by Calculated Risk on 6/07/2016 09:00:00 AM

Tuesday, June 07, 2016

CoreLogic: House Prices up 6.2% Year-over-year in April

Notes: This CoreLogic House Price Index report is for April. The recent Case-Shiller index release was for March. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 6.2 Percent Year Over Year in April 2016

Home prices nationwide, including distressed sales, increased year over year by 6.2 percent in April 2016 compared with April 2015 and increased month over month by 1.8 percent in April 2016 compared with March 2016, according to the CoreLogic HPI.

...

“Low mortgage rates and a lean for-sale inventory have resulted in solid home-price growth in most markets,” said Dr. Frank Nothaft, chief economist for CoreLogic. “An expected gradual rise in interest rates and more homes offered for sale are expected to moderate appreciation in the coming year.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.8% in March (NSA), and is up 6.2% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The index is still 7.9% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last year.

The year-over-year comparison has been positive for fifty one consecutive months.

Monday, June 06, 2016

Duy on Fed: "June is off the table, September is coming into focus"

by Calculated Risk on 6/06/2016 05:01:00 PM

From Tim Duy: Employment Report, Yellen, and More A brief excerpt:

Lot's of Fed news over the past few days that add up to a simple takeaway: June is off the table (again), the stars have to align just right for a July rate hike (not likely), and September is coming into focus as the next possible rate hike opportunity. September, however, assumes that the employment report is more of an outlier than part of a trend. that's what the Fed will be taking out of the data in the coming months.See you in September ...

...

Bottom Line: The May employment report killed the chances of a rate hike in June. And it was weak enough that July no longer looks likely as well. I had thought that, assuming a solid May number they would set the stage for a July hike. That seems unlikely now; they will probably need two months of good numbers to overcome the May hit. The data might bounce in the direction of July, to be sure. Hence Fed officials won't want to take July off the table just yet, so expect, in particular, the more hawkish elements of the FOMC to keep up the tough talk.

Why Did the Unemployment Rate fall Sharply with Few Jobs Added?

by Calculated Risk on 6/06/2016 03:05:00 PM

An interesting question is why the unemployment rate fell so sharply in May, even with relatively few payroll jobs added (38,000 jobs added in May).

First, it is important to remember that there are two separate surveys for the Employment Situation Summary. The headline payroll jobs number comes from Current Employment Statistics (CES: payroll survey), a sample of "approximately 145,000 businesses and government agencies representing approximately 623,000 worksites".

The unemployment rate and the participation rate comes from the Current Population Survey (CPS: commonly called the household survey), a monthly survey of about 60,000 households.

Background: To understand how the surveys are conducted, here is an explanation from the BLS about the household survey, and an explanation about the establishment survey.

Here a few definitions from the BLS Glossary:

• Civilian noninstitutional population: Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces.

• Labor force: The labor force includes all persons classified as employed or unemployed in accordance with the definitions contained in this glossary.

• Labor force participation rate: The labor force as a percent of the civilian noninstitutional population.

• Unemployment rate: The unemployment rate represents the number unemployed as a percent of the labor force.

So a lower participation rate - with the same level of employment - would mean a lower unemployment rate.

The following table is based on the Household survey (all seasonally adjusted):

| Household Survey (000s) | |||

|---|---|---|---|

| April | May | Change | |

| Civilian noninstitutional population (16 and over) | 252,969 | 253,174 | 205 |

| Civilian labor force | 158,924 | 158,466 | -458 |

| Employed | 151,004 | 151,030 | 26 |

| Unemployed | 7,920 | 7,436 | -484 |

| Participation Rate | 62.82% | 62.59% | -0.23% |

| Unemployment Rate | 4.98% | 4.69% | -0.29% |

So the estimated number of people in the labor force declined by 458,000 in May, and the number of unemployed dropped by 484,000. A small portion of this decline was due to higher employment, but most of the decline in the unemployed was due to the decline in participation (even while the population increased).

