by Calculated Risk on 8/04/2016 08:33:00 AM

Thursday, August 04, 2016

Weekly Initial Unemployment Claims increased to 269,000

The DOL reported:

In the week ending July 30, the advance figure for seasonally adjusted initial claims was 269,000, an increase of 3,000 from the previous week's unrevised level of 266,000. The 4-week moving average was 260,250, an increase of 3,750 from the previous week's unrevised average of 256,500.The previous week was unrevised.

There were no special factors impacting this week's initial claims. This marks 74 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 260,250.

This was above the consensus forecast of 265,000. The low level of claims suggests relatively few layoffs.

Wednesday, August 03, 2016

Preview of July Employment Report

by Calculated Risk on 8/03/2016 06:35:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus, according to Bloomberg, is for an increase of 185,000 non-farm payroll jobs in July (with a range of estimates between 150,000 to 215,000, and for the unemployment rate to decrease to 4.8%.

The BLS reported 287,000 jobs added in June.

Here is a summary of recent data:

• The ADP employment report showed an increase of 179,000 private sector payroll jobs in July. This was above expectations of 165,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in June to 49.4%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs decreased about 22,000 in July. The ADP report indicated 4,000 manufacturing jobs added in July.

The ISM non-manufacturing employment index decreased in July to 52.7%. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS non-manufacturing payroll jobs increased about 110,000 in June.

Combined, the ISM indexes suggests employment gains of about 88,000. This suggests employment growth well below expectations.

• Initial weekly unemployment claims averaged 256,000 in July, down from 267,000 in June. For the BLS reference week (includes the 12th of the month), initial claims were at 252,000, down from 258,000 during the reference week in June.

The decrease during the reference suggests fewer layoffs in July as compared to June. This suggests a positive employment report.

• The final July University of Michigan consumer sentiment index decreased to 90.0 from the June reading of 93.5. Sentiment is frequently coincident with changes in the labor market, but there are other factors too like gasoline prices and possibly politics.

• Conclusion: Unfortunately none of the indicators alone is very good at predicting the initial BLS employment report. The ADP report and unemployment claims suggest stronger job growth. The ISM reports suggests weaker job growth in July.

My guess is the July report will be close to the consensus forecast.

Off-Topic: Update on Litmus Test Moments

by Calculated Risk on 8/03/2016 03:53:00 PM

Back in May I outlined a few "litmus test" moments in life - moments that define us - and I concluded that we are seeing a political litmus test moment right now (see: Off-Topic: A Comment on Litmus Test Moments)

Since then Mr. Trump has made many more disqualifying statements (too numerous to list).

For example, I wrote that post before Mr. Trump criticized U.S. District Judge Gonzalo Curiel calling him a "Mexican" (although he is an American citizen born in Indiana), and suggesting Curiel was biased because Trump was going to build a wall between the U.S. and Mexico. Trump went on to repeat the same accusations several times, even as many Americans criticized his comments. As Rep Paul Ryan noted, claiming that a person's heritage makes them biased, is "the textbook definition of a racist comment."

I've spoken to several lawyers in San Diego, and Judge Curiel is considered one the best. He was first appointed as a Judge by Republican Governor Arnold Schwarzenegger who wrote after Trump's attack: "Judge Curiel is an American hero who stood up to the Mexican cartels. I was proud to appoint him when I was Gov."

Mr Trump never apologized or backed down.

And the most recent attack on the Khan family is even worse. The VFW statement says what all Americans feel:

Presidential candidate Donald J. Trump has a history of lashing out after being attacked, but to ridicule a Gold Star Mother is out-of-bounds, said the new national commander of the near 1.7 million-member Veterans of Foreign Wars of the United States and its Auxiliary.Once again Trump is unwilling to apologize.

“Election year or not, the VFW will not tolerate anyone berating a Gold Star family member for exercising his or her right of speech or expression,” said Brian Duffy, of Louisville, Ky., who was elected July 27 to lead the nation’s oldest and largest major war veterans organization.

“There are certain sacrosanct subjects that no amount of wordsmithing can repair once crossed,” he said. “Giving one’s life to nation is the greatest sacrifice, followed closely by all Gold Star families, who have a right to make their voices heard.”

My advice for politicians and American citizens who supported Trump: If you haven't abandoned Trump yet, do it now. If your family, friends and co-workers know you supported Trump - tell them you've had enough. They will respect you for changing your mind (if not now, in the near future). If you have a Trump sign in your yard, take it down. If you have a Trump bumper sticker on your car, take it off.

I'm voting for Hillary Clinton, but if you can't stomach voting for her - still vote! - but vote for a 3rd party candidate or write-in another candidate. If you can't stand Hillary (I think she will be fine), maybe you can console yourself that she won without 50% of the vote.

But it is important for our future that Trump loses and loses badly. This vote will be a message to the future that people like Trump are not acceptable. And I guarantee you that you will feel better about yourself in a few years when you can honestly say you didn't vote for Trump.

Q2 2016 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 8/03/2016 12:45:00 PM

The BEA has released the underlying details for the Q2 advance GDP report this morning.

