by Calculated Risk on 8/01/2016 02:22:00 PM

Monday, August 01, 2016

Fed Survey: Banks tightened Standards on Commercial Real Estate, Residential Real Estate demand strengthened

From the Federal Reserve: The July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the July survey results indicated that, on balance, banks tightened their standards on commercial and industrial (C&I) and commercial real estate (CRE) loans over the second quarter of 2016. The survey results indicated that demand for C&I loans was little changed, while demand for CRE loans had strengthened during the second quarter on net.

Regarding loans to households, banks reported that standards on all categories of residential real estate (RRE) mortgage loans were little changed, on balance, except for those eligible for purchase by government-sponsored enterprises (known as GSE-eligible mortgage loans), for which a moderate net fraction of banks reported having eased standards, and for subprime residential mortgages, for which a moderate net fraction of banks reported having tightened standards. Banks also reported, on net, that demand for most types of RRE loans strengthened over the second quarter. In addition, banks indicated that changes in standards on consumer loans were mixed, while demand strengthened across all consumer loan types.

...

In addition, banks continued to report in the July 2016 SLOOS that the levels of standards for all types of RRE loans are currently tighter than the midpoints of the ranges observed since 2005. Moreover, banks indicated that consumer loans to subprime borrowers are currently still tighter than their midpoints, while consumer loans to prime borrowers are currently easier than those reference points.

emphasis added

Construction Spending decreased 0.6% in June

by Calculated Risk on 8/01/2016 11:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending decreased 0.6% in June compared to May:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during June 2016 was estimated at a seasonally adjusted annual rate of $1,133.5 billion, 0.6 percent below the revised May estimate of $1,140.9 billion. The June figure is 0.3 percent above the June 2015 estimate of $1,130.5 billion.Private and public spending decreased in June:

Spending on private construction was at a seasonally adjusted annual rate of $851.0 billion, 0.6 percent below the revised May estimate of $856.6 billion. ...

In June, the estimated seasonally adjusted annual rate of public construction spending was $282.5 billion, 0.6 percent below the revised May estimate of $284.3 billion

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

All three categories have slumped recently.

Private residential spending has been generally increasing, but is 34% below the bubble peak.

Non-residential spending is only 2% below the peak in January 2008 (nominal dollars).

Public construction spending is now 13% below the peak in March 2009.

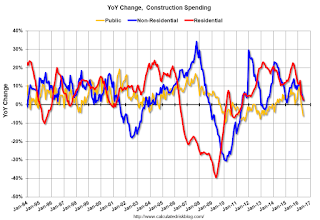

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3%. Non-residential spending is up 2% year-over-year. Public spending is down 6% year-over-year.

Looking forward, all categories of construction spending should increase in 2016. Residential spending is still fairly low, non-residential is increasing (except oil and gas), and public spending is also generally increasing after several years of austerity.

This was well below the consensus forecast of a 0.6% increase for June, and construction spending for the previous two months were revised down.

ISM Manufacturing index decreased to 52.6 in July

by Calculated Risk on 8/01/2016 10:03:00 AM

The ISM manufacturing index indicated expansion for the fifth consecutive month in July. The PMI was at 52.6% in July, down from 53.2% in June. The employment index was at 49.4%, down from 50.4% in June, and the new orders index was at 56.9%, down from 57.0% in June.

From the Institute for Supply Management: July 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July for the fifth consecutive month, while the overall economy grew for the 86th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The July PMI® registered 52.6 percent, a decrease of 0.6 percentage point from the June reading of 53.2 percent. The New Orders Index registered 56.9 percent, a decrease of 0.1 percentage point from the June reading of 57 percent. The Production Index registered 55.4 percent, 0.7 percentage point higher than the June reading of 54.7 percent. The Employment Index registered 49.4 percent, a decrease of 1 percentage point from the June reading of 50.4 percent. Inventories of raw materials registered 49.5 percent, an increase of 1 percentage point from the June reading of 48.5 percent. The Prices Index registered 55 percent, a decrease of 5.5 percentage points from the June reading of 60.5 percent, indicating higher raw materials prices for the fifth consecutive month. Manufacturing registered growth in July for the fifth consecutive month, as 12 of our 18 industries reported an increase in new orders in July (same as in June), and nine of our 18 industries reported an increase in production in July (down from 12 in June)."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 53.2%, and suggests manufacturing expanded at a slower pace in July than in June.

Black Knight June Mortgage Monitor: "Brexit’ Effect Increases Refinanceable Population to 8.7 Million"

by Calculated Risk on 8/01/2016 07:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for June today. According to BKFS, 4.31% of mortgages were delinquent in June, down from 4.79% in June 2015. BKFS also reported that 1.10% of mortgages were in the foreclosure process, down from 1.56% a year ago.

