by Calculated Risk on 11/19/2016 10:47:00 AM

Saturday, November 19, 2016

Schedule for Week of Nov 20, 2016

The key economic reports this week are October News Home sales and Existing Home sales.

Happy Thanksgiving to All!

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.Housing economist Tom Lawler expects the NAR to report sales of 5.47 million SAAR in October, unchanged from September's preliminary pace.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 235 thousand the previous week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

9:00 AM: FHFA House Price Index for September 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.7% month-to-month increase for this index.

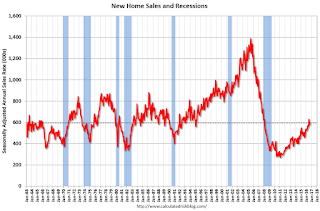

10:00 AM ET: New Home Sales for September from the Census Bureau.

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 593 thousand in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 91.6, unchanged from the preliminary reading 91.6.

2:00 PM: FOMC Minutes for Meeting of November 1-2

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Friday, November 18, 2016

Mortgage "Rates Rip to Highest Levels Since July 2015"

by Calculated Risk on 11/18/2016 05:59:00 PM

From Matthew Graham at Mortgage News Daily: Rates Rip to Highest Levels Since July 2015

It was all pain, all the time for mortgage rates today. Since the election, the average conventional 30yr fixed rate has risen roughly 0.5%, putting November 2016 on a short list of 4 worst months in more than a decade. Two of those months were back to back amid the 2013 taper tantrum and the other was at the end of 2010. Let it be known that the recent surge in rates is more than a mere post-election knee-jerk. Financial markets are fully repricing their expectations of the future, and we can't even begin to assess how that future might actually pan out until Trump takes office.CR Note: Refinance activity will decline sharply, and I expect some slowdown in housing (still thinking about this).

In other words, buckle up for a higher mortgage rate environment. Rates won't necessarily be immune from good days over the next few months, but I certainly wouldn't expect a quick, triumphant return to the promised land (rates from 2 weeks ago, and below) within the same time frame. The most prevalent conventional 30yr fixed rate quote is now 4.125% on top tier scenarios, and more than a few lenders are already up to 4.25%.

emphasis added

Here is a table from Mortgage News Daily:

Sacramento Housing in October: Sales up 4%, Active Inventory down 7.6% YoY

by Calculated Risk on 11/18/2016 02:48:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For a few years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggests healing in the Sacramento market and other distressed markets are showing similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In October, total sales were up 4.2% from October 2015, and conventional equity sales were up 4.4% compared to the same month last year.

In October, 4.4% of all resales were distressed sales. This was down from 4.5% last month, and down from 7.0% in October 2015.

The percentage of REOs was at 2.0%, and the percentage of short sales was 2.4%.

Here are the statistics.

From SAR: Pending sales drop, may indicate slow month for November

Pending sales, those that are already in contract, dropped for the month of October. Month to month, pending sales decreased 16.4%, from 1,444 to 1,207 units. Pending sales are generally an indicator of activity for the upcoming months, when many will be counted as sold once the escrows close. Compared with October 2015, pending sales totaled 1,240.

...

Inventory remains tight throughout Sacramento County with the total Active Listing Inventory decreasing 10.2% from September to October (2,774 to 2,492). Compared to October last year, the current number is down 7.6% (2,697 units). The Months of Inventory decreased, dropping slightly from 1.7 Months to 1.6 Months. The Months of inventory for October 2015 was 1.8.

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 7.6% year-over-year (YoY) in October. This was the eighteenth consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.1% of all sales (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Kansas City Fed: Regional Manufacturing Activity "Expanded Slightly" in November

by Calculated Risk on 11/18/2016 11:15:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Slightly

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded slightly.The Kansas City region was hit hard by the decline in oil prices, but activity is starting to expand again.

“Factory activity in our region rose for the third straight month in November, following a year and a half of near constant declines,” said Wilkerson. “Firms also remained optimistic about future activity.”

...

The month-over-month composite index was 1 in November, down from 6 in October and September ... Most month-over-month indexes slowed somewhat in November. The production index decreased from 18 to 9, and the shipments, new orders, and order backlog indexes also dropped. The employment index eased from 7 to 1, still the second highest reading in over a year. ...

emphasis added

BLS: Unemployment Rates Lower in 7 states, Stable in 41 states in October

by Calculated Risk on 11/18/2016 10:24:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were significantly lower in October in 7 states, higher in 2 states, and stable in 41 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Seven states had notable jobless rate decreases from a year earlier, 5 states had increases, and 38 states and the District had no significant change. The national unemployment rate was 4.9 percent in October, little changed from that of both September 2016 and October 2015.