The BEA reported that investment in non-residential structures decreased at a 7.9% annual pace in Q1. However most of the decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $62.4 billion annual rate in Q1 to a $50.2 billion annual rate in Q2 - and is down from $106 billion in Q2 2015 (declined more than 50%).

Excluding petroleum, non-residential investment in structures increased at a 5.5% annual rate in Q2.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q2, and is up 22% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down slightly year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q2, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 19% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $242 billion (SAAR) (about 1.3% of GDP), and was down in Q2 compared to Q1, but is up 7.3% year-over-year.

Investment in home improvement was at a $220 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.1% of GDP), and is up 9.0% year-over-year.

ISM Non-Manufacturing Index decreased to 55.5% in July

by Calculated Risk on 8/03/2016 10:05:00 AM

The July ISM Non-manufacturing index was at 55.5%, down from 56.5% in June. The employment index decreased in June to 51.4%, down from 52.7% in June. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:July 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in July for the 78th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 55.5 percent in July, 1 percentage point lower than the June reading of 56.5 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 59.3 percent, 0.2 percentage point lower than the June reading of 59.5 percent, reflecting growth for the 84th consecutive month, at a slightly slower rate in July. The New Orders Index registered 60.3 percent, 0.4 percentage point higher than the reading of 59.9 percent in June. The Employment Index decreased 1.3 percentage points in July to 51.4 percent from the June reading of 52.7 percent. The Prices Index decreased 3.6 percentage points from the June reading of 55.5 percent to 51.9 percent, indicating prices increased in July for the fourth consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth in July. The majority of the respondents’ comments reflect stability and continued growth for their respective companies and a positive outlook on the economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was slightly below the consensus forecast of 56.0, and suggests slower expansion in July than in June.

ADP: Private Employment increased 179,000 in July

by Calculated Risk on 8/03/2016 08:20:00 AM

Private sector employment increased by 179,000 jobs from June to July according to the July ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 165,000 private sector jobs added in the ADP report.

...

Goods-producing employment was down by 6,000 jobs in July, following June losses of 28,000. The construction industry lost 6,000 jobs, following June losses of 4,000 jobs. Meanwhile, manufacturing gained 4,000 jobs after losing 15,000 the previous month.

Service-providing employment rose by 185,000 jobs in July, fewer than June’s 203,000 jobs. The ADP National Employment Report indicates that professional/business services contributed 59,000 jobs, down from June’s 78,000. Trade/transportation/utilities increased by 27,000 jobs in July, down from 41,000 jobs added the previous month. Financial activities added 11,000 jobs, following last month’s gain of 9,000 jobs.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong, but is moderating as the economy approaches full employment. Businesses are having a more difficult time filling open job positions, which are near record highs. The nation’s biggest economic problem will soon be the lack of available workers.”

The BLS report for July will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in July.

MBA: "Mortgage Applications Decrease in Latest Weekly Survey"

by Calculated Risk on 8/03/2016 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 29, 2016.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier to the lowest level since February 2016 while the seasonally adjusted Government Purchase Index fell to the lowest level since November 2015. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.67 percent from 3.69 percent, with points decreasing to 0.30 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

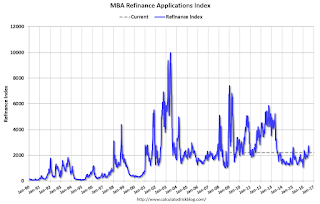

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity has increased this year since rates have declined.

However it would take another significant move down in mortgage rates to see a large increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index is "6 percent higher than the same week one year ago".

Tuesday, August 02, 2016

Wednesday: ADP Employment, ISM non-Mfg Index

by Calculated Risk on 8/02/2016 06:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in July, down from 172,000 added in June.

• At 10:00 AM, the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.0 from 56.5 in June.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Rise; Potential Volatility Ahead

Mortgage rates moved higher again today, after hitting the lowest levels in roughly 2 weeks last Friday. Like yesterday, today's increase was fairly minimal in the big picture, but successive days of weakness can add up. Unlike yesterday, most borrowers would now be seeing slightly higher costs on today's rate quotes compared to Friday's.Here is a table from Mortgage News Daily:

Here's the good news though: apart from the past 2 days, today's rates are the lowest in more than 2 weeks. After rising to a range of 3.5-3.625% last week, conventional 30yr fixed rates are now more likely to be quoted in a 3.375-3.5% range on top tier scenarios.

emphasis added

U.S. Light Vehicle Sales increase to 17.8 million annual rate in July

by Calculated Risk on 8/02/2016 04:11:00 PM

Based on a preliminary estimate from WardsAuto (ex-Jaguar and Porsche), light vehicle sales were at a 17.78 million SAAR in July.

That is up about 2% from July 2015, and up 6.5% from the 16.69 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for July (red, light vehicle sales of 17.78 million SAAR from WardsAuto).

This was above the consensus forecast of 17.3 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Sales for 2016 - through the first seven months - are up almost 2% from the comparable period last year.

A solid month for auto sales.

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 8/02/2016 01:00:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic (through June 2016) and NSA Case-Shiller National index since 1987 (through May 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings are now declining.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.