by Calculated Risk on 5/11/2016 01:58:00 PM

Wednesday, May 11, 2016

Q1 2016 GDP Details on Residential and Commercial Real Estate

The BEA has released the underlying details for the Q1 advance GDP report.

In April the BEA reported that investment in non-residential structures decreased at a 10.7% annual pace in Q1.

The decline was due to less investment in petroleum exploration. Investment in petroleum and natural gas exploration declined from a $64.6 billion annual rate in Q4 to a $38.7 billion annual rate in Q1. "Mining exploration, shafts, and wells" investment is down 68% year-over-year.

OUCH!

Excluding petroleum, non-residential investment in structures increased at a 10.2% annual rate in Q1. That is solid growth.

The first graph shows investment in offices, malls and lodging as a percent of GDP. Office, mall and lodging investment has increased a little recently, but from a very low level.

Investment in offices increased in Q1, and is up 28% year-over-year -increasing from a very low level - and is now above the lows for previous recessions (as percent of GDP).

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is unchanged year-over-year. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment increased further in Q1, and with the hotel occupancy rate near record levels, it is likely that hotel investment will increase further in the near future. Lodging investment is up 32% year-over-year.

Home improvement was the top category for five consecutive years following the housing bust ... but now investment in single family structures has been back on top for the three years and will probably stay there for a long time.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions as a percent of GDP. I expect further increases over the next few years.

Investment in single family structures was $234 billion (SAAR) (about 1.3% of GDP), and is up 10.4% year-over-year.

Investment in home improvement was at a $195 billion Seasonally Adjusted Annual Rate (SAAR) in Q1 (about 1.1% of GDP), and is up 11.8% year-over-year.

Update: Framing Lumber Prices Up Year-over-year

by Calculated Risk on 5/11/2016 10:32:00 AM

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

Prices are now up year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through April 2016 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 8% from a year ago, and CME futures are up about 20% year-over-year.

MBA: "Mortgage Applications Slightly Increase in Latest MBA Weekly Survey"

by Calculated Risk on 5/11/2016 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 6, 2016.

...

The Refinance Index increased 0.5 percent from the previous week. The seasonally adjusted Purchase Index increased 0.4 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 14 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 3.85 percent from 3.83 percent, with points increasing to 0.35 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity was higher in 2015 than in 2014, but it was still the third lowest year since 2000.

Refinance activity increased a little this year when rates declined.

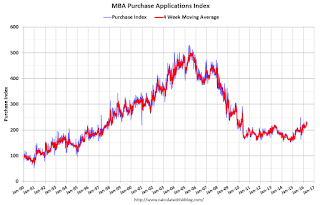

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.

Tuesday, May 10, 2016

Trends in Educational Attainment in the U.S. Labor Force

by Calculated Risk on 5/10/2016 01:44:00 PM

Yesterday I posted a graph of the unemployment rate by level of education.

This brings up an interesting question: What is the composition of the labor force by educational attainment, and how has that been changing over time?

With the help of Tim Duy, Economics Professor at the University of Oregon, and Josh Lehner, at the Oregon Office of Economic Analysis, here is some data on the U.S. labor force by educational attainment since 1992.

Currently, approximately 53 million people in the U.S. labor force have a Bachelor's degree or higher. This is 39% of the labor force, up from 26% in 1992.

This is the only category trending up. "Some college" has been steady, and "high school" and "less than high school" have been trending down.

Based on currently trends, probably more than half the labor force will have at least a bachelor's degree within two decades.

Some thoughts: Since workers with bachelor's degrees typically have a lower unemployment rate, this might push down the overall unemployment rate over time.

Also, I'd guess there will be less labor turnover, and fewer weekly claims (just a guess).

More education is one of the reasons I'm optimistic about the future (see: The Future's So Bright ...)

BLS: Jobs Openings increased in March

by Calculated Risk on 5/10/2016 10:09:00 AM

From the BLS: Job Openings and Labor Turnover Summary

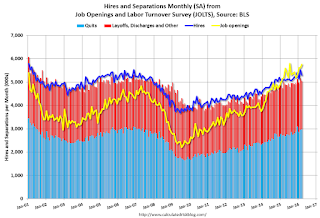

The number of job openings was little changed at 5.8 million on the last business day of March, the U.S. Bureau of Labor Statistics reported today. Hires edged down to 5.3 million while separations were little changed at 5.0 million. Within separations, the quits rate was 2.1 percent, and the layoffs and discharges rate was 1.2 percent....The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

The number of quits was little changed in March at 3.0 million.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for March, the most recent employment report was for April.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in March to 5.757 million from 5.608 million in February.

The number of job openings (yellow) are up 11% year-over-year compared to March 2015.

Quits are up 9% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

This is another strong report, and job openings are just below the record high set in July 2015.

