by Calculated Risk on 8/09/2016 08:01:00 PM

Tuesday, August 09, 2016

Update: "Scariest jobs chart ever"

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Job Openings and Labor Turnover Survey for June from the BLS. Jobs openings decreased in May to 5.500 million from 5.845 million in April. The number of job openings were up 2% year-over-year, and Quits were up 5% year-over-year.

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the July 2016 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 4.3% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

EIA: "Gasoline prices at 16-week low, expected to average less than $2 a gallon by December"

by Calculated Risk on 8/09/2016 05:13:00 PM

The EIA released the Short-Term Energy Outlook today. From the STEO:

• EIA expects the retail price of regular gasoline to average $2.19/gal during the 2016 summer driving season (April through September), 6 cents/gal lower than projected in last month's STEO and 44 cents/gal lower than the price in summer 2015. EIA expects that the U.S. average retail price of regular gasoline reached a peak of $2.37/gal in June and will fall to an average of $2.05/gal in September and to an average of $1.92/gal in December.

• The monthly average spot price of Brent crude oil decreased by $3/b in July to $45/b, which was the first monthly decrease since January 2016. Significant outages of global oil supply contributed to rising oil prices during the second quarter of 2016. However, concerns about future economic growth related to the United Kingdom's June 23 vote to exit the European Union and the easing of supply disruptions in Canada contributed to falling oil prices in late June. Prices continued to fall in July because of concerns about high levels of U.S. and global petroleum product inventories, despite relatively strong demand, and because of growing U.S. oil rig counts. The Baker Hughes U.S. active oil rig count increased for six consecutive weeks in July and early August, the longest stretch of weekly increases in almost a year.

• EIA expects consistent global oil inventory draws to begin in mid-2017. The expectation of inventory draws contributes to accelerating price increases in the second quarter of 2017, with price increases continuing later in 2017. Brent prices are forecast to average $52/b in 2017, unchanged from last month's STEO. Forecast Brent prices average $58/b in the fourth quarter of 2017, reflecting the potential for more significant inventory draws beyond the forecast period.

Las Vegas Real Estate in July: Sales down 10% YoY, Inventory down 1%

by Calculated Risk on 8/09/2016 01:41:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Southern Nevada Home Prices Keep Climbing Amid Tight Supply, GLVAR Housing Statistics for July 2016

“The local housing market is having a pretty solid summer so far,” said 2016 GLVAR President Scott Beaudry, a longtime local REALTOR®. “Home prices have been going up gradually. And although we sold fewer homes and condos in July than we did during the previous month and year, sales have been running ahead of last year’s pace. Our tight inventory might finally be slowing down our sales pace. Sales slipped the most during July for lower-priced homes. This suggests it’s getting harder for entry-level buyers to find the homes they want.”1) Overall sales were down 9.6% year-over-year.

According to GLVAR, the total number of existing local homes, condominiums and townhomes sold in July was 3,447, down from 3,815 total sales in July of 2015. Compared to the same month one year ago, 7.2 percent fewer homes, and 4.2 percent fewer condos and townhomes sold in July.

...

By the end of July, GLVAR reported 7,338 single-family homes listed without any sort of offer. That’s down 1.3 percent from one year ago. For condos and townhomes, the 1,212 properties listed without offers in July represented a 48.0 percent decrease from one year ago.

...

As in past months, GLVAR continued to track declines in distressed sales and a corresponding increase in traditional home sales, where lenders are not controlling the transaction. In July, 5.7 percent of all local sales were short sales – when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 7.1 percent of all sales one year ago. Another 5.9 percent of all July sales were bank-owned, down from 7.7 percent one year ago.

emphasis added

2) Active inventory is down 1.3% from a year ago.

NY Fed: Household Debt Increased Slightly in Q2 2016, Delinquency Rates Declined

by Calculated Risk on 8/09/2016 11:00:00 AM

The Q2 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Balances Increase Slightly, Boosted By Growth In Auto Loan And Credit Card Balances

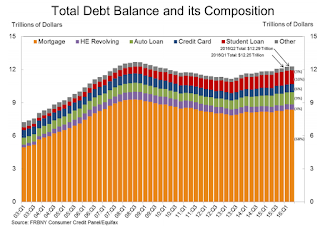

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which reported that household debt increased by $35 billion (a 0.3 percent increase) to $12.29 trillion during the second quarter of 2016. This moderate growth was driven by increases in auto loan and credit card debt, which increased by $32 billion and $17 billion respectively. Mortgage debt declined by $7 billion in the second quarter, after a $120 billion increase in the first quarter, and student loan balances were roughly flat. Meanwhile, this quarter saw improvements in overall delinquency rates and another historical low (over the 18 years of the data sample) in new foreclosures. ...

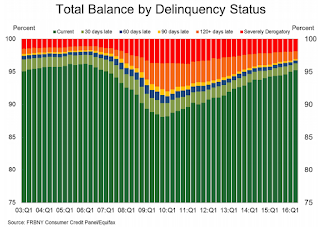

Overall delinquency rates improved, continuing the trend in place since 2010. In the second quarter, 4.8 percent of outstanding debt was in some stage of delinquency down from 5 percent previous quarter, and 5.6 percent in the second quarter of 2015. There were 82,000 consumers with new foreclosure notations on their credit reports – another low in the 18-year history of this data set.

