279.1 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, but is 31% below the bubble peak.

Non-residential spending is now 1% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 12% below the peak in March 2009, and 9% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 5%. Non-residential spending is up 5% year-over-year. Public spending is down 1% year-over-year.

Looking forward, all categories of construction spending should increase in the coming year. Residential spending is still fairly low, non-residential is increasing - although there has been a recent decline in public spending.

This was slightly below the consensus forecast of a 0.6% increase for October, however spending for August and September were revised up. A solid report.

ISM Manufacturing index increased to 53.2 in November

by Calculated Risk on 12/01/2016 10:07:00 AM

The ISM manufacturing index indicated expansion in November. The PMI was at 53.2% in November, up from 51.9% in October. The employment index was at 52.3%, down from 52.9% last month, and the new orders index was at 53.0%, up from 52.1%.

From the Institute for Supply Management: November 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November, and the overall economy grew for the 90th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The November PMI® registered 53.2 percent, an increase of 1.3 percentage points from the October reading of 51.9 percent. The New Orders Index registered 53 percent, an increase of 0.9 percentage point from the October reading of 52.1 percent. The Production Index registered 56 percent, 1.4 percentage points higher than the October reading of 54.6 percent. The Employment Index registered 52.3 percent, a decrease of 0.6 percentage point from the October reading of 52.9 percent. Inventories of raw materials registered 49 percent, an increase of 1.5 percentage points from the October reading of 47.5 percent. The Prices Index registered 54.5 percent in November, the same reading as in October, indicating higher raw materials prices for the ninth consecutive month. Comments from the panel cite increasing demand, some tightness in the labor market and plans to reduce inventory by the end of the year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 52.3%, and suggests manufacturing expanded at as faster pace in November than in October.

Another solid economic report.

Weekly Initial Unemployment Claims increase to 268,000

by Calculated Risk on 12/01/2016 08:50:00 AM

The DOL reported:

In the week ending November 26, the advance figure for seasonally adjusted initial claims was 268,000, an increase of 17,000 from the previous week's unrevised level of 251,000. The 4-week moving average was 251,500, an increase of 500 from the previous week's unrevised average of 251,000.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 91 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 251,500.

This was above the consensus forecast. The low level of claims suggests relatively few layoffs.

Wednesday, November 30, 2016

Thursday: ISM Mfg, Auto sales, Unemployment claims, Construction Spending

by Calculated Risk on 11/30/2016 07:20:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC:

"OPEC today struck what increasingly appears to be a historic deal, with both cuts and participation well in excess of earlier expectations. Total OPEC cuts, compared to OPEC production as recorded by secondary sources for October 2016, are forecast at 1.2 mbpd. To this is added 0.3 mbpd from Russia, and another, yet-to-be-confirmed 275 kpbd from Mexico, Oman and Kazakhstan.Thursday:

In total, this would represent a cut of over 1.7 mbpd. Compliance should be expected at 70% based on historical precedent, representing an effective cut of 1.2 mbpd compared to October 2016 levels. This is a big deal, and may be enough to balance markets (which some think are already drawing in any event). With these cuts, global excess crude and product inventories should be run off as soon as the end of Q2 2017, and not later than Q4 2017.

This implies that a robust recovery for the global oil sector is in store, with a strong H2 2017 in the outing."

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 253 thousand initial claims, up from 251 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for November. The consensus is for the ISM to be at 52.3, up from 51.9 in October. The ISM manufacturing index indicated expansion at 51.9% in October. The employment index was at 52.9%, and the new orders index was at 52.1%.

• Also at 10:00 AM, Construction Spending for October. The consensus is for a 0.6% increase in construction spending.

• All day, Light vehicle sales for November. The consensus is for light vehicle sales to decrease to 17.8 million SAAR in November, from 17.9 million in October (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in October

by Calculated Risk on 11/30/2016 04:21:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined to 1.21% in October, down from 1.24% in September. The serious delinquency rate is down from 1.58% in October 2015.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is generally declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.37 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% for about 7 more months.

Note: Freddie Mac reported yesterday.