Does this mean 458,000 people dropped out of the labor force in May? Probably not. There is a lot of month-to-month volatility in the household survey (the establishment survey is much better for jobs). The following table shows a comparison to May 2015 (year-over-year change).

| Household Survey (000s) | |||

|---|---|---|---|

| May 2015 | May 2016 | Change | |

| Civilian noninstitutional population (16 and over) | 250,455 | 253,174 | 2,719 |

| Civilian labor force | 157,367 | 158,466 | 1,099 |

| Employed | 148,748 | 151,030 | 2,282 |

| Unemployed | 8,619 | 7,436 | -1,183 |

| Participation Rate | 62.83% | 62.59% | -0.24% |

| Unemployment Rate | 5.48% | 4.69% | -0.78% |

This makes more sense. About one third of the decline in the unemployment rate over the last year is due to the declining participation rate, and about two-thirds is due to more employment. As I've noted before, the participation rate is expected to decline due to demographics and long term trends.

My sense is that some of the increase in the participation rate over the last few months was due to survey volatility, and that was reversed in May. The real disappointment in the May report is the few jobs added in the establishment report over the last three months.

Yellen: Current Conditions and the Outlook for the U.S. Economy

by Calculated Risk on 6/06/2016 12:36:00 PM

The speech may be viewed here live.

From Fed Chair Janet Yellen: Current Conditions and the Outlook for the U.S. Economy Excerpts:

[T]he overall labor market situation has been quite positive. In that context, this past Friday's labor market report was disappointing. Payroll gains were reported to have been much smaller in April and May than earlier in the year, averaging only about 80,000 per month.2 And while the unemployment rate was reported to have fallen further in May, that decline occurred not because more people had jobs but because fewer people reported that they were actively seeking work. A broader measure of labor market slack that includes workers marginally attached to the workforce and those working part-time who would prefer full-time work was unchanged. An encouraging aspect of the report, however, was that average hourly earnings for all employees in the nonfarm private sector increased 2-1/2 percent over the past 12 months--a bit faster than in recent years and a welcome indication that wage growth may finally be picking up.Yellen remains cautiously optimistic, but no indication of a rate increase in June.

Although this recent labor market report was, on balance, concerning, let me emphasize that one should never attach too much significance to any single monthly report. Other timely indicators from the labor market have been more positive. For example, the number of people filing new claims for unemployment insurance--which can be a good early indicator of changes in labor market conditions--remains quite low, and the public's perceptions of the health of the labor market, as reported in various consumer surveys, remain positive. That said, the monthly labor market report is an important economic indicator, and so we will need to watch labor market developments carefully.

Black Knight: First Time Foreclosure Starts Lowest on Record

by Calculated Risk on 6/06/2016 09:44:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for April today. According to BKFS, 4.24% of mortgages were delinquent in April, down from 4.72% in April 2015. BKFS also reported that 1.17% of mortgages were in the foreclosure process, down from 1.63% a year ago.

This gives a total of 5.41% delinquent or in foreclosure.

Press Release: Black Knight’s April Mortgage Monitor: Cash Transactions Account for Over 60 Percent of Low-Priced Home Sales

Today, the Data and Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of April 2016. This month, Black Knight looked at the cash share of residential real estate transactions by core-based statistical areas (CBSAs), breaking each CBSA into five equal price tiers. While the data showed that overall cash sales are slowing, they still account for the bulk of transactions on homes in the lowest 20 percent of property values. As Black Knight Data & Analytics Senior Vice President Ben Graboske explained, there is significant disparity between high- and low-end markets nationwide in this regard.

“As the inventory of distressed properties has dried up nationwide, the overall share of cash sales has been on the decline as well,” said Graboske. “From a peak of 45 percent of all real estate transactions back in Q1 2011, cash sales accounted for just 35 percent of home purchases in the first quarter of 2016. What’s striking though, is the disparity between the high and low ends of the market. At the national level, cash sales made up approximately 30 percent of transactions on properties in the top 20 percent by value of their respective markets. For those in the lowest 20 percent of property values, over 60 percent of sales were cash transactions. While down significantly from its peak of 75 percent of all transactions at the bottom of the housing market, this is still quite high for cash sales, historically. The prevalence of cash sales at the low end of the market can likely be chalked up to two primary factors. First, negative equity is still higher than average among this segment of the market, resulting in increased distressed discounts for buyers. Second, lower-priced homes simply require less capital to purchase outright, making cash sales possible for more people.”

emphasis added

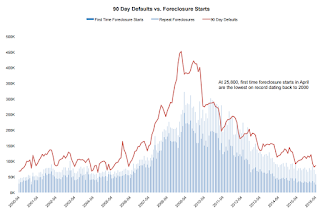

Click on graph for larger image.