...

New Hampshire and South Dakota had the lowest unemployment rates in October, 2.8 percent each. Alaska and New Mexico had the highest jobless rates, 6.8 percent and 6.7 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. Alaska, at 6.8%, had the highest state unemployment rate. Note that the lowest unemployment rate in Alaska was 6.3%, so this is pretty close to the all time low.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only four states and D.C are at or above 6% (dark blue). The states are Alaska (6.8%), New Mexico (6.7%), Louisiana (6.3%), D.C. (6.1%), and West Virginia (6.0%).

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/18/2016 05:01:00 AM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.47 million in October, unchanged from September’s preliminary pace and up 3.4% from last October’s seasonally adjusted pace. I project that unadjusted sales last month were virtually unchanged from last October, with the difference between the YOY growth in adjusted vs. unadjusted sales reflecting calendar effects (one fewer business day, and one fewer Friday, this October compared to last October. Hurricane Matthew negatively impacted hone closings in some southeastern coastal markets, but the impact on the national sales numbers was fairly modest.

On the inventory front, local realtor/MLS data, as well as data compiled by realtor.com, suggest that the inventory of existing homes for sale in October fell by more on the month than last October. How that translates into the NAR’s estimate for October is not clear, however, because the NAR’s September inventory estimate looked too high relative either to local realtor/MLS reports or to realtor/com data. For September the NAR estimated that the inventory of existing homes for sale showed a “contra-seasonal” increase of 1.5% from August (NAR seasonal factors show a “typical” monthly drop in September of about 3.9%), and a 6.8% YOY decline. Realtor.com data, in contrast, showed a monthly drop of 1.7%, and a YOY decline of 9.4%. It should be noted that the NAR inventory numbers are estimates for the end of the month, while realtor.com numbers reflect average listings during the month. If anything, however, end of month numbers would be expected to show even bigger monthly declines that average listings in September (given the trend in listings at that time of the year).

If I had to “guess,” I’d guess that the NAR’s inventory estimate for October will be about 4.9% lower than September’s preliminary estimate (which should be revised downward), and 8.1% lower than a year ago.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price in October should be up about 7.0% from last October.

CR Note: The NAR is scheduled to release October existing home sales on Tuesday, November 22nd. The consensus is for 5.44 million SAAR in October.

Thursday, November 17, 2016

Goldman: "Market expectations of quick fiscal expansion may be running ahead of political and legislative realities"

by Calculated Risk on 11/17/2016 04:41:00 PM

A few brief excerpts from analysis by Goldman Sachs economist Alec Phillips: A Fiscal Boost in 2017: How Much, How Fast?

Tax reform has political momentum, which is likely to increase the budget deficit... In light of the election result, we assume that the deficit will increase by more than previously expected. Specifically, we assume that fiscal policy choices under the next Congress will increase the budget deficit by around 0.75% of GDP, or around $150bn, in 2018, and similar amounts over the next few years.CR Note: The "infrastructure" proposal that many investors are focusing on is really a proposal for about $100+ billion in tax credits to spur private investment in infrastructure (I've seen some people talking about $1 trillion in infrastructure investment - but that is the projected size of the private investment, not the proposed government spending). This proposal is actually very modest in terms of a fiscal boost. More analysis to come when we see the actual proposals, but I think analysts might be overestimating the boost from government spending in 2017.

... but the market is more focused on fiscal “stimulus” than Congress is. There are risks in both directions to our fiscal assumptions, but we note that financial markets appear to be more focused on fiscal “stimulus” than lawmakers are. ...

Both sides support some type of infrastructure program, but neither side seems enthusiastic. Although President-elect Trump has highlighted infrastructure among the priorities he hopes to address, the reaction from Congressional Republicans has been tepid. While some believe the inclusion of an infrastructure plan in the tax legislation that Congress is expected to consider in 2017 could increase Democratic support for the combined package, others are wary of proposals to use the proceeds from taxing the unrepatriated profits of US multinationals to pay for it. Instead, Republican lawmakers appear more inclined to use the bulk of the proceeds from taxing those overseas earnings to offset the budgetary effects of reducing statutory tax rates.

Obamacare “repeal” seems unlikely to change the fiscal picture for 2017 or even 2018. Congress will face a number of challenges in reforming the ACA in 2017, and we would expect that the process to devise a replacement plan will take until late 2017, if not 2018. We would also expect whatever replaces the current system to take effect after the midterm congressional elections, in 2019. This could lead to uncertainty regarding the changes that might be made, but we expect that whatever changes to the ACA might ultimately occur, they would probably not take effect until 2018 at the earliest and more likely 2019.