Fed's Beige Book: Modest to moderate expansion, Tightening labor market

by Calculated Risk on 11/30/2016 02:33:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Cleveland based on information collected on or before November 18, 2016."

Reports from the twelve Federal Reserve Districts indicate that the economy continued to expand across most regions from early October through mid-November. Activity in the Boston, Minneapolis, and San Francisco Districts grew at a moderate pace, while Atlanta, Chicago, St. Louis, and Dallas cited modest growth. Philadelphia, Cleveland, and Kansas City cited a slight pace of growth. Richmond characterized economic activity as mixed, and New York said activity has remained flat since the last report. Outlooks were mainly positive, with six Districts expecting moderate growth.And on real estate:

...

A tightening in labor market conditions was reported by seven Districts, with modest employment growth on balance. Districts noted slight upward pressure on overall prices..

emphasis added

Residential real estate activity improved across Districts. Reports about existing- and new-home sales were mixed, but most Districts noted a slight to modest increase during the period. Residential construction was up in the Cleveland, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, and Dallas Districts. Home prices grew in many Districts, including Boston, Philadelphia, Cleveland, Atlanta, St. Louis, Kansas City, and San Francisco. Philadelphia reported that the strength of the single-family market is in high-end housing. In contrast, Kansas City reported that sales of low- and medium-priced homes continued to outpace sales of higher-priced homes. Dallas reported that the sales of lower-priced homes remained solid. Home inventories were generally reported to be low or declining and restraining sales growth. Boston, Philadelphia, Cleveland, Richmond, and Minneapolis reported low or decreasing inventories. Reports on inventory levels varied in Atlanta, while inventories held steady in Kansas City.Real estate is decent.

Commercial construction activity moved higher in the New York, Cleveland, Richmond, Atlanta, St. Louis, Kansas City, and San Francisco Districts. In contrast, Minneapolis noted a slowing in commercial construction. The Boston, Richmond, Minneapolis, and San Francisco Districts reported increases in leasing activity, while Philadelphia noted a lull in nonresidential leasing growth compared with the prior period. Dallas reported leasing activity as mostly unchanged. Commercial sales activity continued to be robust in Minneapolis and grew modestly in Kansas City. Ongoing multifamily construction has been steady at a fairly high level in New York. Multifamily construction varied in the Atlanta District and slowed somewhat in Richmond, Minneapolis, and San Francisco.

NY Fed: Household Debt Increased Slightly in Q3 2016, Mortgage Delinquency Rates Declined

by Calculated Risk on 11/30/2016 11:16:00 AM

The Q3 report was released today: Household Debt and Credit Report.

From the NY Fed: Total Household Debt Remains Sluggish Yet Non-Housing Debt Continues Expanding

The Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt increased modestly by $63 billion (a 0.5% increase) to $12.35 trillion during the third quarter of 2016. There were increases across every type of non-housing debt, with a 2.9% increase in auto loan balances, a 2.5% increase in credit card balances, and a 1.6% percent increase in student loan balances this quarter. This report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

...

Mortgage delinquencies continued to decline as seen since the financial crisis, while new foreclosure notations reached another new low for the 18-year history of this series.

...

Overall delinquency rates worsened slightly this quarter, while the rate of bankruptcy notations continued its overall trend of improving since the financial crisis.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q3. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q3, from the NY Fed:

Mortgage balances, the largest component of household debt saw a 0.1% decline during the quarter. Mortgage balances shown on consumer credit reports on September 30 stood at $8.35 trillion, a $12 billion drop from the second quarter of 2016. Balances on home equity lines of credit (HELOC) declined by $6 billion, to $472 billion. By contrast, balances on every type of non-housing debt grew in the second quarter, boosting up the total.

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is generally declining, although there was a slight increase in short term delinquencies in Q3. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate increased slightly in Q3 to 4.9%. From the NY Fed:

Overall delinquency rates worsened slightly in 2016Q3, reflecting an uptick in early delinquencies. As of September 30, 4.9% of outstanding debt was in some stage of delinquency. Of the $609 billion of debt that is delinquent, $400 billion is seriously delinquent (at least 90 days late or “severely derogatory”).