This gives a total of 5.41% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: ‘Brexit’ Effect Increases Refinanceable Population to 8.7 Million; Auto Debt Among Mortgage Holders at Highest Level in at Least 10 Years

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of June 2016. After the United Kingdom voted to leave the European Union on June 23, 2016, increased investor interest in U.S. Treasury Bonds again drove down mortgage interest rates. In light of this development, Black Knight analyzed the effect that new multi-year lows in rates are having on the population of 30-year mortgage holders who could both likely qualify for and benefit from refinancing. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, in the current rate environment, the effect of even slight declines in mortgage interest rates have proven to have far-reaching impact on the refinanceable population, though much less than one might think on home affordability.

“The reality is that, post-‘Brexit,’ mortgage interest rates declined by about 15 basis points – not significant in the grand scheme of things,” said Graboske. “But for 2.8 million borrowers with current rates right at 4.25 percent, this modest decline was enough to put them 75 basis points above today’s prevailing rate, the point at which we consider a borrower to have incentive to refinance. Of these, 1.2 million also meet broad-based eligibility criteria -- loan-to-value ratios of 80 percent or less, credit scores of 720 or higher and are current on their mortgage payments -- bringing the total refinanceable population to 8.7 million, the highest level we’ve seen since late 2012. However, unlike the 66 percent of borrowers Black Knight identified a few months ago, who could have both likely qualified for and had incentive to refinance in the spring of 2015 but for whatever reason didn’t do so, the vast majority of these new candidates did not have such incentive last year. This has produced a nearly 50 percent increase in the number of borrowers with newfound incentive to refinance, which may well be creating a more pronounced impact on refinance applications and originations as these borrowers rush to take advantage.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows new seriously delinquent loans by vintage. New delinquencies are still coming mostly from bubble-era legacy loans.

From Black Knight:

• Just over 210,000 borrowers that entered 2016 current on their mortgage payments are now 60 or more days delinquent; this is 17,000 below last year, but still about 10 percent above historical standards

• Nearly 60 percent of new seriously delinquent loans are coming from pre-crisis vintages (2007 and earlier), despite those vintages making up just 26 percent of active mortgages

• Over the first half of 2016, one of every 100 borrowers in a pre-2008 vintage mortgage that was current at the beginning of the year is now 60 or more days past due, as compared to just three out of every 1,000 borrowers in a 2008 or later vintage

The second graph shows foreclosure starts. From Black Knight:

The second graph shows foreclosure starts. From Black Knight:

• Total foreclosure starts have now reached historic norms, with Q2 2016 starts volume hitting an 11-year lowStill working through the backlog, but almost back to normal. There is much more in the mortgage monitor.

• Over 55 percent of foreclosure starts continue to be repeats as the industry continues to work through lingering inventory from the crisis

• Looking specifically at first time foreclosure starts, Q2 2016’s 84,300 first time foreclosure starts represent a 20 percent decline from Q2 2015 and the lowest volume seen on record since at least 2000

• The second lowest quarter on record for first time foreclosure starts was Q1 2016, and Q2 represented a 16 percent decrease from that point

• April 2016 saw the lowest total foreclosure starts in 11 years and the lowest one-month volume of first time starts on record

Sunday, July 31, 2016

Monday: ISM Mfg, Construction Spending

by Calculated Risk on 7/31/2016 07:45:00 PM

Weekend:

• Schedule for Week of July 31, 2016

Monday:

• At 10:00 AM ET: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from June. The ISM manufacturing index indicated expansion at 53.2% in June. The employment index was at 50.4%, and the new orders index was at 57.0%.

• Also at 10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

• At 2:00 PM, the July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: S&P are up 3 and DOW futures are up 38 (fair value).

Oil prices were down over the last week with WTI futures at $41.34 per barrel and Brent at $43.25 per barrel. A year ago, WTI was at $47, and Brent was at $53 - so prices are down 15% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.13 per gallon (down over $0.55 per gallon from a year ago).

CoStar: Commercial Real Estate prices increased in June

by Calculated Risk on 7/31/2016 10:09:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Property Price Growth Rebounds In Second Quarter

CRE PRICE INDICES RESUMED HEALTHY GROWTH IN SECOND QUARTER. After experiencing modest growth in the first quarter of 2016 in the wake of global economic uncertainty, both CCRSI’s national composite price indices ended the second quarter of 2016 on a stronger note as investor confidence rebounded. The value-weighted U.S. Composite Index, which is influenced by the sale of high-quality, larger assets, advanced by 3.3%, while the equal-weighted U.S. Composite Index, which reflects the more numerous sales of smaller properties, rose 2.1% in the second quarter of 2016.

HOWEVER, THE PACE OF PRICE GROWTH HAS MODERATED ON AN ANNUAL BASIS. While price growth resumed in both composite indices during the second quarter of 2016, the rate of increase has dropped into the single digits as of June 2016 from a double-digit annual pace in the 12-month periods ending in June 2014 and June 2015. This suggests the pace of price growth may continue to plateau in 2016 as the current cycle advances. ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value-weighted index increased 1.4% in June and is up 9.0% year-over-year.