NFIB: Small Business Optimism Index increased in April

by Calculated Risk on 5/10/2016 08:54:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Increases One Point in April

The Index of Small Business Optimism rose 1 point in April to 93.6 ... according to the National Federation of Independent Business’ (NFIB) monthly economic survey released today. ...

Fifty-three percent reported hiring or trying to hire (up 5 points), but 46 percent reported few or no qualified applicants for the positions they were trying to fill. Hiring activity increased substantially ... Twenty-nine percent of all owners reported job openings they could not fill in the current period, up 4 points, revisiting the highest level for this expansion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 93.6 in April.

Monday, May 09, 2016

"Mortgage Rates Steady Near 3-Year Lows"

by Calculated Risk on 5/09/2016 08:18:00 PM

Tuesday:

• At 9:00 AM, NFIB Small Business Optimism Index for April.

• At 10:00 AM, Job Openings and Labor Turnover Survey for March from the BLS. Job openings decreased in February to 5.445 million from 5.604 million in January. The number of job openings were up 6% year-over-year, and Quits were up 9% year-over-year.

• Also at 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.3% increase in inventories.

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady Near 3-Year Lows

Mortgage rates moved sideways today, taking them one step closer to officially claiming the title of "3 year lows." Tomorrow marks the three year anniversary of the Wall Street Journal article that began the early days of the 'taper tantrum'--the jarring move higher in rates that resulted from markets coming to terms with the end of the Fed's asset purchases.

While rates aren't as low today as they had been before the taper tantrum, the current rate environment is excellent in its own right. Apart from being fairly close to the all-time lows seen in 2012-2013, today's low rates exist without any Fed asset purchases and without any risk that the Fed will surprise the world with a shift toward stricter monetary policy. In fact, if there's any risk for financial markets, it's that the Fed will continue to back away from their rate-hike campaign that began with the first and only hike in nearly a decade this past December.

Most lenders are right in line with rates seen on Friday. The most prevalent conventional 30yr fixed quote continues hovering around 3.625% with more than a few lenders already back down to 3.5%.

emphasis added

Phoenix Real Estate in April: Sales up 1%, Inventory up YoY

by Calculated Risk on 5/09/2016 02:53:00 PM

This is a key distressed market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

Inventory was up year-over-year in April. This is the second consecutive months with a YoY increase in inventory, following fifteen consecutive months of YoY declines in Phoenix. This could be a significant change.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in April were up 0.8% year-over-year.

2) Cash Sales (frequently investors) were down to 23.8% of total sales.

3) Active inventory is now up 4.9% year-over-year.

More inventory (a theme in 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster - Prices were up 6.3% in 2015 according to Case-Shiller.

Now inventory is increasing a little again, and - if this trend continues in Phoenix - price increases will probably slow.

| April Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash | Percent Cash | Inventory | YoY Change | |

| Apr-08 | 4,8751 | --- | 986 | 20.2% | 55,7261 | --- |

| Apr-09 | 8,564 | 75.7% | 3,464 | 40.4% | 44,165 | -20.7% |

| Apr-10 | 9,261 | 8.1% | 3,641 | 39.3% | 41,756 | -5.5% |

| Apr-11 | 9,328 | 0.7% | 4,489 | 48.1% | 34,515 | -17.3% |

| Apr-12 | 8,438 | -9.5% | 4,013 | 47.6% | 21,125 | -38.8% |

| Apr-13 | 8,744 | 3.6% | 3,670 | 42.0% | 20,083 | -4.9% |

| Apr-14 | 7,656 | -12.4% | 2,469 | 32.2% | 29,889 | 48.8% |

| Apr-15 | 8,368 | 9.3% | 2,120 | 25.3% | 25,950 | -13.2% |

| Apr-16 | 8,437 | 0.8% | 2,008 | 23.8% | 27,232 | 4.9% |

| 1 April 2008 does not include manufactured homes, ~100 more | ||||||

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 5/09/2016 12:19:00 PM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• April Employment Report: 160,000 Jobs, 5.0% Unemployment Rate

• Comments: A Decent Employment Report

• Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

• Update: "Scariest jobs chart ever"

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend has been down for all categories, and the "less than 5 weeks", "6 to 14 weeks" and "15 to 26 weeks" are all close to normal levels.

The long term unemployed is below 1.3% of the labor force, however the number (and percent) of long term unemployed remains elevated.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and all four groups were generally trending down - although the rate has somewhat flattened out recently.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 1.24 million.

Construction employment is still below the bubble peak, but close to the level in the late '90s.

The BLS diffusion index for total private employment was at 56.3 in April, down from 58.6 in March.

The BLS diffusion index for total private employment was at 56.3 in April, down from 58.6 in March.For manufacturing, the diffusion index was at 47.5, up from 36.7 in March.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Overall private job growth was somewhat widespread in April, but manufacturing employment is struggling.

Update: "Scariest jobs chart ever"

by Calculated Risk on 5/09/2016 09:01:00 AM

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever".

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I was asked if I could post an update to the graph, and here it is through the May 2016 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 4.0% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).