Click on graph for larger image.These graphs from Black Knight shows 90 day defaults vs. foreclosure starts.

From Black Knight:

• While total foreclosure starts are the lowest they’ve been since April 2005, at just 25,800, first time foreclosure starts are the lowest on record, dating back to at least 2000There is much more in the mortgage monitor.

• Reduced foreclosure starts in April are due in part to the seasonality of 90-day default activity. 90-day defaults typically hit their calendar year low in March leading to a month-over-month reduction in foreclosure starts in the month of April – observed in 10 of the past 12 years.

• Improved mortgage performance has also led to a reduction in foreclosure starts. March saw the lowest one month volume of 90-day defaults in 11 years, down 11 percent from last year and down 82 percent from the January 2009 peak

• Additionally, the ratio of new foreclosure starts to 90-day defaults is lower than pre-crisis norms, likely due to an increased focus on pre-foreclosure loss mitigation

Sunday, June 05, 2016

Monday: Yellen

by Calculated Risk on 6/05/2016 07:10:00 PM

Fed Chair Janet Yellen will speak on Monday at 12:30 PM ET. The speech may be viewed here live. This will be a key speech following the disappointing jobs report on Friday.

Monday:

• At 10:00 AM ET, The Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 12:30 PM ET, Speech by Fed Chair Janet Yellen, Economic Outlook and Monetary Policy, To the World Affairs Council of Philadelphia, Philadelphia, Pa.

Weekend:

• Schedule for Week of June 5, 2016

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $48.89 per barrel and Brent at $49.64 per barrel. A year ago, WTI was at $59, and Brent was at $60 - so prices are down almost 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon (down about $0.40 per gallon from a year ago).

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 6/05/2016 11:18:00 AM

By request, here is another update of an earlier post through the May 2016 employment report including all revisions.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,082 |

| GW Bush 1 | -811 |

| GW Bush 2 | 415 |

| Obama 1 | 1,921 |

| Obama 2 | 8,3851 |

| 140 months into 2nd term: 10,062 pace. | |

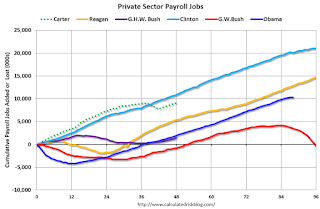

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term, and President Obama is in the fourth year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,921,000 more private sector jobs at the end of Mr. Obama's first term. Forty months into Mr. Obama's second term, there are now 10,306,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 503,000 jobs). This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -708 |

| Obama 2 | 2051 |

| 140 months into 2nd term, 246 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming down turn due to the bursting of the housing bubble - and I predicted a recession in 2007).

For the public sector, the cutbacks are clearly over. Right now I'm expecting some increase in public employment during the remainder of Obama's 2nd term, but nothing like what happened during Reagan's second term.

Below is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 3rd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the fourth best for total job creation.

Note: Only 205 thousand public sector jobs have been added during the first forty months of Obama's 2nd term (following a record loss of 708 thousand public sector jobs during Obama's 1st term). This is about 15% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,082 | 1,242 | 11,312 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 8,385 | 205 | 8,590 | |

| Pace2 | 10,062 | 246 | 10,308 | |

| 140 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The last table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms. Right now it looks like Obama's 2nd term will be in the top 3 for private employment, but not for total employment.

| Average Jobs needed per month (000s) for remainder of Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 312 | 373 | ||

| #2 | 212 | 342 | ||

| #3 | 122 | 276 | ||

Saturday, June 04, 2016

Schedule for Week of June 5, 2016

by Calculated Risk on 6/04/2016 08:09:00 AM

This will be a light week for economic data.

Fed Chair Janet Yellen will speak on Monday.