The equal-weighted index increased 1.3% in May and is up 6.8% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Saturday, July 30, 2016

Schedule for Week of July 31, 2016

by Calculated Risk on 7/30/2016 08:09:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include the June ISM manufacturing and non-manufacturing indexes, July auto sales, and the June trade deficit.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from 53.2 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.2, unchanged from 53.2 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 53.2% in June. The employment index was at 50.4%, and the new orders index was at 57.0%.

10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

2:00 PM ET: the July 2016 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

8:30 AM: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

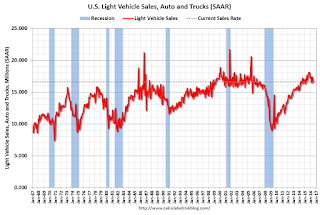

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.3 million SAAR in July, from 16.6 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in July, down from 172,000 added in June.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to decrease to 56.0 from 56.5 in June.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, down from 266 thousand the previous week.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is a 1.8% decrease in orders.

8:30 AM: Employment Report for July. The consensus is for an increase of 185,000 non-farm payroll jobs added in July, down from the 287,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to decrease to 4.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was 2.45 million jobs.

A key will be the change in wages.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.1 billion in May.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $15.5 billion increase in credit.

Friday, July 29, 2016

July 2016: Unofficial Problem Bank list declines to 196 Institutions

by Calculated Risk on 7/29/2016 08:33:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 2016.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2016. During the month, the list fell from 203 institutions to 196 after seven removals. Assets dropped by $1.7 billion to an aggregate $58.9 billion. A year ago, the list held 290 institutions with assets of $83.9 billion.

Actions have been terminated against Ponce de Leon Federal Bank, Bronx, NY ($721 million); Pilot Bank, Tampa, FL ($230 million); Native American Bank, National Association, Denver, CO ($83 million); Georgia Heritage Bank, Dallas, GA ($74 million); and Century Bank of Florida, Tampa, FL ($74 million).

Finding merger partners were Tidelands Bank, Mount Pleasant, SC ($464 million Ticker: TDBK) and Calumet County Bank, Brillion, WI ($89 million).

Lawler: Homebuilder Summary Table for Q2 2016

by Calculated Risk on 7/29/2016 04:01:00 PM

CR Note: Housing economist Tom Lawler sent me these summary results for several large publicly-traded builders who have reported results for last quarter.

Lawler notes: CalAtlantic was formed with the merger of Standard Pacific and Ryland, completed in October 2015. The Q2/2015 statistics for CalAtlantic are pro forma statistics for Standard Pacific and Ryland combined. Also, while MDC Holdings has not yet released its “official” results for Q2/2016, it did release preliminary estimates of selected operations statistics for the quarter, which are shown above.

| Net Orders | Settlements | Average Closing Price (000s) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 616 | 6/15 | % Chg | 6/16 | 6/15 | % Chg | 6/16 | 6/15 | % Chg |

| D.R. Horton | 11,714 | 10,398 | 12.7% | 10,739 | 9,856 | 9.0% | $290 | 290 | 0.2% |

| Pulte Group | 5,697 | 5,118 | 11.3% | 4,772 | 3,744 | 27.5% | $367 | 332 | 10.5% |

| NVR | 4,324 | 3,796 | 13.9% | 3,581 | 3,175 | 12.8% | $379 | 384 | -1.5% |

| Cal Atlantic | 3,921 | 3,954 | -0.8% | 3,484 | 3,119 | 11.7% | $447 | 427 | 4.7% |

| Beazer Homes | 1,490 | 1,524 | -2.2% | 1,364 | 1,293 | 5.5% | $330 | 318 | 4.0% |

| Meritage Homes | 2,073 | 1,986 | 4.4% | 1,950 | 1,556 | 25.3% | $408 | 380 | 7.4% |

| MDC Holdings | 1,647 | 1,481 | 11.2% | 1,272 | 1,126 | 13.0% | $448 | 410 | 9.3% |

| M/I Homes | 1,354 | 1,100 | 23.1% | 1,042 | 919 | 13.4% | $362 | 340 | 6.5% |

| SubTotal | 32,220 | 29,357 | 9.8% | 28,204 | 24,788 | 13.8% | $354 | $340 | 4.0% |

Restaurant Performance Index declined in June

by Calculated Risk on 7/29/2016 03:36:00 PM

Here is a minor indicator I follow from the National Restaurant Association: RPI continues to show mixed results

As a result of softer sales and a dampened outlook among operators, the National Restaurant Association’s Restaurant Performance Index (RPI) declined for the second consecutive month. The RPI stood at 100.3 in June, down 0.3 percent.

“The uneven trend that the RPI followed during the first half of 2016 was due in large part to choppy same-store sales and customer traffic results,” said Hudson Riehle, senior vice president of research for the National Restaurant Association.

“This uncertainly likely contributed to the Expectations Index dipping to a six-month low in June. However, it’s hard to draw definitive conclusions in either direction right at this point, because the indicators continue to send mixed signals,” Riehle said.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 100.3 in June, down from 100.6 in May. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month.