Comments on October Housing Starts

by Calculated Risk on 11/17/2016 01:45:00 PM

Earlier: Housing Starts increased to 1.323 Million Annual Rate in October

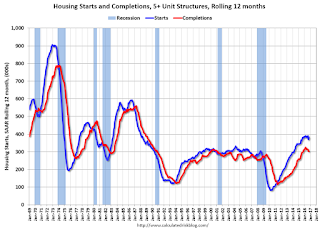

There was a sharp decline in multi-family starts in the previous month (September), and multi-family bounced back in October.

But the big story is single family starts were up again, and there were upward revisions to the prior two months combined. As always, I wouldn't put too much emphasis on any one report, but the trend is positive!

This first graph shows the month to month comparison between 2015 (blue) and 2016 (red).

Year-to-date starts are up 5.9% compared to the same period in 2015. My guess was starts would increase 4% to 8% in 2016, and that still looks about right.

Multi-family starts are down 1.8% year-to-date, and single-family starts are up 10.1% year-to-date.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries, although this has dipped lately). Completions lag starts by about 12 months.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts probably peaked in June 2015 (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics). I also expect completions to move up some more (closer to starts).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong housing report.

Key Measures Show Inflation close to 2% in October

by Calculated Risk on 11/17/2016 11:19:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in October. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for October here. Motor fuel was up 122% annualized in October!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.4% annualized rate) in October. The CPI less food and energy rose 0.1% (1.8% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.0%, and the CPI less food and energy rose 2.1%. Core PCE is for September and increased 1.7% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 2.2% annualized, and core CPI was at 1.8% annualized.

Using these measures, inflation has generally been moving up, and most of these measures are close to the Fed's 2% target (Core PCE is still below).

Yellen: Rate Hike "appropriate relatively soon"

by Calculated Risk on 11/17/2016 09:26:00 AM

From Fed Chair Janet Yellen's testimony before the Joint Economic Committee, U.S. Congress, Washington, D.C.: The Economic Outlook

I will turn now to the implications of recent economic developments and the economic outlook for monetary policy. The stance of monetary policy has supported improvement in the labor market this year, along with a return of inflation toward the FOMC's 2 percent objective. In September, the Committee decided to maintain the target range for the federal funds rate at 1/4 to 1/2 percent and stated that, while the case for an increase in the target range had strengthened, it would, for the time being, wait for further evidence of continued progress toward its objectives.A rate hike in December is very likely. The incoming data has been strong (see housing starts and unemployment claims today that were released after her comments were prepared).

At our meeting earlier this month, the Committee judged that the case for an increase in the target range had continued to strengthen and that such an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the Committee's objectives. This judgment recognized that progress in the labor market has continued and that economic activity has picked up from the modest pace seen in the first half of this year. And inflation, while still below the Committee's 2 percent objective, has increased somewhat since earlier this year. Furthermore, the Committee judged that near-term risks to the outlook were roughly balanced.

Waiting for further evidence does not reflect a lack of confidence in the economy. Rather, with the unemployment rate remaining steady this year despite above-trend job gains, and with inflation continuing to run below its target, the Committee judged that there was somewhat more room for the labor market to improve on a sustainable basis than the Committee had anticipated at the beginning of the year. Nonetheless, the Committee must remain forward looking in setting monetary policy. Were the FOMC to delay increases in the federal funds rate for too long, it could end up having to tighten policy relatively abruptly to keep the economy from significantly overshooting both of the Committee's longer-run policy goals. Moreover, holding the federal funds rate at its current level for too long could also encourage excessive risk-taking and ultimately undermine financial stability.

The FOMC continues to expect that the evolution of the economy will warrant only gradual increases in the federal funds rate over time to achieve and maintain maximum employment and price stability. This assessment is based on the view that the neutral federal funds rate--meaning the rate that is neither expansionary nor contractionary and keeps the economy operating on an even keel--appears to be currently quite low by historical standards. Consistent with this view, growth in aggregate spending has been moderate in recent years despite support from the low level of the federal funds rate and the Federal Reserve's large holdings of longer-term securities. With the federal funds rate currently only somewhat below estimates of the neutral rate, the stance of monetary policy is likely moderately accommodative, which is appropriate to foster further progress toward the FOMC's objectives. But because monetary policy is only moderately accommodative, the risk of falling behind the curve in the near future appears limited, and gradual increases in the federal funds rate will likely be sufficient to get to a neutral policy stance over the next few years.

emphasis added