The Census Bureau will release the Q1 Quarterly Services Report on Wednesday, and the Fed will release the Q1 Flow of Funds report on Thursday.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

12:30 PM ET, Speech by Fed Chair Janet Yellen, Economic Outlook and Monetary Policy, To the World Affairs Council of Philadelphia, Philadelphia, Pa.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $18.0 billion increase in credit.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

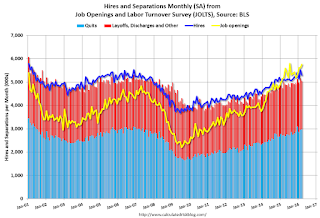

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 5.757 million from 5.608 million in February.

The number of job openings (yellow) were up 11% year-over-year, and Quits were up 9% year-over-year.

10:00 AM: The Q1 Quarterly Services Report from the Census Bureau.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 267 thousand the previous week.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for April. The consensus is for a 0.1% increase in inventories.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

2:00 PM: The Monthly Treasury Budget Statement for May.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for June). The consensus is for a reading of 94.5, down from 94.7 in May.

Friday, June 03, 2016

Payroll Employment: Best Years, Worst Month

by Calculated Risk on 6/03/2016 05:22:00 PM

A couple of years ago - when there was a disappointing jobs report - I called out the people calling it a "disaster".

Here is my post from 2014: Payroll Employment: Best Years, Worst Month

In that post I noted that there were strong employment years with some weak employment months. Sure enough, 2014 saw strong employment growth of over 3 million jobs. Some "disaster"!

Other examples: In 1983, there was a month with 308 thousand jobs lost - but it was a strong year for employment gains. Or 1997, another strong year, with 31 thousand jobs lost in one month.

Job growth has slowed so far in 2016, but I still think we will see over 2 million jobs added this year.

Here is a table of the best years for job growth since 1980 with the worst month of the year (this is after revisions). Obviously there is a significant amount of volatility month-to-month in the employment report.

| Non-Farm Payroll: Best Years, Worst Month | ||

|---|---|---|

| Year | Annual (000s) | Worst Month (000s) |

| 1984 | 3,880 | 128 |

| 1994 | 3,852 | 200 |

| 1983 | 3,458 | -308 |

| 1997 | 3,407 | -31 |

| 1988 | 3,242 | 94 |

| 1999 | 3,179 | 107 |

| 1987 | 3,153 | 171 |

| 1998 | 3,047 | 129 |

| 2014 | 3,015 | 168 |

| 1996 | 2,825 | -19 |

| 1993 | 2,816 | -49 |

| 2015 | 2,744 | 84 |

| 2005 | 2,514 | 68 |

| 1985 | 2,502 | 124 |

| 2013 | 2,311 | 45 |

| 1995 | 2,158 | -15 |

| 2012 | 2,149 | 75 |

| 2006 | 2,092 | 4 |

| 2011 | 2,087 | 42 |

| 2004 | 2,042 | 44 |

| 2000 | 1,951 | -47 |

| 1989 | 1,943 | 40 |

| 1986 | 1,902 | -94 |

| 20161 | 1,795 | 38 |

| 12016 is the hiring pace through May. | ||

Earlier: ISM Non-Manufacturing Index decreased to 52.9% in May

by Calculated Risk on 6/03/2016 03:15:00 PM

Earlier: The May ISM Non-manufacturing index was at 52.9%, down from 55.7% in April. The employment index decreased in May to 49.7%, down from 53.0% in April. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:May 2016 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 76th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., CFPM, chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee. "The NMI® registered 52.9 percent in May, 2.8 percentage points lower than the April reading of 55.7 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 55.1 percent, 3.7 percentage points lower than the April reading of 58.8 percent, reflecting growth for the 82nd consecutive month, at a slower rate in May. The New Orders Index registered 54.2 percent, 5.7 percentage points lower than the reading of 59.9 percent in April. The Employment Index decreased 3.3 percentage points to 49.7 percent from the April reading of 53 percent and indicates contraction after two consecutive months of growth. The Prices Index increased 2.2 percentage points from the April reading of 53.4 percent to 55.6 percent, indicating prices increased in May for the second consecutive month. According to the NMI®, 14 non-manufacturing industries reported growth in May. Respondents’ comments are mixed and vary by industry and company. Overall, the report reflects a cooling-off and slowing in momentum from the previous months of growth for the non-manufacturing sector."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 55.5, and suggests slower expansion in May than in April.

Note that the employment index was especially weak; similar to the BLS employment report.