...

"Today's report highlights a positive ongoing trend in household debt," said Donghoon Lee, Research Officer at the New York Fed. "Delinquency rates continue to improve, even as credit has become more widely available."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt peaked in 2008, and bottomed in Q2 2013.

Mortgage debt decreased in Q2, from the NY Fed:

Mortgage balances, the largest component of household debt, were essentially flat in the second quarter of 2016. Mortgage balances shown on consumer credit reports on June 30 stood at $8.36 trillion, a $7 billion drop from the first quarter of 2016. Balances on home equity lines of credit (HELOC) also dropped by $7 billion, to $478 billion. Non-housing debt balances rose in the second quarter; with increases of $32 billion and $17 billion in auto loans and credit cards, respectively, and a slight decline in student loan balances (-$2 billion).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is declining, although there is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate decreased in Q2 to 4.8%. From the NY Fed:

Overall delinquency rates improved again in 2016Q2. As of June 30, 4.8% of outstanding debt was in some stage of delinquency. Of the $589 billion of debt that is delinquent, $407 billion is seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

NFIB: Small Business Optimism Index increased Slightly in July

by Calculated Risk on 8/09/2016 08:37:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Plateaus

The Index of Small Business Optimism rose one-tenth of a point in July to 94.6 ... according to the National Federation of Independent Business (NFIB).

Reported job creation remained weak in July, with the seasonally adjusted average employment change per firm posting a decline of -0.03 workers per firm, although better than June’s -0.17 reading. Fifty-three percent reported hiring or trying to hire (down 3 points), but 46 percent reported few or no qualified applicants for the positions they were trying to fill. Fourteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem. ... Twenty-six percent of all owners reported job openings they could not fill in the current period, down 3 points from, the highest reading in this recovery.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 94.6 in July.

Monday, August 08, 2016

Tuesday: Small Business Index, Q2 2016 Household Debt and Credit Report

by Calculated Risk on 8/08/2016 09:02:00 PM

Tuesday:

• At 9:00 AM ET: NFIB Small Business Optimism Index for July.

• 10:00 AM: Monthly Wholesale Trade: Sales and Inventories for June. The consensus is for no change in inventories.

• 11:00 AM: The New York Fed will release their Q2 2016 Household Debt and Credit Report

From Matthew Graham at Mortgage News Daily: Mortgage Rates Threatening to Break Post-Brexit Range

Mortgage rates continued higher today, extending a sharp move that began on Friday following stronger-than-expected employment data. There are two distinctly different ways to look at the current rate environment. On the one hand, the average conventional 30yr fixed rate continues hovering in the mid 3's on top tier scenarios. While that's not quite as low as it was in early July, or on some occasions in 2012-2013, it's still in the territory of "all-time lows" in the big picture.Here is a table from Mortgage News Daily:

On the other hand, current rates are near the highest levels in just over a month. This means they're 'threatening'--for lack of a better term--to break out of the low range that followed The UK's vote to leave the EU (Brexit).

emphasis added

Update: U.S. Heavy Truck Sales

by Calculated Risk on 8/08/2016 02:27:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the July 2016 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the recession, falling to a low of 181 thousand in April 2009, on a seasonally adjusted annual rate basis (SAAR). Since then sales increased more than 2 1/2 times, and hit 486 thousand SAAR in November 2015.

Heavy truck sales have since declined - due to the weakness in the oil sector - and were at 399 thousand SAAR in July.

Even with the recent oil related decline, heavy truck sales are still above the average (and median) of the last 20 years.

Click on graph for larger image.

Phoenix Real Estate in July: Sales down 2%, Inventory up 3% YoY

by Calculated Risk on 8/08/2016 11:15:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up 3.3% year-over-year in July. This is the fifth consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in June were down 1.8% year-over-year.

2) Cash Sales (frequently investors) were down to 19.7% of total sales.

3) Active inventory is now up 3.3% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow in Phoenix. Prices in Phoenix are up 1.5% through May (about a 3.6% annual rate) - slower than in 2015.

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| Jul-16 | 7,775 | -1.8% | 1,534 | 19.7% | 23,695 | 3.3% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 8/08/2016 08:12:00 AM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

I wrote an update in 2014, and argued vehicle sales would "mostly move sideways" for the next few years.

Here is another update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through July 2016 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2015 and 2016.

The wild swings in 2009 were due to the "cash for clunkers" program.

The estimated ratio for July close to 14 years - back to a more normal level.

Note: in 2009, I argued the turnover ratio would "probably decline to 15 or so eventually" and that has happened.

The current sales rate is now near the top (excluding one month spikes) of the '98/'06 auto boom.

Light vehicle sales were at a 17.7 million seasonally adjusted annual rate (SAAR) in July.

I continue to expect vehicle sales to mostly move sideways over the next few years.

Sunday, August 07, 2016

Sunday Night Futures

by Calculated Risk on 8/07/2016 07:11:00 PM

Weekend:

• Schedule for Week of Aug 7, 2016

• More Employment Graphs: Prime Age Participation, Duration of Unemployment, Unemployment by Education and more

Monday:

• At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were up over the last week with WTI futures at $41.92 per barrel and Brent at $44.27 per barrel. A year ago, WTI was at $44, and Brent was at $48 - so prices are down less than 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.12 per gallon (down about $0.50 per gallon from a year ago).